2024 Half Year Review: LNG

This half year review is one of a series of reports providing a summary analysis of the first half of 2024 in the tanker, bulker, container, offshore, and LPG/LNG sectors. In each, we explore three areas: the newbuild market, second-hand sale and purchase activities, and demolition trends. Combining Veson’s extensive datasets with many decades of combined experience among our analysts, these insightful reports provide clarity on the key factors influencing each market and the potential implications for stakeholders in the months ahead.

LNG Summary

LNG earnings usually follow a seasonal trend with low earnings in 1H and higher earnings in 2H, and 1H24 is no exception. Large LNG 1-YR TC began the year around 70,000 USD/ day and ended in June around 35,000 USD/day, with an average of 37,400 USD/day throughout the first six months. This is significantly lower than the average rates in the same period last year of 66,000 USD/day.

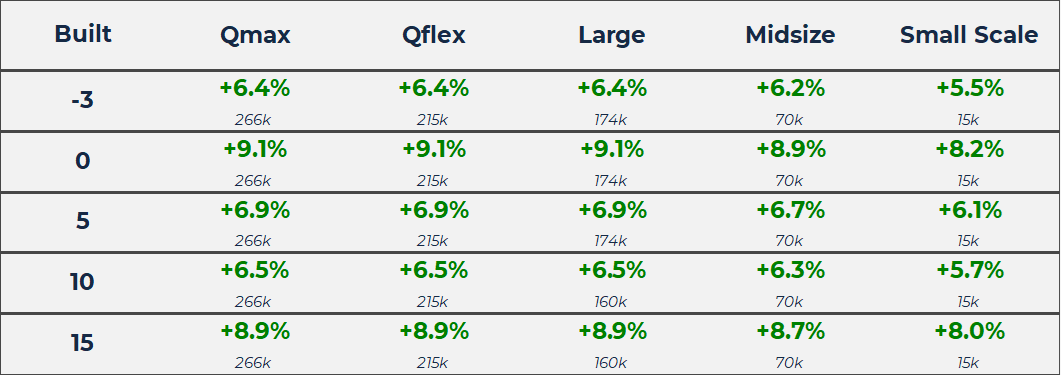

Asset values have however been strong in the first half this year with high ordering activity across several sectors, pushing newbuilding values higher. We have also seen relatively high LNG S&P activity in for secondhand vessels, which can explain the rising asset values.

VV Mini Matrix – Change ($m/CBM)

