2024 Half Year Review: Ferries

This ferry half year review is one of a series of reports providing a summary analysis of the first half of 2024 in the tanker, bulker, container, offshore, and LNG / LPG sectors. In each, we explore three areas: the newbuild market, second-hand sale and purchase activities, and demolition trends. Combining Veson’s extensive datasets with many decades of combined experience among our analysts, these insightful reports provide clarity on the key factors influencing each market and the potential implications for stakeholders in the months ahead.

Ferry summary

Market sentiment softened last month after leading European ferry owner-operator, Tallink, released their unaudited financial results for 1H 2024 confirming passenger volumes were -1.4% down at 2.6 mil, revenue -7.6% (EUR 370.4 mil), EBITDA -15.1% (EUR 81.1 mil), and net profit -69% (EUR 8.7 mil) compared to EUR 28 mil in 1H 2023, confirming that consumer confidence is showing no signs of improving.

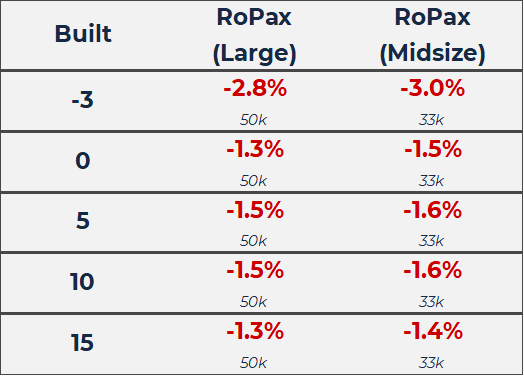

An element of fragility has crept into the ROPAX ferry sector from heightened geopolitical tensions weighing on tourism, and flat to soft freight demand in the premium market of Europe. Values for midsize and large ROPAX (>13,000 GT) generally held in 1H 2024, but a couple of lower-than-average sales transacted for midsize units which dragged down market values for similar. Values for fifteen-year-old midsize ROPAX finished the second quarter at EUR 65.5 mil, down 1.4% from the start of the year.

VV Mini Matrix – Change ($m/GT)

