Vehicle Carrier and RoRo Full Year Review 2022

Vehicle Carriers (PCTC, LCTC)

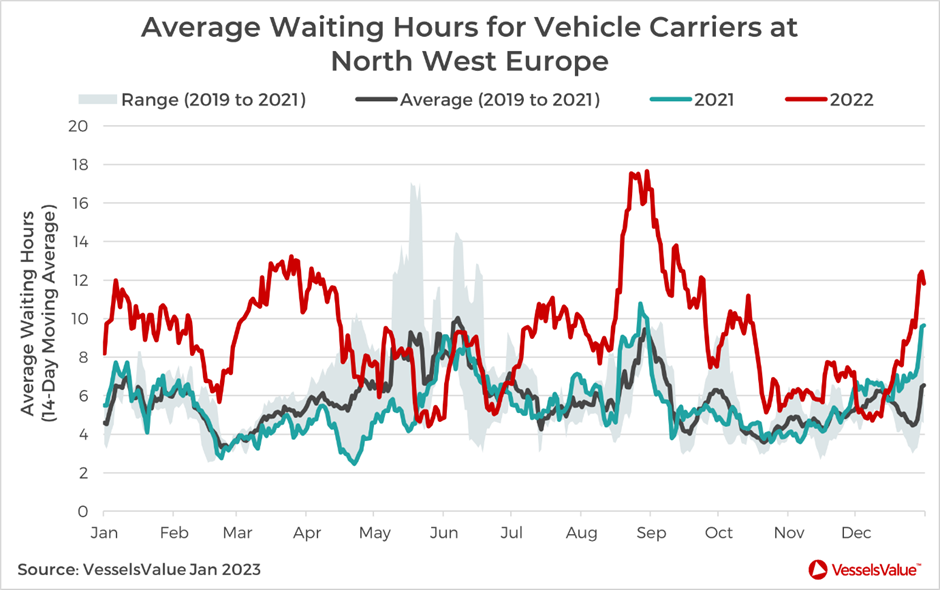

Short Shipping supply got further squeezed for exporters in 2022 due to chronic land side congestion at major ports and terminals in Europe, reducing PCTC (Pure Car Truck Carrier) ship call frequency and therefore capacity. Terminal space completely maxed out in August at major hubs in the Med and Northwest Europe, including Bremerhaven, Zeebrugge and Antwerp, resulting in record delays for Vehicle Carriers on main Transatlantic and Asia to Europe liner services (as shown in Figure 1.1).

A shortage of truck drivers, dockers, microchips, and ships meant cars stayed in ports for longer, leaving no space for new deliveries. PCTC supply was already short entering into 2022, based on historically low vessel orders from 2016 averaging four units per year, followed by excess scrapping in year one of Covid-19. This left the sector in a perilous state to cope with any demand spikes or sustained periods of congestion, both of which materialised last year and widened the supply demand imbalance, pushing up rates and values.

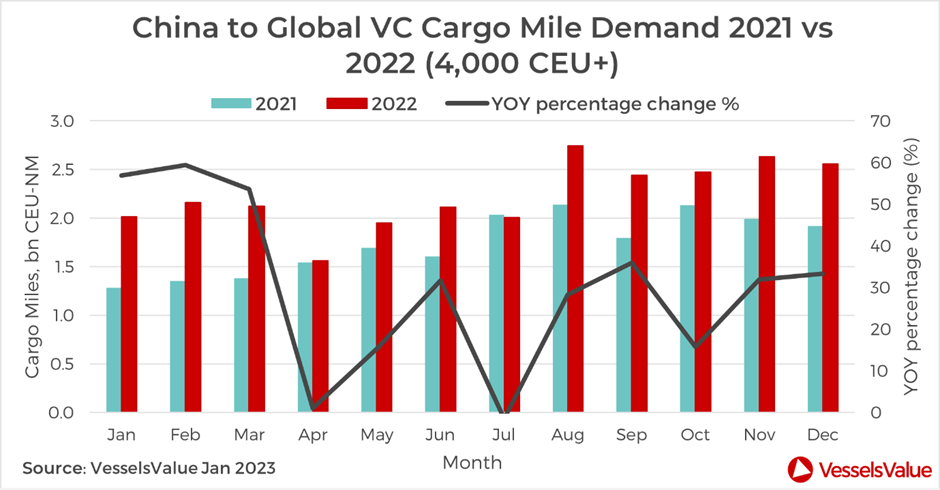

On the demand side, strong EV (Electric Vehicle) trade growth from China lifted global CEU cargo miles by +1.2%. Chinese finished vehicle exports topped c. 3 million units by December, achieving c. 54% growth year on year (YoY) which was phenomenal. Tesla was the star performer again, based on increased deliveries from their Gigafactory in Shanghai. Rival BYD became a shipowner, ordering six units spread over three domestic shipyards, suggesting new OEM (Original Equipment Manufacturer) led models are emerging from China. Whilst a minor but growing share of finished light vehicles were shipped in Containers and dedicated racks stuffed into cargo holds, symptomatic of a supply starved PCTC market.

2022 was a golden year for tonnage providers realising impressive stock gains from highly profitable charters, which went into overdrive after Lake Geneva (6,178 CEU, Jan 2015, Imabari) was extended to Nissan for 100,000 USD/Day in August on a twelve month deal. The same ship was fixed out at 40,000 USD/Day to Glovis at the end of 2021, equating to a +150% increase inside nine months. Charterers were forced to take vessels on longer three and five year deals, at loftier day rates as 2022 closed, whilst demolition was virtually non existent based on general PCTC scarcity.

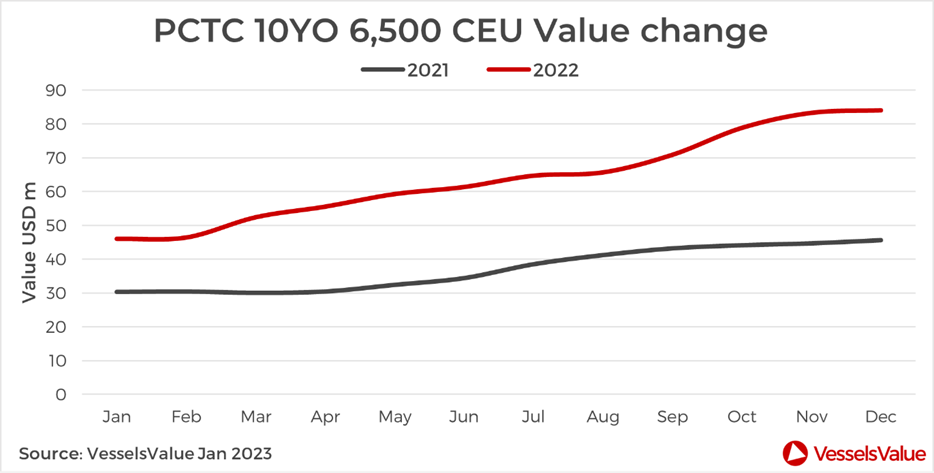

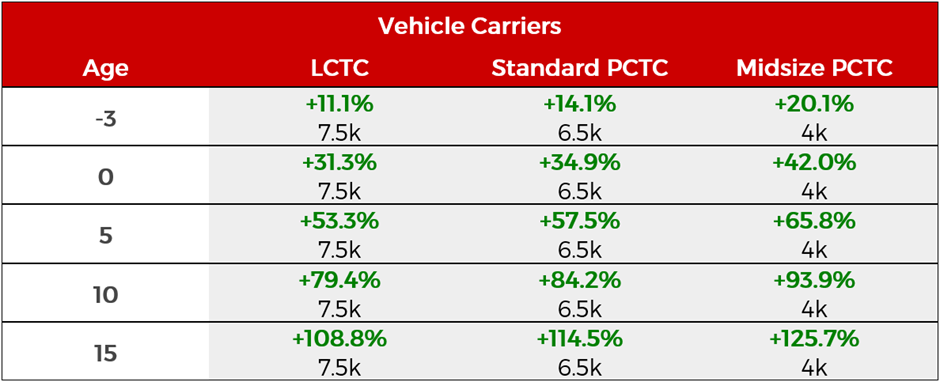

By the year’s end, the VV 1YR 6,500 CEU Time Charter Index had climbed +200% to 103,000 USD/Day. A standard 10 year old 6,500 CEU PCTC increased in value by a whopping +84% to USD 84 mil. 2022 was a record year for rates and values from a genuine super cycle.

Sentiment has turned soft as per one leading shipowner this month, citing recessionary headwinds destructing sales demand. However, we are not seeing any softening in values yet. On the contrary, charter rates continue to edge higher supporting higher values.

Short supply fundamentals have another twelve months to play out possibly longer, until the sector is rebalanced by an armada of deliveries expected in 2024 and 2025, This will almost certainly bring down freight rates and asset values, unless China continues its amazing growth trajectory. The top of the cycle is near, but we are not quite there yet.

versus 2021, 2020 and 2019.

VC S&P Analysis

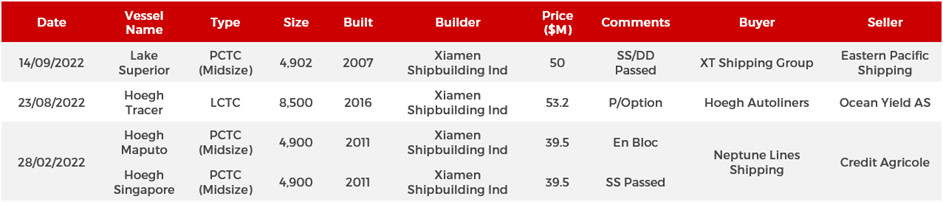

- The biggest deals for S&P revolved around 10 to 15 YO Midsizes built in China. Hoegh Maputo (4,900 CEU, July 2011, Xiamen Shipbuilding) and Hoegh Singapore (4,900 CEU, November 2011, Xiamen Shipbuilding) were snapped up for USD 39.5 mil each by Neptune Lines in February, compared to VV values of USD 33.15 mil each the day before sale. Seen as high prices at the time, they have since proved to be shrewd acquisitions.

- In September, XT Shipping acquired Lake Superior (4,902 CEU, June 2007, Xiamen Shipbuilding) for USD 50 mil from Eastern Pacific. VV’s value was USD 46.63 mil the day before sale. An older, less efficient unit compared to the Hoegh pair, trading on a lower CII rating. However, buyers were prepared to pay a USD +10.5 mil premium to secure this asset just seven months later. Confirming strong intra year appreciation of c.25% for 15YO Midsizes.

- Other headline deals involved purchase options triggered by Hoegh. Large Car Truck Carrier Hoegh Tracer (8,500 CEU, March 2016, Xiamen Shipbuilding) was purchased from Ocean Yield for USD 53.2 mil in August. A bargain deal for one of the largest ships on the water which must have pleased shareholders. The fourth bareboat chartered vessel which Hoegh declared options to buy. VV valued this ship at USD 91.08 mil on the 1st of August. It could have earned more from the charter market, if Hoegh could afford this luxury.

- Bullish sentiment firmed month on month (MoM) for deepsea assets, up +84% for the year based on a standard 10YO 6,500 CEUs. This was on top of +50% growth achieved in 2021 (figure 1.3). A red hot charter market firmed higher in November after Midsize Lake Kivu (4,902 CEU, November 2006, Xiamen Shipbuilding) was fixed out rather than sold, at 75,000 USD/Day for three years to Suardiaz, earning tonnage provider EPS a cool USD 82 mil for the period.

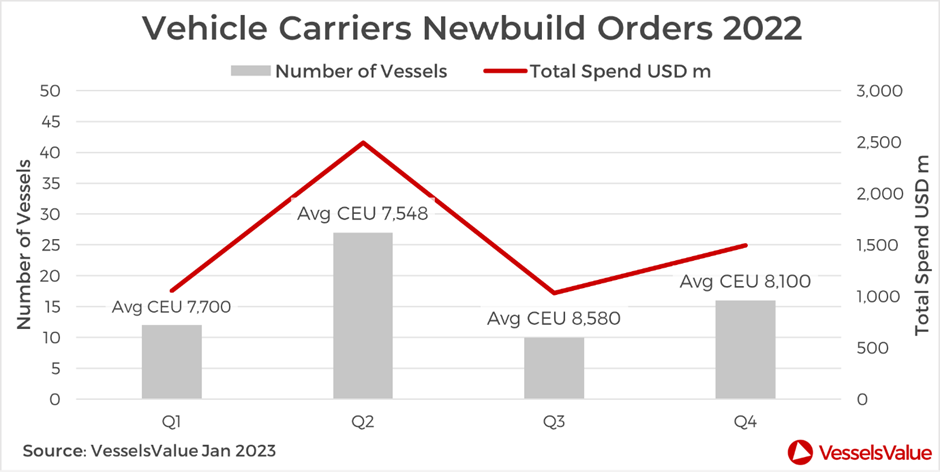

VC Newbuild Orders Rallied

- Total spend up +32% based on USD 6.07 bn

- Total vessels ordered up +20% based on 65 ships confirmed

- Average ship size up +14% based on 7,982 CEU

Increased EV trade growth forced shipowners to order larger ships in 2022. Electric Vehicle demand continues to transform the fleet because unit weights are heavier, and dimensions are generally wider than legacy ICE (Internal Combustion Engine) units, determining more capacity is required to carry the same number of cars around the world because of deadweight.

Additionally, no Smalls or Midsizes were ordered, which is ominous for intraregional supply in Europe and Asia. Investment was squarely focussed on deepsea ships, averaging almost 8,000 CEU in size (as shown in Figure 1.4).

Demolition Non Existent in a Supply Starved Market

Trade Driven by China

- Global Cargo Miles up +1.2%

- China to Global Cargo Miles up +28% based on 26.5 bil CEU-NM (>4,000 CEU)

- Short PCTC supply remained flat at c.590 all year (>4,000 CEU)

Chronic port congestion in Europe led to a complete booking stop by leading operator WalWil in October and November, impacting liner exports to North America, Far East, Middle East and Oceania. A dramatic operational decision deemed necessary to protect OEM contracts, alleviate terminal pressure, and recover schedule integrity to their global network. Increased EV trade from China undoubtedly added to the strain.

Paradoxically, freight rates firmed higher despite reduced service levels for shippers, from reduced supply. PCTCs got sucked into China deepsea trades at the expense of other less attractive routes, including 3,000 to 4,000 CEUs typically employed at an intraregional level.

Short PCTC supply remained stuck at c. 590 vessels (>4,000 CEU) all year, meaning shippers had to pay higher premiums to secure additional capacity and keep contracts up for renewal.

Values Hit Higher Highs

- 1YR 6,500 CEU Time Charter Index climbed +200% to 103,000 USD/Day

- 10YO 6500 CEU Values appreciated by +84% to USD 84 mil

Demand outstripped supply from continued pent up demand, strong EV trade growth from China, and tightening port congestion in Europe slowing ship call frequency.

Over the course of the year, 15YO assets more than doubled in value as per VV’s matrix (which displays values for standard vessels across different ages).

Outlook

- Recent “cautiously optimistic” guidance from leading operator WalWil shows shipowners are quietly confident of another strong year of high freight rates, robust earnings and high values from continued pent up demand

- OEMs must sit tight for another 12 months until PCTC deliveries sufficiently replenish supply to catch up to demand, continuing to look at all logistics alternatives in the meantime

- Vessel number deliveries will add +3% growth to the fleet in 2023. Demolition is expected to stay ultra low, thus a supply uptick looks firm. However, LV sales and production forecasting is also projecting similar growth of +4%, closely tied to export volumes on PCTCs. Further support for “more of the same” arrives from reoccurring port congestion in Europe, and CII gradually slowing fleet speeds

- Overall, fundamentals are not going to change that much in 2023, supporting continued high rates and values until 2024 when supply finally receives a major injection of CEU capacity. 2023 will be the last year of this super cycle

RoRos

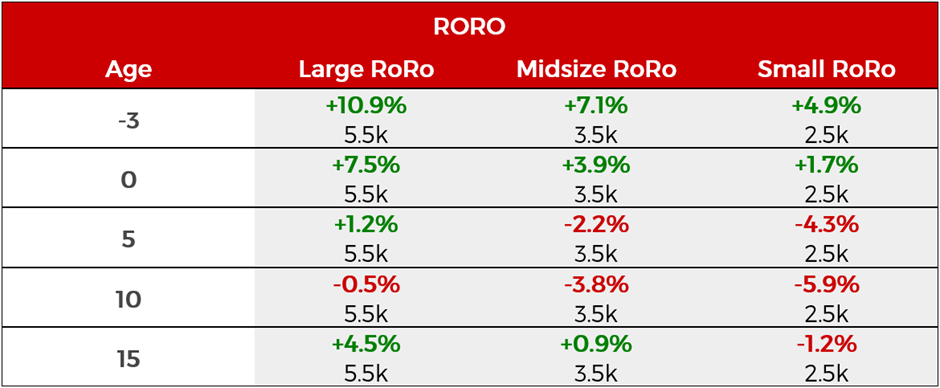

A stable unaccompanied freight market supported by additional overflows from Container and Vehicle Carrier sectors, ensured earnings and values held firm throughout 2022 for RoRos, mostly trading on intraregional routes.

Freight demand was particularly strong in the first half until Container demand collapsed from July, persuading newly gained shippers to return to LoLo (Lift on, Lift off) modalities. Nevertheless, sky high demand for car capacity in Europe kept OEMs interested in RoRos and Ferries for their regional ocean logistics, supporting asset demand. Leading European operator CLdN fixed out three Japanese builds to Ford in Q4 including Melusine (2,307 LM, April 1999, Kawasaki), Clementine (2,307 LM, February 1997, Kawasaki) and Celandine (2,307 LM, January 2000, Kawasaki) on twelve month deals, a growing trend which is likely to continue in 2023.

Charter rates firmed towards the year’s end particularly for scrubber fitted units in the 3,500 LM range. Hafnia Sea (3,332 LM, April 2008, Jinling Shipyard Jiangsu) and Corona Sea (3,332 LM, January 2008, Jinling Shipyard Jiangsu) were fixed out by shipowner Ellingsen to Transfennica at 25,000 EUR/Day for three years in December. Three months earlier, Leevsten (4,076 LM, August 2019, FSG) was extended to Cotunav at 22,000 EUR/Day, also for three years, proving rates had firmed. Whilst for Smalls, Balearia agreed to take scrubber fitted Color Carrier (1,775 LM, January 1998, Damen Galati) on charter paying new owner CLdN 15,000 EUR/Day over 25 weeks to trade as Cadena 4 between Huelva and the Canary Islands.

In S&P, Midsize Gardenia Seaways (4,076 LM, July 2017, FSG) was sold BBHP (Bareboat Hire Purchase) by DFDS to Ulusoy in June for EUR 48 mil. Although not a straight sale, a good reference point for cousins in the sector. Whilst for Smalls, scrubber fitted Color Carrier (1,775 LM, January 1998, Damen Galati) was sold by Color Line to CLdN for EUR 12.5 mil in November. A high price for a 25YO asset showing demand remains firm for vintage units in main market Europe.

In the deepsea segment where less than 10% of the fleet trades, ConRo values rocketed from a red hot charter market. Large assets with capacity to carry +2,000 cars, in addition to dedicated Lane Meter and Container capacity, firmed by +25% in value from exceptionally strong PCTC earnings built into VV’s model. The market realised how valuable deepsea ConRos had become when Jolly Diamante (6,350 LM, 3,001 TEU, December 2001, Daewoo) was sold by RORO Italia / MSC to Liberty Global Logistics for USD 78 mil in June. An impressive price for an 11YO asset, comfortably eclipsing the USD 70 mil order price paid by Ignazio Messina to Daewoo shipyard back in December 2009.

Nine month revenue results released by stock listed Finnlines (+31%), a subsidiary of Grimaldi Group, and DFDS (+61%) showed that Is was a solid year for RoRo operators. RoRos were one of the quickest ship types to recover from the pandemic, and remain a safe bet for investors relative to other sectors including Ferries, based on more stable market fundamentals.

In M&A, CLdN stole the headlines, acquiring Irish Sea specialist Seatruck Ferries from Clipper Group in September, taking ownership of eight vessels including Seatruck Precision (2,166 LM, June 2012, FSG) valued at € 27.57 mil by VesselsValue dated 31st Dec 2022.

RoRo S&P Analysis

RoRo Newbuilds

Values Held Firm

Outlook

- Demand should soften in 2023 according to one leading European operator this week, continuing trends from the second half of 2022. However, recent fixtures suggest otherwise showing firm demand for assets across all ages and sizes, especially scrubber fitter units based on more favourable diesel prices, supporting earnings and values

- Shipowners are setting higher asking prices for 5YO and 10YO RoRos in the 2,000 LM and 4,000 LM size range which is positive for values. Further support arrives from OEMs such as Ford switching over to Small RoRos as an alternative to Vehicle Carriers chronically short on supply

- Balanced supply demand fundamentals, decreased inflationary pressures across Europe, and strong demand for car capacity by OEMs are likely to support RoRo earnings and values into 2024. RoRos continue to be a safe bet for investors

VesselsValue data as of January 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?