Crude Tanker market still showing signs of volatility into 2021

Last year was undoubtedly a volatile year for Crude Tankers, with changes in global oil production and an unforeseen pandemic leaving the market rejoicing at times, but ultimately fraught with uncertainty. In this article, we will use VesselsValue supply and demand data to assess the Crude Tanker market in recent months, as well as to look at what we expect the future to hold for the sector in the short-term.

2020: The highs and lows of the Crude Tanker market

Last year was a significant year for the Crude Tanker market, as rates soared to record highs from mid-March through to early May due to the very low oil price at the time and contango structure in the oil price market. This resulted in traders buying oil in the spot market at low prices and storing it to sell on at a profit. At the peak of the contango market, data shows that 9% of the VLCC, Suezmax and Aframax fleet were participating in temporary floating storage.

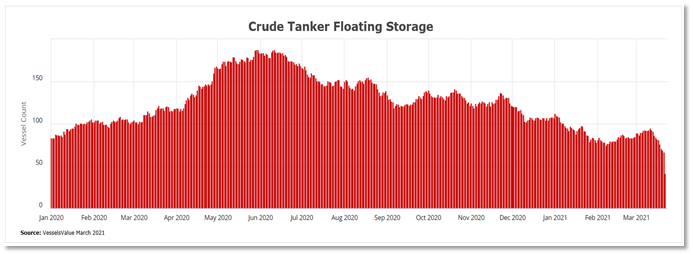

Figure 1 shows a sharp incline in floating storage from “normal” levels in January 2020 through to the peak in May, when around 190 vessels were engaged in floating storage.

High Tanker rates during this period contrasted with many other sectors that were suffering due to the early impacts of the Covid-19 pandemic. For example, as the Bulker market was experiencing exceptionally low rates in March and April 2020 due to a significant demand reduction for raw materials, Tanker earnings were being boosted by these special market conditions. Initially, reduced demand due to Covid-19 was in fact supporting the Tanker market, further intensifying the need for floating storage, as refining curtailed and onshore storage reached capacity.

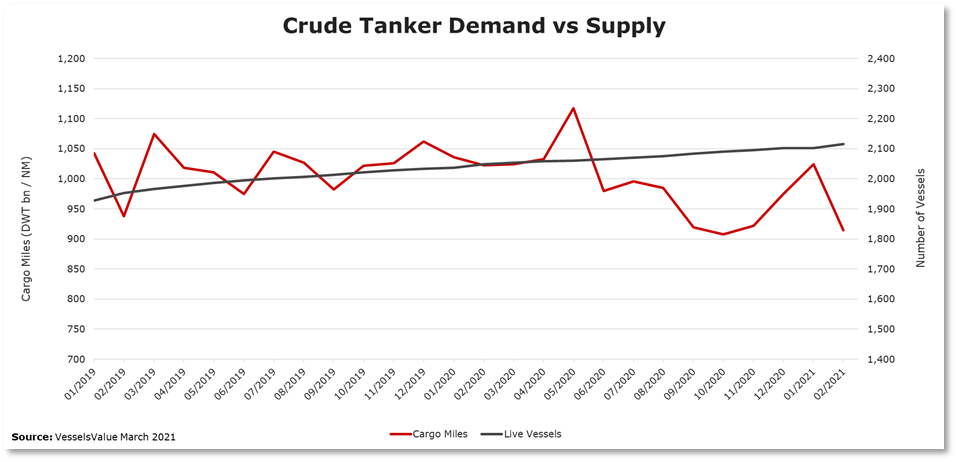

However, these highs did not last throughout 2020, as Crude Tanker demand experienced a rapid decline between May and October last year and cargo miles fell to lows not seen since 2016. Figure 2 shows global Crude Tanker cargo miles and supply since 2019.

Monthly global cargo miles fell 11% between May and October, reaching lows of c.900 DWT bn MT-NM, which was 11% lower than the same period in 2019, suggesting Covid-19 was eventually impacting the tanker market as floating storage began to unwind and the global demand for oil continued to suffer. Alongside poor demand, rates were rapidly collapsing. Between March and November, VLCC earnings had dropped significantly by 96%, from $264,000 per day to $8500 per day, and Suezmax rates fell a similar 95%, from around $94,000 per day to around $4,500 USD per day.

Demand Improvement

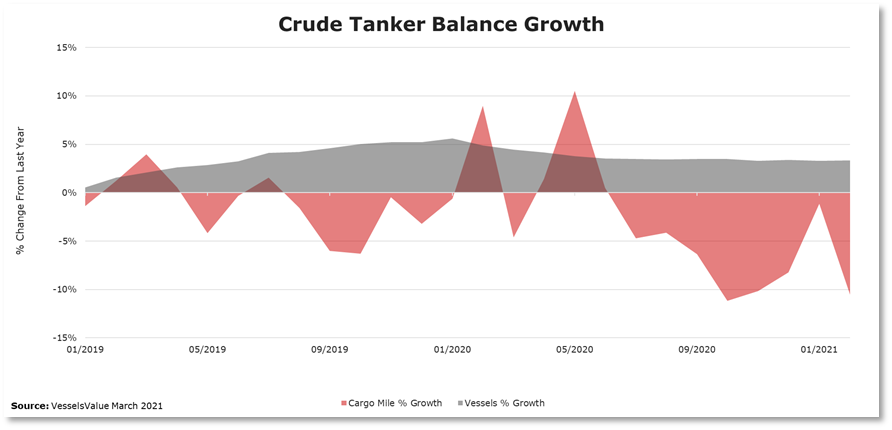

Between November 2020 and January this year, Crude Tanker demand showed some signs of recovery. Figure 3 shows the balance between cargo mile demand growth and fleet growth for VLCC, Suezmax and Aframax vessels.