Newbuildings

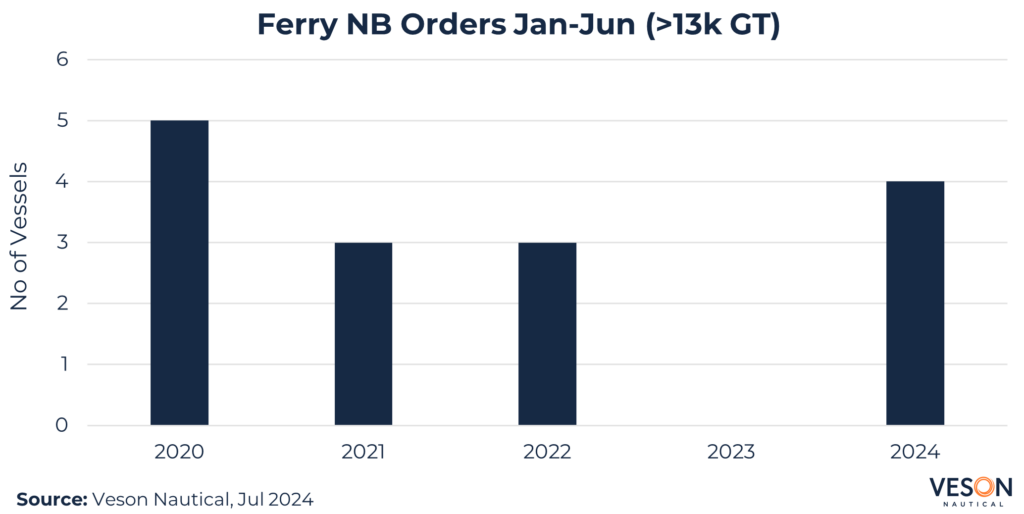

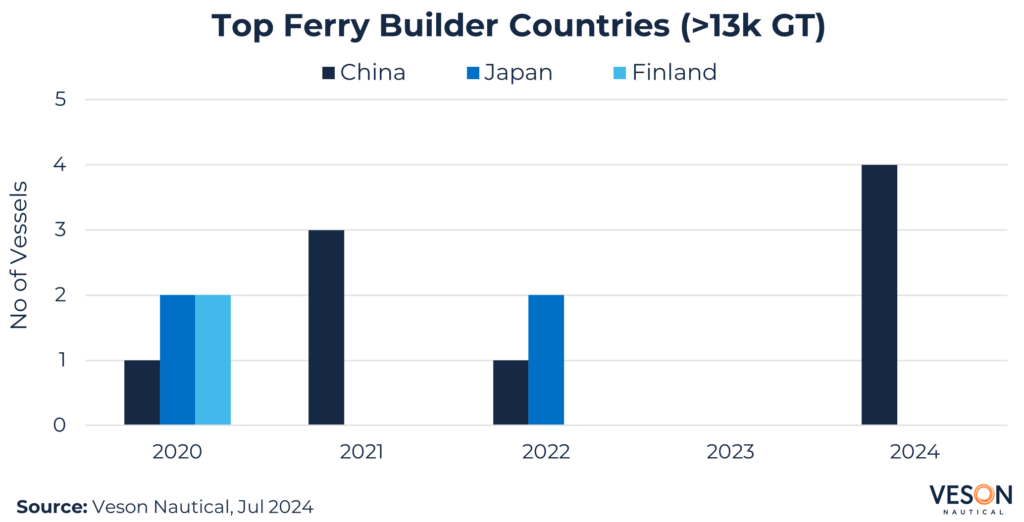

A total of four newbuild deals were concluded in 1H 2024 including options (>13k GT) which was an improvement year-over-year, and broadly in line with the five-year historical average.

In June, Stena RORO booked ordered a pair of LNG Dual Fuel E-Flexers at Jinling Shipyard Weihai plus options for a further two, price undisclosed.

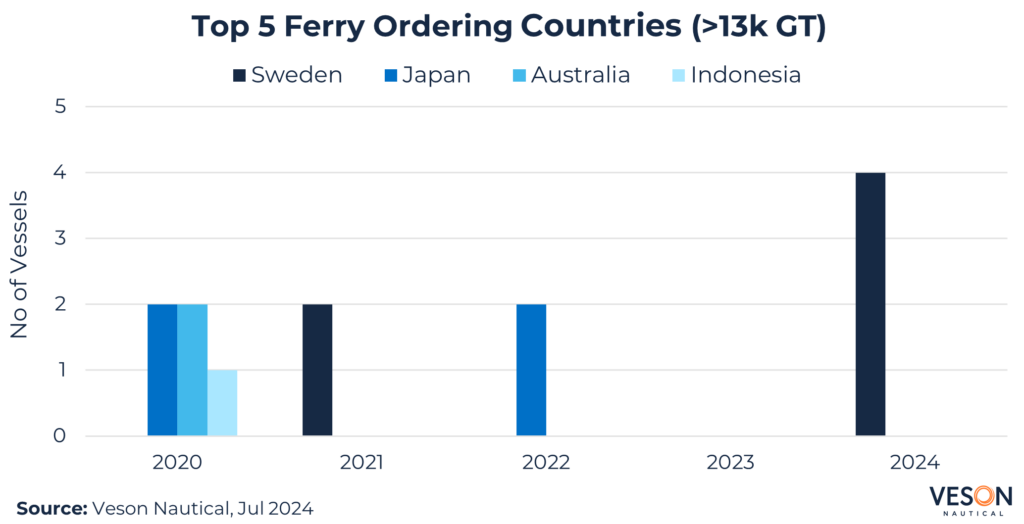

Top orders by country based on five first half years of data confirms Sweden in top spot (6 vessels), followed by Japan (4 vessels) and Australia (2 vessels).

Italy has been quiet but that should all change later this year when Grimaldi firms up a bloc order for nine large ROPAX targeting c.3,000 LM and c.2,500 PAX per vessel, subject to design and yard sign off.

