Containers Lead on Efficiency: 67% of the Fleet Achieves a CII Rating of A–C

With London International Shipping Week 2025 approaching, we dive into the numbers that define today’s global shipping industry. Using VesselsValue (a Veson Nautical solution) data, we take a look at who controls the largest vessel portfolios and how the global fleet measures up against increasingly stringent environmental benchmarks. As the industry faces mounting pressure to decarbonise and regulatory frameworks tighten worldwide, understanding both market concentration and sustainability performance has never been more critical for stakeholders.

In terms of the top 10 global beneficial owners by value, Swiss based MSC currently owns the most expensive fleet with a value of USD 49.6 bil. This is also the largest in terms of vessel numbers with a total of 707 vessels, of which 584 are live and 125 on order. The vast majority of this fleet is of course in the Container sector with Panamaxes and Post Panamaxes accounting for around half of this segment. Within the orderbook, MSC has invested heavily in ULCVs, accounting for around c.59% of the orderbook and the remainder of orders are in the New Panamax category.

Values for the Container vessel type have increased across most sub sectors and age ranges this year, particularly for older ships. For example, 15YO Sub Panamax Container vessels of 2,500 TEU have increased by c.19.96% from the start of the year from USD 26.4 mil to USD 31.67 mil. Given that there are a number of Container owners in the top 10, this would have a significant positive impact on fleet values.

In second place is French owner, CMA CGM whose fleet is valued at USD 35.5 bil and a total of 339 vessels. This fleet is almost entirely dedicated to the Container sector with 243 live vessels ranging from Feedermaxes to ULCVs, 95 vessels on order,c.53% in the ULCV sector, c.34% in New Panamax sector, and the remaining c.13% in the Post Panamax sector.

BoComm leasing is the third largest owner through leasing arrangements in dollar terms, with a fleet value of USD 33.3 bil. However, this fleet ranks second in terms of size with a portfolio of 411 vessels spanning all major sectors, including Bulkers, Tankers, Containers, Gas, RoRo, and Vehicle Carriers.

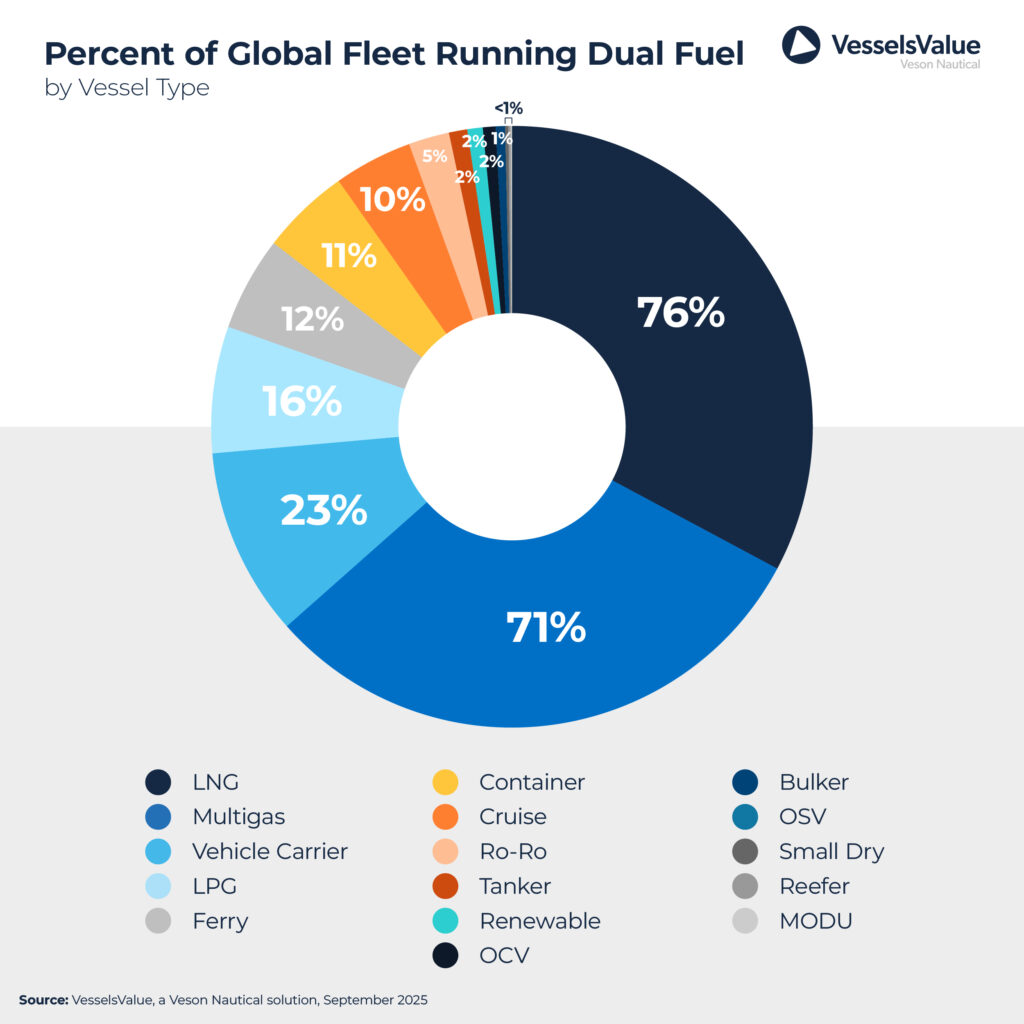

The Gas sectors have the highest percentage of the fleet both live and on order with LNG vessels leading the way at c.76%. Modern and newly built LNG vessels will inherently be dual fuel, but older vessels typically were not built with such a design. However, some vessels may have been built as dual-fuel ready, providing shipowners with the option to retrofit full dual-fuel systems when market conditions or regulations make the investment attractive.

