2024 Half Year Review: Containers

This container half year review is one of a series of reports providing a summary analysis of the first half of 2024 in the tanker, bulker, offshore, and LNG / LPG sectors. In each, we explore three areas: the newbuild market, second-hand sale and purchase activities, and demolition trends. Combining Veson’s extensive datasets with many decades of combined experience among our analysts, these insightful reports provide clarity on the key factors influencing each market and the potential implications for stakeholders in the months ahead.

Container Summary

Increased sailing distances resulting from a prolonged Red Sea crisis became the main driver of demand in 1H 2024, culminating in global TEU-miles gaining a considerable c.20% year-over-year, supported by c.7.1% growth in global boxes shipped from January to June as per Container Trade Statistics (CTS).

Although positive net fleet growth of c.5.3% was actualized, based on 1.64 mil TEU delivered versus 55,267 TEU scrapped, demand comfortably soaked up supply resulting in a tightly balanced container market by Q2, driving up rates and values.

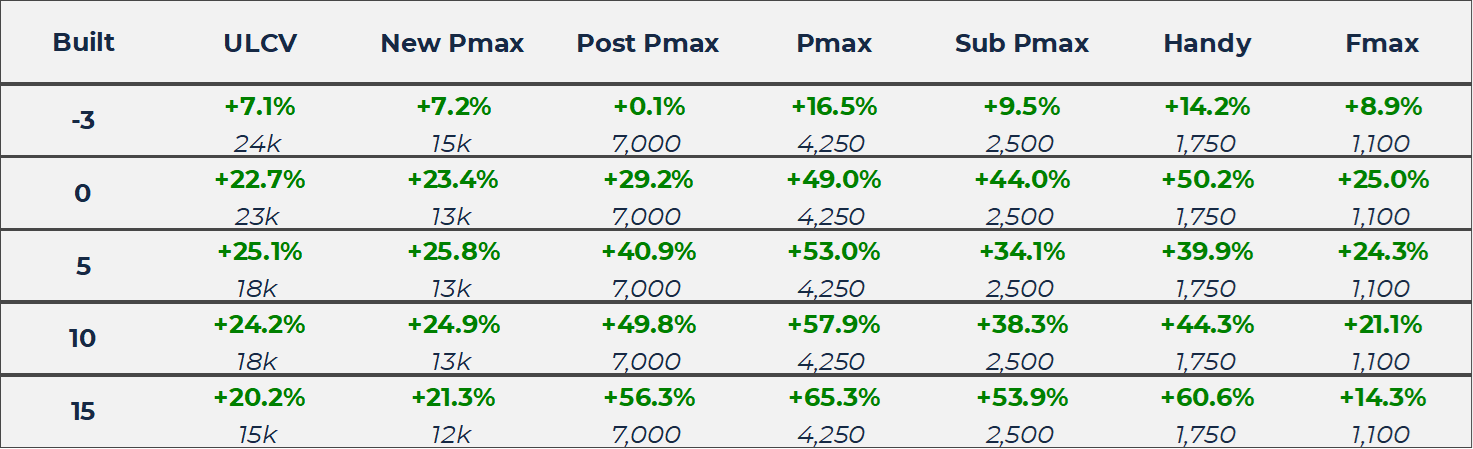

One-year Time Charter (TC) rates for Panamax 4,250 TEU and Sub Panamax 2,500 TEU reached 42,600 USD/day and USD 28,870 USD/day respectively by the end of June, up an impressive c.156% on average since January.

Meanwhile, fifteen-year-old values for Panamax 4,250 TEU and Sub Panamax 2,500 TEU finished the second quarter at USD 30.5 mil and USD 19.5 mil, equating to asset price appreciation of c.65% and c.54% over six months of trading.