Chinese shipyards are the preferred choice for top European ferry owners based on competitive pricing and delivery guarantees. Chinese builders Jinling Shipyard Weihai and Guangzhou CSSC are favoured by Stena, Grimaldi, and MSC, offering price discounts in excess of EUR 100 mil on large ROPAX units compared to similar specifications available from in Europe.

Finland’s RMC has not received any orders since TT Lines booked their new pair of new Spirits in 2020. Likewise, Japanese builders Mitsubishi HI and Naikai Setoda have not received any orders for over a year, but domestic support from shipowners such as MOL Ferry Company remains strong.

Sale and Purchase

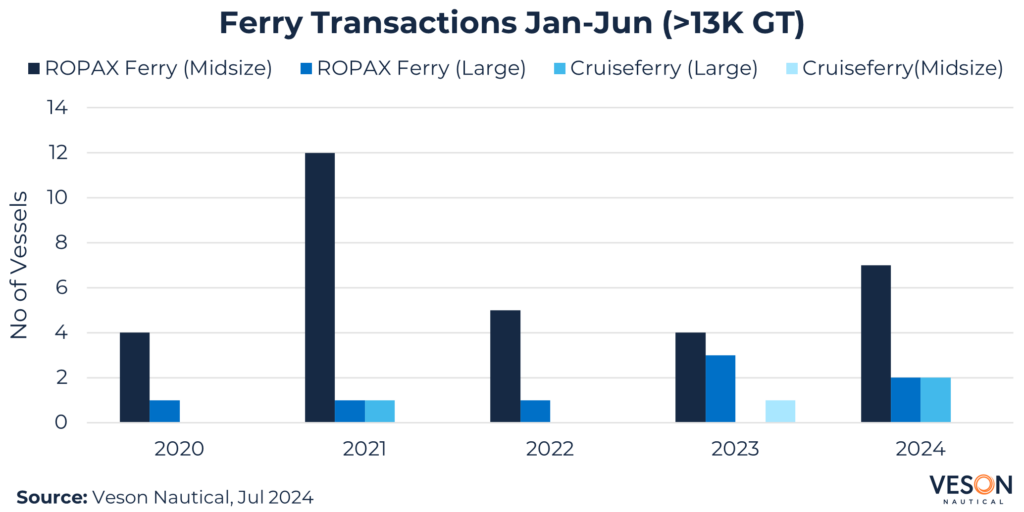

Sale and Purchase (S&P) activity was up c.38% year-over-year based on 11 sales in 1H 2024. Headline transactions included:

- Midsize ROPAX Baja Star (1,400 LM, 705 Pax, Nov 1992, Mitsubishi HI) sold to Ventouris Ferries for EUR 14.6 mil in January, VV value EUR 14.6 mil day before sale.

- Midsize ROPAX Ciudad De Alcudia (3,200 LM, 114 PAX, Jul 1994, Stocznia Gdansk) sold to United Marine Egypt for EUR 19 mil (SS/DD due) in March, VV value EUR 23.9 mil day before sale.

- Large ROPAX Spirit of Britain (3,746 LM, 2,000 PAX, Jan 2011, STX Finland) sold to Irish Continental Group for EUR 74.8 mil (BBHP) in May, VV value EUR 96 mil day before sale basis charter free.

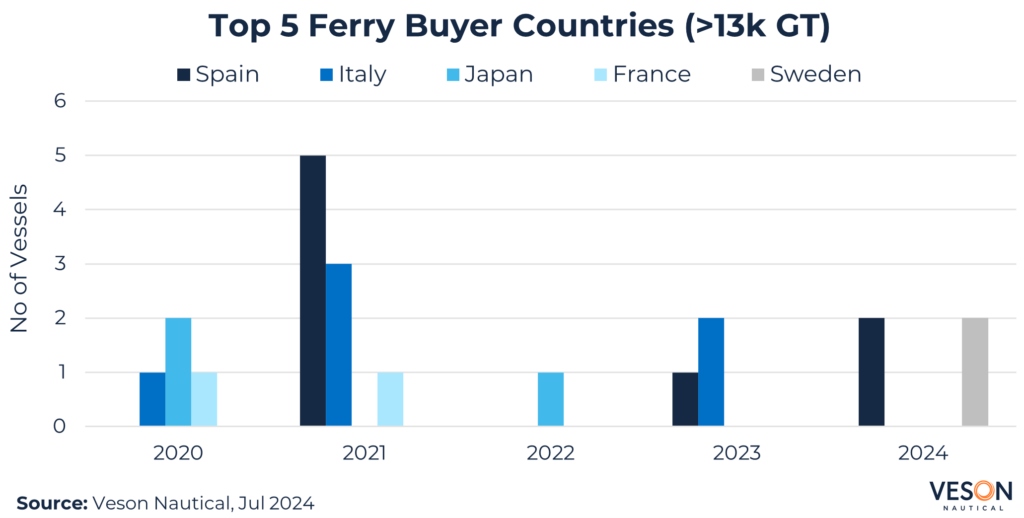

Spain and Sweden were joint top buyers in 1H 2024 based on two ferries each (>13k GT). Sweden’s Gotlandsbolaget purchased Cruiseferries Crown Seaways (970 LM, 1,790 PAX, June 1994, Brodosplit) and Pearl Seaways (LM1,010, 1,989 PAX, Apr 1989, STX Finland) at the end of June in a package deal including port agreements and terminal equipment for c.DKK 400 mil from DFDS.

Focusing on the top five buyer countries in the first half year of trading 2020 to 2024, Spain rank top (8 vessels), followed by Italy (6 vessels), and Japan (3 vessels).

Demolition

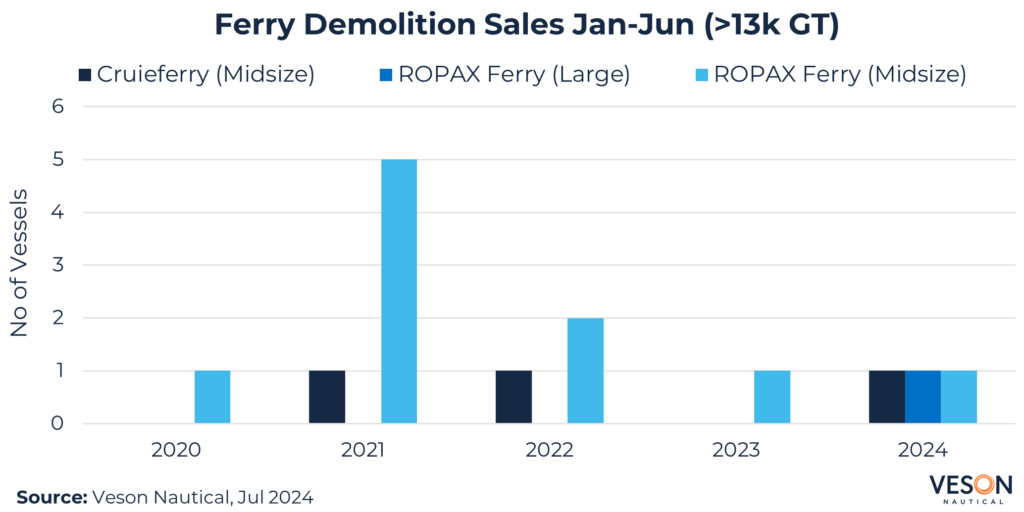

Demolition activity was restricted to 3 vessels. The headline deal involved Cruiseferry Amanah (850 LM, 2,000 PAX, Nov 1979, Fincantieri Castellammare). Demo price 530 USD/LDT, LDT 8,997, which equates to a VV Demo price of USD 4.76 mil. Delivery location India.

Conclusion

If DFDS and Stena release similar half year results to Tallink, we could be in for a period of softening in the ferry market, resulting in more lower-than-average sale prices transacting, weighed down by continued geopolitical headwinds and weak consumer confidence.

On a positive note, a low orderbook of just c.6.5% by vessel numbers (>13k GT) supports stable values, assuming scrapping rates increase as owners renew an ageing fleet for a greener future.

Stay up to date of the market by reading our full 2024 half-year review across the following sectors: