VLCCS: Tight Supply Supports Elevated Asset Values in 2025

The VLCC segment continues to demonstrate robust fundamentals in 2025, supported by strong Chinese demand for strategic reserve building and historically tight fleet supply. Recent rate momentum has been particularly impressive, driven by increased buying activity following Saudi pricing adjustments and minimal new tonnage entering the market.

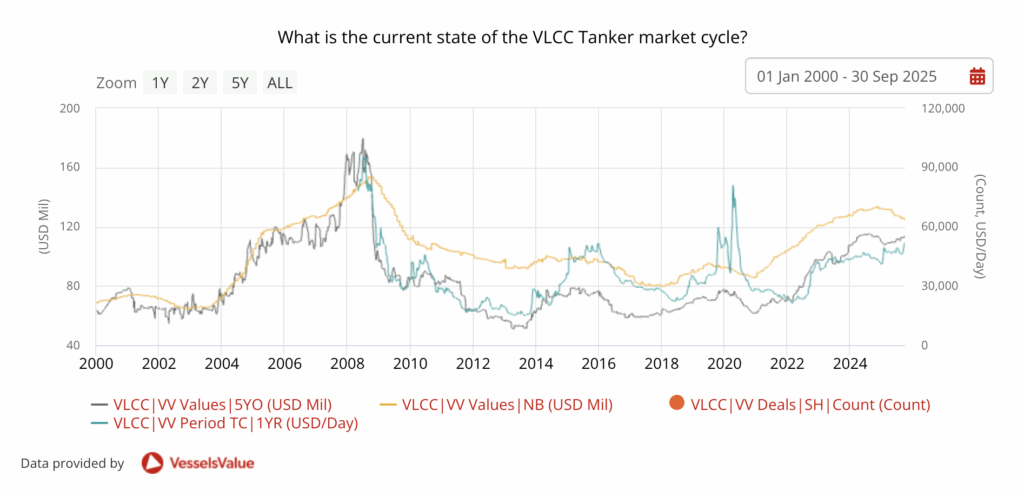

Using VesselsValue Timeseries data we take a look at where we are in the Tanker market cycle. Values, although lower than the 15-year highs seen last year, still remain very strong; since the start of the year, values for VLCCs have risen steadily. For example, 5Y0 VLCCs of 320,000 DWT from USD 109.8 mil to USD 113.62 mil.

VLCC sales and newbuilding orders have plummeted this year-on-year by c.27% from 113 in the first nine months of 2024 to 83 over the same period in 2025. Similarly, there have been almost half as many VLCC newbuilding orders placed with 35 year to date, compared to 69 in the first nine months of 2024. VLCC sales and newbuilding activity have slowed significantly due to record-high newbuilding prices, extended yard delivery timelines, and fuel technology uncertainty deterring new orders.

Despite uncertainty around long-term Chinese crude demand and increased Middle Eastern sourcing patterns, owners remain reluctant to sell profitable assets given historically strong earnings. The aging fleet and minimal scrapping activity have kept supply tight, supporting firm asset valuations even as transaction volumes decline.

Notable recent sales include 4 x VLCC newbuilding resales of 306,000 DWT purchased by Dynacom. The vessels are scheduled to be built at Hengli Shipbuilding and set to be delivered between 2026-7, sold en bloc for USD 118 mil each, VV value USD 118.9 mil each. Similarly, Seatankers purchased 4 x VLCC newbuilding resales of 306,000 DWT , which are being built at Hengli Shipyard and expected to be delivered in 2026 and sold en bloc for USD 118 mil each, VV value USD 120 mil each.

One year timecharter rates for VLCCs surpassed the 50,000 USD/day mark in September, rising by c.12% across September from 46,333 USD/day to 51,333 USD/day, with certain routes hitting the 100,000 USD/day mark on the spot market – the first time since March 2023.

These rates have been driven by a combination of seasonal and geopolitical factors. China’s strategic reserve, buying around 0.5 mil barrels daily, has coincided with the traditional Q4 uptick as refineries ramp runs ahead of winter. Saudi Arabia’s 1 USD/barrel price cut on September 9 encouraged additional Chinese buying as buyers looked to hedge against potential supply disruptions. With minimal fleet growth this year and ongoing ton-mile inefficiencies from prolonged voyage routes, the market has tightened considerably. Our latest Market Insights report examines how Asian buyers, now among the most active players in secondhand markets, are choosing whether to invest countercyclically, ride earnings momentum, or selectively upgrade fleets.

Demolition levels remain very low with only two VLCCs sent for scrap so far this year; with an ageing fleet, this leaves plenty of potential to tighten vessel supply should rates weaken.

The VLCC market in 2025 demonstrates exceptional supply-side support, underpinning strong fundamentals. Asset values remain historically elevated despite moderating from last year’s peaks, while sale and purchase activity has declined sharply alongside a significant drop in newbuilding orders, reflecting strategic market restraint amid record yard prices, extended delivery schedules, and fuel technology uncertainty.

This supply constraint has proven decisive. With minimal fleet growth, an aging vessel profile, limited demolition activity, and persistent ton-mile inefficiencies, the VLCC segment has achieved structural tightness that positions it favourably through year-end, though evolving demand patterns and shifting trade dynamics require ongoing attention.