Strong Demand for Older Crude Tankers Defies Market Slowdown

Older Crude Tankers are defying expectations. In a year where overall Tanker S&P volumes have dipped, demand for vintage tonnage, particularly VLCCs and Aframaxes, remains unexpectedly strong. With buyers focusing on vessels averaging 14 years of age, the market is proving that age is no barrier when earnings are firm and availability is tight.

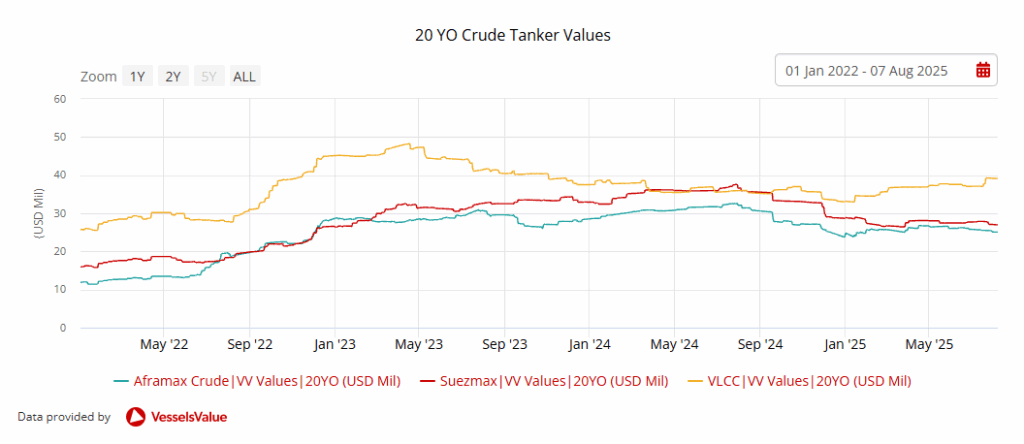

Using VesselsValue Timeseries data, we can see that 228 Crude Tanker deals have been recorded this year to date, down around c.9.2% from 249 in the same period of 2024. However, this drop in volume does not reflect a cooling of sentiment, particularly when it comes to older units, which continue to attract strong buyer interest. VLCC and Aframax values have increased since the start of the year, while Suezmaxes are the only segment seeing softer pricing, likely due an ageing fleet available for sale. For example, values for 20YO VLCCs of 310,00 DWT have surged by c.18.4% since the start of the year from USD 33.14 mil to USD 39.12 mil. In the Aframax sector, 20 YO vessels of 110,000 DWT have increased by c.1.21% from USD 24,77 mil to USD 25.08 mil.

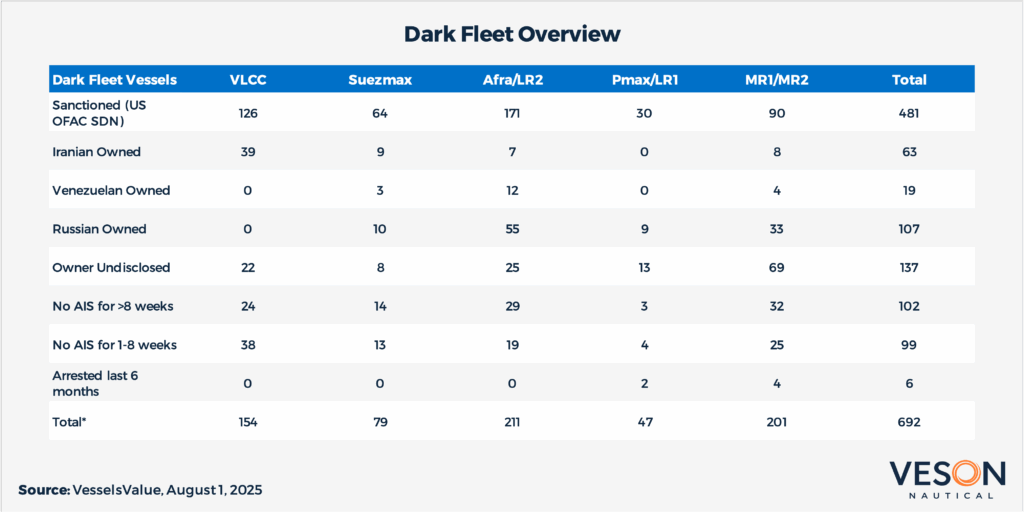

A major factor supporting the market is continued demand from the expanding “dark fleet.” The latest figures from VesselsValue indicate that the figure for potential dark fleet candidates currently stands at 692 vessels, which equates to around 12% of the live Tanker fleet, many of which are older crude units in the 12-18 year range, traded by Middle Eastern or Asian buyers in Russian oil flows, then often reflagged or have multiple ownership changes. This is driven by their lower acquisition costs, short-term earnings potential, and the ongoing viability of older ships in current trading patterns. With oil flows stable and ton-miles elevated, this segment is decisively supporting prices and transaction volumes in vintage tonnage markets.

Earnings fundamentals are adding to the momentum. Since the start of the year, VLCC 1-year timecharter rates have improved noticeably, up by c.13% from the start of the year to around 46.614 USD.Day. Meanwhile, Aframaxes and Suezmaxes have remained stable but at levels well above historical averages. For owners of older vessels, this represents either a lucrative motivation to sell or justification to continue trading tonnage rather than scrapping.

Geopolitics also plays a key role. The ongoing crisis in the Red Sea and continued risks in the Strait of Hormuz have forced operators to reroute voyages, boosting ton-miles and tightening availability. Charterers are increasingly favouring flexible, available ships—often older ones over waiting for modern tonnage.

Notable recent sales include the VLCC Atlantic Loyalty (307,300 DWT, Apr 2007, Dalian Shipbuilding Industry Corp) sold drydock passed to undisclosed buyers for USD 44 mil, VV Value USD 44 mil . The VLCC City of Tokyo (304,000 DWT, Mar 2004, Universal) also sold to undisclosed buyers for USD 41.5 mil, VV Value USD 36.22 mil.

In summary, while the number of Crude Tanker transactions has dipped slightly in 2025, the market for older tonnage remains firm. Unless freight markets soften dramatically or regulatory enforcement tightens more rapidly than expected, ageing Tankers are likely to remain in high demand well into next year.

Monitor market trends in a unified report

Maritime Market Watch is a subscription report that is regularly updated and combines real-time valuations, transactions, fleet trends, trade flows, and green indicators for specific market sectors.