Container Ship Orders Reach Two-year High

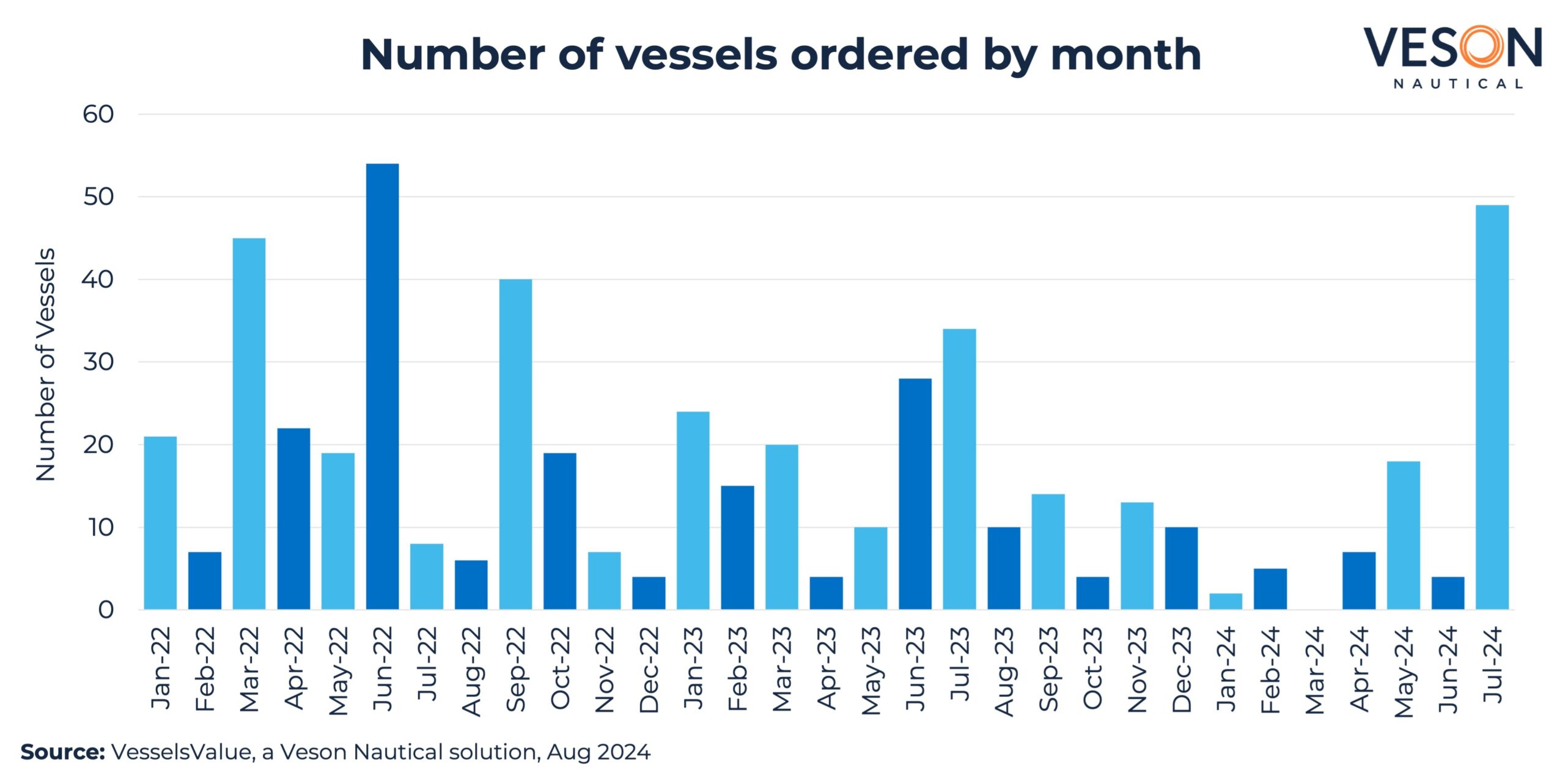

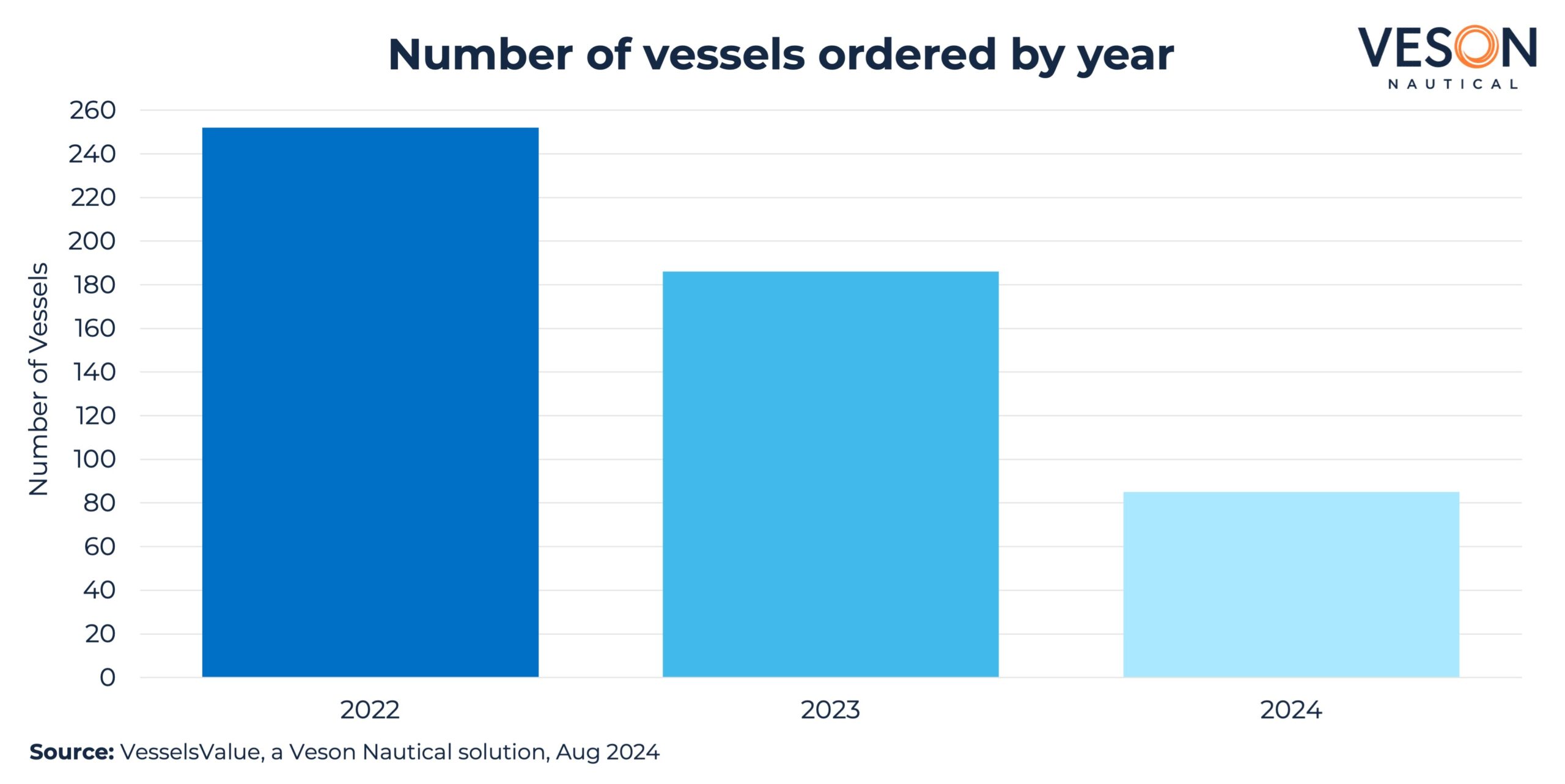

57 newbuilding orders were placed for Container vessels in July 2024, with orders for that month alone outpacing the 40 contracts inked in the first six months of the year. New Container orders for July 2024 represent the highest number of orders since June 2022 where 65 were placed.

Singaporean owners were the most active in July, placing 22 orders which equates to c.39%. Greece ranked second with 15 orders and a share of c.26%—followed by France with 12 and a share of c.21%. The remaining orders came from buyers based in China and Bermuda. The vast majority of these orders are scheduled to be built in Chinese yards, accounting for 79%, and the remainder are set to be built in South Korea.

Almost half of these new contracts were in the New Panamax sector, with a share of c.47%, followed by Post Panamaxes at c.28% and ULCVs at c.21%, with the remainder in the Feeder sector.

Ton-mile demand for Containers has surged as a result of the situation in the Red Sea which has forced owners and operators to travel longer distances in order to avoid any potential conflict zones. This has lent support to Container earnings and one year rates for Post Panamax vessels are currently at 72,000 USD/Day, up by c.60% year-on-year. With no imminent end to the hostilities in sight, it is likely that earnings will remain firm for the foreseeable future.

This situation has led values for Container vessels to experience unprecedented gains since the start of the year, increasing across all sub sectors and age categories. For example, values for 10 YO Post Panamax vessels of 7,000 TEU have increased by c.71.8%, from USD 44.08 mil to USD 75.73 mil. In contrast, values for newbuildings have increased at a much slower rate, for example Post Panamax newbuildings for vessels of 7,000 TEU have increased by just 2.49% from the start of the year from USD 101.99 mil to USD 104.53 mil, making them a more attractive choice for fleet renewal. Meanwhile, S&P levels have fallen, with values so high many owners are waiting to see if the market will change direction.

Notable contracts include 10 x New Panamaxes ordered by Ocean Network Express, scheduled to be built at Jiangsu New Yanzijiang and delivered between 2027-2028, contracted en bloc for USD 170 mil each, VV value USD 170.96 mil.