Shipping Market Outlook: Q3 2024 Forecast

Overview

The Houthi attacks in the Bab Al Mandeb strait and the subsequent rerouting around the Capes has supported all the different shipping markets to varying degrees. The highly unpredictable nature of the Houthis creates a lot of uncertainty, as a sudden cessation of attacks carries a lot of downside risk for shipping, while a long-term extension of the attacks carries significant upside risks. Ongoing geopolitical conflicts, accompanied by related sanctions or trade wars, contribute to an uncertain environment. Any significant escalation or de-escalation in these conflicts could significantly impact the overall economic outlook. The recovery of the Chinese economy is currently unstable, posing uncertainty due to China’s role as a key demand driver. The presence of high interest rates in Western economies raises the risk of a hard landing, potentially dampening and postponing future growth.

Here’s a summary of how this uncertainty could play out across tankers, bulkers, containers, and gas industries based on our forecast data. To request a full report or a consultation with our shipping economists, reach out to our team.

Tankers

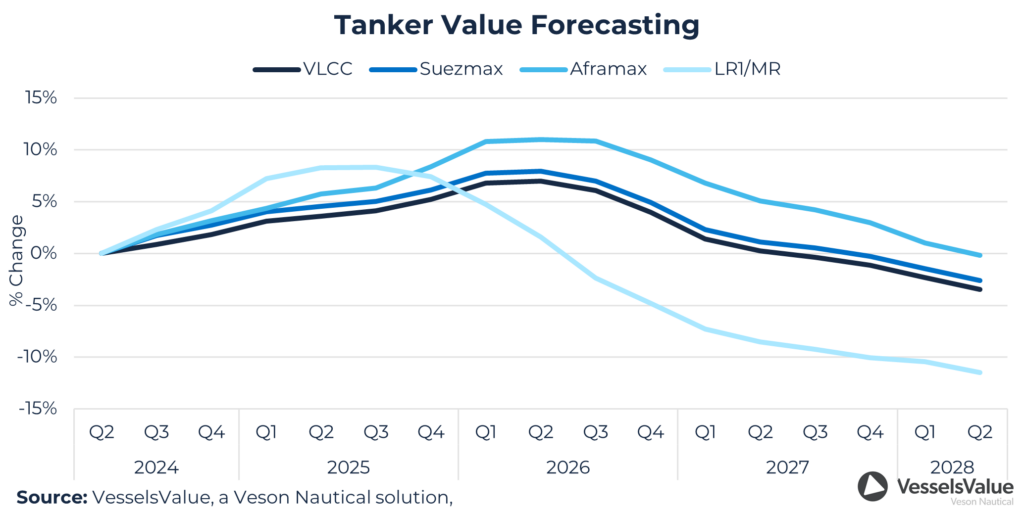

Rate volatility is likely to persist due to fluctuations in oil prices, developments in Russian production, the ongoing situation in the Red Sea, OPEC+ decisions and the compliance of member states, as well as China’s ability to sustain economic growth, high crude import levels, and refinery runs.

We maintain that while Russian exports of both crude oil and products may decline, sourcing supplies to Europe from other suppliers (MEG, US, Latin America) will continue to uphold ton-mile demand and support rates going forward.

Despite high newbuilding prices, activity in the first quarter of 2024 had the highest volume of ordering in DWT terms since Q4 2015 at 16 mil DWT. The second quarter to date is more muted and will come in at about 6 mil DWT, which is about half of what was ordered in Q2 2023. The total Tanker orderbook to fleet ratio, currently at 10%, has been increasing through 2023 and into 2024.

We expect an increase in scrapping; the overall market balance is set to remain tight in the years to come but supply growth may well outpace demand growth post 2025.

Ton-mile demand expectations in 2024 and beyond remain strong in our current Base Case. With no remedy in sight for the Houthi aggression in the Red Sea, we project that the positive impact of sailing longer distances to avoid risk areas in the Red Sea will continue. However, if the risk subsides and it becomes acceptable within the industry to allow ships to transit the Suez Canal once again, the market will likely face a downward correction.

