Assessing the VLCC Market Cycle: Diverging Trends in Values, Earnings, and Liquidity

Using VesselsValue’s Timeseries product, we take a look at the current position of the VLCC market across vessel values, earnings, and S&P activity.

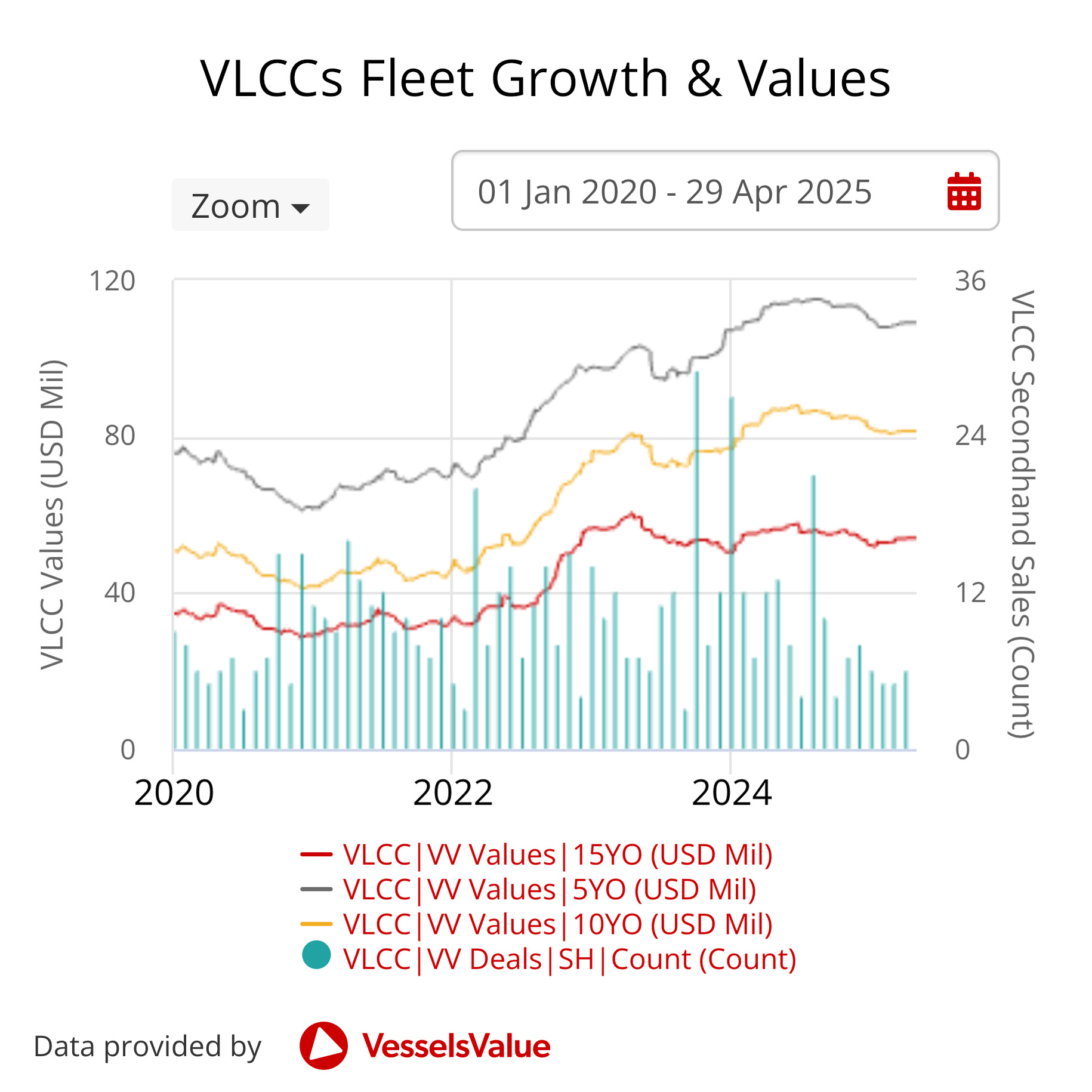

We have seen values for VLCCs fall year-on-year with values for 5YO vessels of 320,000 down by c. 4.1% from USD 113.88 mil to USD 109.21 mil. However, since January 2024, values for 5 YO VLCCs of 320,000 DWT have remained stable—not dropping below USD 107 mil. The last time that values were at these levels was in November 2008, marking a significant historical benchmark and suggesting that, despite downward pressure, asset values could potentially have found a firm floor compared to previous cycles.

Although values have remained strong, the volume of sales has dropped off considerably from the same period last year, declining by c.67% year-on-year. In the first four months of 2024, 58 sales changed hands, whereas only 19 sales were recorded over the same period this year. Data has suggested there are fewer Chinese-built vessels being transacted due to concerns over new US tariffs. This considerable contraction in market liquidity indicates growing caution among buyers, who may be reassessing asset exposure amid evolving market dynamics, or it may reflect a shortage of attractive candidates on the market.

TC rates for VLCCs have increased by c.5% year-on-year from just below 45,000 USD/Day this time last year to 47,000 USD/Day at the time of writing.

This is in contrast to the other Tanker sub sectors that have seen less volatility in earnings, primarily due to market uncertainty notably surrounding potential tariffs introduced by the United States. However, demand for the largest Tankers has remained stable, which is largely due to geopolitical disruptions, including tensions in the Middle East and continued sanctions on Russian crude exports, as well as recent production increases from OPEC—all of which have reshaped trade patterns and favoured larger Tankers.

Notable sales include the VLCC Eurohope (306,500 DWT, Oct 2007, Daewoo) sold to Unknown Chinese buyers for USD 46.25 mil, VV Value USD 45.07 mil. Also the VLCC Australis (299,100 DWT, Nov 2003, Universal) sold for USD 28 mil to SEACON trading as an FSU w/out BWTS, VV value USD 33.14 mil.

The VLCC market remains in a relatively stable position in terms of asset values and earnings, especially when compared to other Tanker sectors. However, the sharp drop in S&P activity suggests that participants are approaching the sector with increased caution. Going forward, continued geopolitical developments and the potential for further regulatory or economic shocks will be key factors influencing the trajectory of the VLCC market.

2025 Mid-Year Shipping Market Report

Enhance your Q3 market strategy by combining our quarterly forecast with a historical recap on newbuilding values, S&P activity, and demolition trends.