Insurance market braces itself for post pandemic value changes

Introduction

The marine insurance market has always been able to adjust to the vagaries of supply and demand. Never has it been more tested than now. With renewal discussions only weeks away, the market must consider high profile losses such as ‘Evergiven’ and ‘X-Press Pearl’, powerful new entrants to the market, and volatility in ship values due to the global pandemic we are experiencing.

We will examine the last point, by analysing the relevant data from the Tanker, Bulker and Container markets.

Tanker

Values and Earnings

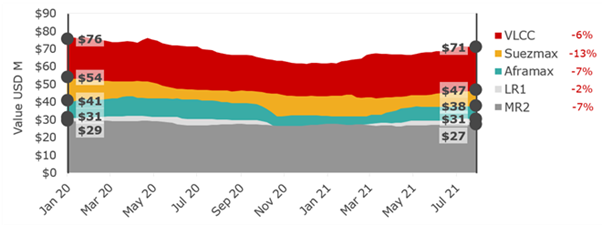

Due to the impact of Covid-19, Tanker values have generally declined from January 2020 to January 2021. With most of the decline happening in the first 12 months of Covid-19. This can be seen in figure 1 below, showing the change in VesselsValue’s daily updated values for typical fixed age five year old Tankers of the different types.

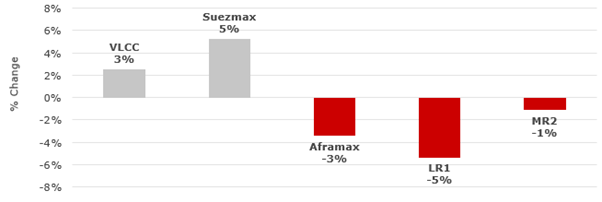

Interestingly, since January 2021, Tanker values have been in recovery even though the Tanker charter market is poor. This is due to high expectations fuelled by the recovery seen in the Container and Bulker sectors and increasing newbuild prices across the board (which is partly due to rising steel prices). Figure 2 shows that Tanker values are close to historical medians, larger Crude Tankers moderately above, smaller Crude and Clean Tankers just below long term averages.

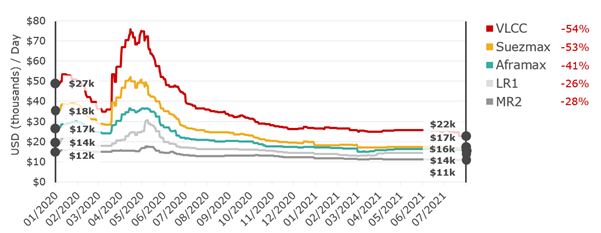

Generally, this recent increase in Tanker values looks high considering the current low charter earning environment as shown in figure 3 with typical Tanker charter rates.

Demand

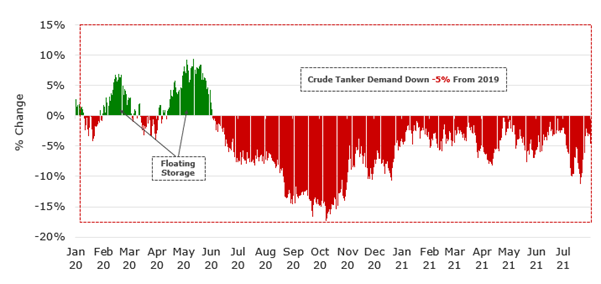

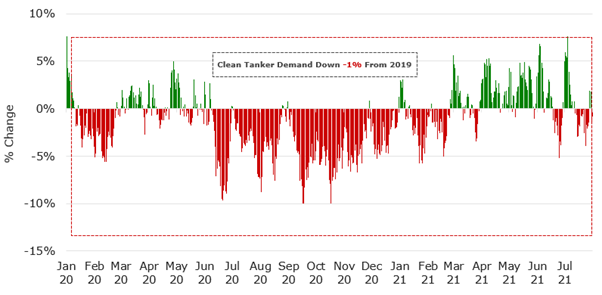

The below two figures clearly demonstrate the change in demand for Tanker shipments post Covid-19. Global crude demand, measured in VesselsValue’s AIS and GIS derived daily updated cargo miles, is down 5% and clean is down 1%, with clean rallying since April 2021.

ViaMar Forecast (updated quarterly)

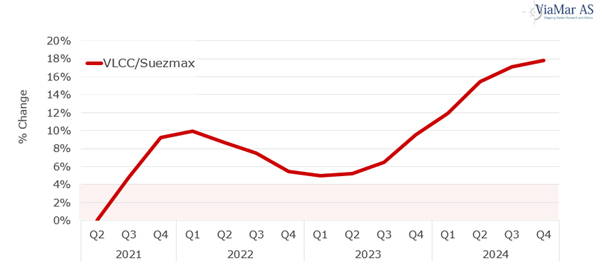

According to the fundamental driven forecasts of our partners, ViaMar in Oslo, the future value changes look relatively positive for Tankers. These figures can be seen in figure 6, which expect the rest of 2021 and later part of 2023 and 2024 to be good for Tanker values. However, due to the change in demand that although a positive outlook, these forecasts are more conservative than those for Bulkers.

