2024 Shipping Market Highlights & Trends

2024 has been defined by significant activity across the maritime industry, with ongoing trends in newbuildings, sale and purchase transactions, and demolition levels defining the year. These dynamics have influenced the operational landscape, highlighting shifts in supply-demand balance, fleet modernization, and regulatory pressures.

Our End-of-Year Market Report is produced each year by Veson Nautical’s Maritime Analysts and provides a summary of the Tanker, Bulker, Container, Offshore, LPG/LNG, VC, RORO, Ferry and Small Tanker sectors for the entire year. Combining Veson’s extensive datasets with many decades of combined experience among our analysts, these insightful reports provide clarity on the key factors influencing each market and the potential implications for stakeholders in the months ahead.

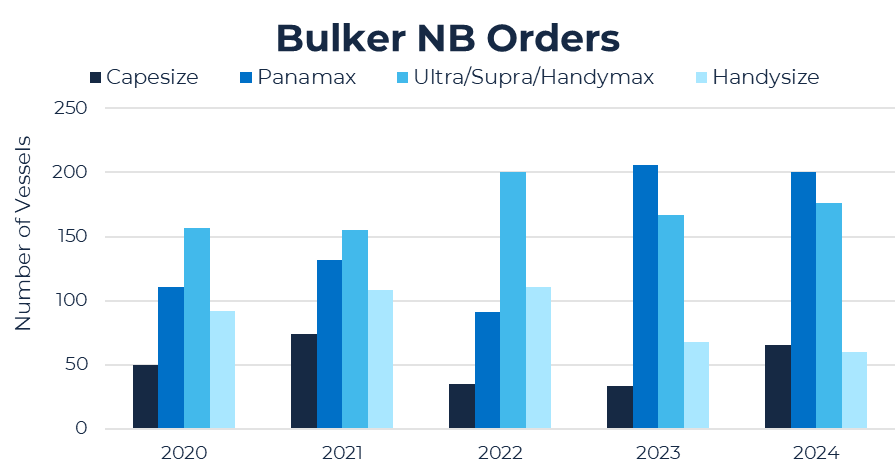

- The newbuilding market experienced continued growth, with a notable rise in orders, particularly in the Post/Panamax and Capesize sectors. Chinese dominance in both ordering and shipyard production remains a defining trend, further consolidating their position in the Bulker industry.

- The Container market experienced remarkable growth over the past year, driven by increased demand, rising earnings, and a robust asset value resurgence across all sectors. The crisis in the Red Sea catalysed significant ton-mile demand, elevating TC rates once again. Values surged across all subsectors, with older vessels experiencing some of the highest appreciation rates, reflecting strong market confidence.

- High ordering activity across all sectors have influenced the newbuilding price for LPG vessels. In addition, secondhand sales have increased 15.6% compared to 2023. Since asset prices have remained firm, vessels sold for demolition have decreased.

- Despite LNG TC rates being soft this year, both newbuilding activity and secondhand transactions have remained high. Large LNG vessels continue to be the most active size for both newbuildings and secondhand vessels. Asset values have increased this year but could start to decline if earnings continue to be soft and ordering activities across segments start to reduce. Demolition sales are at its highest in five years, but this could be the new normal as elderly non-eco vessels are becoming costly to operate and more difficult to renew its TC’s.

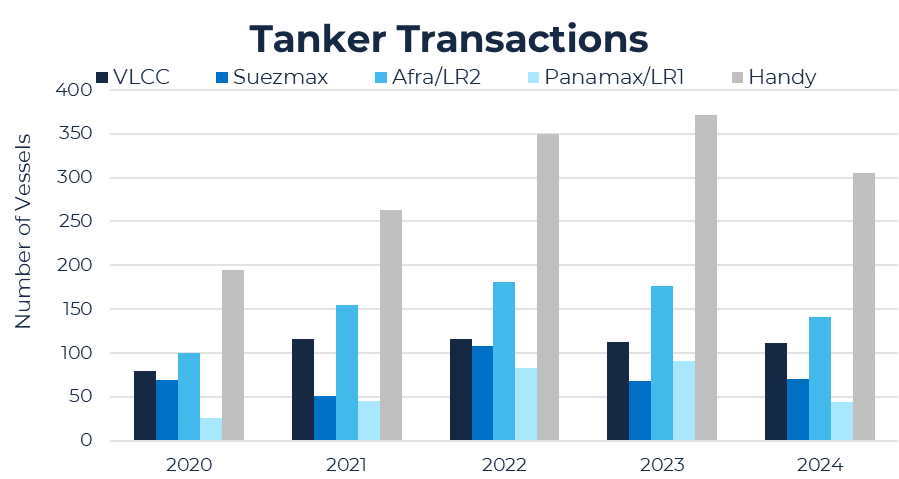

- In the Tanker sector, the secondhand sale and purchase market has seen a decline in activity compared to previous years, as high values and market uncertainty has tempered enthusiasm among buyers.

- The Offshore sector in 2024 has seen a marked recovery and positive growth, bolstered by constrained vessel supply, rising oil prices, and improving market fundamentals. The global Offshore Support Vessel (OSV) fleet utilization rates have continued to rise, reflecting stronger demand, particularly in key regions like Northwest Europe, where near-maximum utilisation rates have been recorded. This upward trend in vessel demand has driven higher earnings for owners, enhancing the profitability of operations and strengthening the financial position of many major players in the sector.

- In the Vehicle Carrier sector, there is sufficient demand for deepsea roll-on / roll-off transportation from China / Asia to maintain above average rates and asset values next year. And there are also c.1 million ‘cars in containers’ out of China that are likely to switch back to RORO modalities in 2025/26, providing an unexpected boost for demand.

- In the RORO sector, it has been a challenging year for freight and operator profits, but demand for secondhand RORO assets remained firm supported by tight supply and increased buyer interest from North America and the Middle East. Looking forward, we expect increased M&A activity from leading European players targeting revenue expansion, and a stable outlook for values in 2025 supported by a strong Container market.

- For Ferries, RoPax assets (>13k GT) generally held their value in 2024 supported by increased S&P activity reflecting firm buyer demand, low newbuild deliveries, and stable passenger and freight demand. Looking forward, we expect to see increased demand for new energy efficient vessels in response to tightening EU regulations, and similarly, an uptick in demolition activity based on an ageing fleet which is likely to be negative for old, large Cruiseferries.

- 2024 was a dynamic and rewarding year for the Chemical Tanker market, marked by strong freight earnings, robust demand, and increased asset values across all vessel segments. The extended Red Sea crisis and longer sailing routes contributed significantly to elevated ton-mile demand, while firm market conditions enabled COAs to be renewed at favourable rates. Investment trends highlighted a strong focus on larger vessels, with substantial orders placed, particularly by Chinese firms

Interested in more maritime insights? Download the full 2024 End-of-Year Report to enhance your market view, knowledge, and predictions.