Multigas rank second with c.71% followed by Vehicle Carriers with a share of 23%. Within the global orderbook, the majority of Vehicle Carriers are dual-fuel specific. This trend is driven by the primary cargo transported aboard these vessels: factory new OEM (Original Equipment Manufacturer) light vehicles, including EVs (Electric Vehicles). OEMs prioritize transporting their new light and heavy vehicles on clean vessels that provide lower emission ratings. This preference has led to increased demand for environmentally superior shipping solutions. As a result, shipowners operating in the Vehicle Carrier sector are ordering dual-fuel ships at significantly higher rates than those in other maritime sectors.

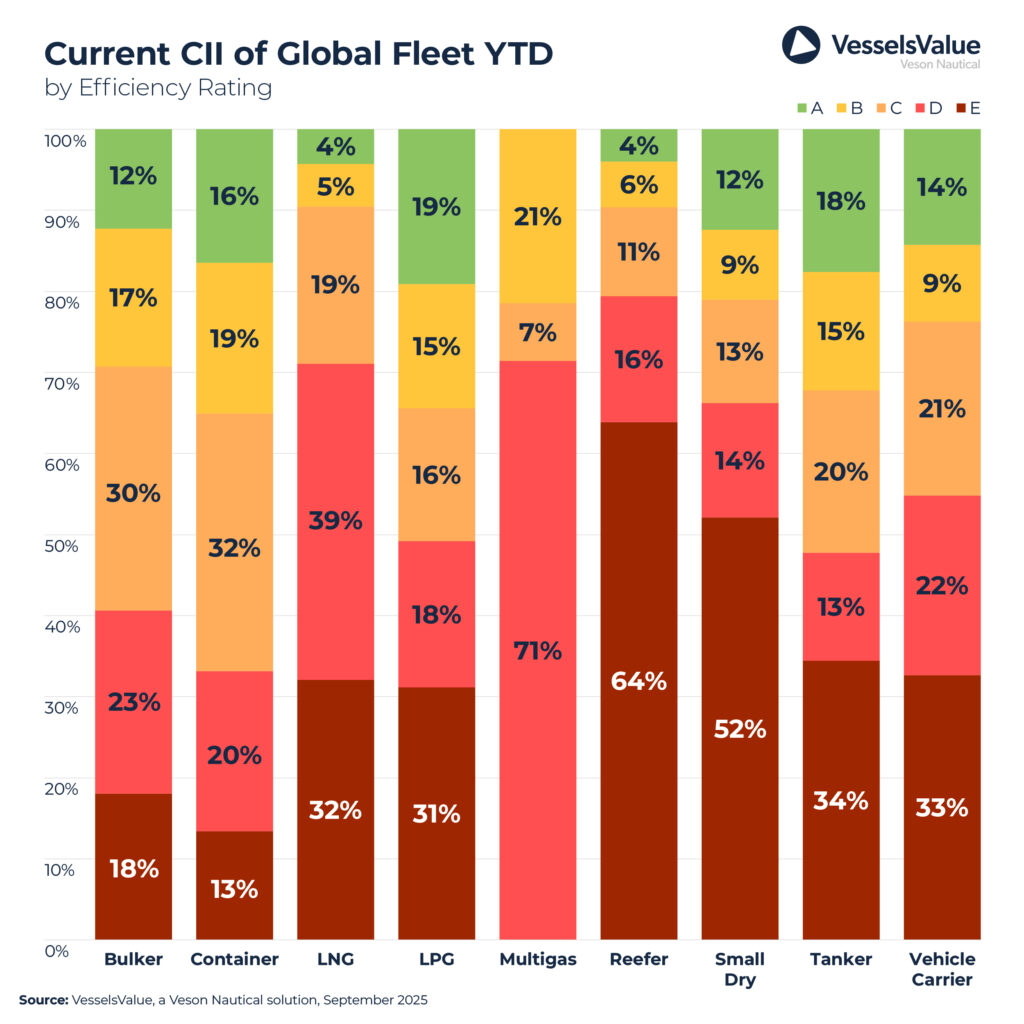

Decarbonisation is of increasingly high importance to the global fleet and a growing percentage of the overall fleet ranks highly in the mandatory energy efficiency ratings from the International Maritime Organization (IMO). The Multigas sector is the fleet with the largest percentage of vessels in band A at c.21% and the Container sector has the most vessels within bands A-C with c.67% of the fleet achieving a rating within this range.

The data reveals a sector in transition. While market concentration remains high among a few dominant players, the rapid adoption of dual-fuel technology and improving energy efficiency ratings demonstrate the industry’s commitment to meeting global decarbonisation goals. The challenge ahead lies in balancing operational efficiency with environmental responsibility as regulatory frameworks continue to evolve and stakeholder expectations intensify.