VV Mini Matrix – Change ($m/TEU)

Newbuildings

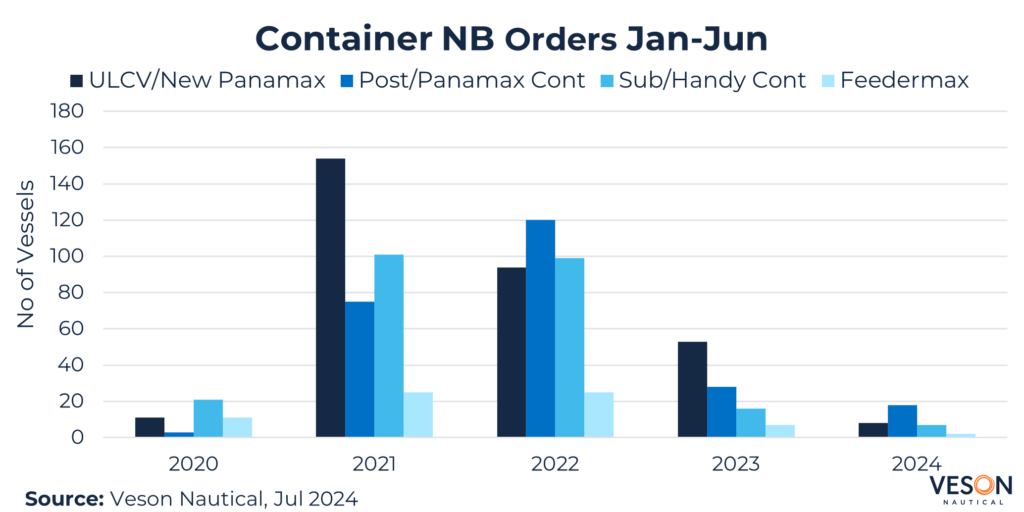

New ship orders were down c.62% year-over-year based on 40 deals including options, compared to 104 deals in 1H 2023. Post Panamax received the most support based on 14 vessels ordered from top buyers including Seaspan Corporation (4 vessels), Danaos Shipping (4 vessels), and TS Lines (3 vessels). Followed by 10 vessel deals for New Panamax from Peter Dohle Schiffahrts (4 vessels), TS Lines (4 vessels), and BAL Container Line (2 vessels) including options.

Notable headline deals:

- 4 x Post Panamax ordered by Seaspan, methanol dual fuel, scheduled to be delivered in 2027, contracted for USD 125 mil each en bloc, VV value USD 122.5 mil.

- 2+2 New Panamax ordered by TS Lines, methanol ready and scrubber fitted, scheduled to be built at Shanghai Waigao for delivery in 2027/28, contracted for USD 145 mil each en bloc, VV value USD 152 mil.

Taiwan was the top buying country in 1H 2024 based on 14 vessels, followed by Germany (6 vessels), Greece (4 vessels), Turkey (4 vessels), and Marshall Islands (4 vessels). Focusing on five years of first half year data, China maintains top spot (149 vessels), followed by Taiwan (96 vessels), and France (88 vessels).

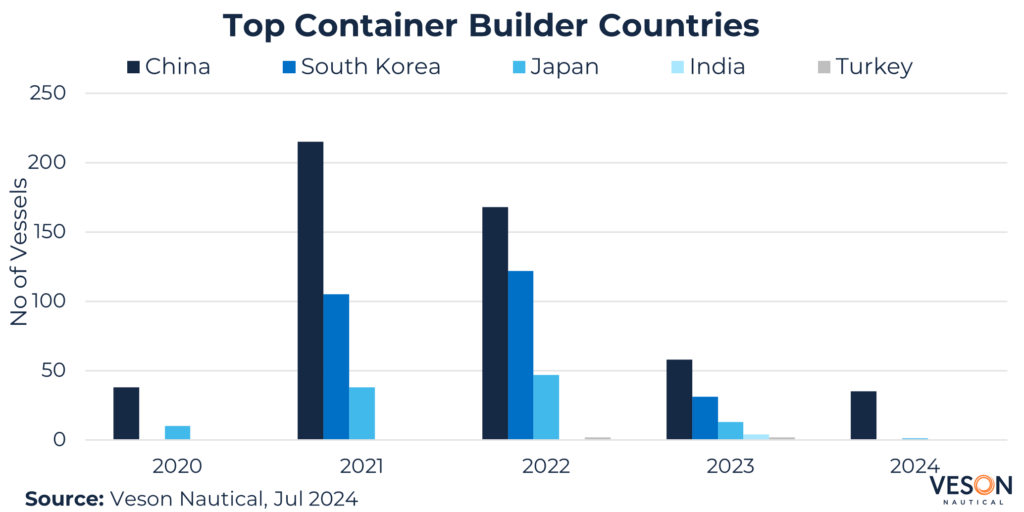

Chinese shipyards dominated orders based on

39 vessels contracted equating to c.97% share, offering highly attractive terms

on price and availability. Looking at five years of first half year data, South

Korean builders rank second based on 258 deals, far behind China winning 510

vessel orders.

