Opportunities in the MR Tanker Market: Spot Earnings and Secondhand Demand

MRs Dominate Tanker S&P

MR secondhand sales have dominated the Tanker sale and purchase sector so far this year, accounting for 35% of Tanker sales.

Unlike the crude markets that saw record highs in the run up to the 5th December sanctions on Russian oil, before the February sanctions on Russian petroleum products came in to force on 5th February, MR Atlantic Basket earnings had fallen by c.61% MoM to 10,380 USD/Day on the 1st February which have now bounced back up by c. 425% to 54,539 USD/Day.

However, secondhand demand for this sector has remained constant, with those speculative buyers now able to take advantage of the upturn in spot earnings that has materialised since last week. As yet, sale prices have not yet increased and therefore it remains to be seen if values will strengthen in the coming weeks. The trend towards older vessels continues, and the average age of vessels sold this year is 17 years.

Notable sales include the MR2 Super Emerald (50,300 DWT, Sep 2006, SLS) sold to unknown Turkish buyers for USD 17.50 mil (BWTS), VV Value USD 17.20 mil and also the MR2 Pink Coral (49,500 DWT, Apr 2003, STX Offshore) sold to Unknown UAE for USD 13.00 mil (SS/DD Due), VV Value USD 15.26 mil.

Bulker Demolition Dips

December 2022 was the strongest month for Bulker scrapping since March 2021. Since then, the number of Bulkers heading for the breaking yard has dipped, as market players hang on for a recovery in earnings, despite spot rates for Panamaxes falling to the lowest levels since 2020. The average age of vessels scrapped so far this year is 28 years, indicating that only the oldest and least efficient tonnage is being scrapped as the market awaits a potential recovery.

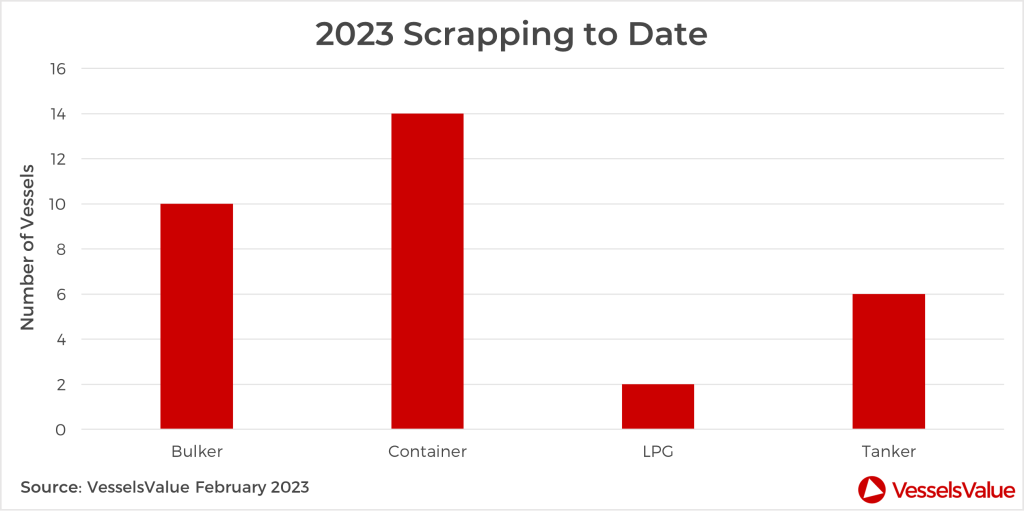

Although most demolition candidates have come from the Container sector so far this year, there have been reports of increasing interest in Bulker demolition as rates fall to new lows despite the Far East having returned to work, following the Lunar New Year celebrations

Bulker values have fallen across most sectors and age categories, but older tonnage has taken the biggest hit with prices for 20 year old Supramaxes and Handys both down by c.6% since the start of the year to USD 9.6 mil and USD 8.37 mil respectively. With both values and rates falling, it is increasingly likely that we will see a resurgence in Bulker scrapping in the near future.

Notable demolition sales so far this month include the Rio Balsas (94,200 DWT, April 1992, Imabari) that sold for 570 USD/LDT, delivery location unknown, also the Jasmine 201 (73,800 DWT, May 1999, Tadotsu Tsuneishi) that sold for 535 USD/LDT, delivery location Bangladesh, VV demo value 550 USD/LDT.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?