Do shipping markets want Biden or Trump for the win?

Let’s forget morals, politics or personal opinion and instead look at VesselsValue’s trade data to construct an informed view on which party would be better for the shipping markets.

Tankers for Trump

Headline: Trump’s support of US crude production, his sanctioning of Iran and temporary blacklisting of certain fleets of large Tankers has been beneficial for the Tanker markets (in the short term at least).

US Crude Exports

US crude production and export has undeniably been favoured by Trump. This has been beneficial to the Tanker market because the largest importers of US crude are in Asia. Asia is further away from the US than the Middle East, so as more Asian oil imports are sourced from the US, the cargos have to travel further, adding to cargo miles, using up vessel supply and driving up the Tanker markets.

Conversely, Biden has suggested policies as part of his campaign which could disfavour US crude exports. His policies backing low carbon energy alternatives have the potential to slow down the upwards trajectory of US crude exports, although he is not expected to ban fracking completely. Alongside investment into cleaner energies, he is also expected to restrict US shale oil production, limiting exports. These policies could have a negative impact on charter rates, particularly for the long-haul trades between the US and Asia which have recently been an important driver of the market. If US exports were to slow down in the future, Asia would have to rely more on imports from the Middle East Gulf, running shorter legs, something that could reduce cargo miles and related charter rates.

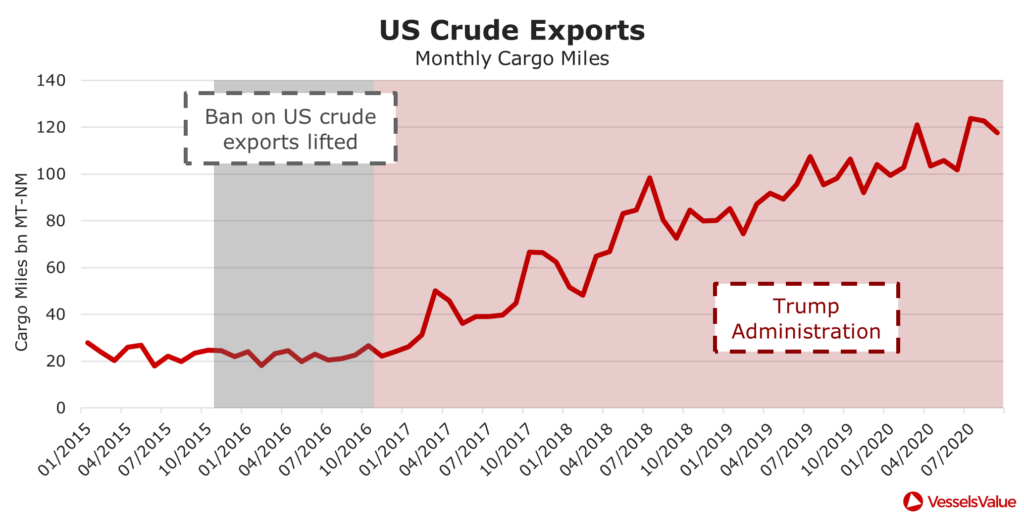

Since the lifting of the US crude oil export ban in December 2015 (under Obama), exports of crude oil have increased, growing at an even greater rate when Trump’s presidency commenced in 2017. The below chart shows total monthly crude US exports by estimated monthly cargo miles.

Crude tanker cargo miles from the US increased by an impressive 159% in the first year of Trump’s presidency, reaching a total of 62.5 bn MT-NM by the end of 2017. Since then, cargo miles have very nearly doubled again, reaching a peak of 123.7 bn MT-NM in July this year.

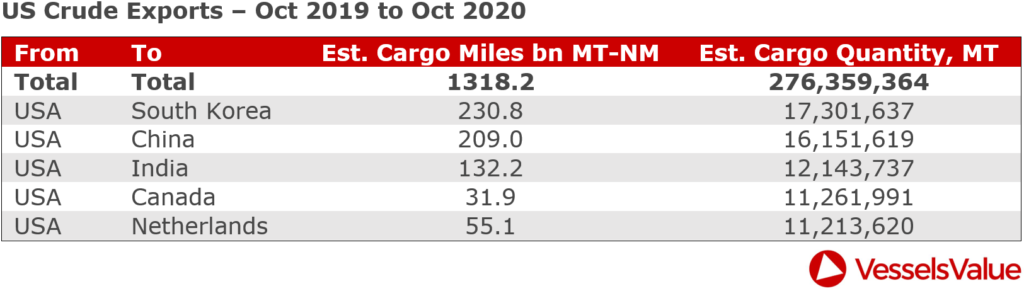

Excluding domestic trade, the largest share of crude oil goes to Asia, as can be seen in the table below which shows the top US exports routes since October 2019. Over the last year, South Korea has become the top importer of US crude oil, importing 6.2% of total exports at 17,301,637 MT. China follows closely, receiving 16,151,619 MT.

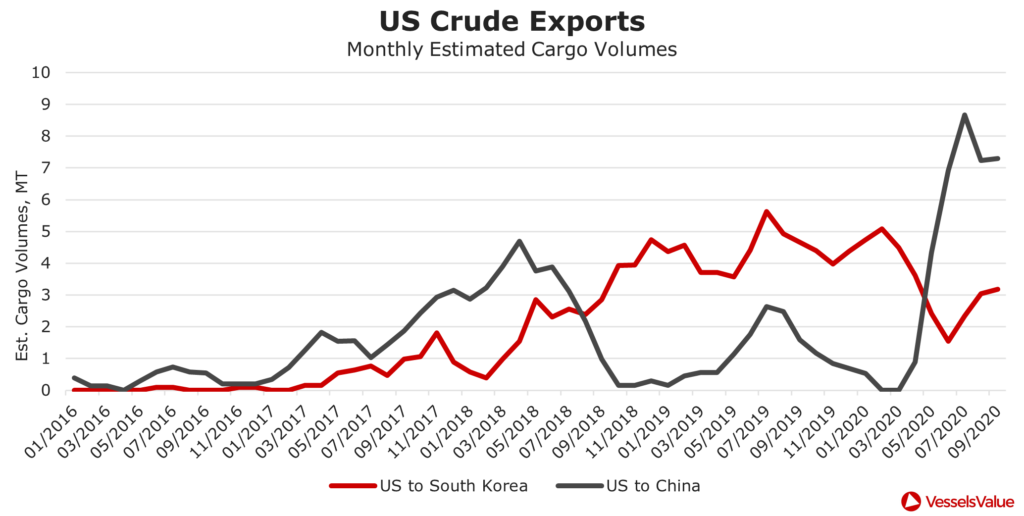

The chart below shows how the top two routes have changed over time, by monthly cargo volumes.

Iran Sanctions

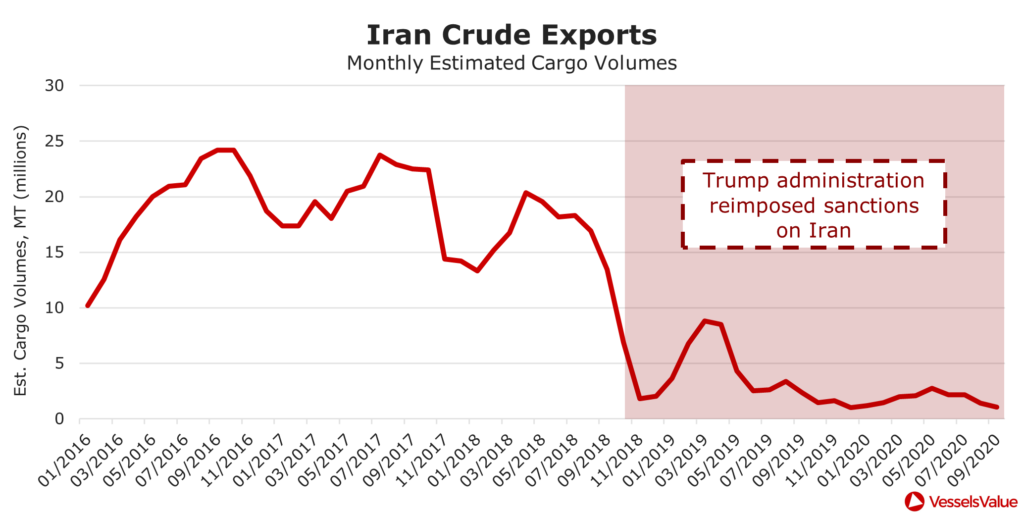

Trump has advocated imposing heavy sanctions and tariffs in his term, causing both positive and negative effects on the Tanker markets. Sanctions he imposed on Venezuela and Iran, amongst others, have somewhat benefitted US crude exports. The below chart shows how there was a steep decline in estimated cargo volumes leaving Iran, once Trump reimposed strict sanctions on the country.

In 2018, Trump unveiled additional penalties on Iranian oil buyers, causing Iranian oil exports to plummet almost overnight. This caused exports to drop by 90% from 18,315,123 MT in July 2018 to 1,801,654 MT in November 2018. Choking oil trades from influential oil producing countries provides the US with a larger market share for their growing export business.

If Biden were to be voted in, it is expected that he would re-evaluate and ease these sanctions to some degree, which could have the potential to shift some oil supply back to the sanctioned countries, particularly Iran. Iran is much closer to Asia than the US, so this geographical switch could harm distances, cargo miles and hence the Tanker market.

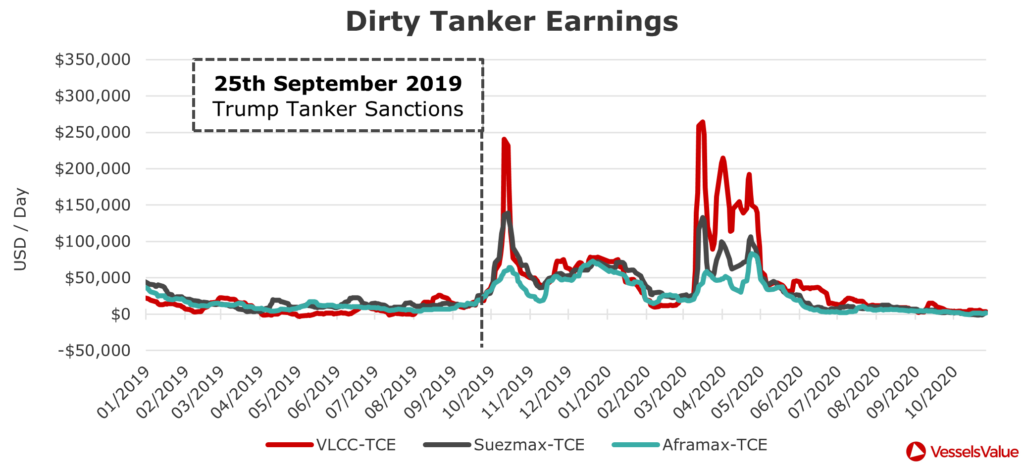

Vessels Blacklisting

In 2019, Trump blacklisted a variety of vessels and companies accused of trading with sanctioned countries. The effect of this was to reduce the available vessels on the market and drive up Tanker rates in the short term. This can be seen on the chart below, which shows Tanker earnings spike in October 2019.

Even though this effect was short lived, the Tanker market benefitted from restricted supply and related upwards volatility which led to some great earnings for Tanker owners. Political volatility tends to be good for Tankers, Trump is volatile, so Tanker owners would likely prefer Trump.

Bulkers for Biden

Headline: Trump’s trade war had harmed US Bulker exports. The January 2020 trade deal has somewhat reversed this recently, but the likelihood is that Trump will continue with the trade war, which could be bad for Bulkers.

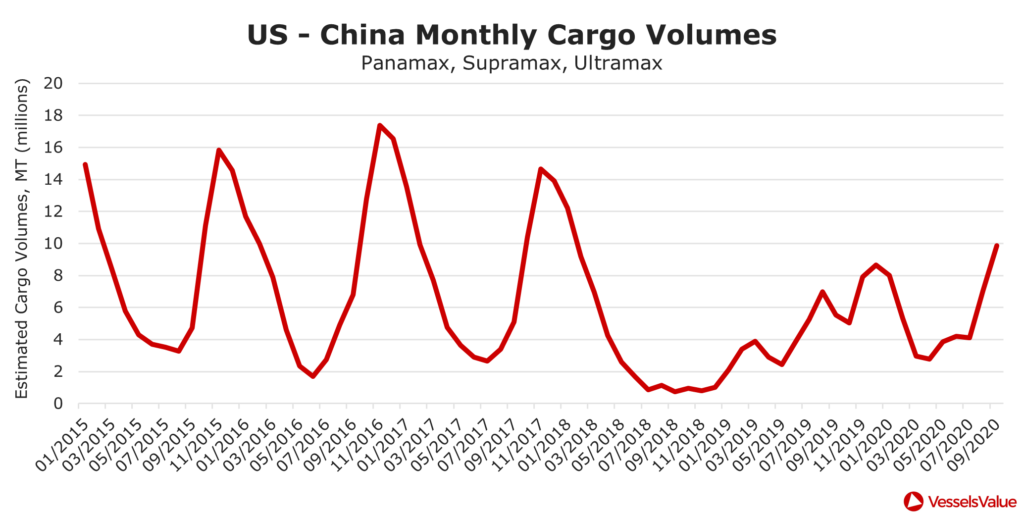

The US to China Dry Bulk trade, including key grain exports such as soya beans and corn, shows clear seasonal trends over the last 5 years, with peaks in cargo volumes between August and November correlating with the start of the marketing year in September. However, since trade differences on the route escalated in 2018, there has been a clear decline and volatility in volumes being imported to China. The below chart shows US to China Bulker trades, focussing on Panamax, Supramax and Ultramax Bulkers.

Since 2018, Dry Bulk trades from the US to China have been much less consistent than in previous years, correlating with when Trump began setting tariffs on China, and vice versa. Seasonal peaks have not reached highs of previous years, although pre-Covid-19 this year, imports to China were beginning to rise again incrementally.

Imports fell in February and March as a result of the pandemic, but since July, as demand began to recover, imports have followed an upwards trajectory, increasing by 140% from 4,109,657 MT in July to 9,872,754 MT in September this year. This suggests that the phase one trade deal that was signed by both countries in January 2020, whereby China agreed to increase their US imports over the next two years, could be showing results as imports begin to rise in line with pre-trade war periods. However, there is a real risk of more trade war type actions if Trump is re-elected, so we expect Bulker owners to be more optimistic with a Biden presidency (despite his attitudes towards trade with China not yet being clear).

Boxships for Biden

Headline: Trump’s protectionist policies have had a negative impact on China to US Container trades. Additionally, Biden’s promise of higher stimulus levels should increase consumer spending and related Container trading volumes.

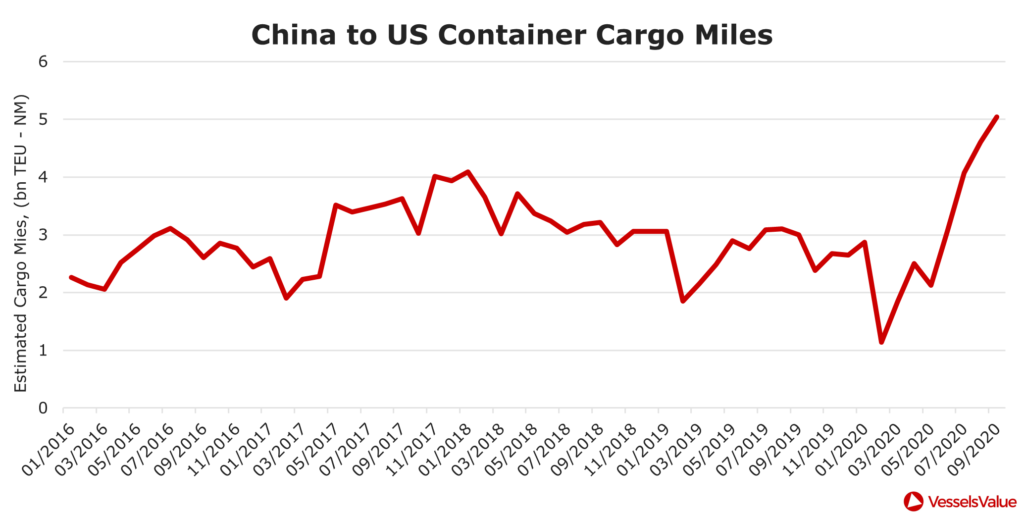

Trump’s protectionist policies, especially against China, could be bad for the Container market as Chinese Container exports to the US are a major driver of Container demand. This can be seen in the chart below which shows cargo miles on the China to US route falling since 2018 when trade hostilities between Trump and China intensified, until the recent sharp recovery in the summer, related to the post lockdown economic recovery.

At this stage it is unclear if Biden will be any more lenient on China, but his statements suggest he is more accepting of the benefits of international trade.

Additionally, Containership demand is driven by economic activity and related consumer spending. Recent history has shown that Trump was very loose with stimulus which has led to record breaking stock markets and increased consumer spending. However, currently the Democrats are proposing a far higher stimulus bill than the Republicans. More stimulus, especially in the wake of the Covid-19 pandemic, should lead to more consumer spending which should benefit the Container markets (as long as owners refrain from over ordering new vessels and causing a vessel oversupply).

Summary

Tankers for Trump. Bulkers and Boxships for Biden.

The result of the US election will undoubtedly have a meaningful impact on global shipping markets with the industry being at the crux of geopolitical trade wars and the movement of goods, however, different sectors will feel different impacts.

The Tanker market is expected to benefit from a Trump presidency as evidence suggests it has already over the last four years. His favouring of US crude production and his blacklisting of certain Tanker fleets has resulted in higher Tanker rates both in the long and short term. Biden is expected to focus on investment into clean energies, thus reducing US crude supply, which could change Tanker trading patterns globally and push down rates.

Biden is likely to be favoured by the Bulker and Container markets, which have suffered as a result of Trump’s protectionist policies and the ongoing trade war between the US and China. However, this is less clear cut as there is still some uncertainty about what a relationship between Biden and China would look like.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?