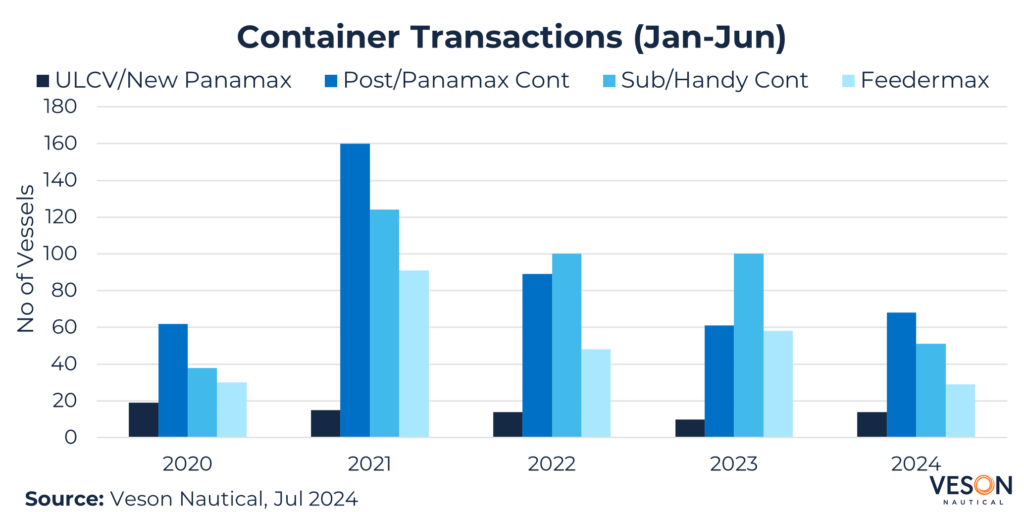

Sale and Purchase

Sale and Purchase (S&P) activity was down c.29% year-over-year based on 162 deals concluded in 1H 2024. The headline willing-seller-buyer transactions by subtype included:

- New Panamax CMA CGM Vela (11,262 TEU, Oct 2008, Daewoo) sold to CMA CGM for USD 54.5 mil (SS Passed) in March, VV Value USD 51.6 mil day before sale.

- Post Panamax MSC Lausanne (6,296 TEU, Nov 2005, Daewoo) sold to MSC for USD 19 mil (DD Due) in January, VV value USD 23.1 mil day before sale.

- Panamax Northern Guild (4,294 TEU, Jan 2009, Hyundai Mipo) sold to CMA CGM for USD 26 mil (SS/DD Passed) in May, VV value USD 24.3 mil day before sale.

- Sub Panamax ALS Clarita (2,794 TEU, May 2006, STX Offshore) sold to MSC for USD 10.3 mil (DD Due) in February, VV value USD 10.7 mil day before sale.

- Handy Starship Leo (1,891 TEU, Feb 2013, Hyundai Mipo) sold to Erasmus Container Lines for USD 16 mil (BWTS) in March, VV value USD 15.9 mil day before sale.

- Feedermax HS Singapore (1,096 TEU, Aug 2009, Kyokuyo) sold to Jiangsu Ocean Shipping for USD 19 mil (SS/DD Due) in March, VV value USD 18.4 mil day before sale.

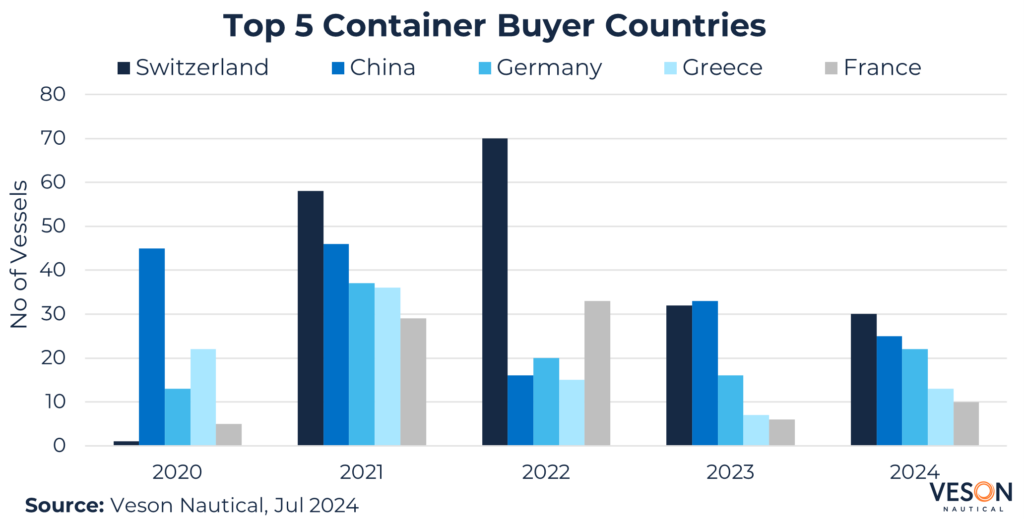

MSC’s relentless appetite for second-hand tonnage ensured Switzerland was the top buyer country based on 30 ships purchased in 1H 2024, followed by China (25 vessels), and Germany (22 vessels). Mr Aponte favoured any ship within the 2,000 TEU to 10,000 TEU size range, typically 15 to 25 years of age.

Demolition

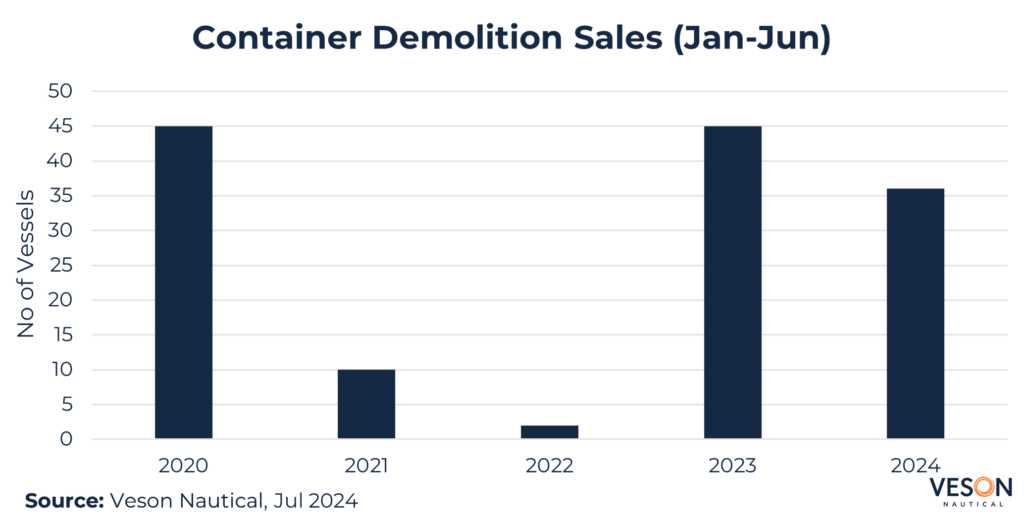

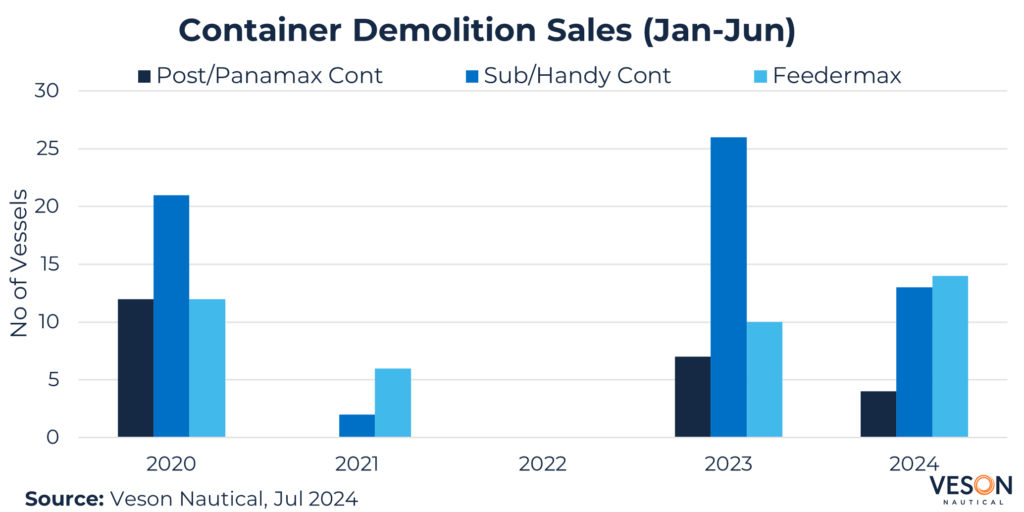

Demolition sales were down c.20% based on 36 vessels sent to the breakers, reflecting strong rates and asset values as shipowners kept vintage units trading for longer in a heated market.

Interestingly, analysis by total TEU confirms a more severe contraction of c.40% year-over-year based on c.53,721 TEU sold averaging 27.5 years of age at 1,492 TEU per vessel. Compared to 91,441 TEU sold in 1H 2023 averaging 28.5 years of age at 2,032 TEU per vessel.

Below are some notable demolition sales for Containers:

- Handy Sawasdee Singapore (1,512 TEU, Dec 1995, Fosen Nordseewerke). Demo price: 602 USD/LDT, LDT 7,138 MT which equates to a VV Demo value of USD 4.29 mil. Delivery location: Bangladesh.

- Panamax MSC Rosella (3,502 TEU, Dec 1993, Samsung). Demo Price: 530 USD/LDT, LDT 13,305 MT which equates to a VV Demo value of USD 7.05 mil. Delivery location: India.

- Post Panamax Ever Uranus (5,652 TEU, Jun 1999, Mitsubishi HI). Demo Price: 542 USD/LDT, LDT 24,328 MT which equates to a VV Demo value of USD 13.2 mil. Delivery location: India.

Bangladesh has accounted for the lion’s share of container demolitions in 1H 2024, receiving c.50% of deals, followed by India taking c.31%.

Conclusion

Container values spiked in 1H 2024 from a fully employed fleet, strong global TEU-mile growth of c.20% tied to continued diversions around the Cape of Good Hope, and a surging charter market that saw one-year time charter rates for Panamax and Sub Panamax gain c.156% on average by the end of June.

Although S&P activity was down c.29% year-over-year, higher sale prices transacted month-over month based on stronger buyer demand for tonnage, resulting in valuations for fifteen-year-old assets appreciating c.50% on average from Post Panamax down to Feedermax. Whilst newbuild values gained c.10.6% on average including Ultra Large Container Vessel (ULCV) and New Panamax, supported by green fleet renewals.

Back in January, Panamax ALS Clivia (4,398 TEU, Mar 2010, Hyundai Samho Heavy Ind) sold to Ignazio Messina for USD 20.5 mil (BWTS) which was seen as a high price at the time. However, by May, Panamax Northern Guild (4,294 TEU, Jan 2009, Hyundai Mipo) sold to CMA CGM for USD 26 mil (SS/DD Passed), around c.30% higher for similar confirming a hot market.

Shipowners have yet to pull the trigger on the next major round of demolition which remains low despite strong scrap prices, because older vessels are generating more profitable returns. This scenario is likely to last until a resolution to the Red Sea crisis is found, and ships can return to the Suez Canal with confidence. In the interim, shipowners will continue to make hay from a tight supply-demand market balance supporting strong cash flows.

Stay up to date of the market by reading our full 2024 half-year review across the following sectors: