Market Chat: Week 50

Containers values continue to soften

Container values have continued to fall across all sub sectors and age categories in Q4 of 2022. Sale and purchase transactions have dropped steadily across each quarter of the year. In Q4 to date, only 25 sales have been reported, a drop of c.81% year on year.

The decrease in demand for Container vessels comes as earnings have continued to fall from the record breaking peaks seen earlier this year, where one year Timecharter rates for Post Panamax vessels reached a historic high of 148,500 USD/Day. Rates have since softened, but have yet to reach pre-Covid levels and are currently at 65,590 USD/Day. This comes as easing port congestion has increased vessel supply. At the same time, global economic concerns continue to put pressure on consumer spending, which is consequently having an impact on Container demand.

Notable sales reported mid December include Sub Panamax Container AS Cleopatra (2,742 TEU, August 2006, Wadan Yards MTW) that sold to undisclosed buyers for USD 20.90 mil, VV value USD 19.81 mil.

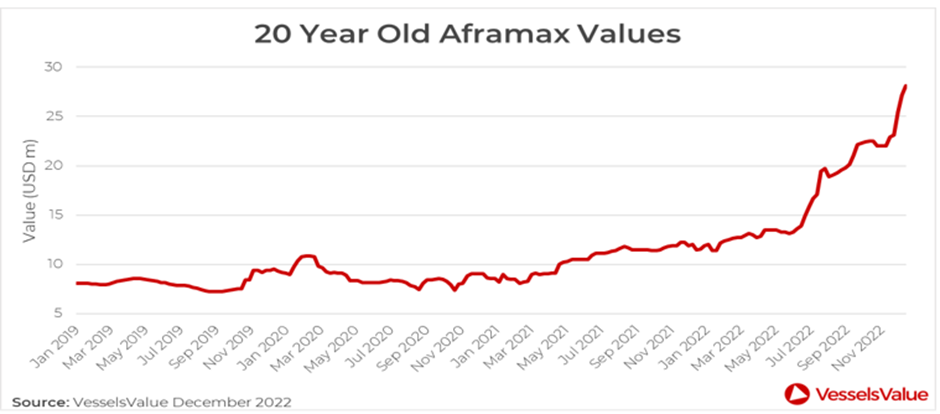

Aframax lead gains in Tanker values

Tanker values continue to firm with the most impressive gains seen in the Aframax/LR2 sectors, particularly for older vessels. Values for 20 year old Aframaxes of 105,000 DWT have increased by c.27% since the start of Q4 to USD 28.02 mil, the highest levels since November 2008.

Aframax freight rates have experienced plenty of volatility this year, but strengthened in the run up to the sanctions on Russian oil that came in to force earlier this month. Aframax TCE earnings are currently at around 80,632 USD/Day. This time last year, rates were at 11,471 USD/Day, an increase of 69,161 USD/Day year on year.

Notable sales this week include LR2 the Minoansea (108,800 DWT, Aug 2008, SWS) sold to undisclosed buyers for USD 39 mil, VV value USD 37.21 mi. The same vessel was sold in July of this year for USD 20.80 mil.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?