Forecast as of Q3 2021.

Bulkers

Values and Earnings

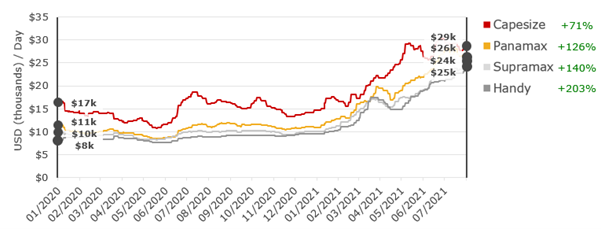

2020 was not a buoyant charter market and so moderate declines in values were seen. However, that’s all changed. Bulker values have been booming since the beginning of 2021 in line with the exceptional charter market, due to the rapidly increasing demand since mid 2020.

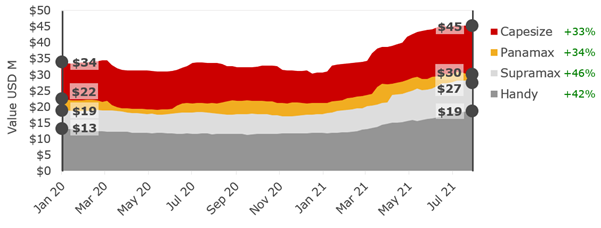

Current values are at recent historical highs, so recovery is fully underway, demonstrated by a 5 year old Supramax increasing in price by 46% from USD 19 mil to USD 27 mil as seen in figure 7 below.

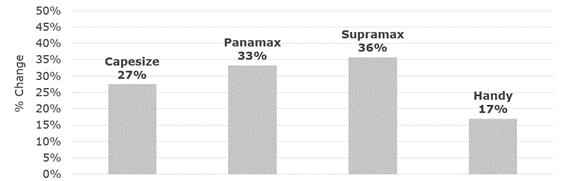

Figure 8 shows the current market value over a 30 year median, Bulker values are significantly high with Panamaxes up 33% and Supramaxes up 36%. In the well known shipping cyclical market, this could imply downside risk. However, the sentiment is currently on a high and the recovery is expected to continue for the foreseeable future.

The reason for the boom is that 2020 saw charter values mostly at, or below OPEX levels. This meant some owners were trading at a loss and in many cases, just breaking even.

2021 has seen huge increases in rates and high profitability for owners. A Handysize Bulker, since April 2020 has increased 203% from USD 8 mil to just over USD 24 mil as seen in figure 9.

Demand

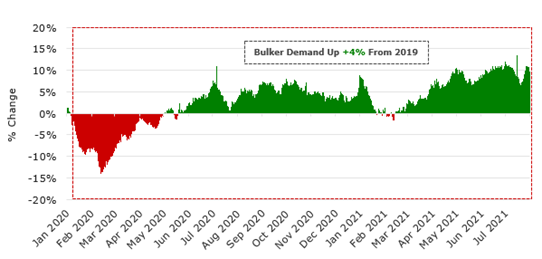

The demand for Bulkers has been extremely affected by the pandemic. We can see in figure 10 that in early 2020 Bulker demand suffered due to the mutual impact of Covid-19 on trading and commodity processing. However, this recovered mid 2020 and since then we have seen high demand which has led to high charter rates and a massive improvement in values.

ViaMar Forecast (updated quarterly)

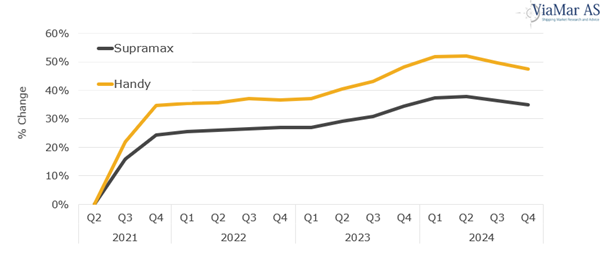

Figure 11 highlights an interesting dynamic for the insurance market to consider. According to the fundamental driven forecasts of our partners, ViaMar in Oslo, Bulkers are forecast to be very positive throughout 2021, continuing through 2022 and increasing again in 2023. Unusually, the smaller types (Supra and Handy) are expected to perform better than larger types which normally do better in recovery.

Containers

Values and Earnings

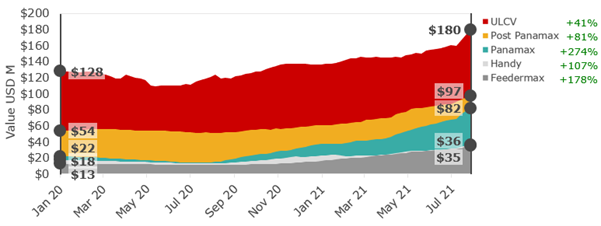

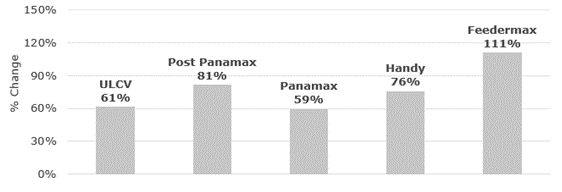

The Container market is booming. Like Bulkers, early 2020 saw initial declines in values due to Covid-19 restrictions and market reticence. Figure 12 shows that since mid 2020 the Container market has been on fire due to high consumer demand, catching up for lost shipments in early 2020, and years of low new building.

A five year old Panamax worth USD 22 mil in January 2020 is currently selling for USD 82 mil.

Looking at the current Container market against the historical 30 year median shows that Container values are significantly above long term averages.

Similarly, to Bulkers, in shipping’s cyclical markets this could imply a significant downside for future risk. That said, sentiment is currently very high and continuation of recovery is expected for at least one more year as seen in figure 13.

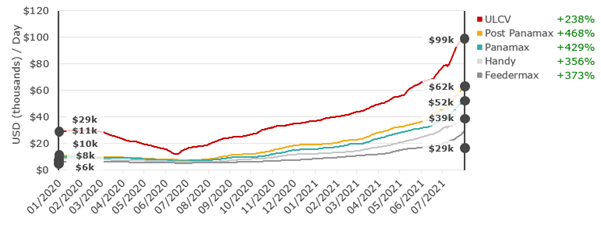

Container charter rates are even higher than in 2007. Rates were generally flat or down until a year ago. Figure 14 shows how the boom started and there is currently no sign of it stopping. The percentage Container charter rate increases range from +238% to +468%.

Demand

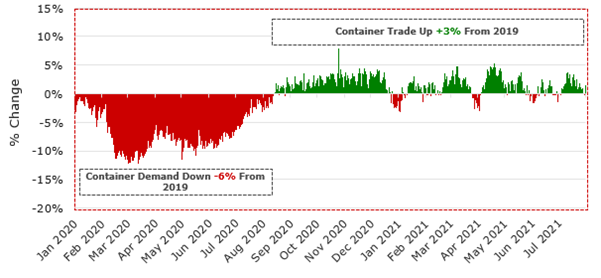

Global demand for Containers post Covid-19 was down 6% as demand just disappeared. Since September 2020, a significant recovery in demand has occurred due to consumer confidence changing combined with a catch up for lost shipments due to the start of the pandemic.

Figure 15 shows that since September 2020, Container trade has been up 3% since 2019. Newbuilding has been flat over many years leading to demand growth exceeding supply growth and resulting in a bull market.

ViaMar Forecast (updated quarterly)

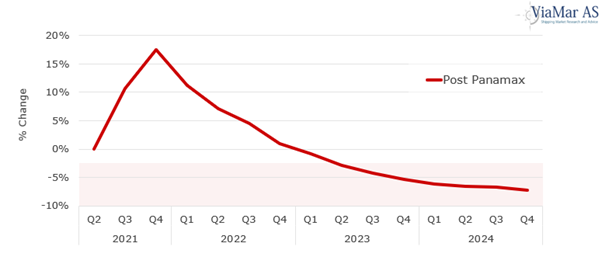

According to the fundamental driven forecasts of our partners, ViaMar in Oslo, the future value changes for Containers are different to both Tankers and Bulkers.

Containers are forecast to remain positive until the end of 2022, then as newbuild orders are delivered, the market is likely to decline due to fleet growth. Figure 16 shows that insurers will have to factor into their calculations that even on the currently very popular Container vessels like the Post Panamax, the high values will not last for too much longer.

Conclusion

As we all know, the shipping markets are incredibly volatile due to their inherent global and interconnected fundamentals. They are particularly susceptible to black swan events, with Covid-19 being the most significant and wide ranging of these since the 2008 global financial crash.

Somewhat surprisingly, the knock on effects of Covid-19 have been mostly positive to the shipping markets (Tankers excluded). The initial disruptions to international trade in 2020 have resulted in excess vessel demand and limited vessel supply in 2021, leading to high Bulker markets and essentially the best Containership markets. This rising tide has also brought up Tanker values in the last 8 months even in the face of negative earnings across most Tanker types.

As can be seen by the summary analysis in this document, the critical thing for any market participant with an exposure to risk, such as insurers, is to have access to multiple different sources of objective and real time data across values, earnings, vessel demand, trade flows and more. This analysis has only scratched the surface of what VesselsValue provides so please contact us for a deeper dive.

VesselsValue data as of August 2021.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?