Containers continue to triumph

The Container market continues to impress with record breaking rates and ordering never seen before. Olivia Watkins, Head Cargo Analyst takes us through what has been happening with orders, transactions, values, rates and trade for the first half of 2021 and how these sky-high figures compare to previous years’ activity.

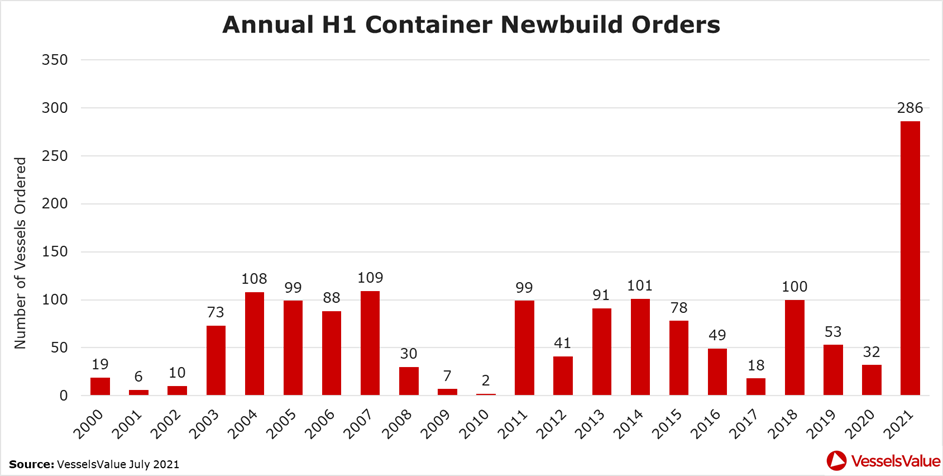

Container Ordering

The ordering market for Containers is at historic highs. A total of 286 Containers were ordered in the first half of 2021. This is up an incredible 790% from H1 2020.

