The GCC’s Top Shipowning & Newbuilding Trends

Using VesselsValue data, we take a look at the fleet owned by nations within the Gulf Cooperation Council (GCC), shining a spotlight on the top 10 newbuilding buyers in 2024, the most popular vessel types ordered, and the most prominent owners in the region.

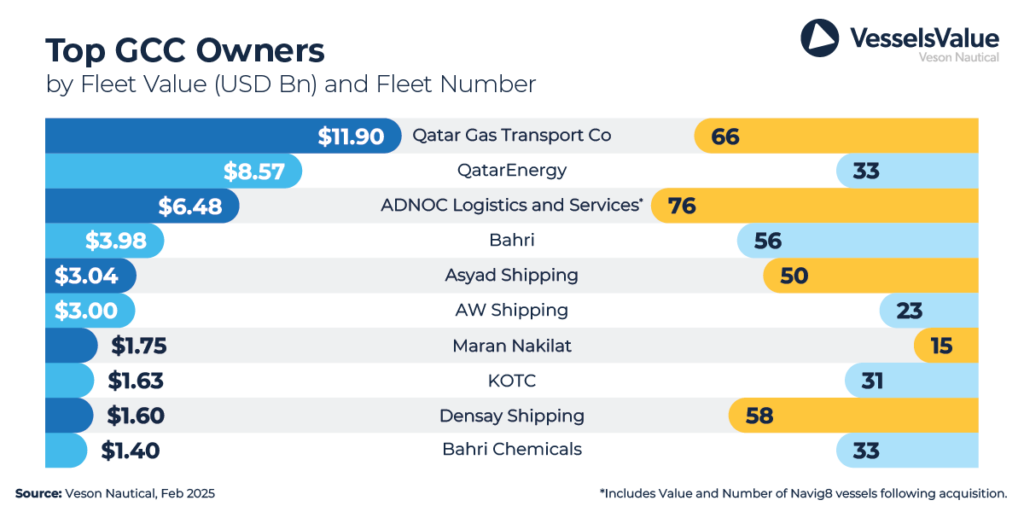

Of the top owners within the GCC, taking into account both the live fleet and on order, Qatar Gas Transport Co is currently the top GCC company in monetary terms, with a fleet value of USD 11.9 bn. The fleet consists of 36 live LNG and LPG vessels with a further 30 on order. Qatar Gas also placed the highest value newbuilding order in February 2024 with their investment in 15 large LNG vessels, scheduled to be built at Samsung and contracted for USD 230 mil each—which equates to a total of USD 3.5 bn.

QatarEnergy is the second largest owner with a fleet value of USD 8.57 bn with an orderbook of 33 Large LNG vessels.

ADNOC Logistics and Services rank third with a fleet value of USD 6.48 bn. However, in terms of vessels numbers, ADNOC have the largest fleet with 76 vessels. ADNOC has received a boost in rankings due to its acquisition of an 80% stake in Navig8, set to be completed in 2027.

In 2024, the top ship types ordered by GCC based companies were LNG, LPG, and Tanker sectors with 44, 23 and 15 vessels contracted respectively at a total value of USD 14.3 bn.

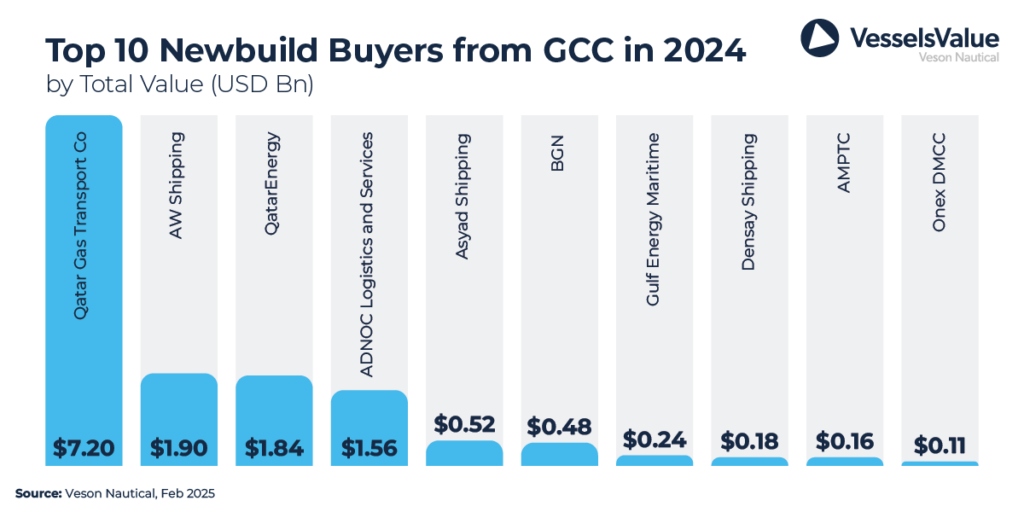

Of the top GCC companies ordering vessels last year, Qatar Gas Transport Co. were the biggest spenders in the newbuilding sector, ordering 30 vessels, amounting to an impressive USD 7.2 bn. The bulk of this order consisted of Large LNG vessels of 174,000 CBM, which accounted for c.57%, followed by QMAX LNG of 271,000 CBM with a share of c.30%. Finally, VLGC LPG orders of 88,000 CBM accounted for c.13%.

AW Shipping ranked second, investing USD 1.9 bn in nine VLEC vessels of 93,000 CBM, which are scheduled to be built at Jiangnan Shanghai Changxing and delivered between 2026-27. They also ordered four VLAC vessels of 99,000 CBM at the same yard, which are scheduled to be delivered between 2026-28.

QatarEnergy is in third place, spending USD 1.84 bn for eight Large LNG vessels of 174,000 CBM, scheduled to be built at Hanwha Ocean and delivered between 2027-28.

Tankers were the most popular vessel purchased within the GCC zone in 2024, with 156 transactions taking place and worth an impressive USD 5 bn as the supply-demand imbalance caused by the Red Sea crisis fuelled market sentiment and expectations of high earnings. This kept values strong for this sector, and there was plenty of second hand market throughout the year as this also boosted orders for new vessels.

The LNG sector was the second most active last year with a spend of USD 1.8 bn for just 12 vessels. The majority of these acquisitions were for the Large LNG sector with an average age of 11 years.

Bulkers were the third most popular vessel purchased in 2024 with 51 sales reported and valued at USD 772 mil. Smaller vessels were the most popular, with the majority of purchases in the Handy/Supra/Ultramax sectors with a share of c.69%, followed by Panamax/Kamsarmaxes accounting for c.18%, and finally, Capesizes accounting for just c.13%.