Car Carrier Sector Ripe for Consolidation,$150k per day Rates Remain a Possibility

Maersk’s Exit from Hoegh Attracts Rival Bids

Most subject matter experts were not surprised to see AP Moller-Maersk exit Hoegh Autoliners last month, selling off their remaining 20 million shares pocketing a cool USD 169 mil in the process, after incrementally decreasing their position over the last twelve months from an original stake of 26.4% in 2021. What lies beneath is the interesting part.

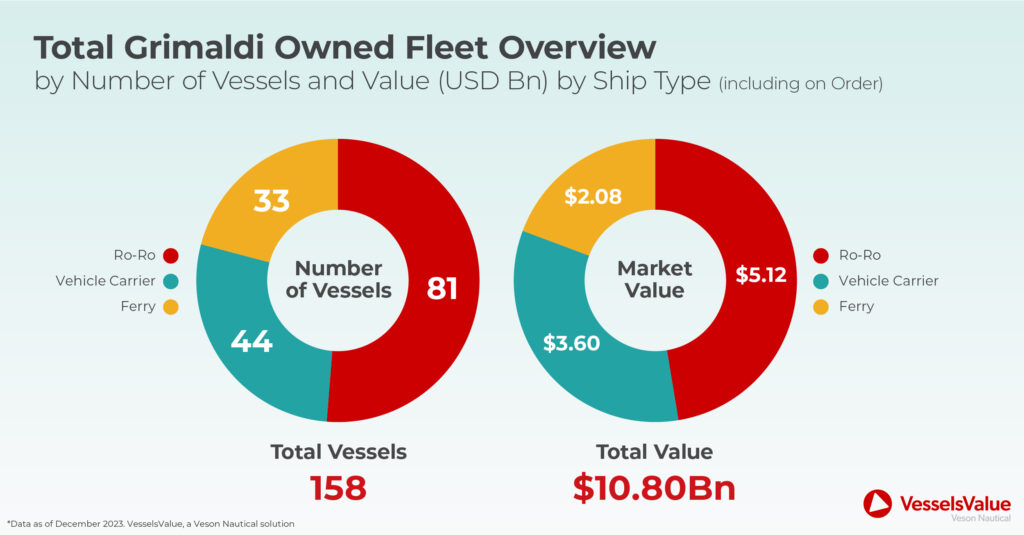

A door has now been left open for a direct competitor to buy in, riding on the wave of record-breaking earnings in the Vehicle Carrier sector that is odds-on to continue in 2024, driven by exceptional demand growth from China / Asia. And we think Grimaldi could be a good outside bet as the private Neapolitan family readies for their next stage of expansion, noting Emmanuele Grimaldi has stated that 2023 will be the group’s best year ever targeting turnover of USD 5 bil, up 67% versus pre pandemic. After all, Grimaldi are the largest RORO shipowner on the planet based on a fleet value of USD 10.8 bil including ‘on order’ and subsidiaries as per VesselsValue (dated 4th Dec 2023).

Frequently on the look-out for new opportunities, they remain active having acquired part of the Spanish shipping company Naviera Armas in 2021, following their acquisition of shortsea RORO specialist Finnlines in 2016 that was years in the making, after an initial 11.6% share buy in 2005. Their takeover of deepsea CONRO specialist ACL in the year 2000 was a master stroke.

And as market leaders in Intra-European, West African, US East Coast, and East Coast South American RORO trades, it makes sense based on complementary liner services. We expect a fair amount of interest however, because Hoegh are a first-class shipowner that have led the way on green ship orders. Whilst their valuation could firm higher in 1H 2024 from a widening supply-demand imbalance emerging in the trade.

Market Getting Tighter, More Upside for Rates

Looking at the macro picture, global supply is under pressure from increasing congestion in the Panama Canal which is starting to impact liner services, and upheaval in the Red Sea following a PCTC hijacking weighing on shipowners’ confidence. More ships are being diverted from normal routes adding CEU-miles and transit times, reducing net capacity from less port call frequency. We should not be surprised to see an equivalent ‘Panama Adjustment Factor’ surcharge pushed by deepsea RORO operators in coming weeks, following in the footsteps of their Container cousins noting MSC are insisting on USD 297 per TEU on ‘Asia-East Coast US/Gulf.’ Additionally, a war risk surcharge is now being requested by some box carriers which sets the tone for all cargo ships.

Our forecast for net supply growth next year is 6.9% based on increased Large Car Truck Carrier newbuild deliveries (>7,000 CEU) and low scrapping rates, marking a 5% improvement versus 2023. However, the bulk of newbuilds won’t hit the water until the second half of 2024 supporting a high freight rate environment in the interim.

Focusing on demand from the Far East which drives growth in this sector, China is having an exceptional fourth quarter forecasting seaborne light vehicle exports of 4.1 mil for 2023 excluding land-based containerised trade to Russia, equating to 52% growth YoY which is extraordinary. In a nutshell, this explains why rates and asset values exploded in the Vehicle Carrier sector from the tail end of 2021, because China started to scale up exports at speed benefitting from strong global demand for EVs and the largest car market by country sales. All the while, supply growth barely moved at just 1-2% post Covid.

We are forecasting demand growth of 7% from the Far East in 2024, as China’s light vehicle exports start to plateau aligning more closely to global light vehicle sales forecasting, inferring a balanced market by 2025 as rates return to long term historical averages.

Rate Predictions for 2024

Now let’s make some rate predictions for 2024 based on the one-year 6,500 CEU Index. Eyebrows were raised last year when Veson analyst Dan Nash suggested 150,000 USD/Day was possible in 2023, considering the index was at a historical high of 77,000 USD/Day at the time. We didn’t quite get there due to a lack of liquidity, but we are getting closer. VVs 1-Year 6,500 CEU Index now stands at 123,000 USD/Day, up 10% since early October. A rate of 150,000 USD/Day in the first half of 2024 remains plausible if supply continues to tighten as vessels take longer to transit through canals and dangerous seas, compared to 6-7% demand growth. My base case scenario for peak rates in 2024 is 130,000 USD/Day. Let’s see.

On the S&P front, only one notable secondhand sale has transacted so far this quarter. Hoegh Bangkok (6,500 CEU, Jun 2007, Uljanik Brodogradiliste) was sold to Beijing Changjiu Logistics for USD 63 mil in October. Our current market value for this asset is USD 64.26 mil (dated 4th Dec 2023). Straight willing seller-willing buyer deals have been rare this year, however, all we need is one big price significantly above values to drive the market higher.

Final Thoughts

We expect to see some consolidation amongst European shipowners in the coming years, in response to China’s emergence as a global RORO player threatening the status quo. Maersk’s exit from Hoegh Autoliners provides an excellent opportunity for a competitor like Grimaldi to jump in, they certainly have the money, and we think shareholders will want to listen. On paper, Wallenius Wilhelmsen seem like a better cultural fit. However, Grimaldi’s appetite for growth should not be underestimated, they are better aligned in terms of liner services and green ships on order, and the timing feels right. It could be an interesting year ahead for M&A, long overdue in the deepsea RORO sector.

Want to know more about how our

data can help you assess the market?