Russian Naval Drills Impact Black Sea Trade Flows

Despite ending a blockade of Ukraine’s Black Sea ports, Russian naval manoeuvres in the early part of February have visibly impacted traffic in the region.

Ukrainian officials denounced Russian naval drills off its Black Sea coast last week, saying the presence of warships made navigating the busy trade route “impossible”. Traders were more cautious in their assessment, but data from VesselsValue shows a visible impact on trade volumes. The Black Sea is a major export region for several key commodities, including crude oil, refined oil products, liquified petroleum gas (LPG), steel, grain, and other agricultural products.

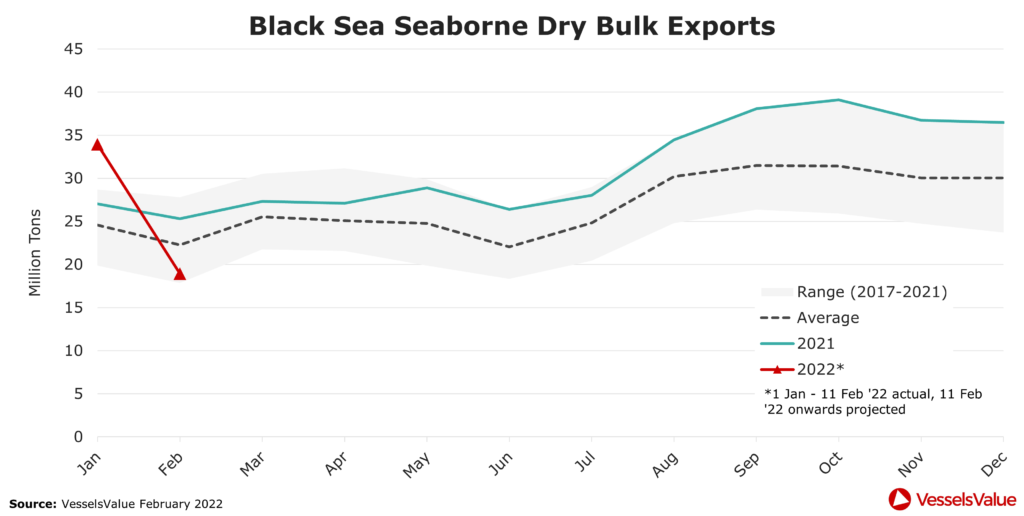

Dry bulk exports registered a particularly strong January. However, as shown below, shipments of dry commodities in February are on course for a -44% month-on-month fall. Some -15% behind the five year average for the time of year, toward the lower end of their 2017-2021 range.

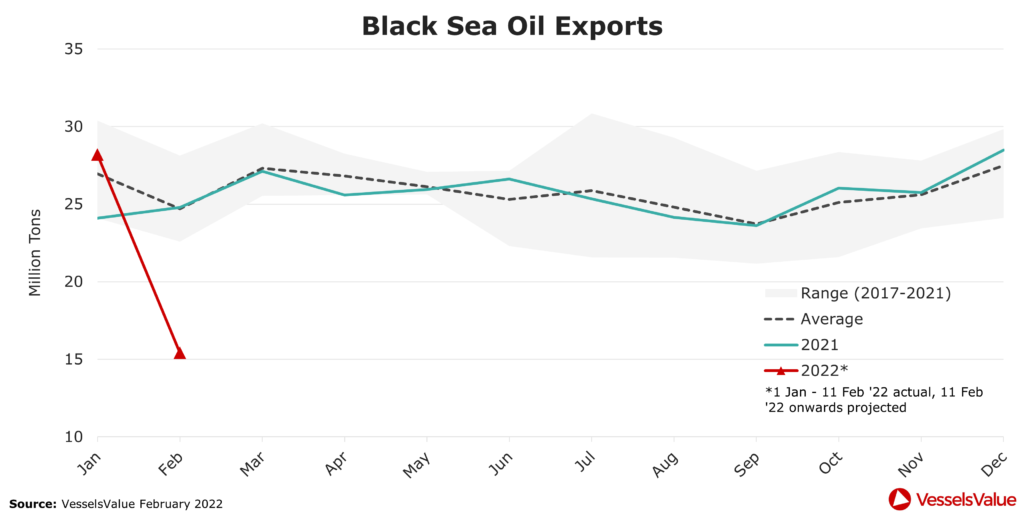

Oil exports were faring even worse, although there are additional factors at play, with generally weak demand for the region’s Caspian grade of crude oil reported from Asian refiners, which make up much of its customer base. January exports were again relatively strong, as shown below, but February volumes are on course for a -45% month-on-month decline and will be some -37% less than the five year average for the time of year.

