2024 Half Year Review: Offshore Sector

This offshore sector half year review is one of a series of reports providing a summary analysis of the first half of 2024 in the tanker, bulker, container, offshore, and LNG / LPG sectors. In each, we explore three areas: the newbuild market, second-hand sale and purchase activities, and demolition trends. Combining Veson’s extensive datasets with many decades of combined experience among our analysts, these insightful reports provide clarity on the key factors influencing each market and the potential implications for stakeholders in the months ahead.

Offshore Sector Summary

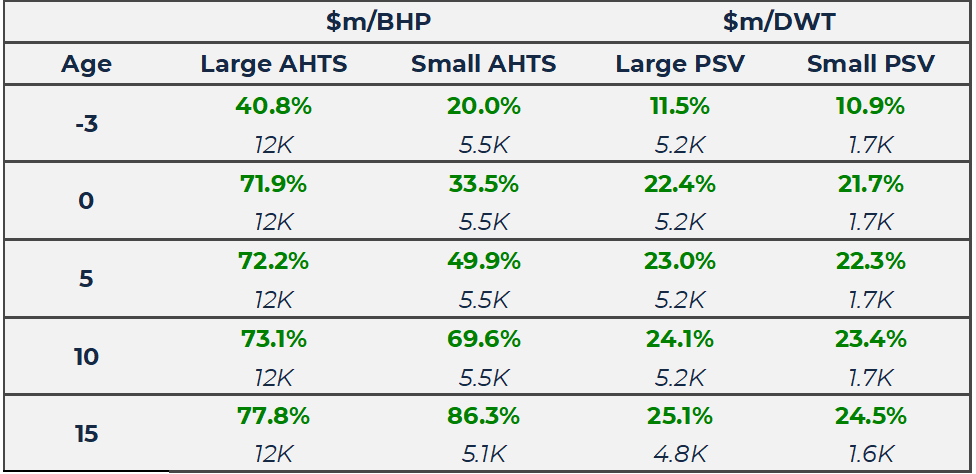

The offshore sector has seen a very strong start to the first half of 2024 and values across all ages and sizes have firmed considerably. This can be attributed to high rates across the sector due to the tightening supply of vessels. The orderbook has finally kicked into life for the OSV sector, with the first PSV order for over five years taking place. There has been limited activity in the sale and purchase market compared to other years, mainly due to the attractive rates that owners have seen throughout the sector. There have been many acquisitions and mergers throughout the year so far, the most notable of these was DOF Group ASA acquiring Maersk Supply Service (MSS) in a deal worth USD 1.1 bn.

VV Mini Matrix – valuation change between 1st January 2024 – 30th June 2024

Main highlights of the year to date:

- Norwegian owner DOF has agreed to acquire Maersk Supply Service in a USD 1.11 bn cash and share agreement.

This has been the most notable acquisition so far of the year. As part of the agreement, DOF will receive 22 vessels—8 CSVs, 13 AHTS vessels, and 1 cable layer—in return for USD 577 mil in cash and a 25% ownership share in the combined business, which will do business under the DOF Group name. One of the driving forces behind the acquisition, according to DOF, was the ability to expand the fleet quickly without requiring a long lead time for newbuilds and with a far lower investment need per vessel. - Marinakis inks largest PSV order in a decade, and Capital Offshore has placed an order with Fujian Mawei Shipbuilding for four firm PSVs, along with four options.

The vessels were ordered for USD 45 mil, having a DWT of 5,500 and being DP2 fitted, being the largest order in the segment’s history. This gives Mr. Marinakis’s business a larger footprint after entering the offshore sector, with up to 11 PSVs in his fleet. PSV values have risen over the start of the year, with there being a limited number of second-hand candidates. If demand remains strong, Marinakis has the option to flip the vessels before they are launched during delivery or deploy the vessels into the market and maximise the high rates in the sector. - In a USD 692 mil agreement, Singapore’s Cyan Renewables will buy Australian subsea operator MMA Offshore.

