Renewable energy moves East

Unlike Scrubbers and LSFO which are mitigating the existing problem, renewable energy is a long term solution to the environmental issues faced globally. Europe has led this initiative, and through the last 19 years of development the cost of renewable energy, particularly offshore windfarms has decreased significantly. Shipowners and operators are beginning to see this market no longer as a niche, but a market which provides significant opportunity. We are aware of the developments in Europe, but how is this potential being realised in the Far East?

Despite plans to double the United Kingdom’s offshore wind capacity by 2030, China is on track to become the global leader in offshore wind by as early as 2021. At present in China, energy from wind power is the third largest source after coal and hydroelectricity.

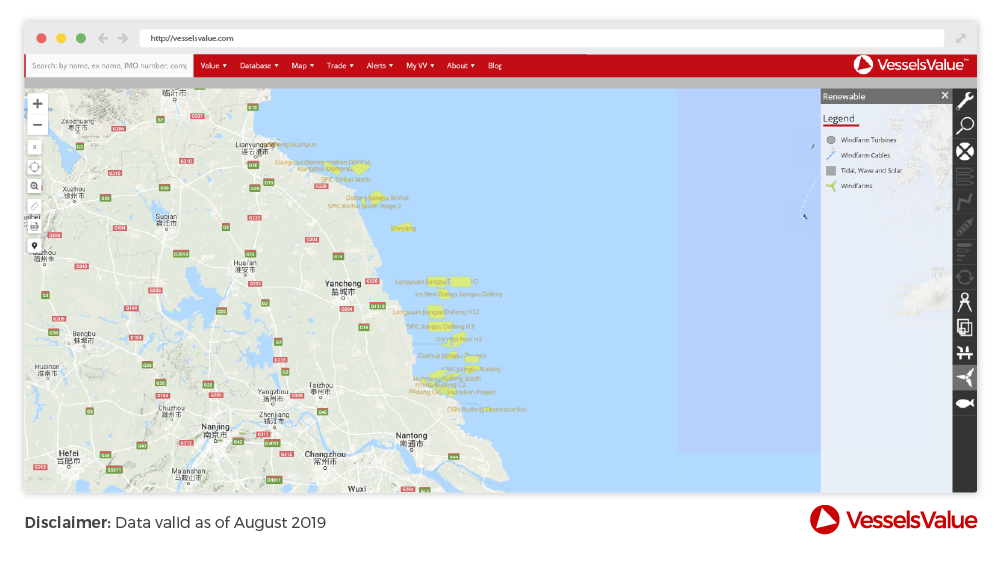

China is the world leader in power generated from wind, but most of these projects so far have been in onshore locations. However, as China has a long coastline of approximately 14,500km the scope for offshore wind farm locations is vast.

The cost of electricity generated from offshore wind farms in China is due to drop significantly due to a new policy from the National Development and Reform Commission released in May of this year. Therefore, price of electricity from offshore wind is therefore expected to drop from $0.12/kWh next year to $0.11/kWh in 2020.

This will prove to be the first ever move from the Chinese government to lower the price of electricity generated from offshore wind farms. This move will hasten the construction of more offshore wind installations by 2021.

