DWT capacity falls across bulkers and tankers transiting the Suez Canal

Nearly a year since hostilities erupted in the Red Sea region, we can observe the significant and ongoing impact this conflict continues to have on global shipping routes using Veson trade data. The Suez Canal, one of the world’s most important maritime chokepoints, has seen reduced traffic as shipowners and operators weigh the risks posed by instability and potential threats to vessels transiting the area.

As a result, many shipping companies have opted to take the considerably longer route around the Cape of Good Hope at the southern tip of Africa, despite the added distance, higher fuel costs, and increased travel time. This detour can add several thousand miles to a journey, extending transit times by up to two weeks depending on the vessel’s speed.

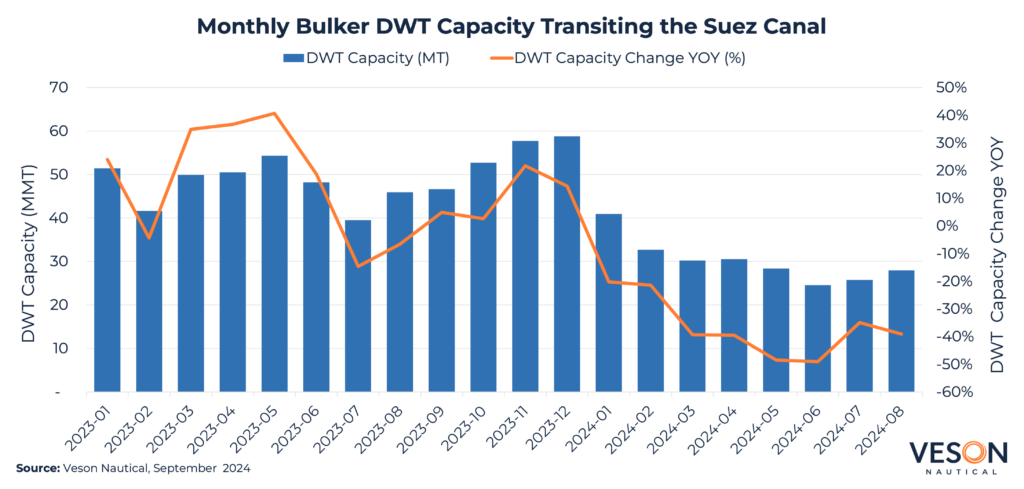

There have been changes in Bulker traffic transiting through the Suez Canal since October last year and the DWT capacity has fallen overall, particularly when compared year on year. For example, in August, the number of Bulkers transiting the Suez Canal fell from 703 in August 2023, equating to a DWT capacity of 45.9 mil MT, to 427 in August 2024—or 27.9 mil MT, a decline of c.39% year-on-year.

As owners opt for longer routes around the Cape of Good hope to avoid the Red Sea area, ton-mile demand has increased for most vessel types. As a result, Bulker earnings have surged with Capesize one-year rates up from 14,380 USD/Day this time last year to 23,270 USD/Day, an increase of c.61.8% year-on-year. Bulker values increased considerably across almost all sub sectors and size categories, with the biggest increase seen in 15YO Capesizes of 180,000 DWT, up by c.45.49% from USD 19.85 mil to USD 28.88 mil. Notable recent sales include the Capesize BC Cape Azalea (208,200 DWT, Aug 2012, Nantong COSCO KHI) sold to Unknown Chinese buyers for USD 38.5 mil, VV Value USD 38.17 mil.

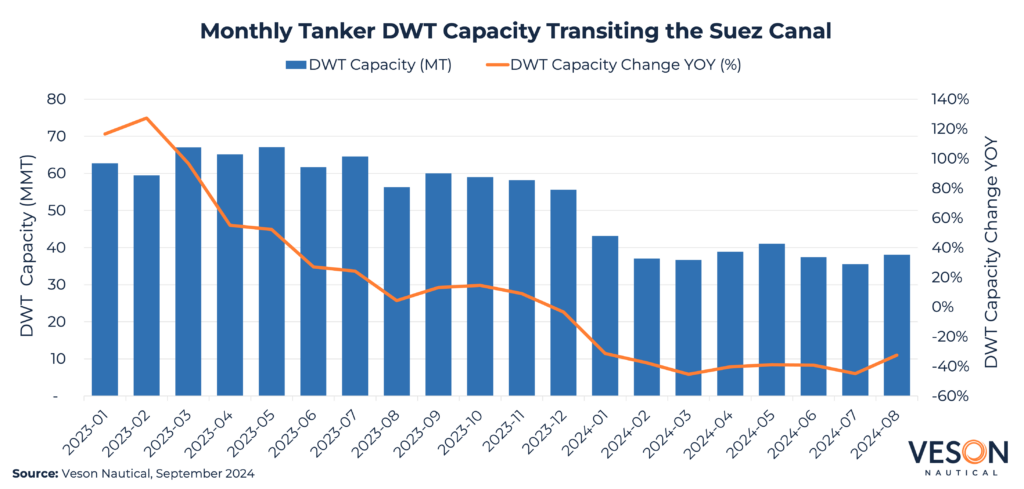

The volume of Tankers travelling through the Suez Canal has also taken a hit over the past year with the number of vessels in this sector down by c.49.78% in August 2024 where 202 Tanker transits were recorded with a DWT capacity of 16.6 mil MT. Compared to August 2023, 385 Tankers passed through the canal at16.7 mil MT.

Tankers, which were already in high demand following the sanctions on Russian oil that came in to force at the end of 2022 have witnessed a further boost to ton-mile demand and earnings as more owners opt to avoid the Red Sea region. For example, one year period rates for MRs have increased by c.6.2% year-on-year from 41,730 USD/Day to 44,300 USD/Day.

Due to sustained high demand, Tanker values have continued to increase this year. For example, 15 YO MRs of 50,000 DWT have increased by c. 27.61% year-on-year from USD 22.78 mil to USD 29.07 mil. This is after achieving an all-time high of USD 29.52 mil in August 2024. Notable recent sales include the MR2 (Chem/Prod) Kalamos (46,700 DWT, Jan 2004, Iwagi Zosen) sold to undisclosed buyers for USD 17.8 mil, VV Value USD 17.9 mil.

This adjustment in global shipping routes not only reflects the direct consequences of the Red Sea conflict but also highlights the broader geopolitical and economic uncertainties that continue to shape the global maritime landscape. As the situation remains unresolved, shipping companies may continue to favour the longer, safer route over the Suez Canal for the foreseeable future, further disrupting global trade flows.