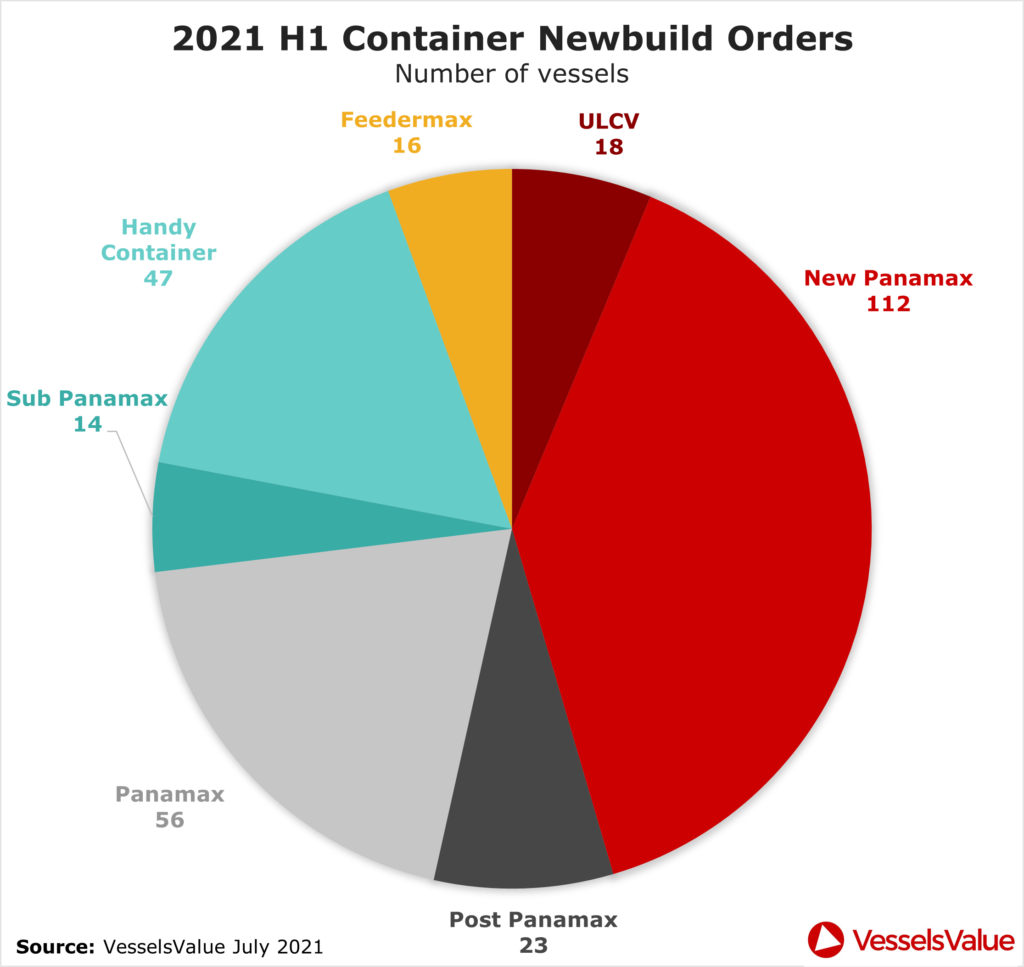

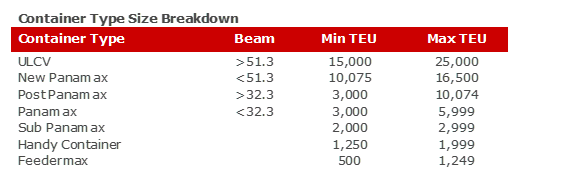

New Panamax Containers, which are typically 13-15,000 DWT, have been at the forefront of the ordering activity. The development of port infrastructure and the ability to fit larger vessels through the Panama Canal has meant this size of vessel is particularly desirable. There are currently 388 New Panamax vessels live on the water at the moment with a further 175 on order across the sector.

Amongst these orders, Seaspan have come in as top orderer in the first half of 2021, by number of vessels and total value in USD bn, with all vessels being greater than 12,000 TEU which is the New Panamax type. See below figure 3.

Evergreen have come in second by total value in USD bn ordered due to their orderbook comprising of New Panamax and ULCV Containers.

Although Wan Hai Lines are second by number of vessels ordered with the majority of their vessels at around 3,000 TEU.

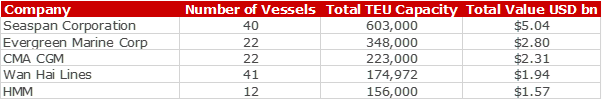

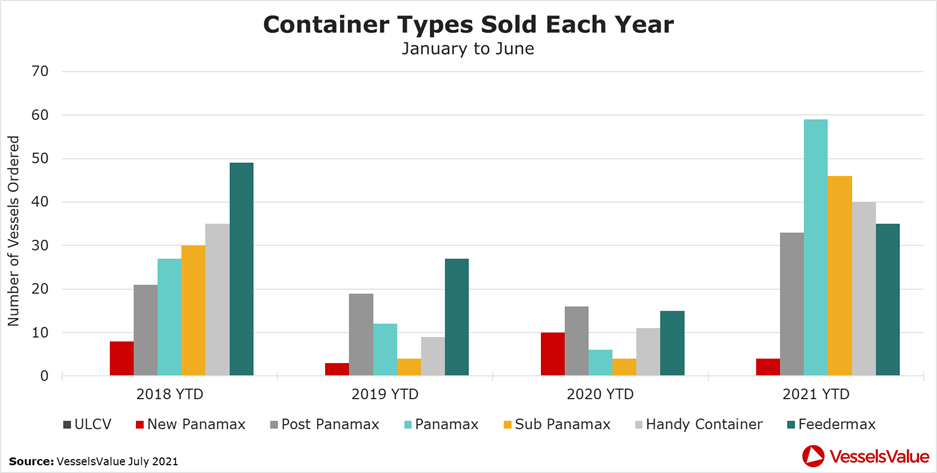

Container Sales

On the contrary to the newbuild orders, we’ve seen a significant increase in activity in the secondhand Panamax Container market. The number of sales is up 780% for year to date 2021 compared to year to date 2020. See figure 4 below.

Recent acquisitions where new entrants are paying more than USD 100,000 pd for a short-term fixture of between 65-80 days has meant Owners like MSC have been buying vessels instead of entering the charter market as it works out more cost effective. For example, the Mexico (4,839 TEU, Feb 2002, Hyundai HI) sold for USD 50.5 mil to MSC at the end of June. The alternative would be to take a vessel on a five-year charter which could cost up to USD 70 mil.

Another benchmark sale confirmed earlier in June was the Kowloon Bay (4,992 TEU, Jul 2004, Hyundai HI) also bought by MSC for USD 42.5 mil. She was bought 2 weeks earlier than the Mexico for USD 8 mil less.

These sales have shown how the Panamax Container market is setting new benchmarks each week.