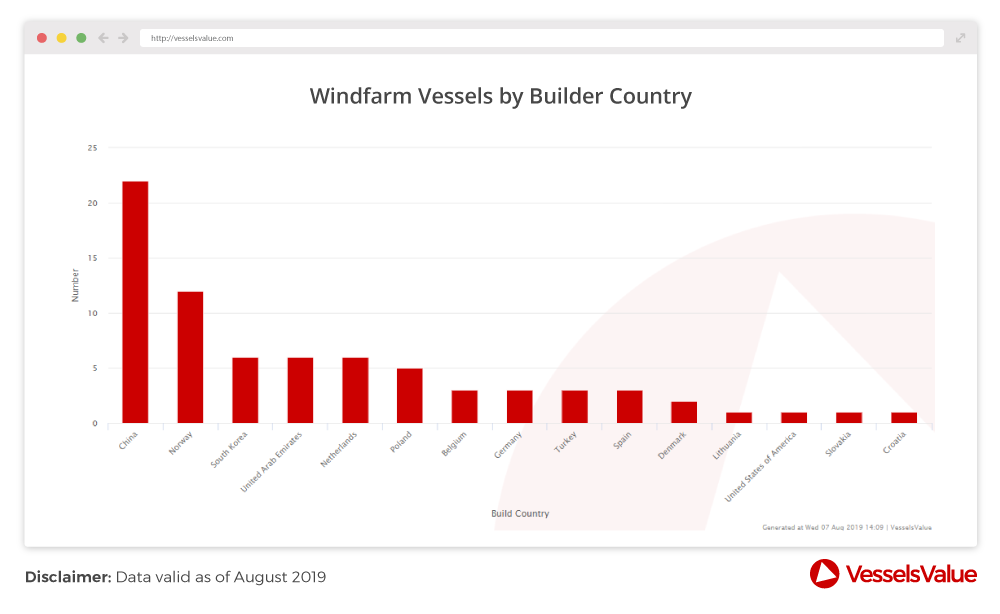

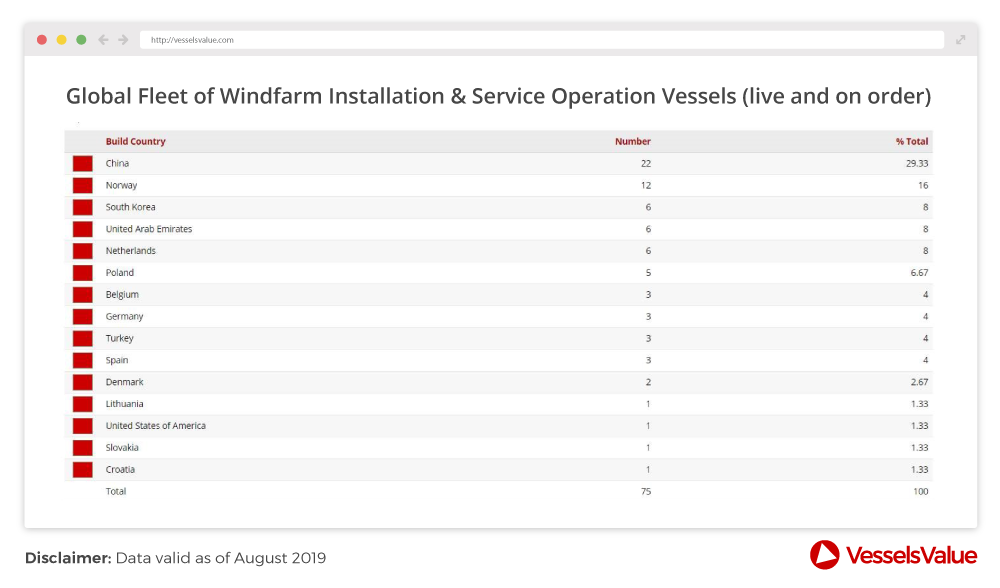

The below table shows a breakdown of the global fleet of Windfarm Installation and Service Operation Vessels totalling 75 ships (live and on order) with an average growth rate over the past 5 years of over 10%.

These windfarm vessels started to be ordered in the early 2000’s to coincide with the global initiative to diversify into renewable energy, with the North Sea leading the way.