Bulkers

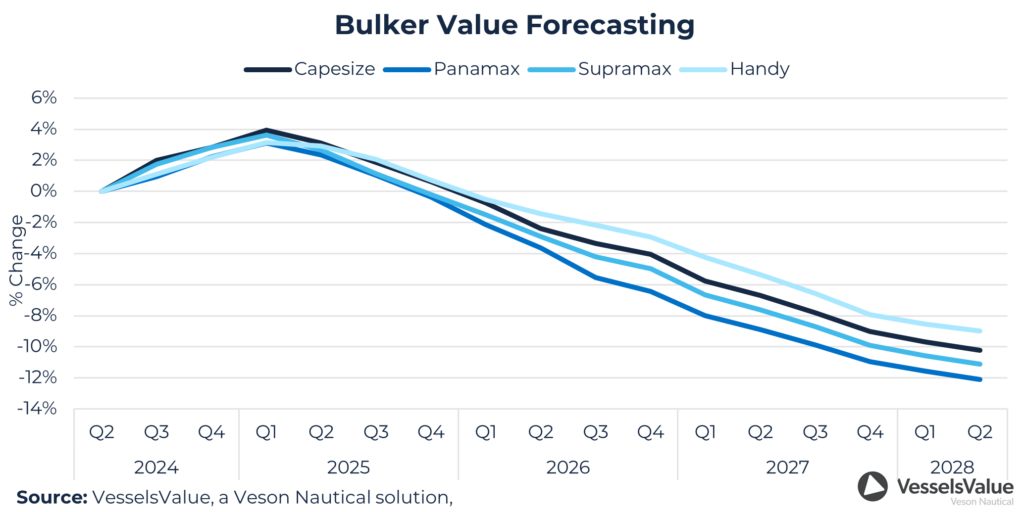

The Chinese government has issued several stimulus measures to support the struggling real estate sector. However, these measures have yet to have an effect on the property sector. As prices are falling, real estate investment is declining and confidence in the real estate market remains low. Going forward, we expect a deceleration in the decline of the real estate sector, rather than a strong rebound, and this will weigh down the Chinese steel production.

As China emerges as the largest producer of green energy components, such as electric vehicles, windmills, and solar panels, we expect to see an increase in steel demand to support this sector.

The opening of the Simandou iron ore mine in Guinea, scheduled for 2025, is likely to increase ton-mile demand due to the longer sailing distances.

Increased bauxite imports to China from Guinea as part of the green transition also continue to support the Bulker market and it is a trend that we expect to continue as part of the ongoing green transition.

The current canal disruptions and the consequent rerouting are adding an additional layer of upside in the near term as the ton-miles are significantly affected. We estimate that rerouting could increase the total Bulker ton-mile demand by about 1.2% in 2024.

Despite declining demand, we expect the coal trade to remain at relatively elevated levels due to the growing energy demand in developing countries.

The orderbook for Bulker vessels is still comfortably low at around 10% of the total fleet, and ordering activity remains limited due to the uncertainty of the future of fuels and high newbuilding prices. We therefore expect net fleet growth to remain low during our forecasting period.

Containers

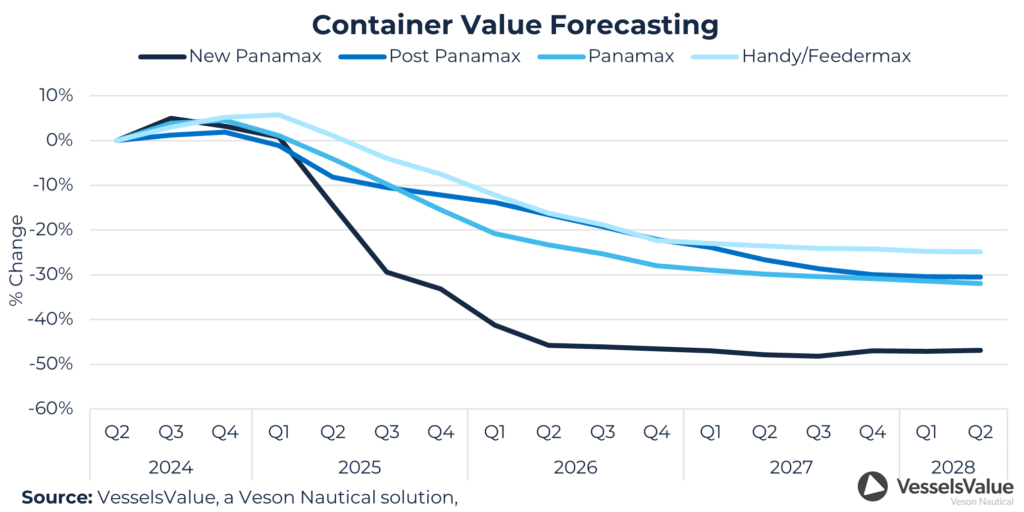

Demand growth in the first quarter of 2024 is positive for all major routes with most growth in the trans-Pacific eastbound trade at 22.4%, followed by trans-Pacific westbound with 8% demand growth. Our current analysis points to total TEU demand growth of 3.5% yearly average over the period 2024-2027, with a forecasted growth for 2024 of 5.7%

With the current conflict in the Red Sea, freight rates have increased sharply and are expected to stay at high levels throughout 2024. Longer sailing distances, congestion at ports, and an earlier than expected peak season have increased demand for goods, and supply has not managed to keep up with this pace.

Improved macroeconomic outlooks and interest rate cuts will be positive for demand in our forecast period, in addition to continuing growth in emerging markets. However, the effective supply growth was recorded at 6.4% in 2023 which we expect will rise at an average pace of 7.5% between 2024-2027.

The orderbook is still significant at ~25% of the fleet at the beginning of 2Q24. With almost 9 mil TEU’s entering the market over the next couple of years, we expect a supply surplus.

Scrapping activity has remained muted with 0.13 mil TEU’s in 2023, but this is expected to increase going forward. However, with the recent strong market, we expect muted scrapping activity once again in 2024.

Gas

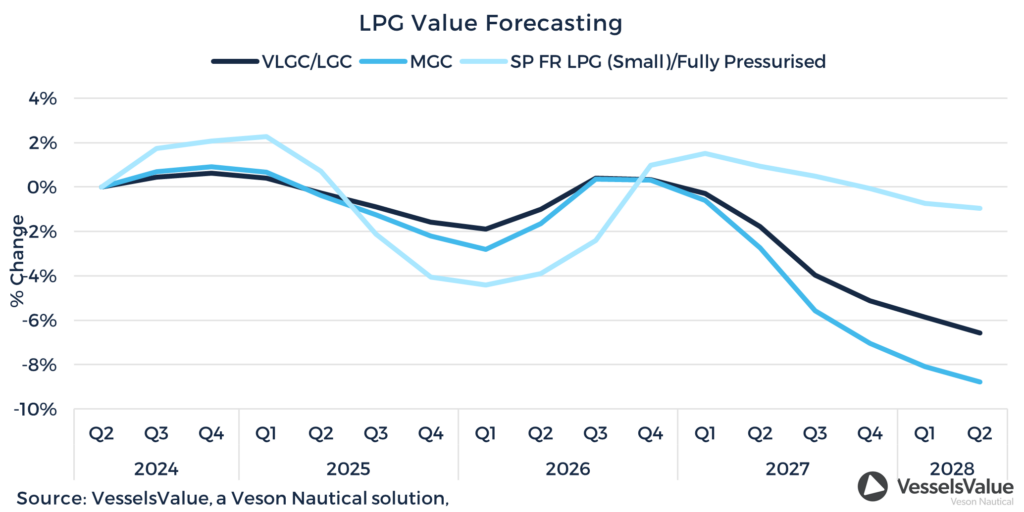

Market players are still ordering VLAC’s and the orderbook has reached 43 vessels with several vessels expected to be delivered in 2026 and 2027. Net fleet growth for VLGC/VLAC is expected to grow 10.8% in 2024. With the current ordering activity in the past year, we expect supply growth to put pressure on earnings at the end of our forecast period.

Earnings are expected to average around 51,000 USD/Day in 2024 as US production growth is expected to be modest and domestic consumption is likely to increase.

Despite the pressure on transits through the Panama Canal due to the recent drought in the Gatun Lakes last year, we still expect some increase in daily transits for 2024 as the water level projections are improving, according to the Panama Canal Authority.

LPG demand in Asia is expected to grow in 2024 for PDH plants and domestic consumption. The PDH capacity in China is expected to increase by 7 million tons this year, but with muted operating rates, we do not expect full utilisation. We forecast a continuation of the current trade pattern in CBM mile demand.

Asia will become more self-reliant with ethylene, propylene, and butadiene as new mixed feed crackers and PDH units start up, however a sizeable inter Asia trade is likely to continue to grow due to maintenance cycles and price differences. So far this year, we are seeing a decline for all petrochemical gases as Asian demand is muted.

All information provided is for informational purposes only. To the extent that any provided information is based on Veson Data, Veson excludes to the extent permitted by law all implied warranties relating to fitness for a particular purpose, including any implied warranty that Veson Data is accurate, complete, or error free. Veson Data are collated and processed by and on behalf of Veson in accordance with methodologies and assumptions published and updated by Veson from time to time which do not take into account particular circumstances applicable to individuals and therefore; (i) are made available on an ‘as is’ basis; (ii) are not intended as a substitute for formal valuations; (iii) should not be used solely as trading, investment, or other advice; and (iv) are not intended as a substitute for professional judgement. To the extent permitted by applicable law, Veson shall have no liability to party for any errors or omissions in the content of the information provided.