2024 Half Year Review: LPG

This half year review is one of a series of reports providing a summary analysis of the first half of 2024 in the tanker, bulker, container, offshore, and LPG/LNG sectors. In each, we explore three areas: the newbuild market, second-hand sale and purchase activities, and demolition trends. Combining Veson’s extensive datasets with many decades of combined experience among our analysts, these insightful reports provide clarity on the key factors influencing each market and the potential implications for stakeholders in the months ahead.

LPG Summary

The LPG market has experienced a volatile 1H24 with earnings for VLGC’s plummeting from 125,000 USD/day at the beginning of the year, to only 16,500 USD/day a month later. This drop is likely due to a cold spell in the US, resulting in production outages and higher domestic consumption. This led to significant draws for propane inventory and higher Mt. Belvieu propane price, which again reduced the arbitrage substantially. Since then, earnings have managed to recover, averaging 51,000 USD/day in 1H. US LPG production has been strong so far this year with 5.5% growth in 1H, leading to export growth of c. 11%. The rainy season in Panama Canal has made it possible to increase daily transits, which reduced the distance between US and Asia, and the water levels are now slightly above five-year average. Daily transits have increased to 35, slightly below maximum and are therefore putting pressure on earnings.

With volatility in earnings, secondhand and newbuilding values have declined somewhat for the larger vessels, but we are seeing overall strong asset prices for all sizes.

VV Mini Matrix – Change ($m/CBM)

Newbuildings

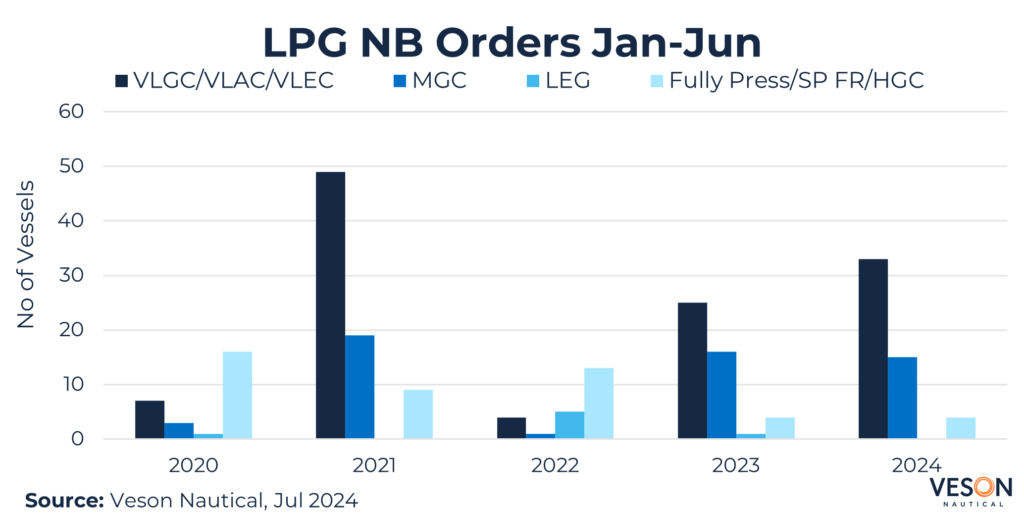

52 vessels have been ordered in 1H24 compared to 46 in 1H23, showing a 13% increase. The biggest increase is from the larger vessels such as VLGC’s and VLAC’s. The appetite for VLAC’s are still high, as market players eyes an opportunity to trade ammonia when the volumes are becoming substantial. However, these vessels will most likely be trading regular LPG until sufficient blue and green ammonia are produced, which we expect will take another couple of years. With the high ordering activity, we have seen the orderbook to fleet increase to c. 27% and c. 31% for VLGC/VLAC and MGC respectively. We are seeing market players ordering several vessels at once.

Headline newbuilding orders include:

- 4 X 93,000 CBM VLAC by Maersk Tankers, set to be built at Hyundai Samho and delivered during 2028 and contracted en bloc for USD 116.9 mil each, VV value USD 119.2 mil.

- 3 X 88,000 CBM VLAC by Atlas Maritime, set to be built at Hyundai Heavy ind. Delivered during 2027 and contracted en bloc for USD 123.9 mil each, VV value USD 116.3 mil.

- 4 X 93,000 CBM VLAC by Alpha Gas, set to be built at Hyundai Heavy ind. and Hanwa Ocean. Delivered during 2027 and contracted en bloc for USD 125.3 and 123.3 mil each. VV value USD 119.9 and 116.8 mil.

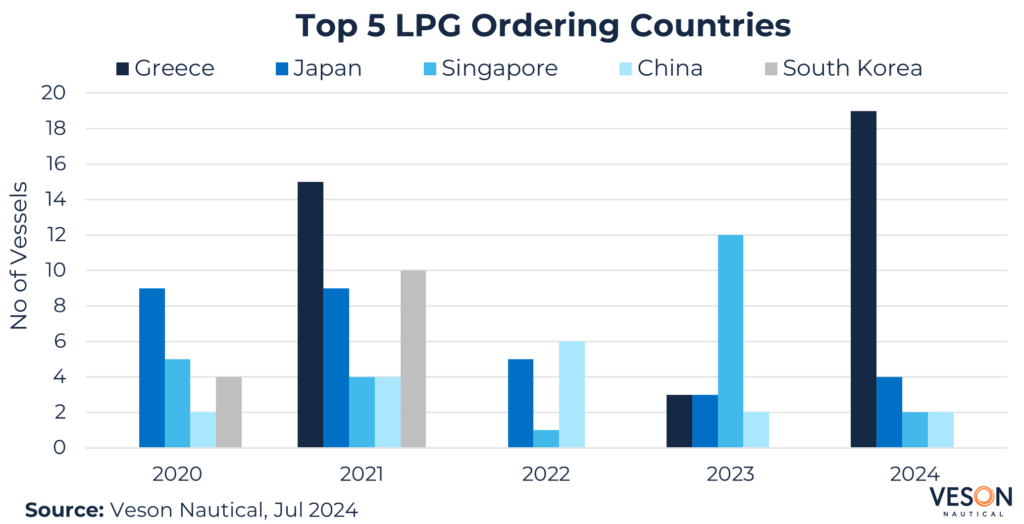

Greece was the top buying country for newbuildings in 1H24 with 19 vessels, followed by Japan (4) and Singapore/China (2). Greek owners have picked up the activity significantly after almost being absent in the past two years when we look at 1H statistics for previous years.

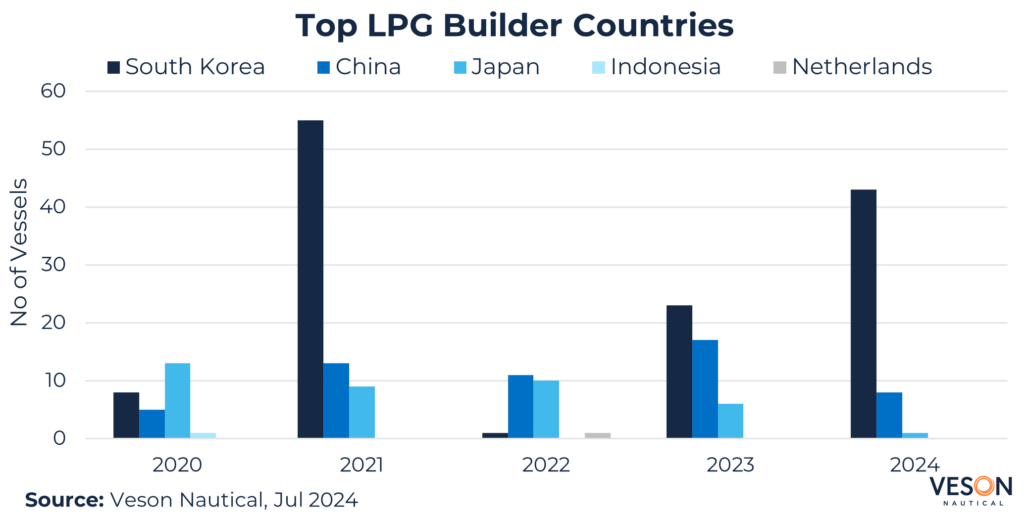

South Korea is still dominating newbuildings for LPG with 43 vessels in 1H24, 87% higher than same period last year. China is the second largest newbuilder with 8 vessels in 1H24, down from 17 in the same period last year.

Sales and Purchase

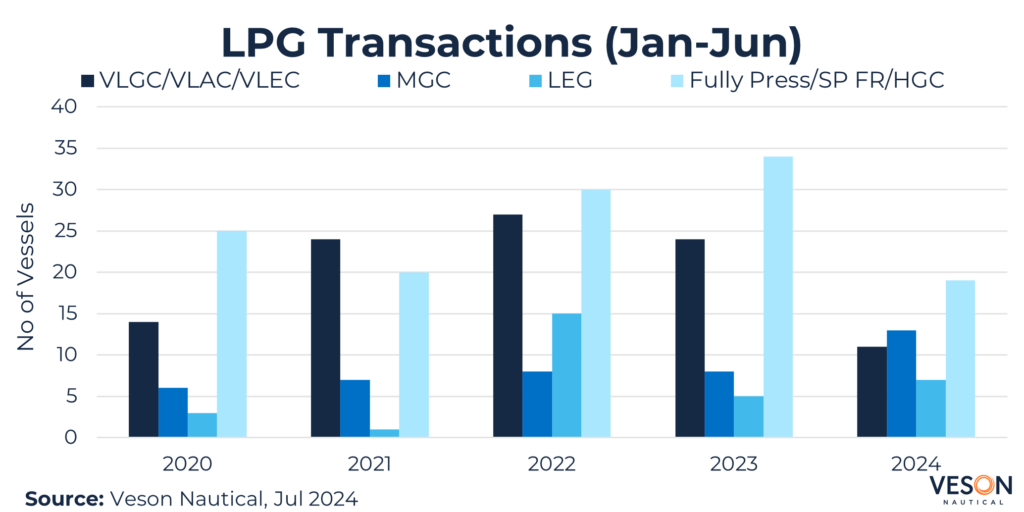

Taking a closer look at the transactions made in the first half this year, we can see that most transactions were made for the smaller vessels, which is in line with historical S&P. However, the overall activity has declined -30% compared to the same period last year and is the lowest since 1H20. For the largest vessels we have seen a -54% decline compared to the same period last year. This indicates that secondhand values might be expensive at this point and younger and greener vessels could be preferred.

Notable sales include:

- VLGC Solina Gas (75,000 CBM, Jun 2008, Hyundai Heavy Ind.) sold from Sygnius Ship Management to Carpe Diem Shipping for USD 62 mil, VV value USD 57.64 mil.

- MGC Seasuccess (38,000 CBM, Jan 2018, Hyundai Mipo) sold from Thenamaris to Anadoluhisari Tankercilik for USD 59 mil, VV value USD 58.74 mil.

- LEG Formosogas (16,250 CBM, Jun 2006, Jiangnan Shanghai) sold from Formosa Plastics to Proton Shipmanagement for USD 18 mil, VV value USD 19.59 mil.

- SP FR Pertusola (18,000 CBM, Apr 1999, Fincantieri Sestri) sold from Carbofin to unknown Turkish for USD 14 mil, VV value USD 12.1 mil.

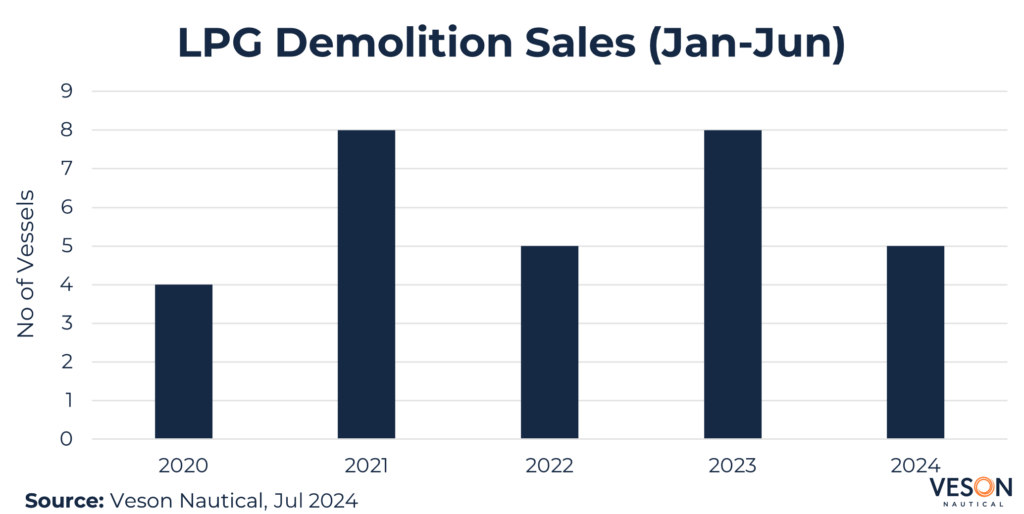

Demolition

Demolition sales reached five vessels in 1H24, all in the small size (below 3,500 CBM) segment. With a relatively young age distribution in the other segments, it is expected that we see highest scrapping activity in the small size segment. The age distribution for the demolition sales are ranging from 15-35 years old, five scrapped in Bangladesh and one in India.

Below are some demolition sales for LPG:

- Fully Press Xing Tong 313 (2,000 CBM, Jul 1996) Demo price: 510 USD/LDT, LDT 1,909 which equates to a VV Demo value of USD 0.97 mil. Delivery location: Bangladesh.

- Fully Press Pilatus 21 (1,245 CBM, Aug 1989) Demo price: 520 USD/LDT, LDT 889 which equates to a VV Demo value of USD 0.46 mil. Delivery location: Bangladesh.

Conclusion

VLGC earnings have been firm in the first half this year despite seasonal volatility. Newbuilding activity has also been high, with VLAC as the preferred vessel in the large segment. We are also seeing dual fuel vessels and dual fuel ready vessels being ordered, which indicate a direction towards a green transition. With the high orderbook to fleet, we could see less ordering activity for the next six months. However, if earnings remain strong, market players tend to justify both expensive asset prices and high orderbook to fleet. There was nothing out of the ordinary in the scrapping activity and since both VLGC and MGC have a young age distribution, the scrapping activity is expected to remain in the small size segment going forward.

Stay up to date of the market by reading our full 2024 half-year review across the following sectors: