2019 Big Spenders

2019 has proven to be a particularly volatile year for shipowners. Record highs (Tankers), 3 year lows (Bulkers) and trade wars (Containers) made for good headlines, but how did this volatility affect second hand spending?

Bulkers

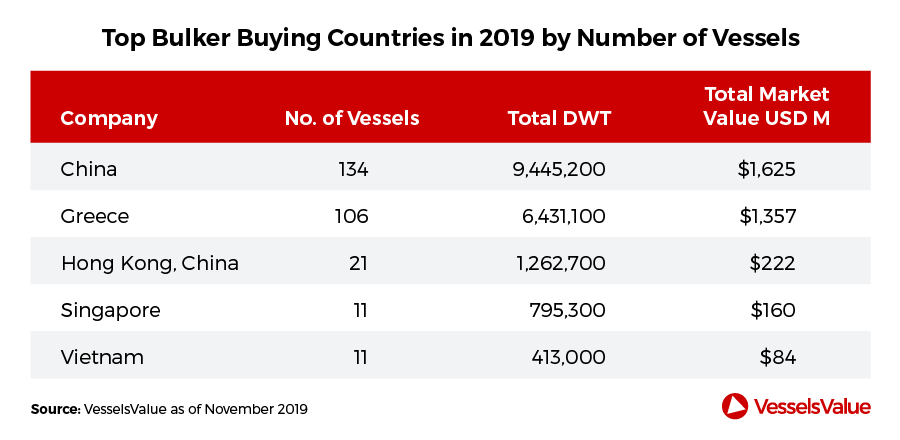

Chinese companies have purchased 47% of all Bulkers transacted on the second-hand market so far this year. Greek companies come in second place with 37% of bulkers bought. The closest next is Hong Kong, with just 7%, showing how much China and Greece dominate this market.

The dry sector experienced the highest number of transactions compared to the other sectors as rates experienced huge volatility. The BDI saw 3 year lows as well as 5 year highs during 2019, with rates across the sector now sitting comfortably above historical averages.

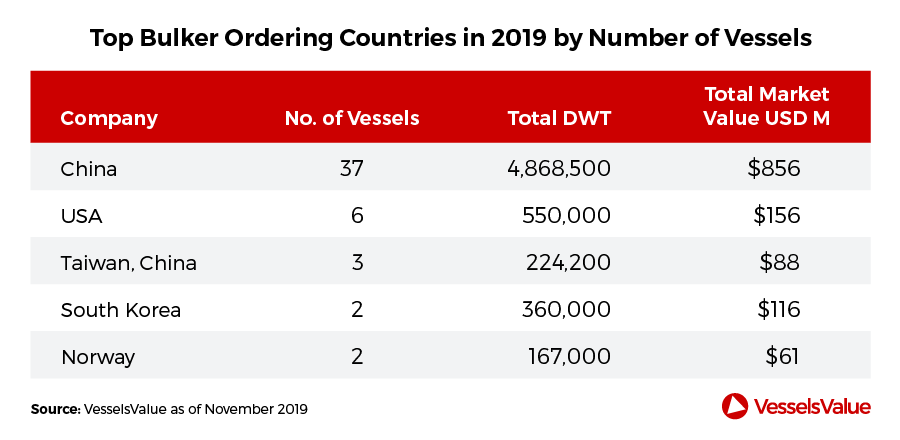

China has led the way with significant spending on newbuilding Bulkers. With 24 out of the total 37 Bulkers bought YTD 2019, COSCO Shipping Bulk and Avic Leasing are dominating this space. As we can see, China is well ahead of any competition in the newbuilding Bulk market, with the second highest ordering from USA with a total of 6 Bulkers.

Tankers

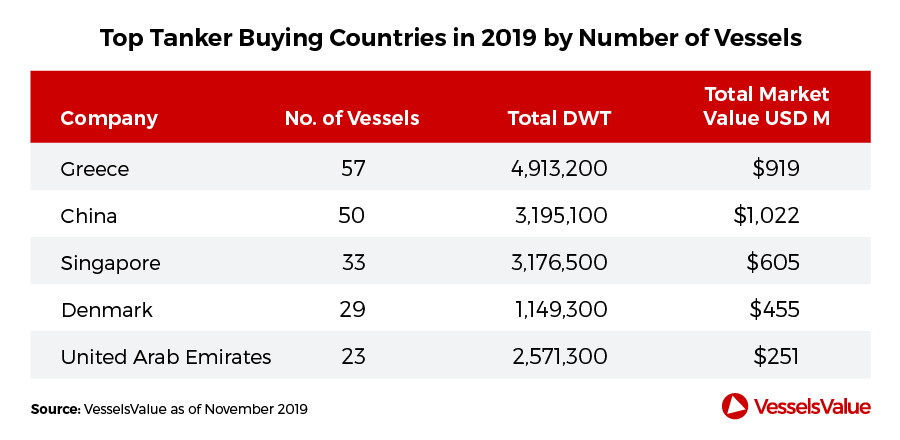

Once again, Greece and China competed for superiority in another key shipping sector. This time however, the Greeks take pole position, purchasing 7 additional tankers than Chinese companies. The capacity of Greek purchases (almost 5 million DWT) shows that Greece is keeping to the tradition of owning large Tanker tonnage.