The buyout deal from Cyan Renewables was overwhelmingly approved by MMA Offshore’s shareholders. MMA will introduce Cyan to the Australian and Asian markets, helping to expand exposure in the regions. For its money, Cyan Renewables will take on 21 offshore ships, including 2 Multipurpose Supply Vessels (MPSVs), 7 Platform Supply Vessels (PSVs) and 10 small-medium size anchor-handling tug supply units (AHT/AHTSs). VesselsValue currently values the MMA Offshore fleet at USD 357 mil.

Newbuilding

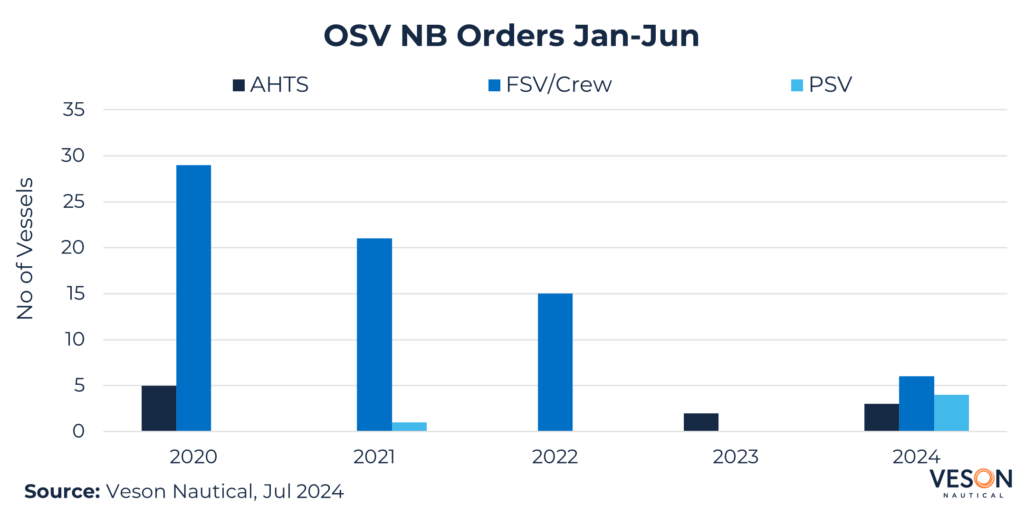

With the recent order by Capital Offshore for PSVs, newbuilding activity within the offshore sector has potentially taken a turn. The returns on newbuilds are now beginning to make sense at this stage of the cycle. Petrobras demonstrated this by putting out a tender for 12 newbuild PSVs in Brazil against long-term charter agreements, in addition to up to 26 other newbuild vessels of different kinds. Further orders could be anticipated as the market supply continues to tighten.

The most notable recent newbuild was from Greek shipping tycoon, Marinakis, who ordered 4x Large PSVs at the end of July (5,500 DWT, 2026/2027, Fujian Mawei Shipbuilding) for USD 45 mil, VV Value USD 44 mil. This was the first significant order in the past five years for the PSV sector. Saudi Arabia’s Rawabi Vallianz Offshore Services ordered 3x Medium AHTS (7,373 BHP, Nov 2026, Hantong) at the start of January for an undisclosed price, VV Value USD 12.50 mil. There was also an order by French Bourbon Marine and Logistics for 6x Crew Boats to be built at Piriou, Vietnam, in 2025. OSV Newbuild orders through the first half of 2024 are up 550% from 2 to 13 in the same period last year, demonstrating a potential ongoing shift in the OSV orderbook.

Newbuild values have firmed throughout the first half of 2024. For example, a Medium PSV (2027/3,600 DWT) NB value has firmed from USD 34.52 mil to USD 38.47 mil, a 11.4% increase, whilst a AHTS Large (2027/12,000 BHP) has increased from USD 20.19 to USD 28.42 mil, a 40.7% increase from the start of the year.

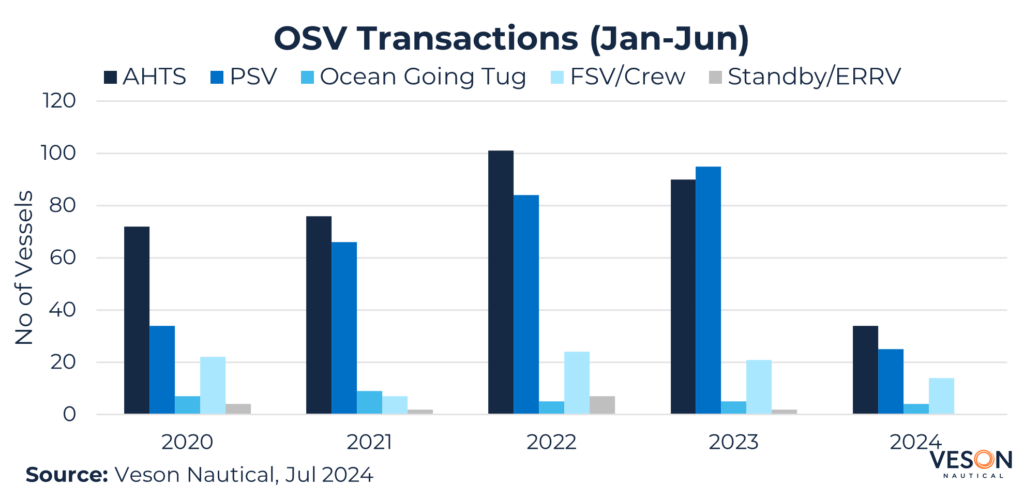

Sale and Purchase

So far this year, the volume of overall sale and purchase transactions in the OSV sector has dropped. There has been a decrease of c.64% YoY in sale and purchase activity from the same period last year, from 213 to 77 vessels sold. This is a result of the high rates that the offshore sector has finally started to see. Owners are now choosing to take advantage of the earnings instead of potentially selling their vessels for cash.

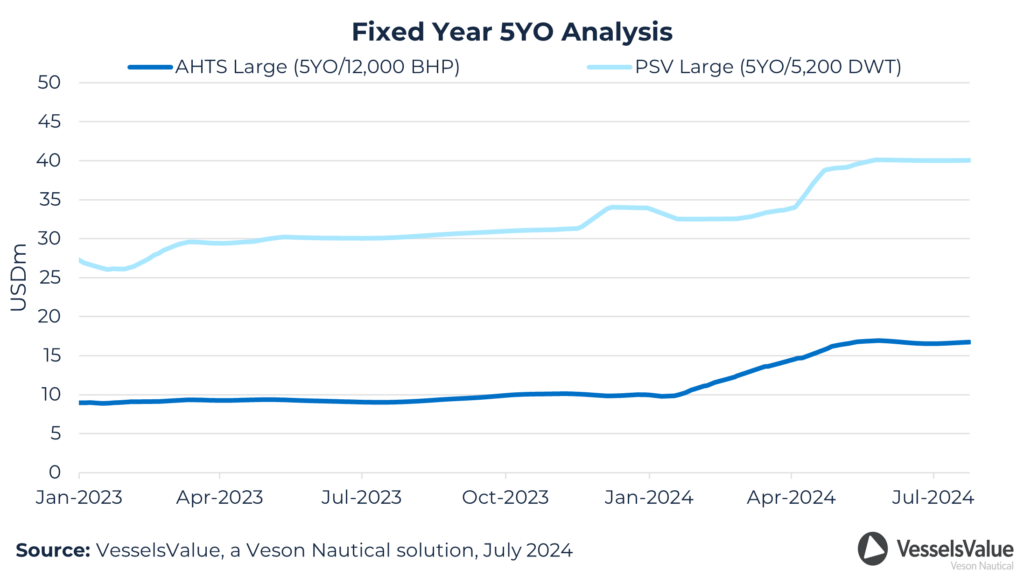

VV’s Fixed Age value calculation quotes the value of a vessel and removes age depreciation. Secondhand values across all ages and sizes in the OSV sector have firmed from the start of the year. For example, a 5YO AHTS (12,000 BHP), has increased from USD 9.63 mil to 16.58 mil, a 72% increase just in the 1st half of 2024. PSVs have seen a similar trend, a 5YO PSV (5,200 DWT) has increased in value from USD 32.55 mil to USD 40.02 mil in the same time frame, a 22.9% increase.

Notable sales include:

- PSV (Large) Standard Supplier (5,200 DWT, Oct 2007, Vard Brattvaag) sold to Capital Offshore for USD 22.70 mil, VV Value USD 23.96 mil

- PSV (Large) POSH Jaegar (4,100 DWT, Mar 2018, PaxOcean Engineering) sold to Gardline Marine Sciences for USD 25 mil, VV Value USD 23.66 mil

- PSV (Medium) GSP Licorn (3,300 DWT, Oct 2007, Simek) sold to Sea Shipping AS for USD 12 mil (Laid Up), VV Value USD 14.07 mil

- PSV (Medium) Island Dragon (3,800 DWT, Jun 2014, Vard Brevik) sold to Horizon Maritime for USD 25.80 mil (SS/DD Passed), VV Value USD 22.15 mil

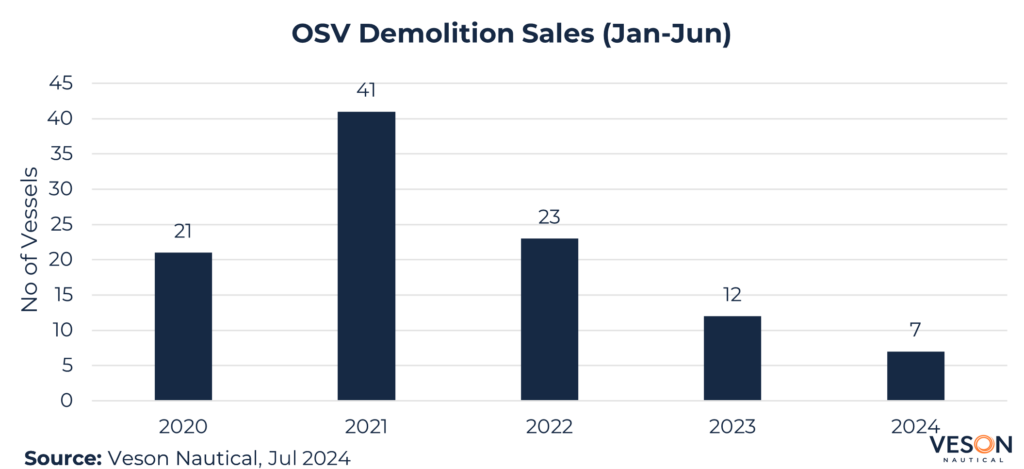

Demolition

There has been a significant decrease in the amount of demolition sales in 2024, with only seven deals confirmed so far in 2024 — a drop of 42% from the same time last year. More notably, this is a fall of 83% from 2021, where there were 41 demolition sales in the same period. The main reasons for the limited number of demolition vessels correlate with the high earnings which are now available for owners for the first time in many years. Further, OSVs at the end of their life cycle now have the potential to earn revenue so owners are more reluctant to send them for demolition.

Below are some notable recent demolition sales for OSVs:

- AHTS (Very Large) Dong Fang Yong Shi 2 (12,200 BHP, Jun 1983, Hyundai HI Ulsan Shipayrd). Demo price: 635 USD/LDT, LDT 2,254 which equates to a VV demo price of USD 1.18 mil, Delivery location: Bangladesh

- PSV (Large) Han Ji 2 (4,700 DWT, Mar 1995, Ulstein Verft). Demo price: 595 USD/LDT, LDT 2,126 which equates to a VV demo price of USD 1.11 mil, Delivery location: Bangladesh

Conclusion

The outlook for the offshore sector is certainly optimistic and rates can be expected to firm further as vessel supply still will remain tight in the near future. The orderbook for OSVs may begin to start flowing as high-rate potential in the sector will be a very attractive proposition. However, due to the time lag for building being on average 3 years, the market can be expected to continue its positive trend for the rest of the year. The sale and purchase market might continue to slow in its number of transactions as owners are finally receiving strong rates on their fleets, therefore, are not willing to sell.

Stay up to date of the market by reading our full 2024 half-year review across the following sectors: