2024 Half Year Review: Tankers

This half year review is one of a series of reports providing a summary analysis of the first half of 2024 in the tanker, bulker, container, offshore, and LNG / LPG sectors. In each, we explore three areas: the newbuild market, second-hand sale and purchase activities, and demolition trends. Combining Veson’s extensive datasets with many decades of combined experience among our analysts, these insightful reports provide clarity on the key factors influencing each market and the potential implications for stakeholders in the months ahead.

Tanker Summary

The tanker market has experienced a notably dynamic first half of the year, with both rates and values maintaining a strong position. Values for Tankers have firmed across all age categories and sub sectors, buoyed by strong demand and firm earnings which look set to remain for the foreseeable future. Values and earnings have been supported by the increased ton-mile demand that arose initially because of sanctions on Russian oil. However, the conflict in the Red Sea, which has seen owners travel around the Cape of Good Hope to avoid this area, has further added to this demand.

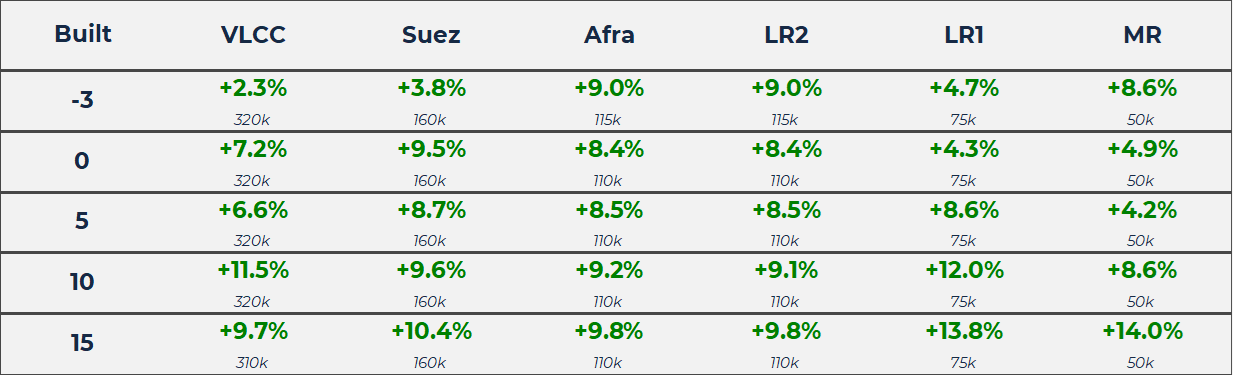

Fifteen year old LR1s of 75,000 DWT saw the biggest increase in values over the last six months, up by c.13.8% from USD 27.79 mil to USD 31.63 mil.

VV Mini Matrix – Change ($m/DWT)

Newbuildings

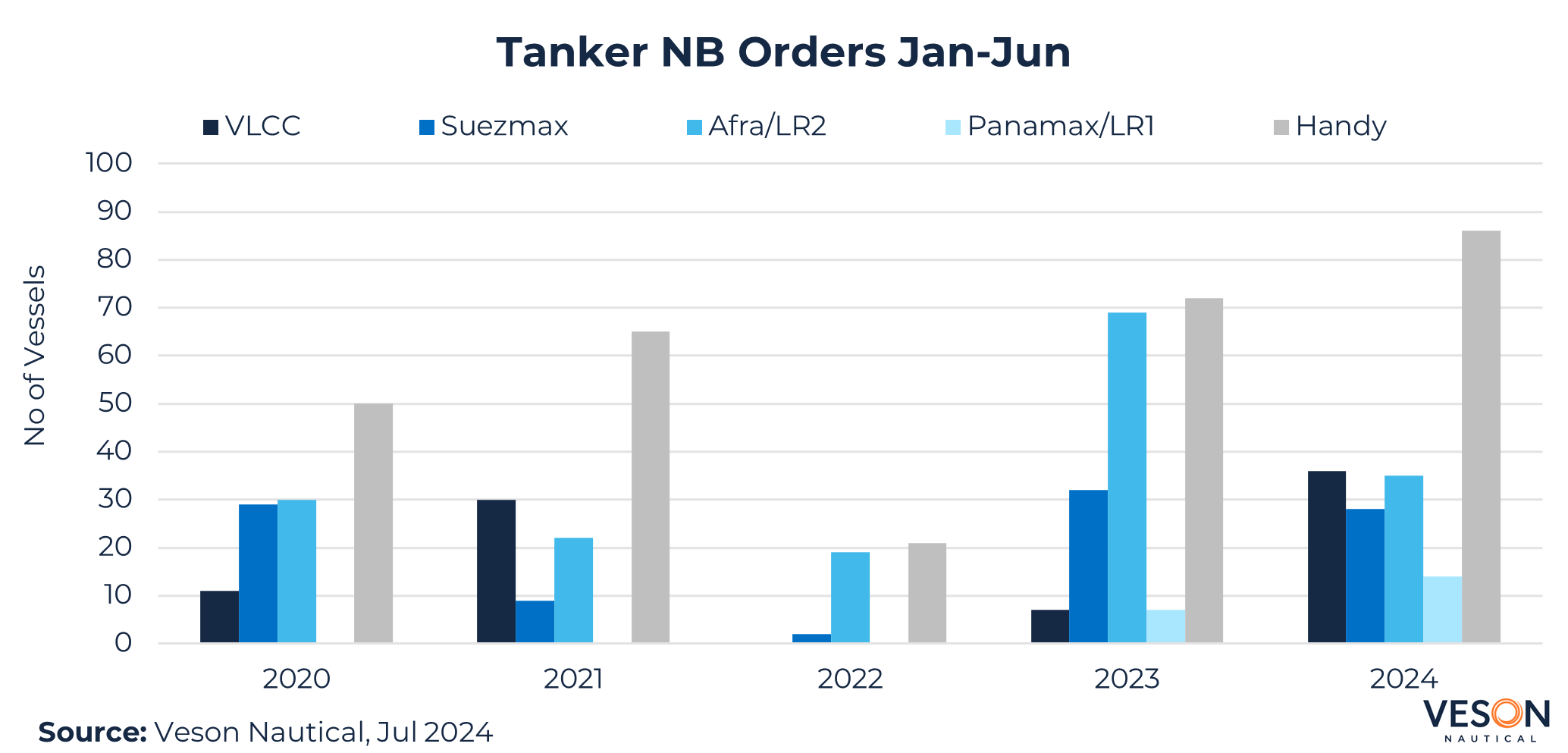

Tanker newbuilding orders for the first half of the year are at the highest levels in VV records. Overall, tanker orders have grown by c.6% year-on-year from 187 in H1 2023 to 199 in H1 2024. This is due to various factors, including fleet renewal schemes to meet the latest green regulations, an aging fleet, and owners seeking to future proof their fleets with the latest technology and fuels.

Values have strengthened across almost all sub sectors and age categories, for example, values for 15-year-old LR1s of 75,000 DWT have increased by c.13.82% since the start of the year from USD 27.79 mil to USD 31.63 mil.

Notable new sales/ headline sales include:

- 4 x LR2 Tankers of 114,800 DWT ordered by Vitol, scheduled to be built at Dalian Shipbuilding and delivered between 2026-27 and contracted for USD 73.5 mil each en bloc, VV value USD 71.75 mil.

- 4 x LR1 Tankers of 75,000 DWT ordered by Tsakos Energy, scheduled to be built at New Times Shipbuilding for delivery between 2027-2028 and contracted for USD 55 mil each en bloc, VV value 55.3 mil.

The most popular sector for newbuilding is the Handy sector, which has seen a steady increase over the last few years. To date, there have been 86 orders compared to 72 for the same period in 2023, an increase of c.19%. In second place with 36 orders is the VLCC sector, up from zero in 2022 and just seven in 2023: a jump of c.414% year-on-year. Afra/LR2s have moved down to third place as investment in new vessels has fallen by almost 50% from last year. 35 orders have been placed this year, compared to 69 in H1 2023. In fourth place with 28 new orders is the Suezmax sector, falling by 12.5% year-on-year. Panamax/LR1s are in fifth place with 14 orders, double the number reported last year, as interest rebounds once again for this sector following an extended period with no new orders placed.

Once again Greece has been the most active in the tanker newbuilding sector, accounting for almost a quarter of new orders with 56 sales reported, representing a dip from the 68 orders placed last year. Singapore is in second place, with 19 tanker orders so far this year, representing an increase of c.58% year-on-year. China and South Korea are joint third with six orders to date each.

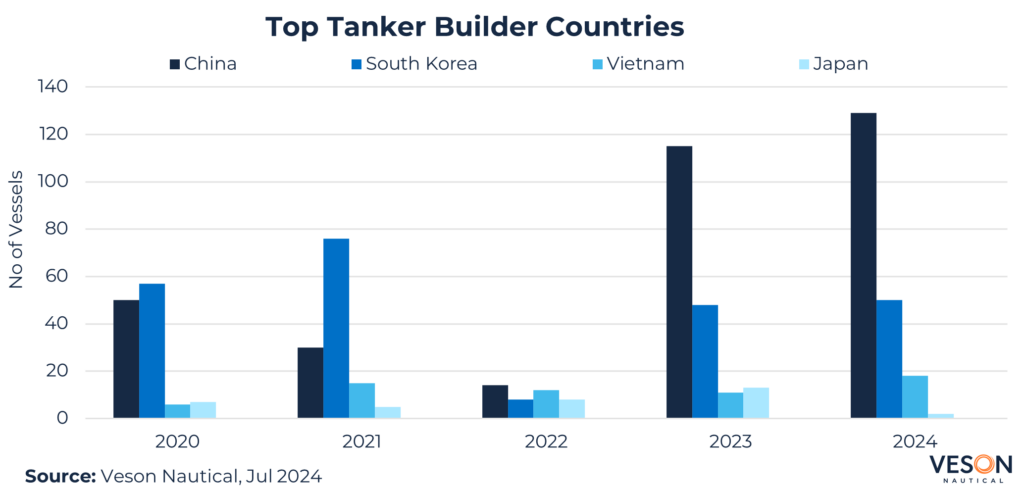

Most tankers continue to be built in China, with 129 additions to the orderbook this year, an increase of c.12% from 115 in H1 2023. South Korea ranks second, with 50 new orders, up from 48 last year. In third place is Vietnam with 18 new orders, up from 63 in 2023 an increase of c.64%. Japan ranks fourth with just two orders, compared to 13 last year, a decrease of c.85%.

Sale and Purchase

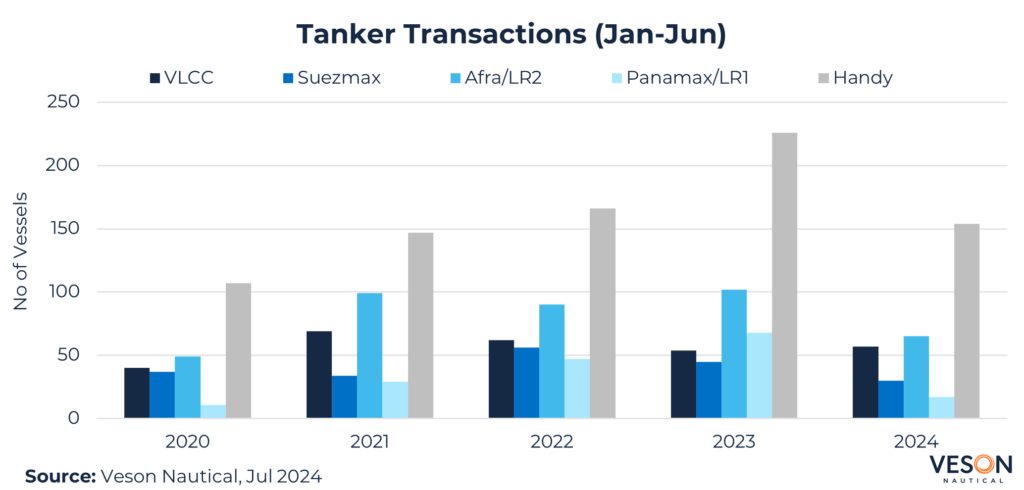

Sale and purchase transactions in the first half of 2024 are down from the highs of 2023, with 323 sales reported so far in 2024 compared to 495 for the same period last year, a fall of c.35%.