Observing the total market value of Tankers in 2019 purchased compared to the number of vessels, Singaporean companies have bought close to the same DWT capacity of tankers compared to China. This implies that Singaporean Companies have acquired older and larger tonnage than Chinese entities, which could be linked to fuel storage plays as the shipping world prepares itself for the introduction of IMO2020. One thing for certain is that all tanker owners, particularly VLCC, Suezmax and Aframax owners, would have enjoyed a huge spike in returns during the recent high tanker rates environment.

Greece has set the pace with total tanker newbuildings as well. Almost equalling their total second had purchases, Greek companies have ordered a combined total of 43 tankers. Interestingly, the company with the largest number ordered this year is South Korean entity Sinokor.

Containers

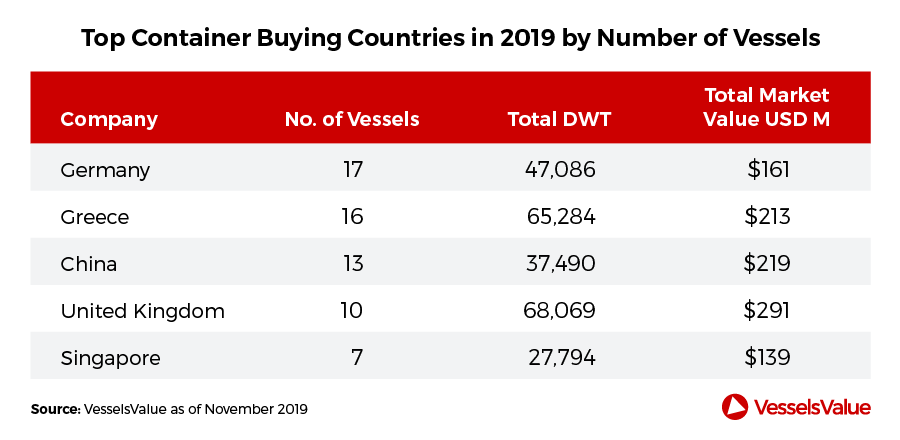

The Container market has seen a relatively low number of second-hand transactions. Traditional Container owning country Germany is placed at the top but only marginally above Greece and China. Returns in the Container market have been relatively strong for the larger sizes, despite the well-publicised ongoing trade war, as cargo miles have increased significantly over the last year and some of the fleet has been side lined with scrubber fitting. That said, the smaller sizes have had poor results.

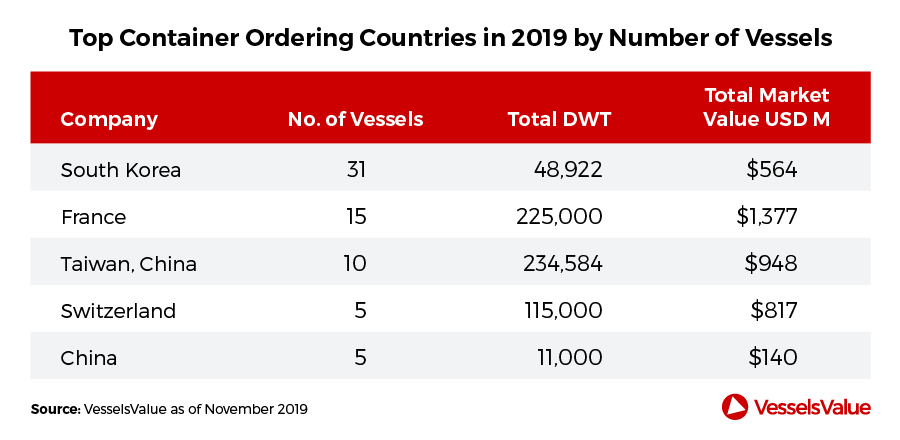

Despite not appearing in the top 5 for second hand SnP, South Korea tops the list for number of Containerships ordered. France, through CMA CGM have ordered a total TEU of 225,000, the second largest amount of TEU and second highest number of vessels ordered out of the top 5 for number of Containerships ordered.

LPG

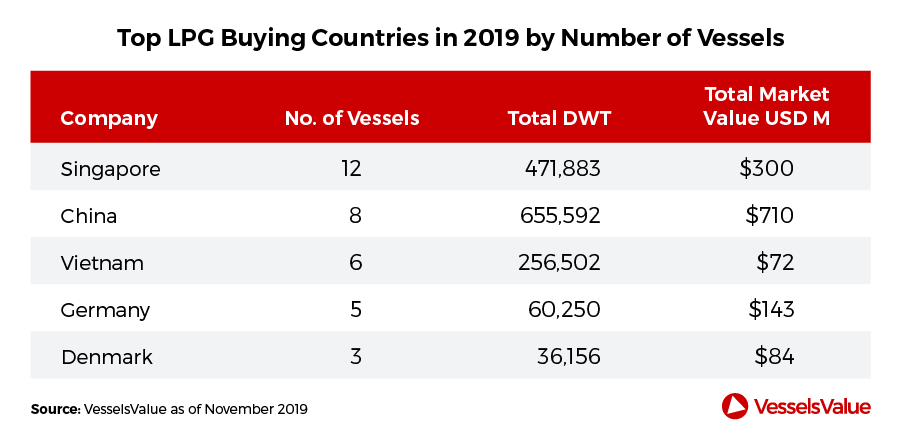

Singapore comes in first position for LPG vessels bought, however it is not at the top in terms of capacity. China has clearly invested in large, high value gas carriers, as the world looks to continue emphasising cleaner fuels across the industry. In terms of second hand sale and purchase, and spot charters the Gas market is still developing, and will likely become more important as time goes on.

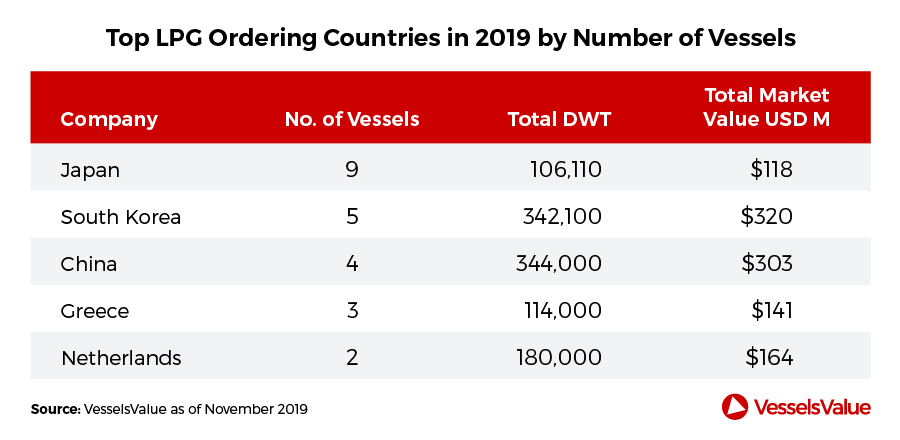

LPG orders are dominated by the Japanese, but with a comparatively low capacity and value compared to South Korea and China.

LNG

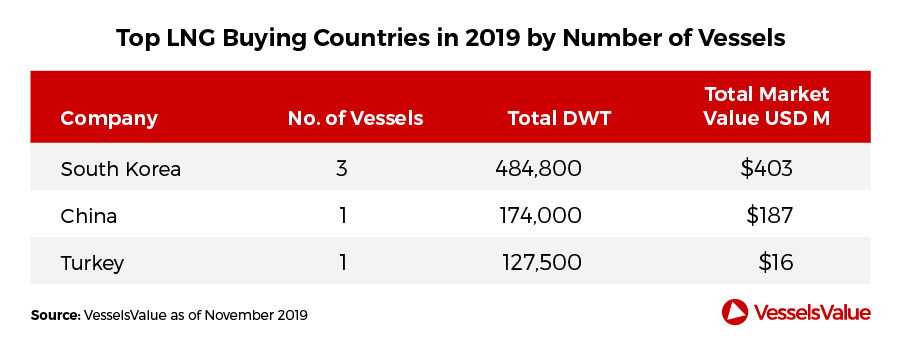

In a sector with only 5 S&P deals completed, South Korean companies top the list with 3 vessels bought.

In terms of newbuild orders, the LNG sector is dominated by the Greeks. Maran Gas holds the largest number of orders out of the USD c.2bn Greek owned gas fleet. Interesting that Greece is not on the second hand top 5.

South Korea have seen themselves appear on every newbuild top 5 list, which is consistent with the efforts the South Korean government are expelling on propping up their shipbuilding industry.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?