Falling MR Tanker Prices Fuel Buyer Appetite

MR Tanker values have been on a steady slide since January, sharpening buying appetite, particularly among those eyeing short term earnings potential. With the sector accounting for nearly a quarter of all Tanker deals so far this year, MR activity is setting the tone for the wider product Tanker market.

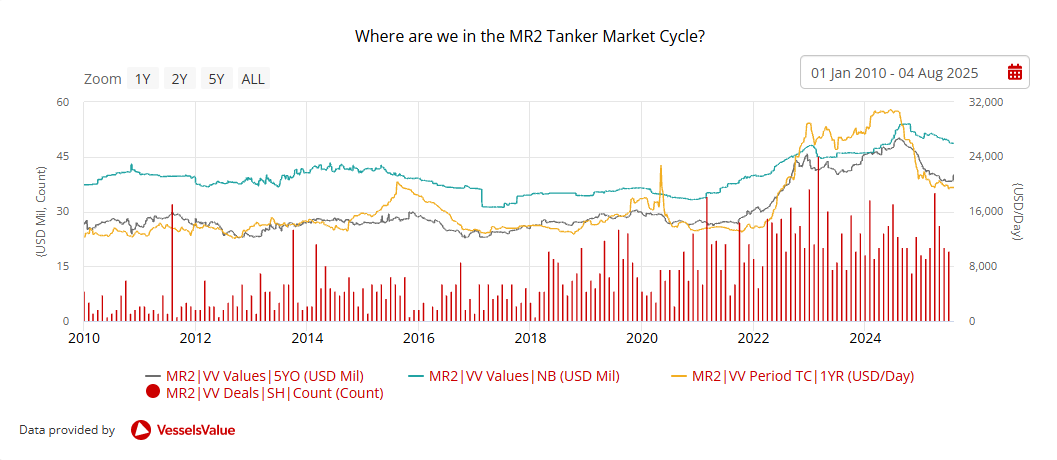

Since the start of the year, MR values have fallen across all age categories—a key factor supporting their current appeal—attracting buyers looking for short-term earnings. Their popularity is not only due to this earnings potential but also their broader trading flexibility compared with other vessel types, leaving them less exposed to sanctions risk than other Tanker sectors— VLCCs, for example. In a market cycle that is arguably near a peak, the ability to secure a quicker return on investment becomes more critical—a factor likely explaining why many investors are favouring MRs over other sectors.

According to VesselsValue Timeseries data, we can see that older tonnage has seen the biggest decline with 20 YO vessels of 45,000 DWT down by c.27.7% since January from USD 15.58 mil to USD 11.46 mil. This reflects freight rates easing and market uncertainty, with older tonnage seeing the steepest declines amid looming regulatory costs. However, across July, values moved up slightly, indicating that values could have found a floor; for example, 5YO vessels of 50,000 DWT increased by c.3.4% month-on-month.

Overall, sentiment is steady to firm. The lack of quality candidates and uncertainty around shipyard availability for 2026–27 continue to lend support to values, especially for younger, scrubber-fitted MRs.

MR S&P activity has picked up slightly this month after a subdued start to the summer and 19 sales were reported in July up from 13 in June. Buyers remain active, especially for modern eco tonnage, though the spread between buyer and seller price ideas continues to cap volumes.

Interest is still coming from both private equity-backed players and traditional Greek buyers as they look to renew fleets ahead of expected regulatory tightening. Greeks have accounted for the majority of sales with a share of c.19%. On the flipside, some owners are choosing to hold off, betting on a stronger winter freight market to lift asset values.

MR2s continue to draw strong buyer interest, with consistent activity observed across both modern and older vessels as the average age of vessels sold this year was 12 years. MR2 transactions have accounted for the highest percentage of Tanker sales in 2025, with a market share of approximately 23%.

Earnings for this sector have remained relatively stable and well above historical averages, despite a cooling freight environment. One-year time charter rates have eased from the highs seen in recent years but continue to sit above the past decade’s average and are currently just over 19,500 USD/Day. Due to its versatility to trade on a wide range of routes, this market isn’t reliant on any single region. And, on a macroeconomic level, global refined product demand remained resilient amid ongoing economic uncertainty. Geopolitical tensions and sanctions continue to disrupt traditional trade patterns, boosting ton-mile demand and reinforcing the MR2 segment’s regional flexibility.

Recent notable sales include the MR2 (Chemical/Product) Hafnia Taurus & Hafnia Andromeda (50,300 DWT, 2011, Guangzhou Shipyard International Company Ltd) sold in an enbloc deal to undisclosed buyers for USD 36.5 mil, VV Value USD 37.95 mil. Also the MR2 (Chemical/Product) Grand Ace1 (46,000 DWT, Feb 2006, STX Offshore) sold to undisclosed buyers for USD 11.5 mil, VV Value USD 12.27 mil.

Monitor market trends in a unified report

Maritime Market Watch is a subscription report that is regularly updated and combines real-time valuations, transactions, fleet trends, trade flows, and green indicators for specific market sectors.