Market Chat: Japanese Owners Offload Older Capesizes

Values have fallen below USD 19 mil for the first time since July ’21

Author: Rebecca Galanopoulos Jones

Capesize sales from Japanese owners have increased by c.20% year on year with twelve sales reported over the first seven months of this year. Approximately half of these sales were for larger vessels of over 200,000 DWT. The average age of vessels sold was 15 years and almost all of these vessels were Japanese built and many were sold with long term charters attached. Chinese buyers led the way accounting for four purchases, followed by Singapore with three. Buyers based in Japan, Monaco and Turkey each bought one vessel and two went to undisclosed buyers.

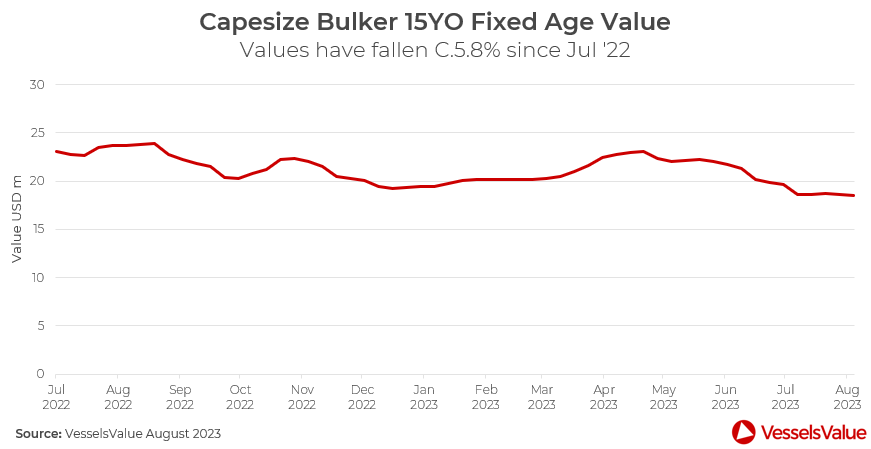

At the end of July, Capesize spot rates were around 15,553 USD/Day, down c.9.9% year on year. With rates relatively flat, this has put downward pressure on Capesize values, following a lacklustre outlook from China. This has been in part due to weak sentiment in the real estate sector which has in turn had an impact on construction and therefore steel demand. Coal demand has supported freight rates to a degree and there is much resting on some sort of rebound in the second half of the year which historically tends to be stronger. And whilst limited fleet supply will provide further support to the market in the medium term, the commodity market seems to be returning to normal following the post pandemic highs. Overall, Capesize values for older vessels have fallen so far this year and since the start of Q3 values for 15YO Capes have fallen by c.5.8% from USD 19.66 mil to USD 18.52 mil. This is the first time that values for this sector have fallen below USD 19 mil since July 2021.

In June, NYK sold the Atlantic Tiger (180,200 DWT, 2006, Imabari) to Winning Shipping for USD 16.65 mil, VV value 18.12 mil (a benchmark sale that pushed values lower. More recently, at the end of July Kitaura Kaiun sold the Shiosai (176,800 DWT, Nov 2009, Namura) was sold to Chinese buyers for USD 20.85 mil, VV value USD 20.92 mil.

VesselsValue data as of August 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?