USTR Port Fees Minimize Impact on Chinese-built Dry Bulk Carriers

On April 17, the Office of the US Trade Representative (USTR) presented an updated proposal for port fees on Chinese-built vessels, initially announced in February. The proposal was an extensive report covering many areas, but certain details created some confusion. There was an increased focus on Chinese owners and operators, but uncertainty remains around how an operator is defined and how it will affect Chinese-leased vessels.

This is currently beyond the scope of this text, as we will focus on Chinese-built dry bulk vessels in isolation as a follow up to our previous blog post, “Potential US Port Fees May Disrupt Dry Bulk Trade and Vessel Availability.” For the fleet of Chinese-built dry bulk vessels, the updated proposal includes several amendments and exceptions that will soften the impact.

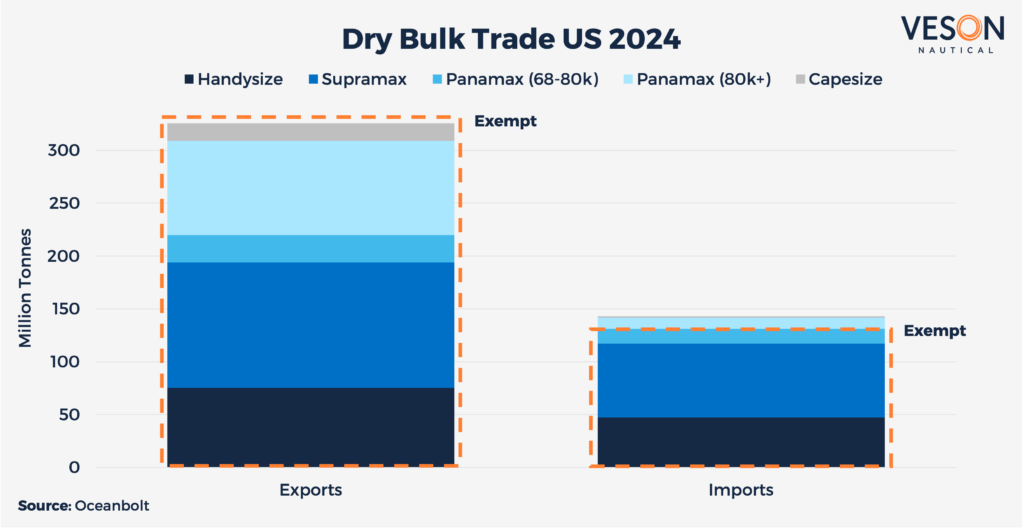

One of the most significant amendments is the exemption of ships arriving in port in ballast condition, i.e., vessels that will load commodities for export. According to Oceanbolt data, the US is a net exporter of dry bulk commodities, exporting more than twice as much as it imports. This means that most Chinese-built dry bulk vessels calling at US ports will not face any port fees, as the majority are used for exports.

While Chinese-built dry bulk carriers transporting imports to the US will still incur port fees, another amendment exempts any bulk carrier with a capacity below 80,000 DWT from these fees. The US is a significant importer of cement and steel products, which are typically carried on Supramaxes and Handysizes. Both of these vessel categories fall below the 80,000 DWT limit, meaning that most imports will also be exempt.

As a result of these exceptions, the dry bulk vessels that will be affected by the additional port fees are Kamsarmaxes, Post-Panamaxes, and Capesizes carrying inbound cargoes to the US. According to Oceanbolt data, this trade amounted to approximately 12 million tonnes in 2024, representing only 3% of the total US dry bulk trade.

In our last update, we stated that Chinese-built vessels accounted for 45% of US dry bulk port calls. This means that all else being equal, only 45% of these 12 million tons will be affected. Therefore, we do not expect the USTR port fees on Chinese-built vessels to have a significant impact on the dry bulk markets, as Japanese and Korean dry bulk carriers could easily absorb the trades affected by the port fees.

Another hearing is scheduled by the USTR for May 19, which could clarify some uncertainties and bring further amendments.