Values have increased across all tanker sub sectors and age categories. 15 YO MRs of 50,000 DWT have increased by c.14% this year from USD 24.21 mil to USD 27.61 mil. Demand for tankers continues as a result of geopolitical factors including sanctions on Russian oil and conflict in the Red Sea area which have increased ton-mile demand for this sector.

Notable sales include:

- LR2 Alpine Confidence (107,600 DWT, Mar 2010, Tadotsu Tsuneishi) sold to unknown Chinese buyers for USD 43.80 mil, VV Value USD 45.57 mil

- LR1 Avra Patros (75,000 DWT, Aug 2008, Sungdong) sold to unknown Greek buyers for USD 29.75 mil, VV Value USD 29.52 mil

- MR2 CSC Progress (45,800 DWT, Oct 2007, Jinling Shipyard Jiangsu) sold to undisclosed buyers for USD 21 mil, VV Value USD 21.42 mil

- MR2 (Chem/Prod) Gunmetal Jack (50,100 DWT, Aug 2009, SPP) sold to Besiktas Likid Tasimacilik for USD 28 mil, VV Value USD 27.97 mil

Handy tankers have been the most popular sector once again, with 154 reported accounting for almost half of all tanker sales at c.48%. Although this is a fall from the highs of last year, when 226 sales were confirmed, this figure is back to around the same levels as those seen in recent years. Afra/LR2s are the second most popular vessel type this year, accounting for c.20% with 65 sales reported. In third is the VLCC sector which represents c.18% of sales with 57 sales reported in the first six months, compared to 54 last year, an increase of c.6% and the only sector that has seen a jump in a positive direction. Suezmaxes rank fourth with a share of c.9% and 30 sales reported, down from 45 last year. Finally, Panamaxes/LR1s account for c.5% with 17 sales to date, down by c.75% year-on-year.

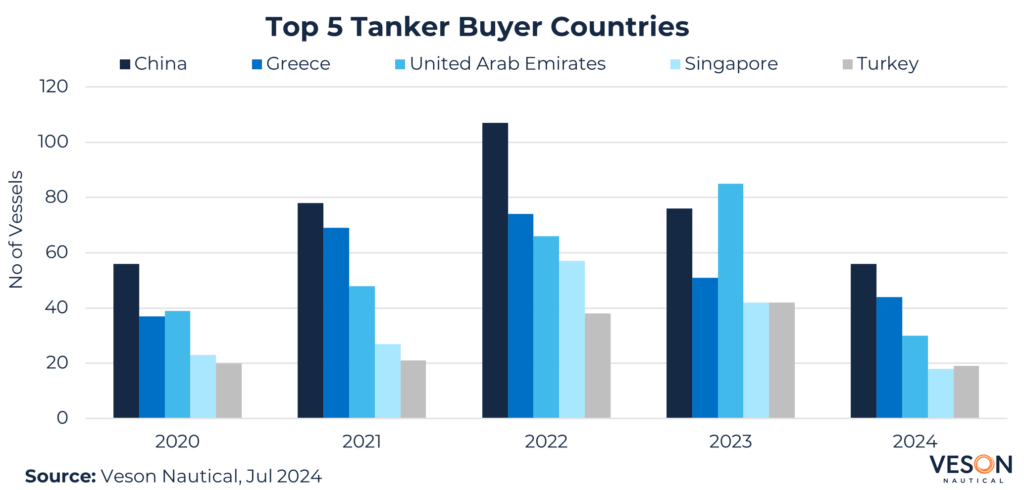

China has been the most active investor in the secondhand market this year, overtaking the UAE who led in H1 2023. Chinese bulker purchases have fallen from the highs of 2022, hitting 107 purchases to 76 last year and falling to 56 so far in 2024, a fall of c.26% year-on-year. Greece has moved up to second place with 44 sales reported to date, compared to 51 last year. After a bumper year in 2023, the UAE has fallen from first to third place in 2024 with just 30 sales reported so far, down from 85 last year, plunging by c. 65%. Turkey were the fourth biggest buyers with 19 to date, down from 42 last year. Finally, Singapore ranked fifth with 18 purchases, down from 42 last year. There are still a significant number of sales to unknown buyers with an average age of 17 years, indicating that although the market for older tankers entering into the dark fleet may have slowed from the highs of 2022-23, this market is still quite active.

Demolition

With little incentive for owners to scrap vessels thanks to high earnings and values, demolition levels have fallen even further this year. To date, only six tankers have been sent to the breakers yard in 2024, compared to eight in H1 2023, the majority have been in the Afra/LR2 sector where three vessels have been sent for scrap.

Firm earnings, strong values and continued demand for older tankers nearing demolition age (often bought to trade on the dark fleet) have encouraged owners to trade vessels for as long as possible. The average age of tankers sold for demolition this year is 24 years old, indicating that only the oldest vessels are being sold for demolition. Approximately one third of these vessels were scrapped in Bangladesh, with the remainder sent to yards in Pakistan, India and Indonesia.

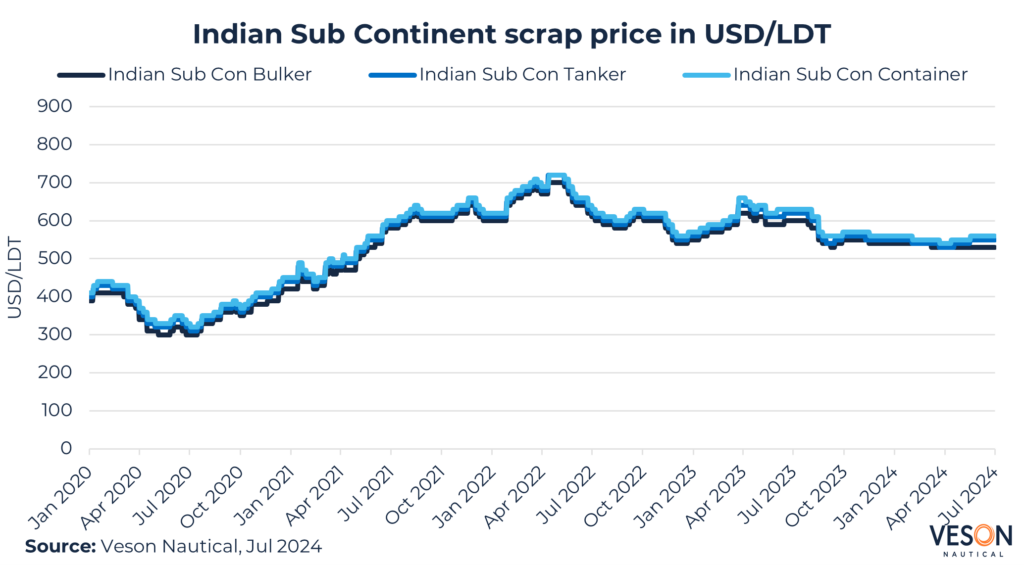

The graph below shows the average scrap price in the Indian Sub Con. This region represents the highest scrap price available between Bangladesh, India and Pakistan recycling yards.

At the end of H1 2024, the scrap price is c.11% lower when compared to the scrap price at the end of H1 2023. Indian sub-continent scrap prices dipped during Q3 2023 and have remained relatively flat since then. Current prices for tankers are 550 USD/LDT compared to 620 USD/LDT for the same period last year.

Below are some notable recent demolition sales for tankers:

- Suezmax Jal Gamini (157,500 DWT, May 2000, Daewoo) Demo price: 541 USD/LDT which equates to a VV Demo value of USD 11.89 mil. Delivery location: Bangladesh.

- MR1 Swarajya (32,900 DWT, Nov 1998, Hyundai Heavy Industries Ulsan Shipyard) Demo price 540 USD/LDT which equates to a VV Demo value of USD 4.5 mil. Delivery location Bangladesh.

Conclusion

In the first half of 2024, the tanker market has experienced significant activity, with newbuilding orders reaching record highs according to VV records. This surge in orders is accompanied by strengthened values across all sectors, indicating a robust market environment. While second-hand sales have decreased from the peak levels seen in 2023, they continue to remain strong due to sustained demand. Additionally, there has been minimal demolition activity, with only the oldest vessels being scrapped. Overall, the tanker sector shows a healthy and dynamic market landscape as we move further into 2024.

Stay up to date of the market by reading our full 2024 half-year review across the following sectors: