Are 2024 Market Conditions Conducive to Consolidation in Chemical Tankers?

The chemical tanker-owning sector is no stranger to mergers and acquisitions with a history of notable activity over recent decades. But this year, transactions are continuing amid less obvious market conditions. Veson analysts explore the data and look at what is driving them.

Introduction

Acquisitions, consolidations, and mergers have been a distinct theme in the Chemical Tanker industry over the past decade and beyond. In recent years, notable buyouts have pulsed through the sector in quick succession. For example, in 2016, Stolt acquired Jo Tankers for USD 575 m. Later the same year, Team Tankers took over Eitzen before exiting the sector altogether. Then, in 2019, MOL acquired Nordic Tankers for an undisclosed sum, followed closely by Ace Quantum buying BW Chemical ships for USD 350m around the same time. Activity even continued through the COVID-19 pandemic, with Chembulk Tankers moving their fleet to Womar pools in March 2020, followed by Songestran Group taking over Depoli Tankers later that year.

We expect this trend to continue in 2024. MOL completed their USD 400 m acquisition of Fairfield in March, adding 81 multi-segregated chemical carriers to their portfolio, boosting their combined fleet value to USD 1.53 bn according to data from VesselsValue, a Veson Nautical solution. However, what is different this time around is that previous mergers and acquisitions (M&A) occurred in challenging market conditions, when smaller owners were struggling to stay afloat, and asset prices looked attractive. The opposite is true today, which makes the current round of takeover negotiations even more compelling.

Chemical Tanker Market Conditions

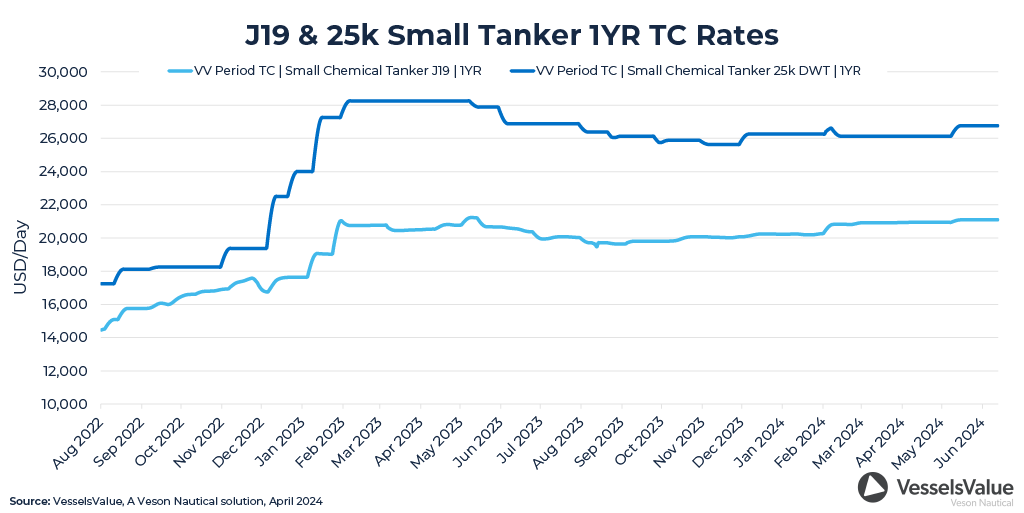

Widely reported geopolitical events and natural phenomena have created a strong tanker market this year, following years of underinvestment in the global fleet. This has left the sector chronically short on supply. Spot, COA, and Time Charter rates have consistently been on the rise over the last 18 months. One-Year Time Charters for J19s and 25ks have climbed by c.45% and c.55% respectively since August 2022, and as noted by Stolt-Nielsen CEO, Udo Lange, have, “plateaued to an all-time high” in 2023. This has resulted in stellar profits for shipowners which should hold for another 12–24 months, based on the fundamentals.

The overwhelming consensus from owners, brokers, and charterers in attendance at the annual AFPM conference in San Antonio, Texas in March 2024, was that this year’s high freight rate environment is here to stay for another two years. There is little to suggest that—barring any major new legislation or catastrophic geopolitical events—rates should not continue rising into the midterm. See figure 1.

Chemical Tanker M&A Outlook for 2024

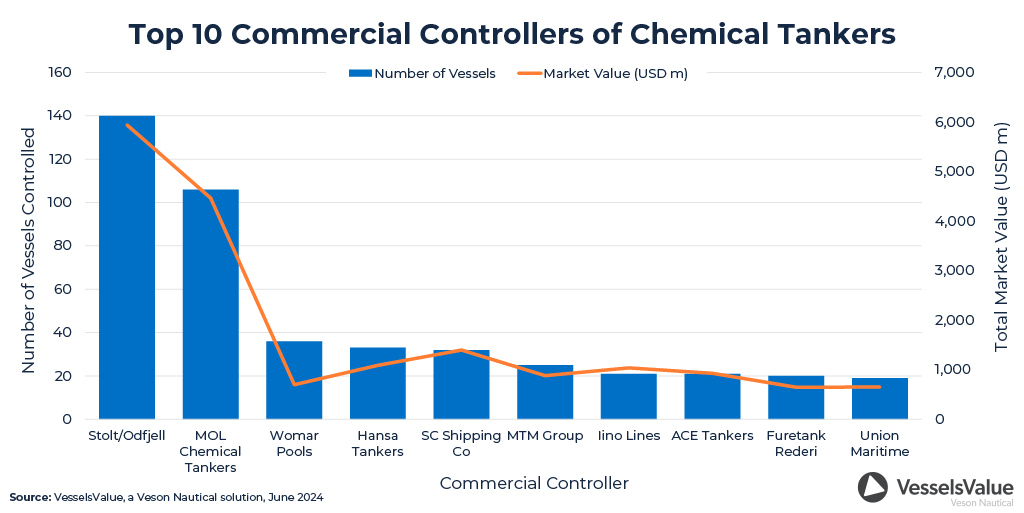

Rumors have circulated for some time about a merger between two of the largest chemical shipowners, Stolt and Odfjell, which have gathered pace this year after Stolt-Nielsen upped their shareholding in Odfjell to 13.6% in February. This prospect has prompted questions from the market, speculating on what synergies could be achieved, what cost-cutting measures would be expected, and how the new company could look if a hypothetical merger came to fruition.

A portfolio comparison shows that Stolt Tankers owns 117 live ships worth an estimated USD 1.87 bn, rising to USD 2.69 bn when including 15 vessels on order (including 6 x 38k DWT StSt tankers in a joint venture with NYK Line). Odfjell controls a live fleet of 69 vessels, with an estimated worth of USD 1.32 bn, excluding 12 x 25-40k DWT StSt tankers on order due for delivery 2024–2027. Stolt also owns 14 terminals and Odfjell owns four. These assets would complement each other well.

These companies compete directly on multiple shipping lanes, targeting the same customers and carrying the same variety of biofuels, chemicals, and organic cargoes. A market reaction could cause rates to climb higher post-merger, based on reduced options for charterers. However, a merger could also present improved cost synergies, resulting in lower freight rates for charterers. This conjecture is subject to Odfjell engaging further, which is not obvious based on the hot chemical market.

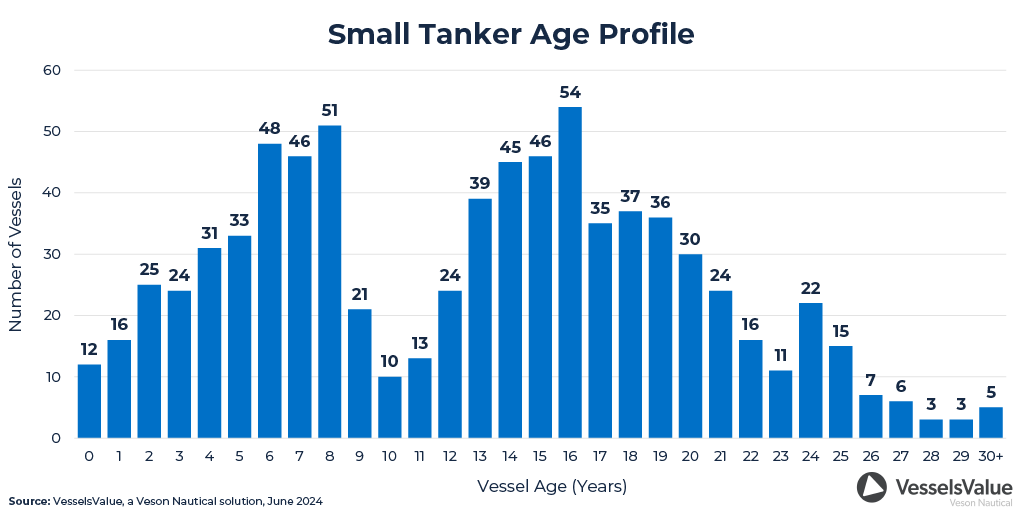

Looking at the macro picture, most analysts forecast a continued high-rate, high-asset price environment, based on a small orderbook of just c.6.3%. The ageing fleet also means vintage ships are now trading past 30 years of age, symptomatic of a supply-starved market (see Figure 2). Further support is derived from continued unrest in the Middle East and persistent issues in the Panama Canal which are causing cargo miles to rise, widening the supply-demand imbalance.

This stronger market has been compounded by the exit of larger MR1s and MR2s in the chemical segment due to strong CPP markets. In poor CPP markets, these vessels can switch to carrying bulk commodity chemicals, adding significant tonnage to the chemical market, and resulting in softening freight rates. COA business has improved for all Chemical Tanker owners by 15–20% YoY, which is proving a net-positive for asset values.