Container Values

With the ever-firming rates across the Container sector, we have seen a surge in values. Increased US imports, port congestions and a shortage of capacity is pushing freight rates to record levels on key routes from China to the US and Europe. A secondary outbreak of Covid-19 in Southern China has prompted even more delays and congestion across ports which has tightened supply.

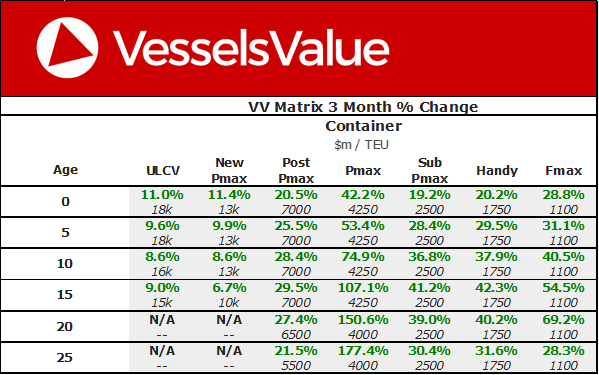

The below figure shows the 3 month percentage change in values across the Container sector. As a result of the increased S&P market and rates, the Panamaxes (4,250 TEU) have benefitted the most from increased values. For example, 15 year old 4,250 TEU tonnage has more than doubled in value in just 3 months. At the end of March, a generic 15 year old Panamax was worth USD 20 mil, today she is worth USD 48 mil.

Container Rates

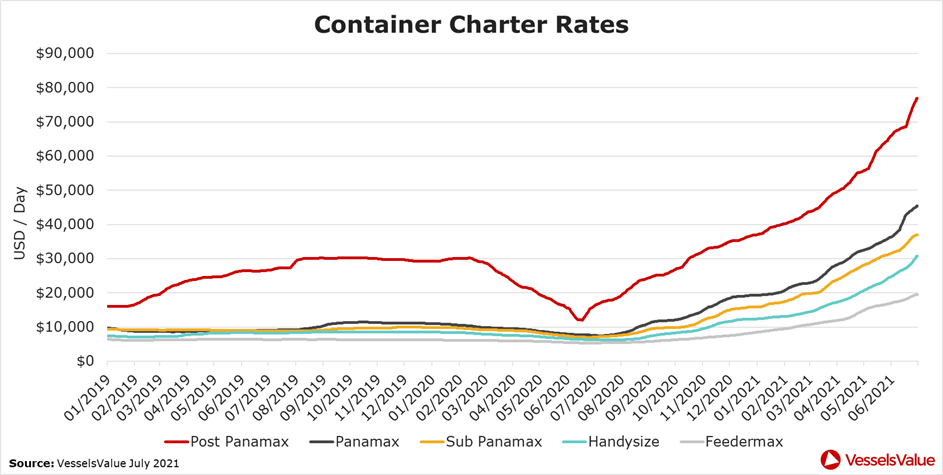

The below figure 6 shows the prolonged increase in charter rates that is impacting the market.

Every single earnings value has more than doubled since the beginning of the year for example Panamax Containers were earning USD 19,000/day, today they are earning USD 45,000/day.

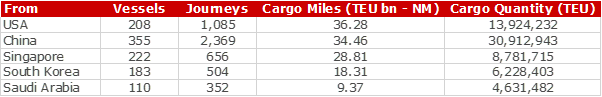

Container Trade

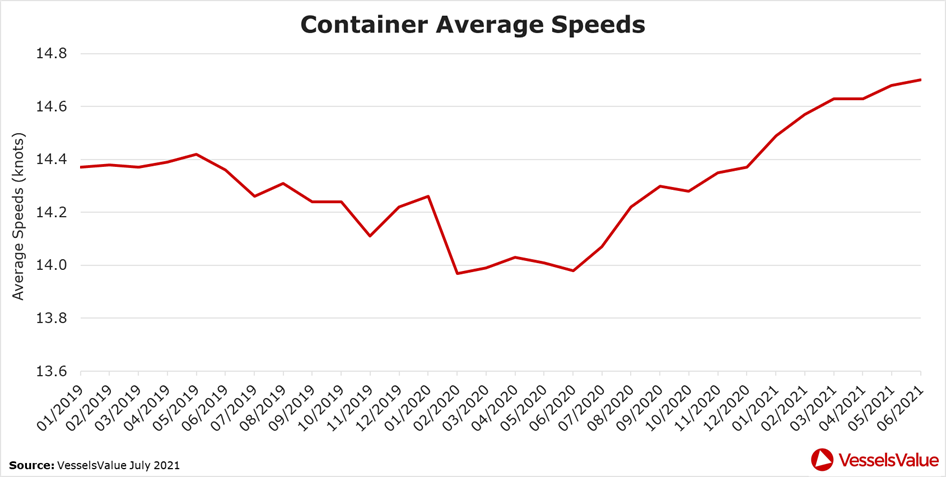

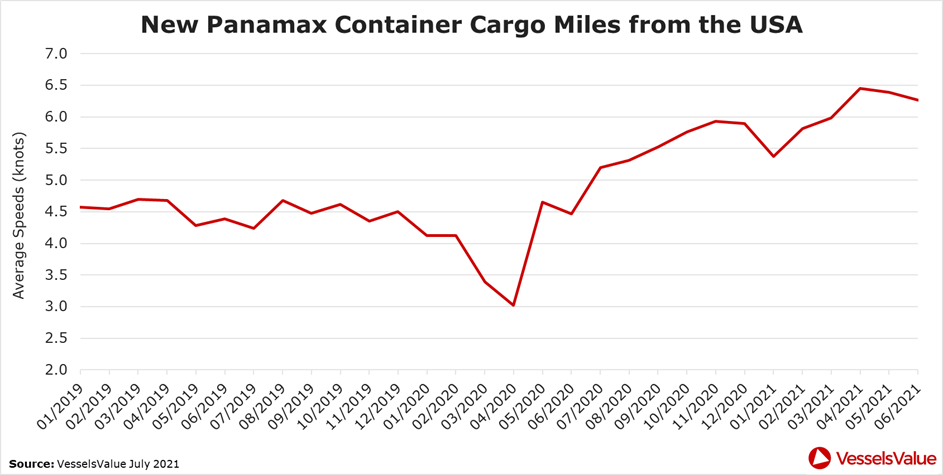

As we surpass the mid-year point of 2021, Container speeds are continuing to increase, as they have been for the last 8 months. The average laden speed across all Container vessels was 14.70 knots in June, showing a 5.2% YoY growth as well MoM growth of 0.5%. New Panamax vessels take the top spot with speeds of 16.37 knots. These high speeds continue to be supported by favourable market conditions.

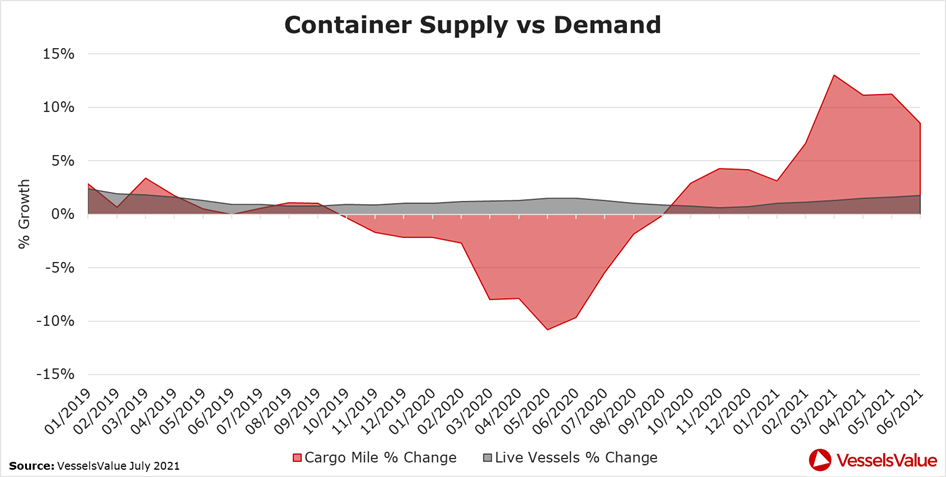

Alongside increasing speeds, cargo miles have been growing through the first half of 2021, with June’s figures at 161.9 bn TEU-NM, almost back to pre-pandemic levels. Fleet growth is set to increase which may disrupt the balance between supply and demand, but for the near future this balance looks positive for Container vessels, as YoY cargo mile growth continues to exceed YoY fleet growth.

Since the start of 2021, cargo miles from the USA rank the highest for New Panamax Container vessels, indicating the popularity of US trades for this vessel type, especially in this post pandemic Covid-19 recovery period.

Appendix

The below table shows VesselsValue’s size breakdown for each Container category by naming convention, beam and TEU.

VesselsValue data as of July 2021.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?

Comments

Leave a Comment