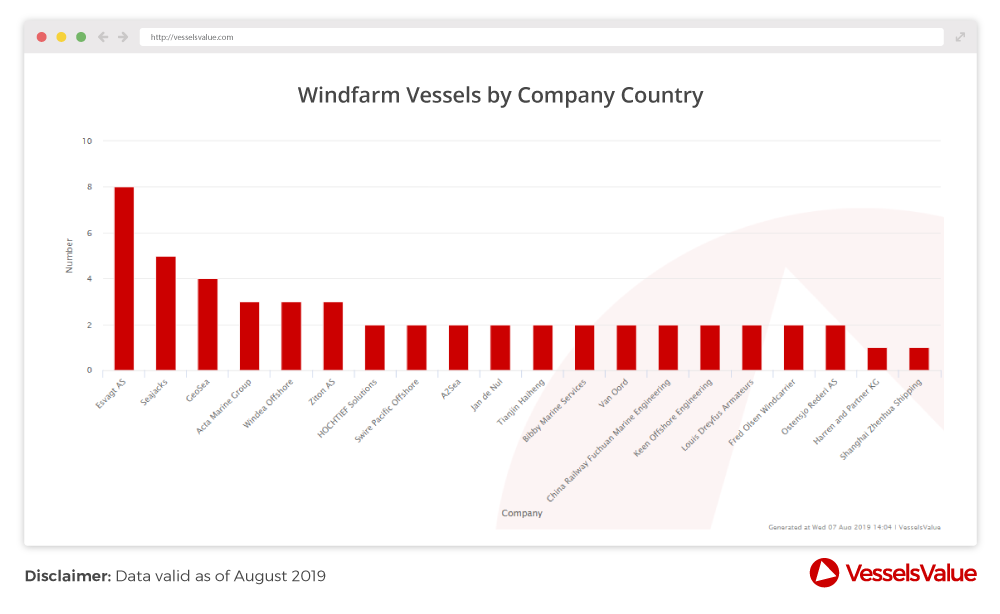

The top 2 owners of this asset class are Esvagt of Norway and Seajacks UK however, if we were to group the fleet by country of ownership, the data paints a different picture with the Chinese controlling nearly 20% of the fleet. Perhaps this is not surprising as China installed over 1000MW of new offshore wind farms in 2017 across 18 locations. This market development, coupled with massive future offshore wind investments such as the $18 billion Jiangsu Province wind power project expansion, China is likely to exceed the national goal of 200GW generated by onshore and offshore wind power by 2020.

When looking at renewables and vessel activity, it is important to note it is not just specalised vessels that are benefitting from global efforts to become a more eco friendly environment.

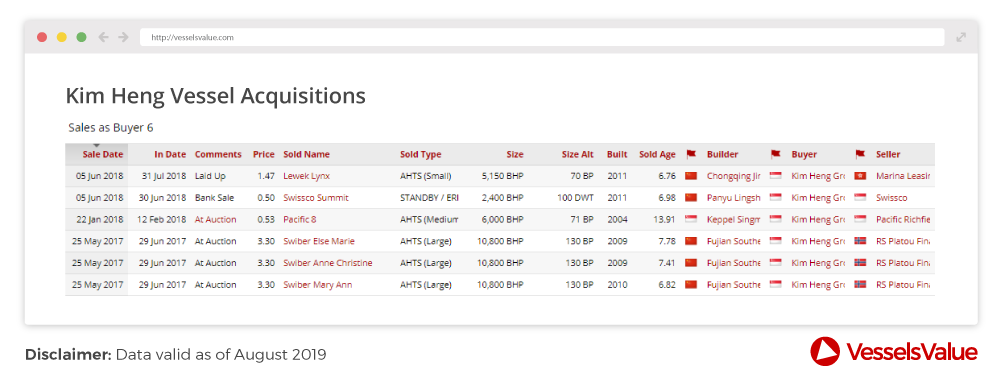

Singaporean owner Kim Heng Offshore Marine recently signed a memorandum with Taiwan’s Hung Hua Construction to provide offshore support vessels to transport, deliver and install a series of Taiwanese windfarms. Taiwan plans to expand its offshore windfarm capacity, which stood at 703.99 MW in 2018, according to government figures. The Taiwanese government aims to commission a further 500 MW of capacity in 2020 and another 5 GW between 2021 and 2025, with more to follow up to 2030 which is great news for Kim Heng who have acquired over half their owned fleet at very competitive prices during the offshore vessel market downturn.

Source: VesselsValue August 2019

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?