Asset Values Have Never Been So High

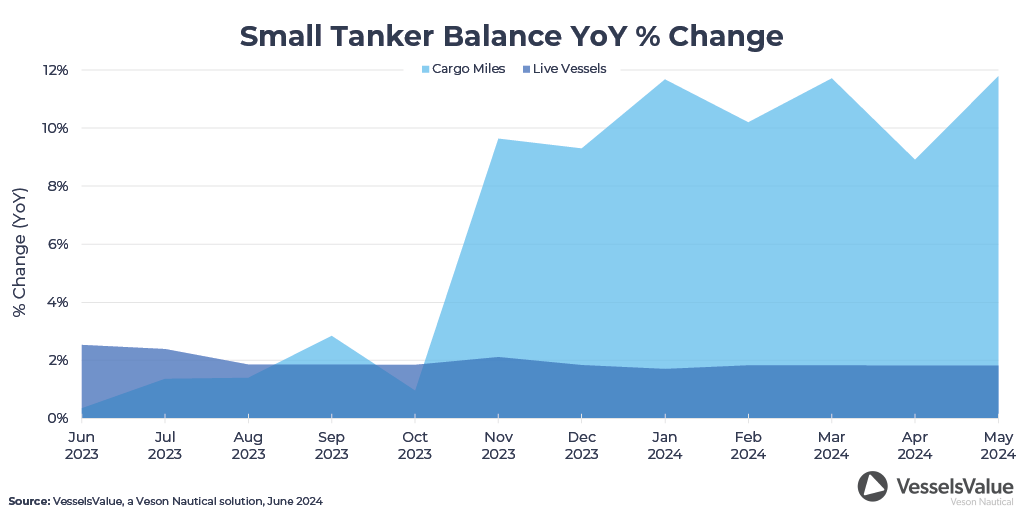

Asset values for Chemical Tankers are approaching historical all-time high levels due to years of underinvestment in the global fleet. According to VesselsValue trade data, cargo miles have averaged c.11% growth YoY since November 2023, whereas vessel supply growth has crawled along at c.2% growth by comparison, leaving a delta of c.9% in favor of demand growth. This imbalance explains why rates and values for Chemical Tanker are so elevated today and are likely to remain this way through to 2026.

Focusing on the S&P market, 17-year-old J19 Livarden (20k DWT, June 2007, Fukuoka) was sold for USD 18 m (BWTS) to Focus Shipping in February of this year. Using the VesselsValue Fixed Age Analysis, we can see that a similar ship of this age and size would have been worth USD 10 m less back in April 2019. Likewise, 10-year-old 25k DWT Beatrice (25.9k DWT, Nov 2013, Asakawa) was sold for USD 29 m (DD passed) in the same month to DM Shipping, compared to a VesselsValue valuation of USD 30.1 m the day before sale. Such a vessel would have expected to sell for USD 15 m in April 2019, thus representing a near 100% increase in value over a five-year period.

More recent evidence that we remain in bull market territory for secondhand assets includes the 13-year-old 21k DWT StSt Chem Bulldog (21,300 DWT, Sept 2010, Asakawa), which sold for USD 23.5 m to undisclosed buyers in April, versus a VesselsValue estimation of USD 22.7 m the day before sale. Also, 15-year-old J19 Chem Jupiter (19.8k DWT StSt, Dec 2008, Kitanihon Zosen) sold for USD 19.5 m (SS/DD passed) to undisclosed buyers versus a value of USD 19.65 m the day before sale.

Lastly, modern MR1 Golden Lavender (34.7k DWT, Feb 2022, Fujian Mawei Shipbuilding) sold for USD 36 m (BWTS) to Union Maritime versus a value of USD 32.9 m the day before sale, subsequently firming values for this asset class.

Conclusion

The chemical tanker-owning sector remains a dynamic arena for mergers and acquisitions, driven by a confluence of high asset values, robust freight rates, and strategic consolidation moves. The current M&A landscape is marked by some unprecedented market conditions in which asset prices are soaring in response to supply constraints in contrast to more distressed scenarios of previous years. While speculation surrounding a potential merger between Stolt and Odfjell has hinted towards further consolidation on the horizon, our analysts are not yet confident that a deal will develop this year, noting the potential for difficulties with competition and markets authorities in addition to the strong independent positions of each company.

Overall, with high freight rates likely to persist and a small order book indicating sustained demand-supply imbalances, the outlook remains bullish for chemical tonnage. The high valuations seen in recent S&P transactions underscore strong market fundamentals and again suggest that the current uptrend is set to continue. As geopolitical events and natural phenomena continue to shape market dynamics, the chemical tanker sector is poised to respond with strategic M&A activities driving growth and value creation.