Market Chat: Tankers Strengthen VLCC Earnings

Tankers continue to strengthen

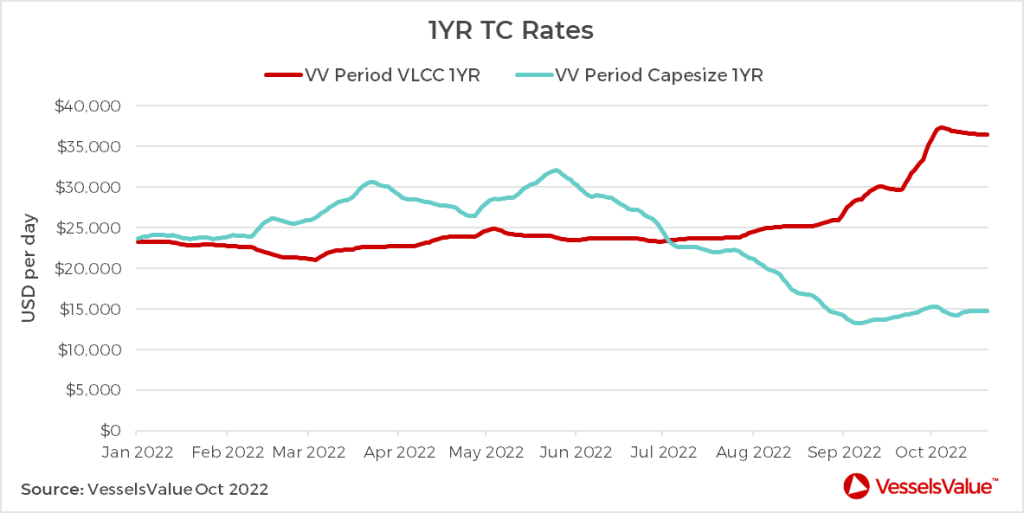

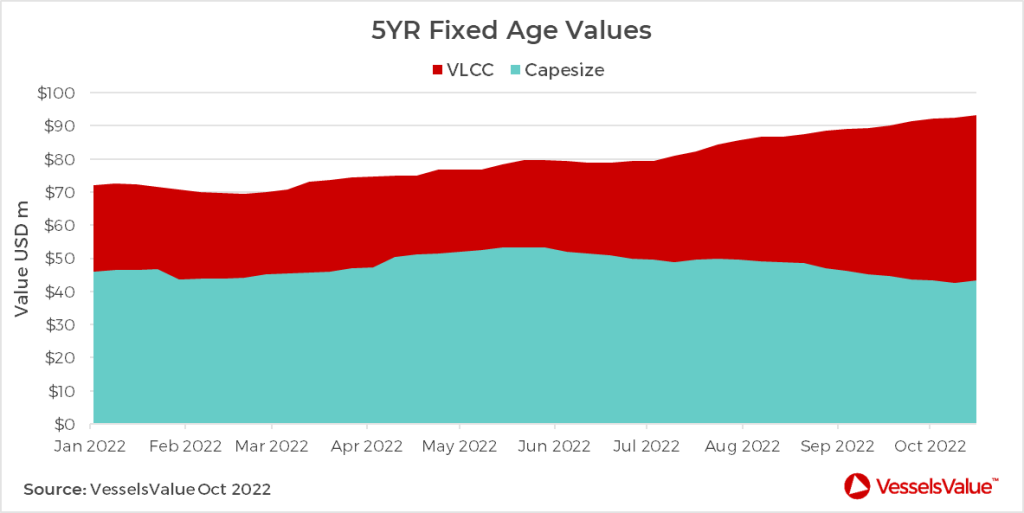

VLCC asset prices and rates are finally seeing the increases that the market was hoping for. Sentiment for Tankers is strong with VLCC earnings having risen consistently since June and peaking towards the end of September at almost 70,000 USD/day.

This is primarily due to seasonality, with an increase in demand as we approach the northern hemisphere winter. Additionally, there is a change in trade flow patterns due to the conflict in Russia and Ukraine, congestion and a reduction in vessel supply. The latter is caused by vessels being sold out of the market and into the ‘dark fleet’, operated by owners not subject to international sanction laws.

Despite a softening following the announcement of production cuts by OPEC+ earlier this month, rates have bounced back up. Baltic Exchange rates for TD3C-TCE Middle East Gulf to China are currently at 66,038 USD/day. Rates for the same period last year were 73 USD/day.

Sale and purchase activity for Tankers remains firm, 890 transactions were recorded in the first three quarters of 2022, up 17% year on year and Tanker values have risen across the board since January.

There is a clear trend towards older tonnage. So far this month, sales include the Suezmax Nordic Cosmos (160,000 DWT, January 2003, Samsung) sold to undisclosed buyers for USD 21 mil, the VesselsValue market value was USD 22.55 mil. Also, the LR2s Sea Legend and Alburaq (112,500 DWT, Dec 2008/Oct 2008, Hyundai HI) sold to undisclosed buyers for USD 35 mil each in an en bloc deal, with a VesselsValue market value of USD 36.56 and 36.20 mil respectively. 16 year old, Korean built, MR1 Baltic Advance, sold for USD 16.5 mil, the VesselsValue market value was USD 15.47 mil.

Bulker values turning a corner

Bulker values are now beginning to stabilise. After falling during Q3, Capesize values for 5 year old vessels plunged by c.13% over the course of the last quarter from USD 49.83 mil to USD 43.32 mil. Since the beginning of October, values have turned a corner and have begun to show signs of improvement, particularly for older vessels. Values for 15 year old Capesizes have now increased by 5% from the start of October to USD 21.26 mil.

This is due to improvements in freight rates that reached 21,175 USD/day on the 5th October, according to the Capesize 54-TCA route from the Baltic after plummeting to a two year low at the end of August of 6,413 USD/day. Demand for Bulkers is receiving a boost due to renewed coal demand stemming from the energy crisis. The ongoing conflict between Russia and Ukraine that has increased ton mile demand for this sector, and the impact of new stimulus measures from the Chinese government.

Average values for 20 year old Panamaxes have increased by 2.34% since the beginning of the month to USD 10.93 mil. For example, the Panamax Golden Harvest (76,600 DWT, July 2001, Imabari) sold to Chinese buyers earlier in October for USD 10.50 mil. VesselsValue market value the day before the sale was USD 10.53 mil and the current market value is now USD 10.89 mil, an increase of 3%.

VesselsValue data as of 15th October 2022.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?