Superyacht Values Launched

VesselsValue brings transparency to a traditionally opaque market with automated Superyacht values

London based online valuation and data provider, VessesValue Ltd, have today launched their automated valuation platform for Superyachts, an industry first.

The company who already have deep roots in the maritime industry have gone live with daily updated current and historical values back to 2012, available for over 6,000 Superyachts greater than 24m in size.

It is the first time their product has been available to the wider consumer community as well as existing industry stakeholders.

The database that underpins their automated valuations contains over 9,000 live and on order Superyachts together with a comprehensive searchable record of all asking prices, sale and purchase transactions, newbuilding contracts and refits in an effort to bring true transparency to the market.

“20% of the Superyacht fleet is for sale at any given time but sale prices are rarely disclosed to the market place. VesselsValue’s aim is to bring transparency into the sector and become the number one go to valuation service for Superyachts globally” states Chief Commercial Officer, Matthew Freeman.

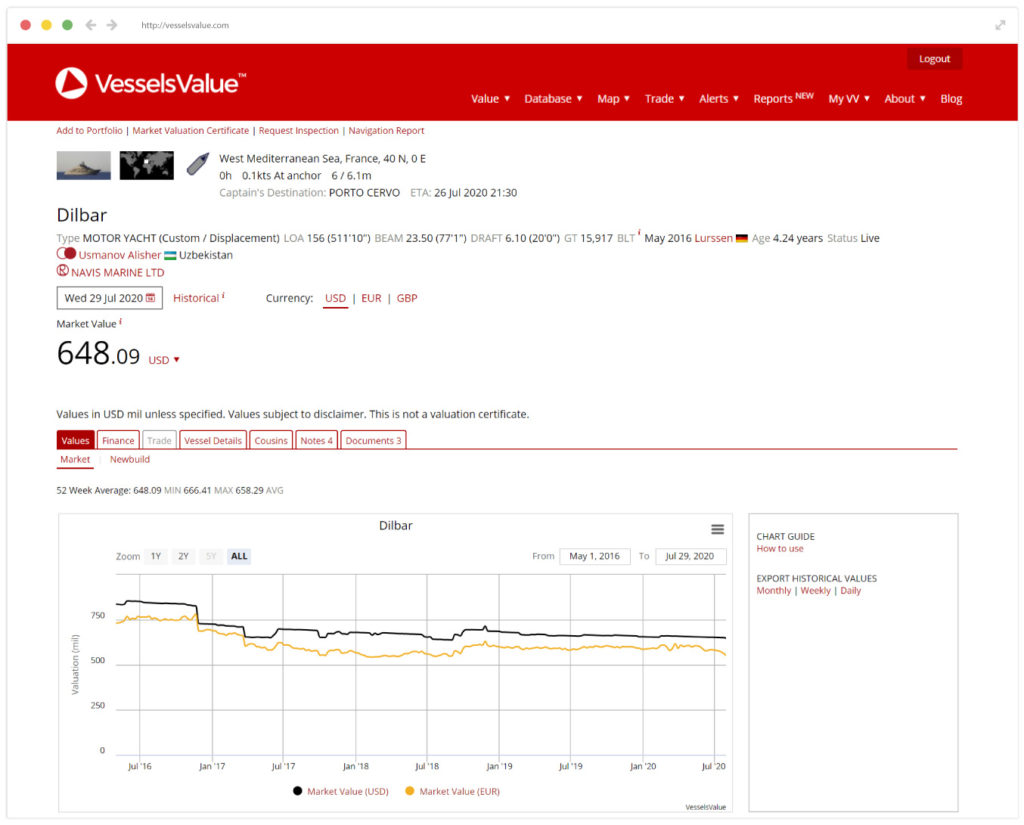

The worlds largest live Motor Yacht (by Gross Tonnage) is M/Y Dilbar, 15,917 GT / 156m LOA, blt 2016 Lurssen which has a VesselsValue value today of USD 648 mil. This one of a kind Superyacht is owned by Russian oligarch Alisher Usmanov.

Screenshot of M/Y Dilbar

For those with a more modest budget, VesselsValue data suggests a 60m 10 year old Superyacht from a top yard is worth c. USD 36 mil and a 30m planing yacht of same age to be USD 2.6 mil without adjusting for any extra features.

VesselsValue’s Superyacht team is led by a team of experts including yachting specialist Dennis Causier. Dennis has been involved in the industry for over 40 years both in an advisory role and as a yacht owner himself and acts as a commercial counterpoint to the data that VesselsValue provides. Project lead Sam Tucker has over 9 years experience both on and offshore.

Pictured L-R: Matthew Freeman (Chief Commercial Officer), Dennis Causier (Senior Superyacht Specialist), Sam Tucker (Project Lead)

Sam Tucker, Project Lead states that “Valuing a Superyacht is not the same as valuing a commercial cargo carrying vessel. Superyachts are seldom purchased as investments as such they do not commonly have a definable earning value. We have taken extra time and due diligence immersing ourselves into the world of Superyachts, gaining stakeholders trust and approval in order to better understand the true value of these assets. We consider good clean data and market transparency to be essential and integral parts of the valuation process and believe our product will save prospective yacht owners, financiers and other market participants a great deal of time and money.”

VesselsValue’s automated Superyacht valuations have come at a time when the world is under constraint of the COVID-19 pandemic however unlike other maritime assets, their depreciation has not been as severe.

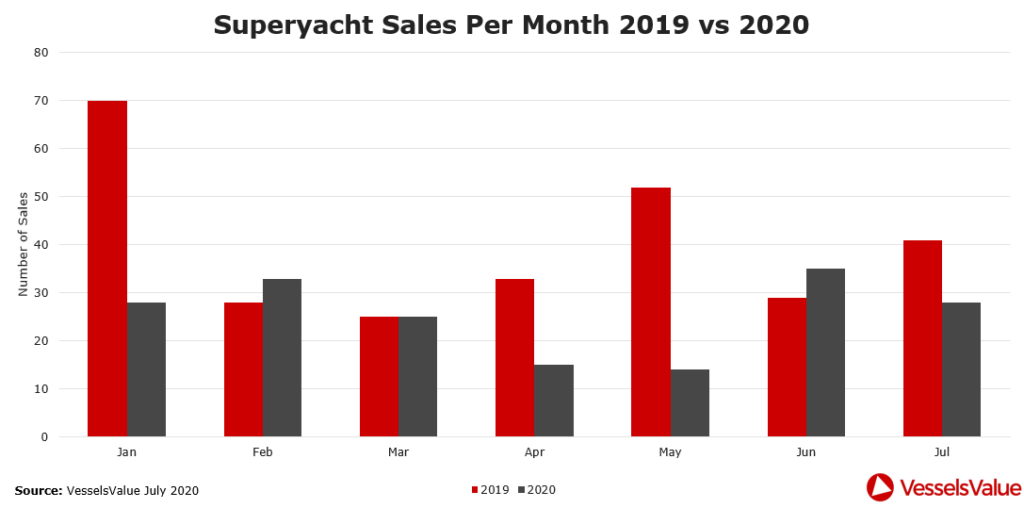

“Changes to our Superyacht values have been primarily driven by sale and purchase data” says Tucker. “2019 was a good year for Superyacht sale and purchase with a high level of liquidity seen. Sales for 2020 are down 30% but there still remains a healthy level of transactions occurring giving the VesselsValue model sufficient data points to consider.”

Number of confirmed sales per month, Jan – Jul, 2019 vs 2020

“As we approach summer in the northern hemisphere, utilisation rates typically increase and sales experience a seasonal lull. This year could be different with the pent up demand being realised in the market place.” Tucker says. “With the Monaco Yacht Show being cancelled this year, all eyes will be on the Cannes and Fort Lauderdale shows and the transactions that will follow.”

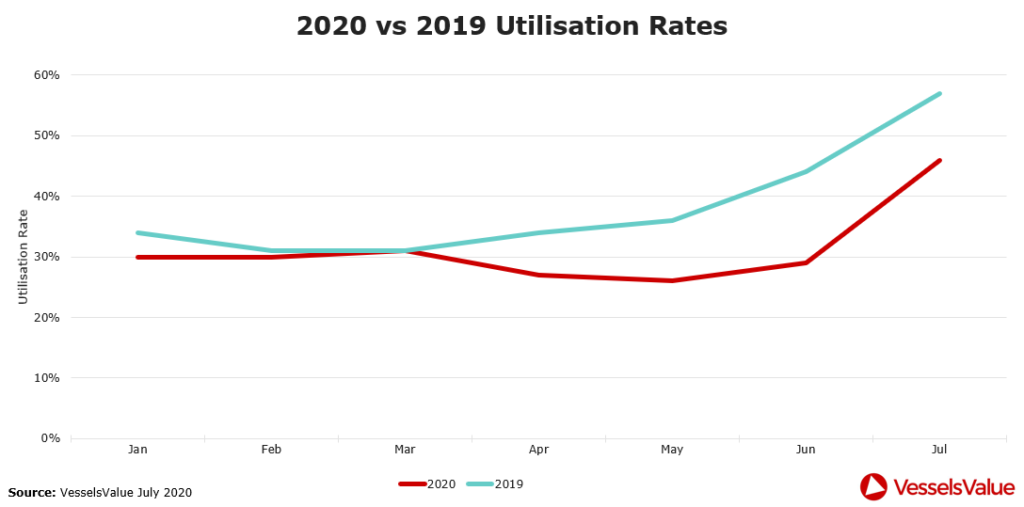

VesselsValue is able to directly capture changes in market sentiment through the increased significance given to recent sales when calibrating their model but also through the collection and analysis of Superyacht utilisation. Using their own AIS tracking platform, VesselsValue is able to identify the daily positions and movements of individual yachts. Analysing this data in conjunction with the known location of marinas and shipyards, enables the company to gauge Superyacht usage. Then after adjusting for seasonality, VesselsValue is able to compare and model current and historic usage of yachts for use as a measure of sentiment in their regressions.

Comparison of Superyacht utilisation rates 2019 vs 2020

2020 to date shows a lower level of utilisation due to the travel restrictions enforced by global governments, however, the VesselsValue model needs to see a sustained period of lower utilisation in addition to lower sale prices achieved for any meaningful effect on valuation to occur.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.