Market Chat: Week 44

Container sales slow

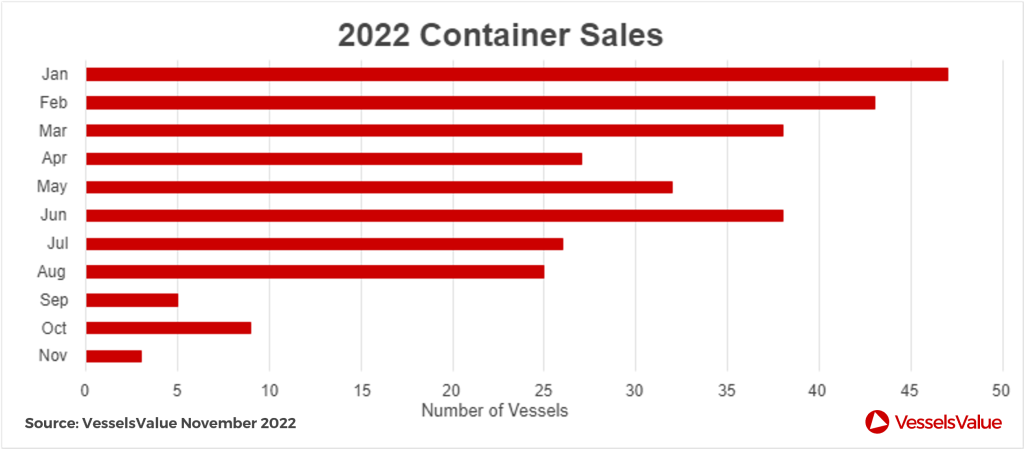

2022 to date has seen a total of 292 Container sales, with the majority of these transactions taking place in the first half of the year. In October there were just nine Container sales reported, compared to 47 in January, a decrease of 81%.

Of the sales recorded, four went to Greek buyer Contships, and four went to Swiss owner MSC, including the Panamax Zim Genova (4,253 TEU, April 2007, Dalian) that sold for USD 45 mil, VV value USD 48.78 mil.

Values for modern Container vessels have fallen across all sub sectors. The VV value for a five year old New Panamax vessel is currently at USD 107.25 mil, even though this is a fall of 39.5% from the start of the year, prices are still at incredibly high levels.

Values have fallen as earnings have taken a downwards trajectory following the record highs earlier this year. One year Timecharter (TC) rates for Post Panamax Containers are currently at 69,000 USD/Day. Although still far above historic averages, this is a fall of 54% from the record high of 148,500 USD/Day from March to August of this year. Economic fears and a fall in demand globally have continued to put pressure on rates.

MRs values dip slightly since start of Q4 but remain high

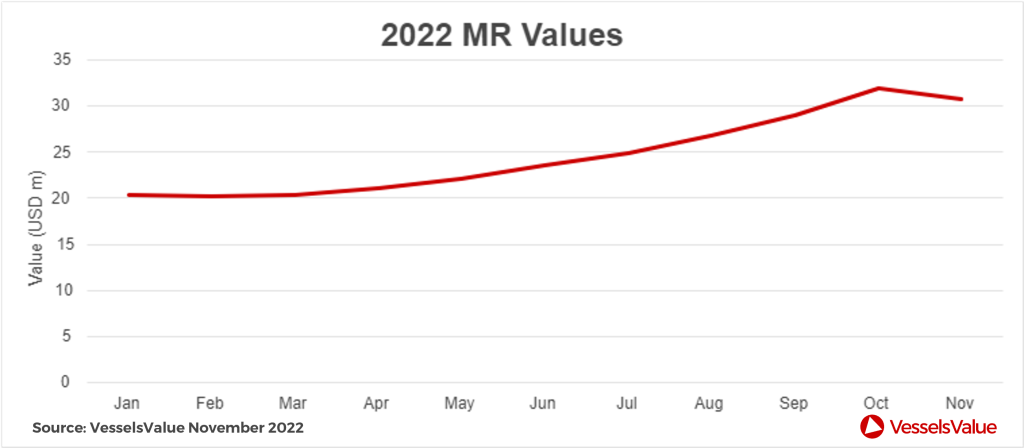

MR Values have dipped slightly after reaching a peak in mid October following a steady rise since February. Values for 10 year old, 50,000 DWT, MR2s have fallen by c. 3% since the start of Q4 to USD 31.07 mil. This comes as earnings for MRs have fallen from the highs of almost 70,000 USD/Day on the MR Pacific Basket (TC2 & TC14), seen in early August to 34,545 USD/Day. However, rates remain very firm and are up by 258% year on year from 9,652 USD/Day this time last year.

Despite this small drop, MR values remain at historically high levels and out of all the Tanker subsectors, older MR tonnage has seen the biggest increase this year with values for 20 year old 45,000 DWT vessels worth nearly double today, up from USD 6.6 mil in January to USD 12.18 mil today.

So far this year, there have been 209 MR sales reported, up c.21% from last year and the average age of vessels sold is 11 years. Recent benchmark sales include the Atlantica Bell (50,900 DWT, March 2006, STX Offshore) that sold to undisclosed buyers for USD 20.7 mi, VV value USD 17.61 mil.

VesselsValue data as of 10th November 2022.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?

Comments

Leave a Comment