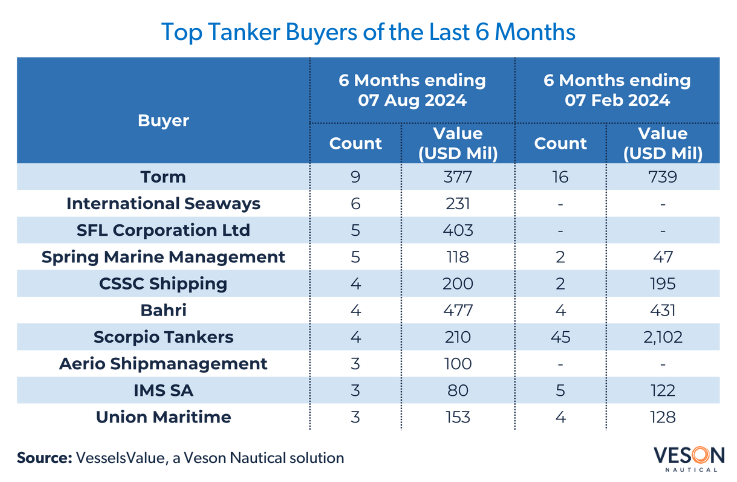

Top Tanker buyers of the last six months

The top three buyers of the last six months in the Tanker sector have already spent over 1 bn USD. Using VesselsValue data, we take a look at the top Tanker buyers since March 2024. The busy sale and purchase market has been driven by the positive sentiment in the market as supply continues to be stretched due to geopolitical situations in Europe and the Red Sea.

Furthermore, as newbuilding ordering has been modest over the past couple years, ship owners are wagering that the charter markets will be strong with ton-miles reaching high levels and supply growth remaining manageable. In addition, most Tanker markets have been generating very healthy returns over the past couple of years, which has enabled companies to reinvest or grow their current fleets, even at the current high vessel price levels.

Torm has been the top Tanker buyer by number of vessels over the last six months, with their purchase of nine MR2 Tankers ranging in DWT from 49,700 to 50,000 and with an average age of 10 years, valued at 377 mil USD. Torm has splashed out over 1.1bn USD over the last year, and in the previous six months, the company spent 739 mil USD on 16 Tankers—including 10 LR2s and six MRs.

International Seaways ranked second, placing an order for six LR1 Tankers of 73,600 DWT on order at K Shipbuilding. They are scheduled to be delivered between 2025-2026, VV Value 231 mil USD.

SFL Corporation ranked third with a spend of 403 mil USD for five vessels, including three 2024 built Aframax Tankers and two very modern Handy Chemical Tankers.

Spring Marine Management ranked joint third, also purchasing two LR2s and three MRs. The average age of these vessels was 15 years and the total spend was relatively low, totaling 118 mil USD.

In fourth position CSSC Shipping have purchased four MR Tankers over the last six months, with a spend of 200 mil USD.

Joint fourth is Bahri with their purchase of four five-year-old Korean built VLCCs, making them the biggest spender of the last six months with an investment of 477 mil USD.

Scorpio Tankers also ranked joint fourth, buying two LR2 and two MR Tankers totaling 210 mil USD, which seems somewhat subdued in contrast to their 2.1 bn USD purchase of 45 Tankers over the previous six-month period.

Aerio Shipmanagement came in fifth place, purchasing three mid-aged MR Tankers with a value of 100 mil USD.

Also joint fifth were IMS SA who also purchased three more mature MR Tankers for 80 mil USD.

Union Maritime equally ranked fifth with their order of three LR2 Tankers, which are scheduled to be built in various Chinese yards and delivered in 2027, are valued at 153 mil USD.