Market Chat: Container Values Strengthen After Post-Boom Decline

Container values have risen significantly across almost all sectors and age categories since the start of the year. This follows an extended period of decline, where values fell steadily after reaching a record peak during the Container boom at the end of Q1 2022.

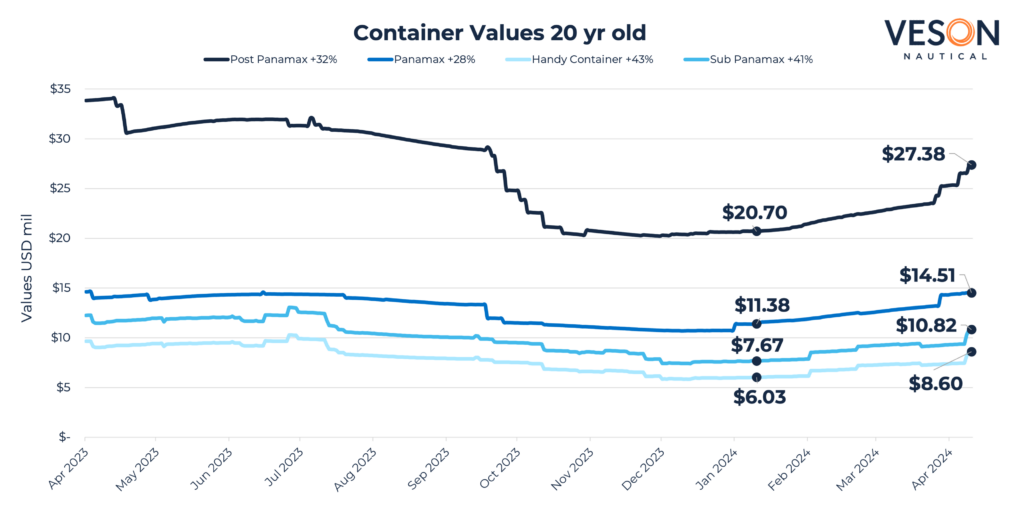

However, since January 2024, values have taken a turn in the opposite direction. Older vessels have shown the most strength, with values for 20-year-old Handy Containers of 1,750 TEU up by as much as 43% since the new year, increasing from USD 6.99 mil to USD 8.6 mil.

The increase in values has been supported by climbing earnings since the start of the year. In the Handysize sector, for example, period earnings for one-year have jumped by c.39.4% from 9,280 USD/day on the first of January 2024 to 12,940 USD/day when this post was written. This is largely due to the ongoing disruption in the Red Sea. By rerouting around the Cape of Good Hope, vessels are travelling longer distances, reducing available vessels and therefore pushing up rates.

According to VesselsValue trade data, Container journeys transiting around the COGH have increased by nearly 200% in Q1 2024 versus Q1 2023. However, the latest forecast from VesselsValue predicts that, despite the ongoing conflict, as more and more Container newbuildings hit the water, vessel supply will continue to outpace demand and this will put pressure on rates going forward.

MSC show no signs of slowing down with their Container buying spree of the past few years, with their activity accounting for almost a quarter of all Container sales reported so far this year. Notable benchmark sales include the Post Panamaxes Buxcoast (6,892 TEU, Aug 2001, Daewoo) and the Buxcliff (6,892 TEU, Jun 2001, Daewoo) which sold for USD 22.5 mil each in an en bloc deal, VV value USD 20.01 and USD 19.95 mil respectively. Also in March the sub Panamax Odysseus (2,824 TEU, 2006, Hyundai Mipo) sold to MSC for USD 15.9 mil, VV value USD 13.61 mil.