2025 Mid-Year Shipping Market Trends & Highlights

The first half of 2025 has been characterised by cautious S&P activity, which has been shaped by regulatory tightening, reduced investor sentiment, and persistent geopolitical uncertainty. Instability in the Middle East, particularly disruptions in the Red Sea, has continued to affect global trade flows and routing strategies, while renewed tariff tensions have weighed on asset values and transaction volumes.

Environmental compliance deadlines continue to drive fleet renewal in certain sectors and rising financing costs and lingering inflationary pressures have tempered appetite for risk across much of the market. Notably, sectors such as Suezmax Tankers and modern LNG carriers have seen stronger interest, while older and less efficient vessels face growing pressure amid tightening margins.

Veson Nautical’s 2025 Mid-Year Shipping Market Report, compiled by our maritime analysts, offers a comprehensive review of S&P activity across the Tanker, Bulker, Container, Offshore, LPG/LNG, Vehicle Carrier, RORO, Ferry, and Small Tanker segments. Drawing on Veson’s deep data resources and the broad industry insight of our team, this report captures key trends shaping the first half of the year and outlines the outlook for asset markets into the second half of 2025.

Here is a brief overview of how the major market sectors are performing:

Bulkers

Capesize values climbed c.7.7% in 1H 2025 on firm iron ore demand and limited fleet growth, while most other segments saw declines in values. Newbuilding orders hit their lowest 1H total since 2017 at 169 vessels (down c.26% YoY), and S&P volumes dropped c.36% YoY to 425 sales. Demolition stayed minimal at 34 vessels, as firm earnings kept older ships in service.

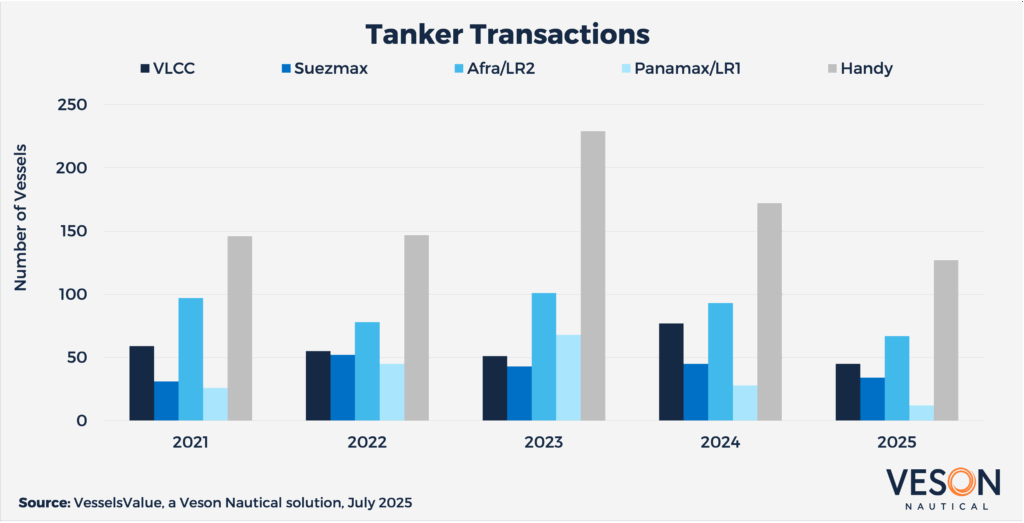

Tankers

Asset values slipped across most segments supported by a decline in orders down c.74% YoY (289 to 74), and S&P activity falling c.31% YoY to 285 transactions. MR2s stood out, making up c.34% of sales and maintaining average TC rates of just over USD 20,100/day, supported by flexible deployment and resilient demand. Demolition rose to 15 vessels—the highest since 2022.

LPG

Earnings averaged c.24% below 1H 2024, with VLGC rates down to USD 37,900/day despite short-term spikes from Middle East tensions. Newbuilding orders fell 80% YoY to just 14 vessels, and S&P activity dropped 25% YoY to 55 deals. Six older, small fully-pressurized vessels went for scrap.

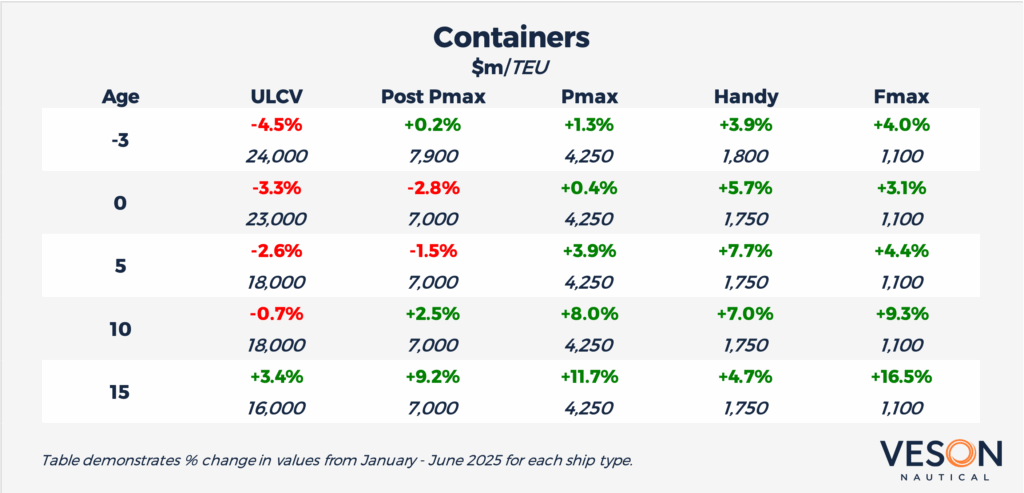

Containers

Tight tonnage supply and rerouting around the Cape of Good Hope kept charter markets firm (up c.28% YoY for sub-8,500 TEU ships), boosting values across most segments. Newbuilding orders surged 288% YoY to 194 vessels, while S&P volumes fell 21% and demolition plunged 87% to just 4 ships.

Vehicle Carriers

An influx of Large Car Truck Carriers lifted supply by 5% against just 4% growth in Asia’s light vehicle exports, pushing the VV 1-Year 6,500 CEU TC Index down 44% since January. Values for 10-year 6,500 CEU ships fell c.11%, no newbuilds were ordered, and only 9 S&P deals closed; demolition was absent in 1H.

Offshore

High utilization (North Sea OSVs at c.95%) and spot AHTS rates above USD 100k/day drove further gains in secondhand values, though S&P volumes halved to 69 deals as owners held tonnage. Newbuild orders rose c.50% YoY to 36 vessels, led by AHTS units

Interested in more maritime insights? Download the complete 2025 Mid-Year Shipping Market Report to enhance your market view, knowledge, and predictions:

2025 Mid-Year Shipping Market Report

Enhance your Q3 market strategy by combining our quarterly forecast with a historical recap on newbuilding values, S&P activity, and demolition trends.

All information provided is for informational purposes only. To the extent that any provided information is based on Veson Data, Veson excludes to the extent permitted by law all implied warranties relating to fitness for a particular purpose, including any implied warranty that Veson Data is accurate, complete, or error free. Veson Data are collated and processed by and on behalf of Veson in accordance with methodologies and assumptions published and updated by Veson from time to time which do not take into account particular circumstances applicable to individuals and therefore; (i) are made available on an ‘as is’ basis; (ii) are not intended as a substitute for formal valuations; (iii) should not be used solely as trading, investment, or other advice; and (iv) are not intended as a substitute for professional judgement. To the extent permitted by applicable law, Veson shall have no liability to party for any errors or omissions in the content of the information provided.