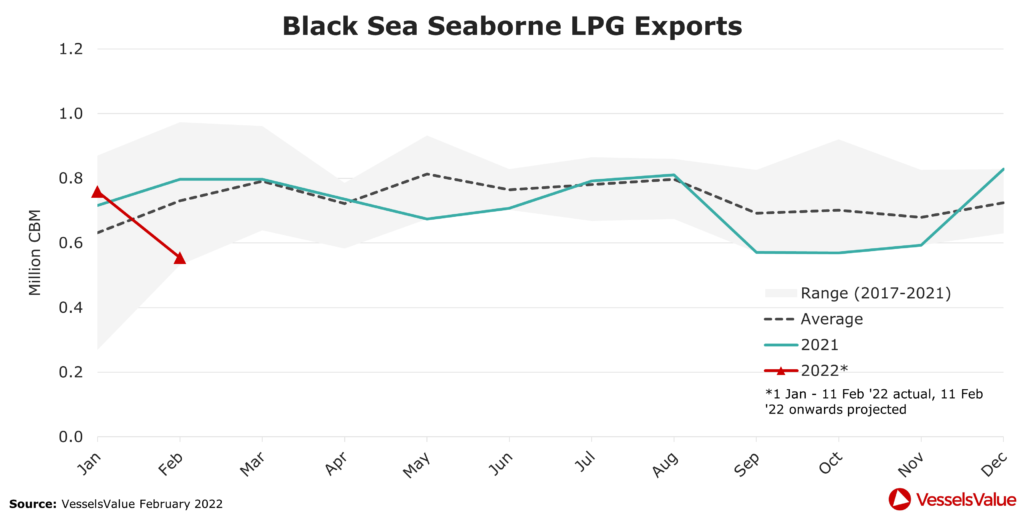

Meanwhile, LPG volumes showed some impact, but were not quite so badly affected. These include ammonia, mainly used for fertiliser production, and other chemical gases. Black Sea exports are on course for a -27% month-on-month decline, falling to some -24% below the five year average and at the very lower end of the 2017-2021 range.

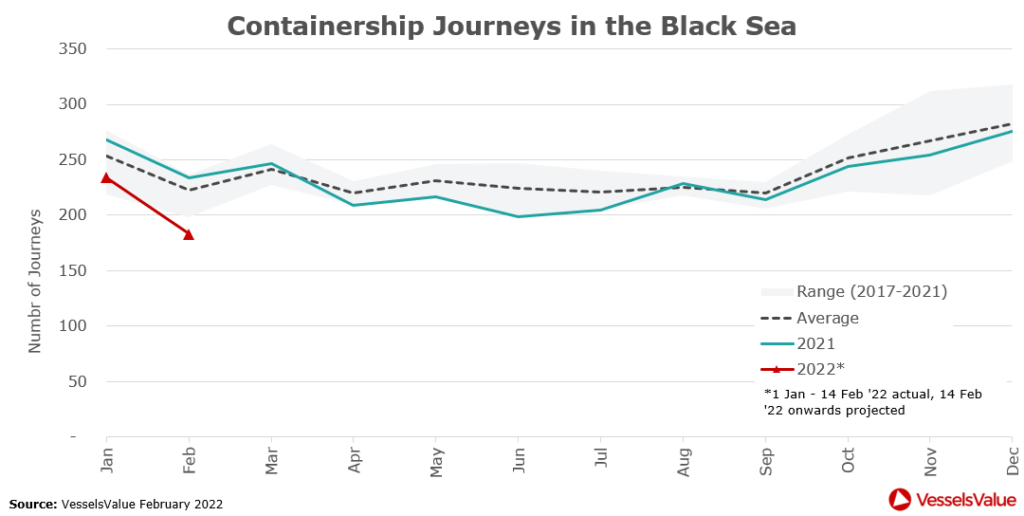

Regarding Containers, data from VesselsValue shows that Containership journeys in the Black Sea were already weak, trending slightly below five year seasonal averages since April 2021. However, in February 2022, they fell below the lower end of their five-year range and are on course for a -22% year-on-year drop, as shown below.

These figures quantify the scale of challenge currently facing shippers and supply chains in the region, with the data showing that trade from the Black Sea suffered at least a partial blockade.

Data as of February 2022.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?

Comments

Leave a Comment