YoY cargo mile % growth change increased from -11.2% in October last year to a much more reassuring -1.2% in January this year, suggesting the market was moving towards recovery as demand growth edged towards supply growth.

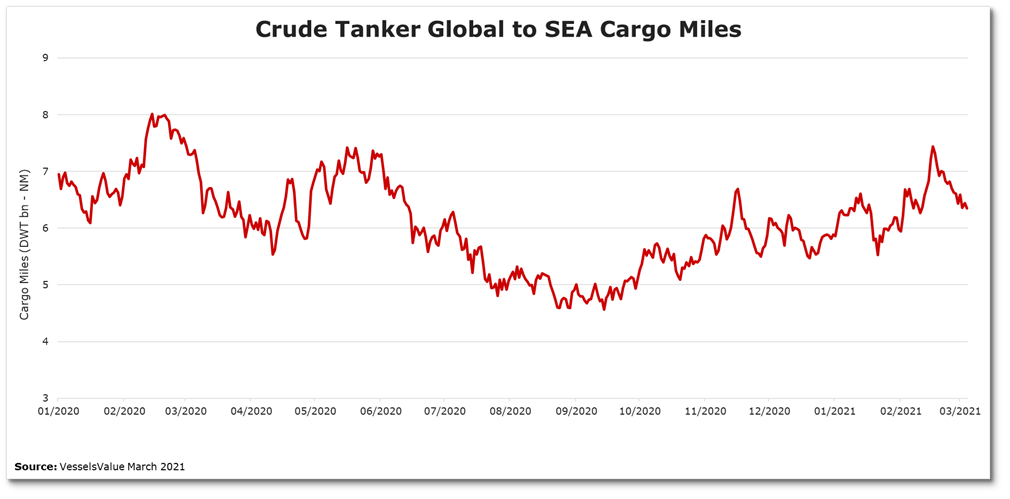

This improvement was supported by demand in emerging markets, recovering faster than first expected, alongside the initiation of vaccination rollouts in many countries. Figure 4 shows Crude Tanker cargo miles into South East Asia.

Cargo miles into South East Asia, one of the world’s largest importing regions of crude oil, increased by 34% between October and January 2021, with China being the main driving force behind this demand. Chinese imports alone accounted for 20% of global crude imports over the last year, with India accounting for 7% of global imports. Despite this, is Asian demand enough to carry the tanker market in the short-term?

A Way Off Recovery

China’s recovery is helping sustain some oil demand, but with a large proportion of the rest of the world in strict lockdowns, global crude demand remains low, keeping rates low. Suezmax and Aframax rates have recently shown some small signs of recovery, however, overall Crude Tanker rates are still suffering compared to rates seen towards the end of 2019 through to May 2020. VLCCs have been hit especially hard, entering negative rates in February.

At the same time, in February, demand volatility returned as global cargo mile recovery was seen to reverse and % growth change increased again to -10.5% compared to the same period in 2020. This reduction in cargo miles followed a surprise OPEC announcement in January, which stated global oil production would remain steady and Saudi Arabia, the world’s top crude exporter, said they would extend their oil production cuts into April 2021. Reduced Tanker exports from Saudi Arabia will only increase the available tonnage on the water, putting more pressure on already low rates. Floating storage now returning close to pre-pandemic levels is also contributing to the pressure on the market.

Fleet growth is relatively steady at the moment, with newbuilds accounting for around 8% of the total fleet size, which is low by historical standards. There is also currently little sign of increased demolition of the biggest crude carriers as the second-hand market is proving more lucrative, so no obvious signs to tighten supply by removing overcapacity by owners.

Summary

Over the last few months, the Crude Tanker market has continued to show signs of volatility, with rates still suffering and cargo miles faltering again in February after a short period of recovery seen towards the end of last year. Oil production cuts imposed by Saudi Arabia and Opec, and floating storage numbers returning to pre-pandemic levels are only expected to exacerbate the situation.

Global oil demand is currently being driven by China and South East Asia, partly due to how well China has managed their response to Covid-19, but sustained low demand across the rest of the world suggests a recovery for the Crude Tanker market is still a way off yet. Tanker owners and operators will be keeping a close eye on demand over the next few quarters, as vaccination programmes bring some hope of demand improvement and lockdowns begin to ease.

VesselsValue Trade data provides real-time, instant, and unbiased current and historical vessel demand data for any vessel type or trading route.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?

Comments

Leave a Comment