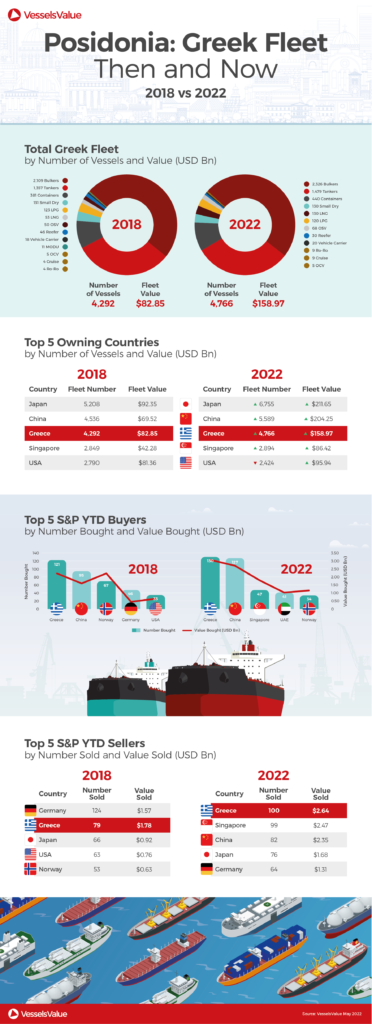

Posidonia Then and Now: A Look into the Greek Fleet

To celebrate the much awaited return of Posidonia after 4 years, we take a look at how the Greek fleet has developed since the last event in 2018, using VesselsValue data.

From 2018 to 2022, the value of the Greek owned fleet increased by 92%. This is a considerable increase considering the fleet only grew by 474 vessels (11%). The Bulker, Container and LNG fleets grew the most significantly, with Greek owners investing in the rapidly rising Bulker and Container markets, and ships that can carry greener cargo such as LNG.

LNG fuel is a clean method of generating energy, and with a healthy infrastructure underpinning it, provides a robust shorter term method of reducing our carbon output in anticipation of green energy sources becoming more reliable and readily available in the future. Hence, despite carrying a carbon based fuel, LNG vessels are to take on an ever growing role in aiding the planet’s move towards a low emission future, and Greek owners are at the forefront of this development.

Despite ranking only 87th in the world by total population, Greece comes in third in terms of vessel ownership, with 4,766 Greek owned vessels on the water in 2022, just behind China (5,589 vessels) and Japan (6,755 vessels).

Greece has maintained its spot as the top buyer since the last Posidonia in 2018. Between January and June 2018, Greeks had purchased 121 vessels. Fast forward to 2022, and 130 vessels have gone to Greek buyers in the same time period with the most popular ship type bought being Bulkers. Chinese buyers are hot on their heels, purchasing a total of 127 vessels year to date.

Since the start of 2022, Greece has sold 100 vessels, accounting for USD 264 billion, making them the world’s top seller of vessels, with the most popular type sold being Bulkers. They were closely followed by Singaporean owners, who have sold 99 vessels this year.

VesselsValue data as of end May 2022.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?