Newbuildings

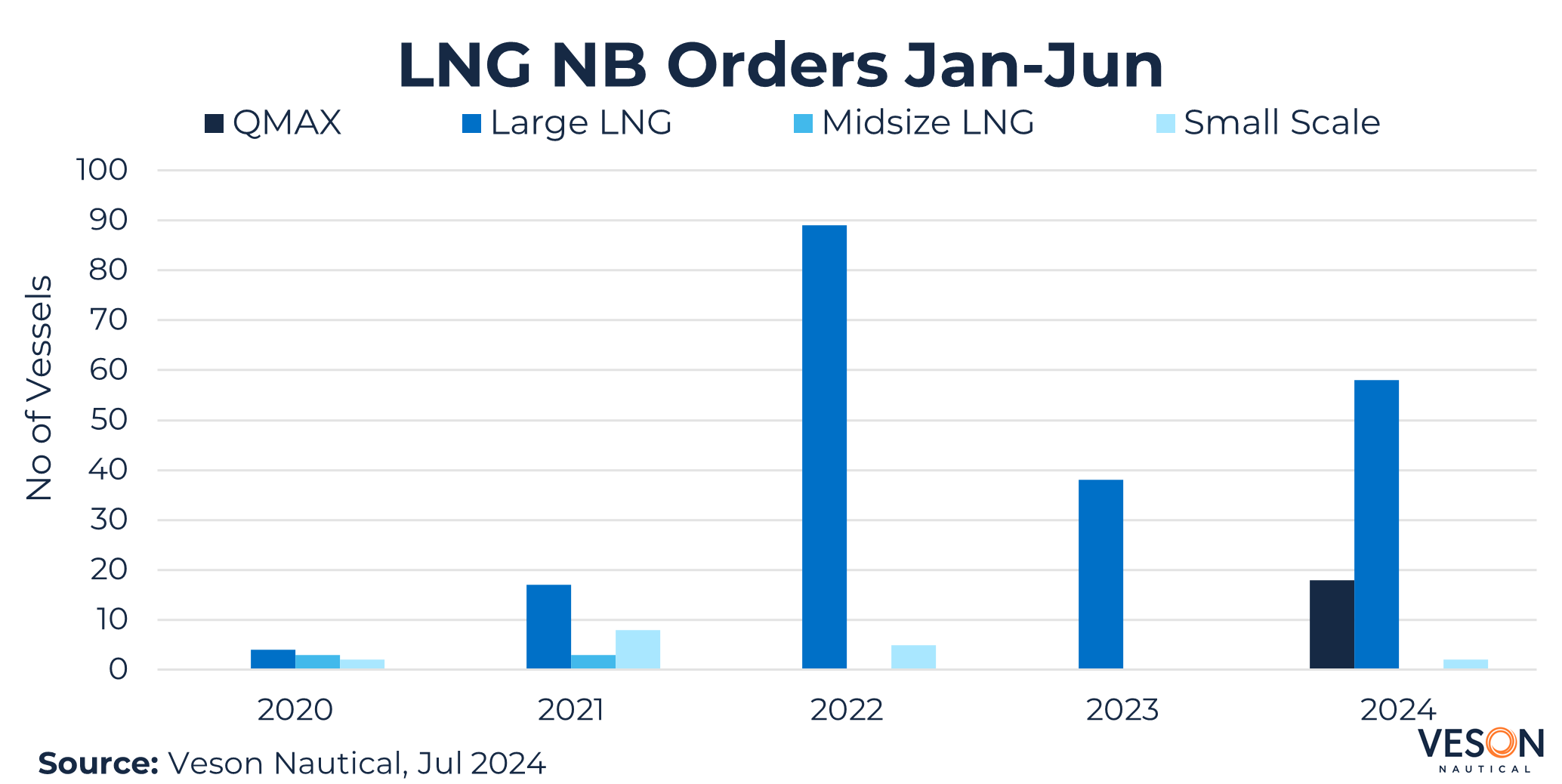

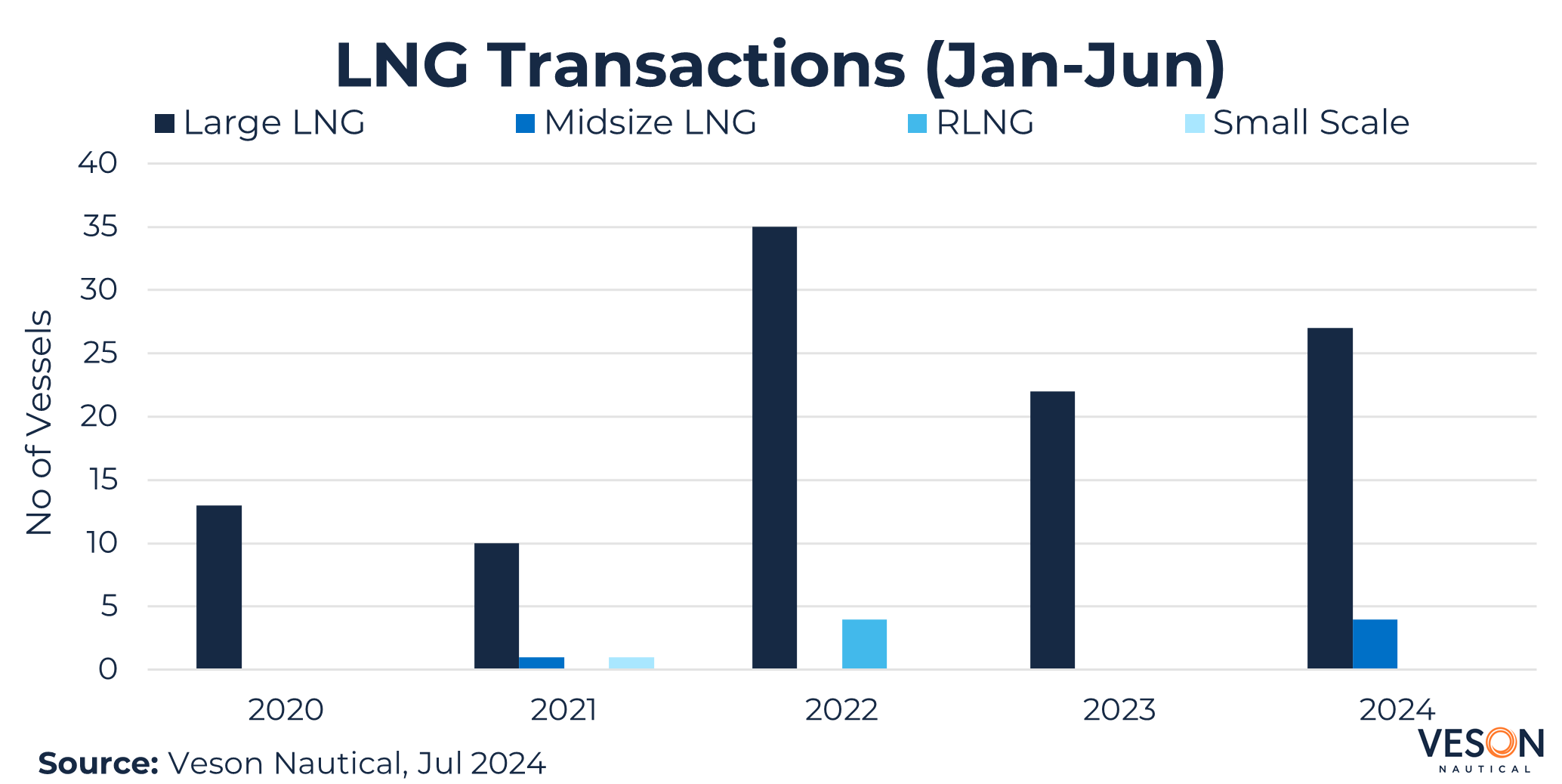

LNG newbuilding orders have increased 105% the first six months compared to the same period last year. 78 vessels have been ordered, which is the second highest 1H in the past five years, only beaten by 1H22 with 94 new orders. Large LNG vessels are still dominating the activity with 58 vessels, followed by 18 QMAX vessels.

Headline newbuilding orders include:

- 4 X 174,000 CBM Large LNG by K Line, set to be built at Hanwha Ocean and delivered during 2027 and contracted en bloc for USD 230 mil each, VV value USD 271 mil.

- 8 X 174,000 CBM Large LNG by QatarEnergy, set to be built at Hanwha Ocean and delivered between 2026-2028 and contracted en bloc for USD 229.9 mil each, VV value USD 268.6 mil.

- 4 X 271,000 CBM QMAX LNG by China Merchants Shipping, set to be built at Hudong Zhonghua and delivered between 2027-2029 and contracted en bloc for USD 310 mil each. VV value USD 345.6 mil.

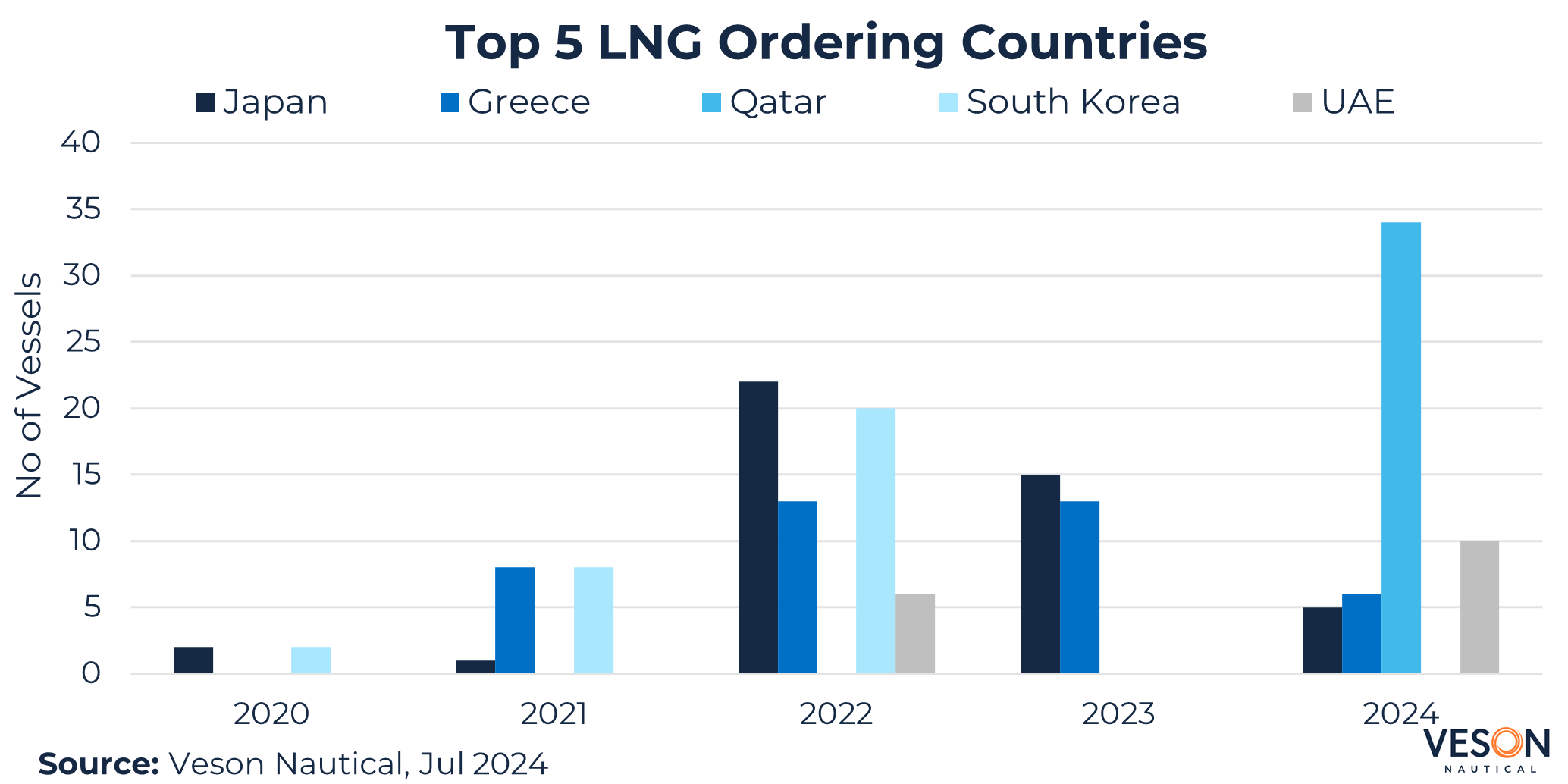

Qatar was the top buying country for newbuildings in 1H24 with astonishing 34 vessels. These vessels are linked to the LNG production expansion in the coming years, which will boost Qatar’s LNG production to 142 MTPA by the end of 2030. UAE and Greece have ordered 10 and 6 vessels respectively.

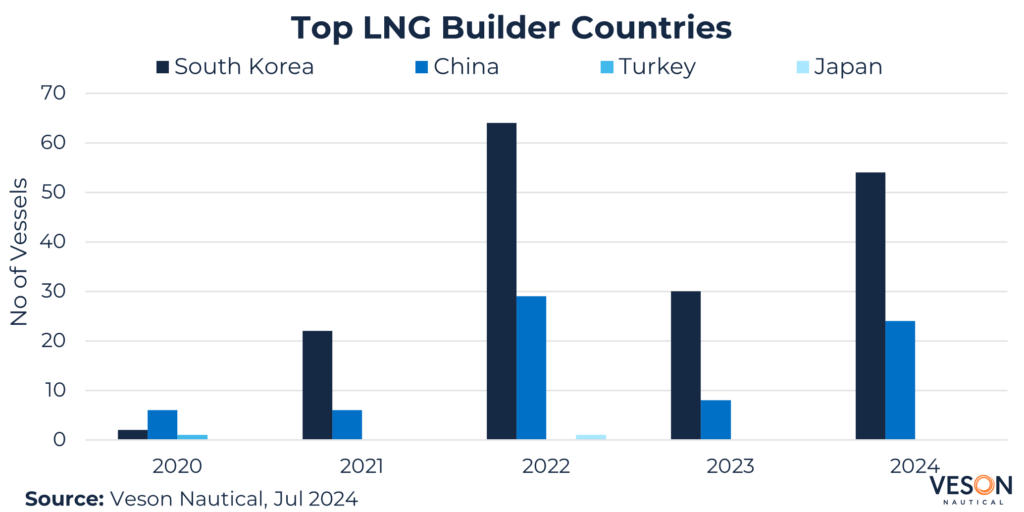

South Korea is still dominating newbuildings for LNG vessels in 1H24 and has 69% market share, China is covering the remaining orders of 24 vessels (31%). Despite seeing China taking a bigger proportion of newbuilding orders at the expense of South Korea and Japan, the majority for both LPG and LNG vessels are still being built in South Korea.

Sales and Purchase

Looking at the S&P made in the first half of this year, we can see that most transactions were made in the Large LNG sector, which is in line with what we have seen in the past five years. Total S&P transactions were 31 vessels in 1H24, a 41% increase from the same period last year.

Notable sales include:

- Large LNG Amur River (149,743 CBM, Jan 2008, Hyundai Heavy Ind.) sold from Dynagas LNG partner to China development Bank Financial Leasing on a bareboat charter back to USD 103.67 mil. VV value USD 86.5 mil.

- Large LNG Venture Gator (Hull 2593) (174,000 CBM, Jul 2024, Samsung) sold from Global Meridian Holdings to Venture Global on a resale to USD 270 mil. VV value USD 291 mil.

Demolition

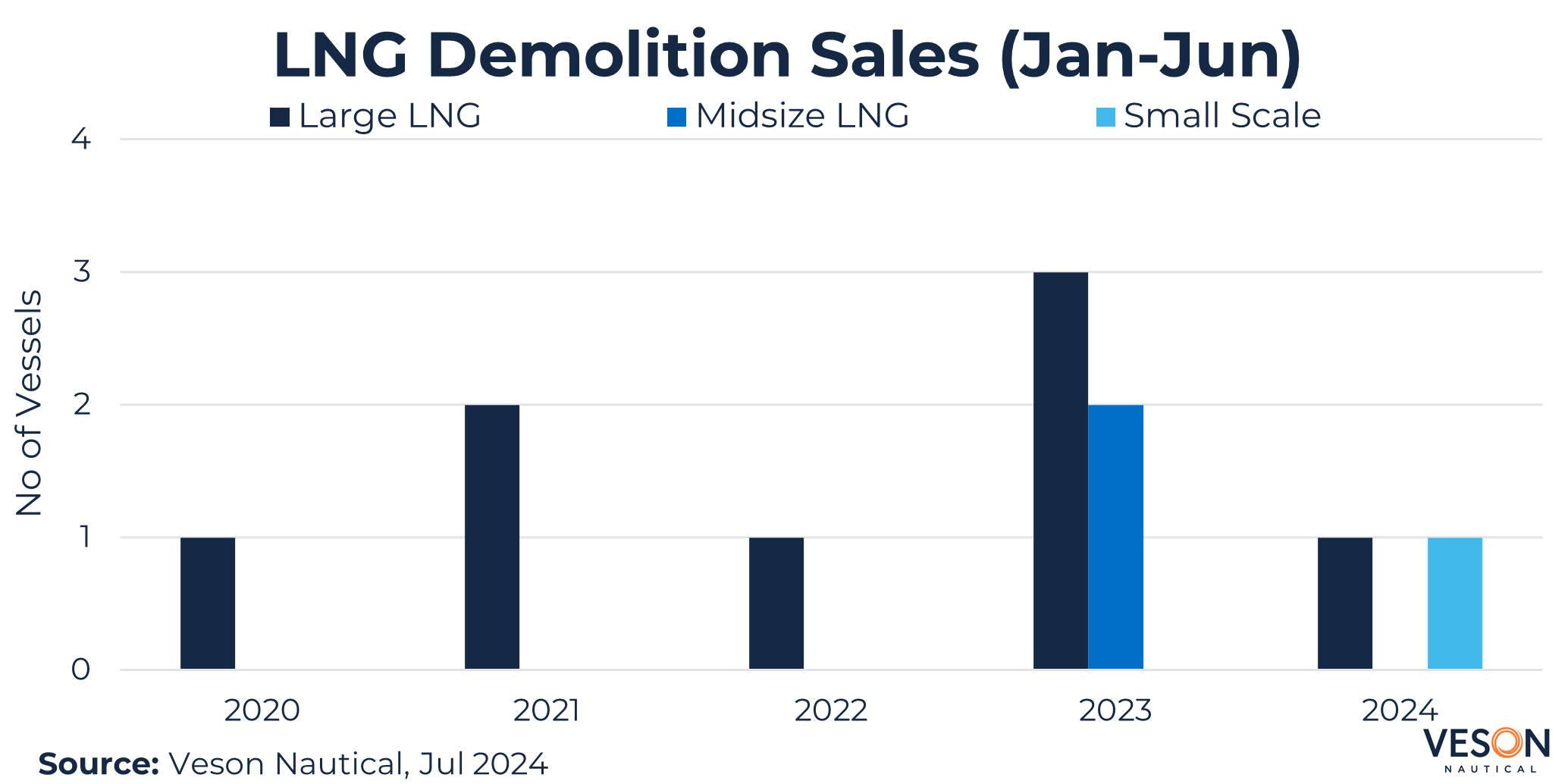

There were two vessels sold for demolition in 1H24, one large LNG and one Midsize LNG vessel. Based on the historical demolition sales, there is nothing out of the ordinary. The LNG fleet is relatively young and therefore seeing few vessels sold for scrap. The two vessels were:

- Large LNG YK Sovereign (127,125 CBM, Dec 1994) Demo price: 620 USD/LDT, LDT 30,120 which equates to a VV Demo value of USD 18.67 mil. Delivery location: Unknown.

- Small Scale LNG Surya Aki (19,538 CBM, Jan 1996) Demo price: 655 USD/LDT, LDT 8,039 which equates to a VV Demo value of USD 5.26 mil. Delivery location: Unknown.

Conclusion

The first two quarters are a historically low season in the LNG market, and 1H24 performed weaker than the same period last year with an average 1-YR TC rate of 37,400 USD/day. Despite rates being below the five-year average in the first six months, newbuilding activity has remained high. We can see that most of the new orders are linked to Qatar and their ongoing LNG production expansion plan. Due to the high activity for new orders, asset prices have increased. We have also seen higher activity for secondhand transactions and increased asset prices for all sizes. Vessels sold for scrapping have remained muted so far this year, but there are usually not many vessels sold for scrap in past years for this sector.

Stay up to date of the market by reading our full 2024 half-year review across the following sectors: