2024 Half Year Review: Vehicle Carriers

This vehicle carrier half year review is one of a series of reports providing a summary analysis of the first half of 2024 in the tanker, bulker, container, offshore, and LNG / LPG sectors. In each, we explore three areas: the newbuild market, second-hand sale and purchase activities, and demolition trends. Combining Veson’s extensive datasets with many decades of combined experience among our analysts, these insightful reports provide clarity on the key factors influencing each market and the potential implications for stakeholders in the months ahead.

Vehicle Carrier Summary

The continued low supply of Pure Car and Truck Carriers (PCTCs), combined with strong Chinese-driven export growth from Asia has ensured minimal change to market balance dynamics in the first half year for vehicle carriers. This has kept rates and values at historical highs. However, market sentiment eroded in Q2 from:

- On-going Red Sea diversions around the Cape of Good Hope (COGH),

- Depleting operator profits,

- A general lack of liquidity to support high vessel prices, and,

- Significant import duty hikes introduced by the European Union on Chinese made electric vehicles ranging from 27% to 47% subject to OEM, that are likely to impact key trading routes.

By the end of June, VVs One-Year 6,500 CEU Index had lost c.8%, signalling an end to peak rates and perhaps marking the top of the cycle. Ten-year values for standard 6,500 CEU and 4,000 CEU finished the second quarter at USD 95.4 mil and USD 72.9 mil respectively, slightly down quarter-over-quarter, but up c.9% from the start of the year.

VV Mini Matrix – Change ($m/CEU)

Newbuildings

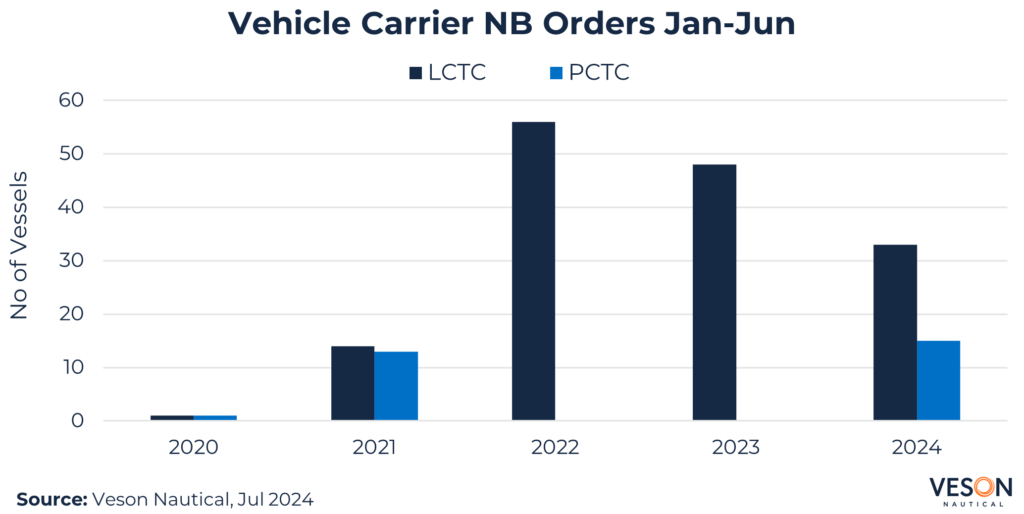

Vehicle carrier orders were in line with the previous year based on 48 deals, including options, for a combined total spend of c.USD 4.79 bn. Interestingly, the number of Large Car and Truck Carriers (LCTCs) ordered was c.31% down year-over-year, supporting a declining trend following strong orders in 1H 2022 and 1H 2023.

Focusing on midsize PCTCs, which comprise a marginal share of the c.41% orderbook, Eastern Pacific Shipping Pte.Ltd. (EPS) confirmed deals for 6 x 5,500 CEU Dual Fuel LNG units from China Merchants Jinling Shipyard (2 vessels) and Fujian Mawei Shipyard (4 vessels), paying USD 80 mil and USD 85 mil per vessel with repeat options.

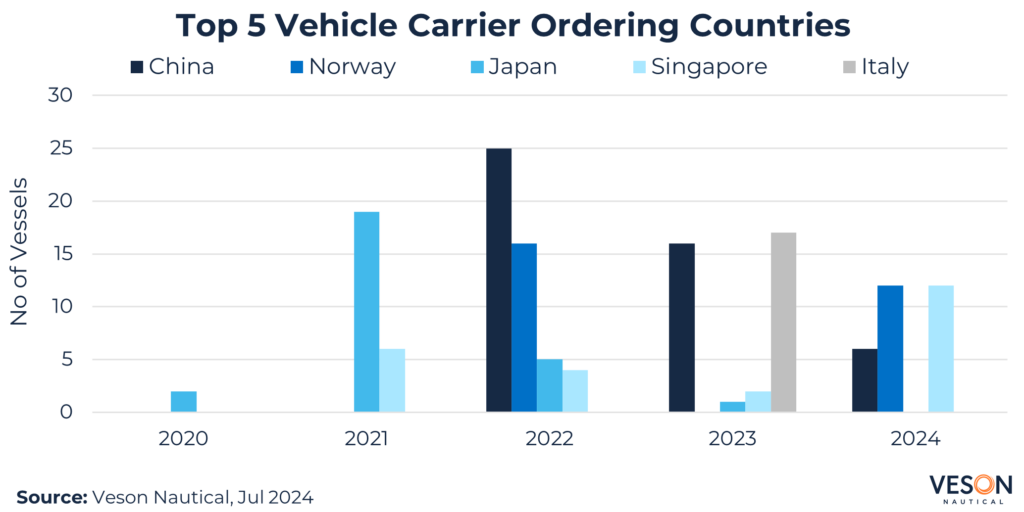

Norway and Singapore shared top spot for vehicle carrier orders in 1H 2024 based on 12 vessels each, followed by South Korea (10 vessels), and China (6 vessels). South Korea made the headlines after 10 x 10,800 CEU Dual Fuel LNG units were booked at Guangzhou CSSC (8 vessels) and Shanghai Waigao Shipyard (2 vessels) by Glovis and Korea Ocean Business Corporation. These ships will be the largest vehicle carriers trading after delivery from 2027.

Focussing on five years of first half year data, China are the top buyer (47 vessels), followed by Norway (28 vessels) and Japan (27 vessels).

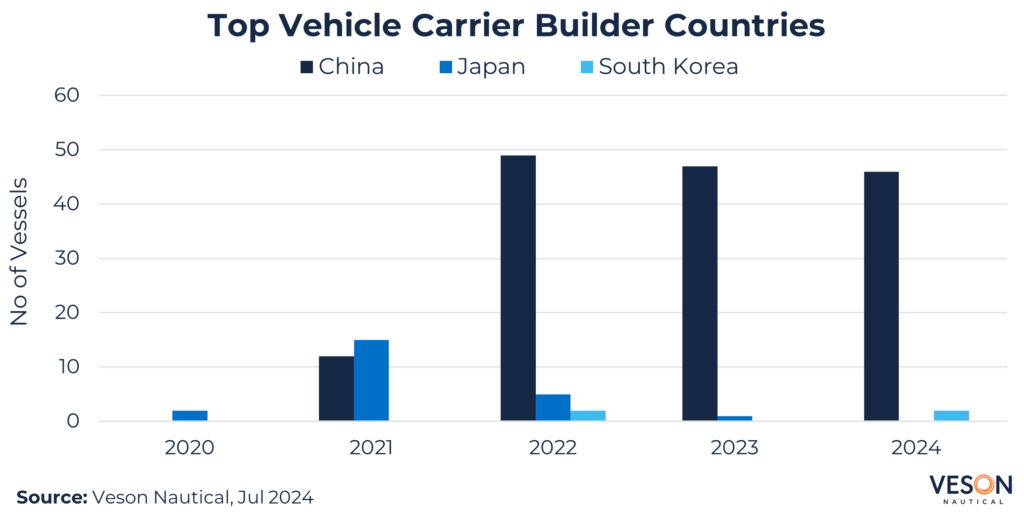

Chinese shipyards continued to dominate, taking c.96% of all orders in 1H 2024 based on 46 vessels including options; a repeat of the previous year supported by increased investment by OEMs SAIC, Chery, and BYD.

South Korea was a distant second following a pair of 7,500 CEU Dual Fuel LNG units booked by Ray Car Carriers at Hyundai Mipo paying USD 134 mil per vessel, a premium of c.25% versus similar specification units based on top China yards.

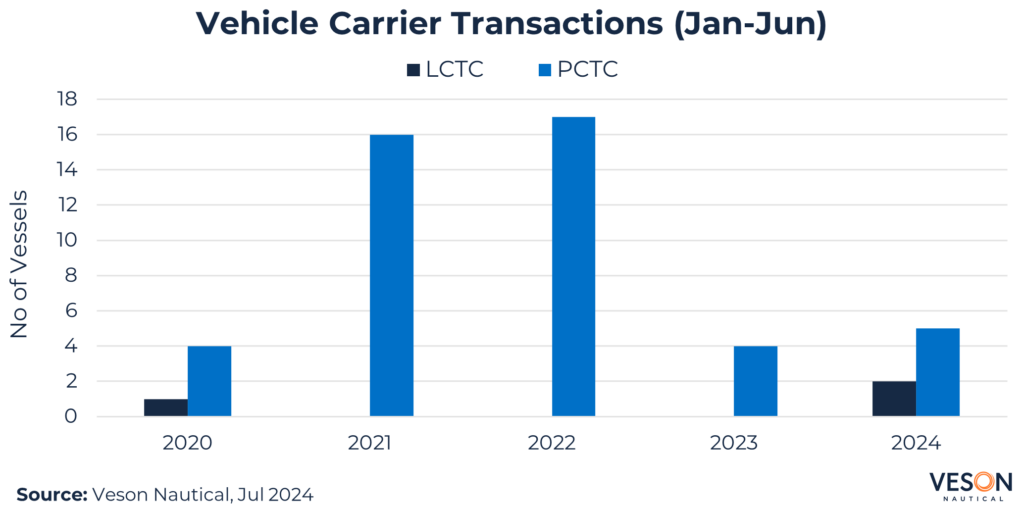

Sale and Purchase

Second-hand sales activity remained subdued, recording 7 deals in 1H 2024 including two purchase options exercised by Wallenius Wilhelmsen and Hoegh Autoliners, broadly in line with the previous year. The headline transaction on the open market involved:

- Midsize Viking Amber (4,200 CEU, Sep 2010, Nantong Mingde Heavy Ind) sold to Suardiaz for USD 64.6 mil in February, VV value of USD 57.2 mil the day before sale.

Additionally, Hoegh Kobe (6,000 CEU, Oct 2006, Daewoo) sold to Changjiu Logistics for USD 59 mil (DD Passed) in April on a private sale, VV value USD 70.2 mil today.

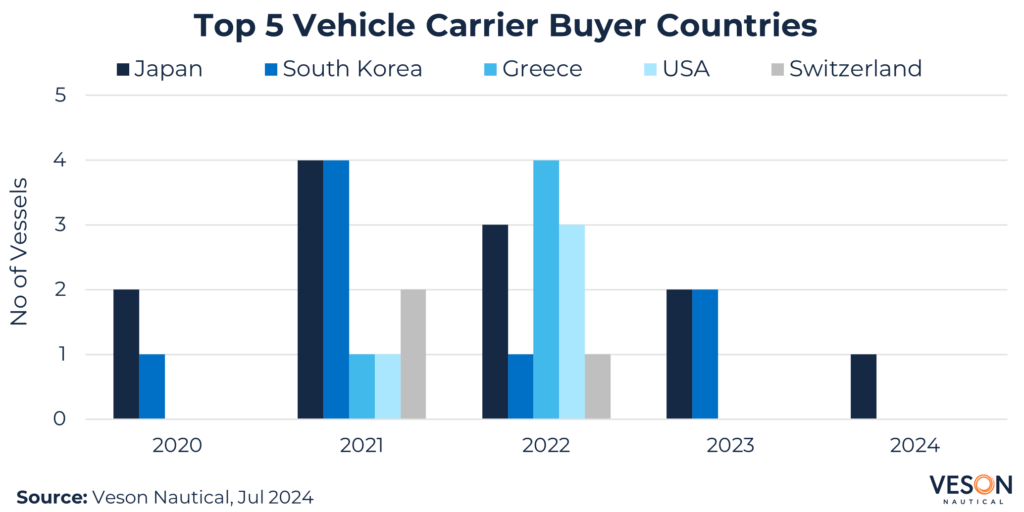

Focusing on five years of first half year data by buyer countries, Japan are top (12 vessels), followed by South Korea (8 vessels) and Greece (5 vessels). However, China is challenging the status quo after Changjiu Logistics acquired their second PCTC, and ICBC Financial Leasing concluded a refinance deal on CMA CGM Daytona (7,050 CEU, Apr 2024, Jinling Shipyard Jiangsu) in February.

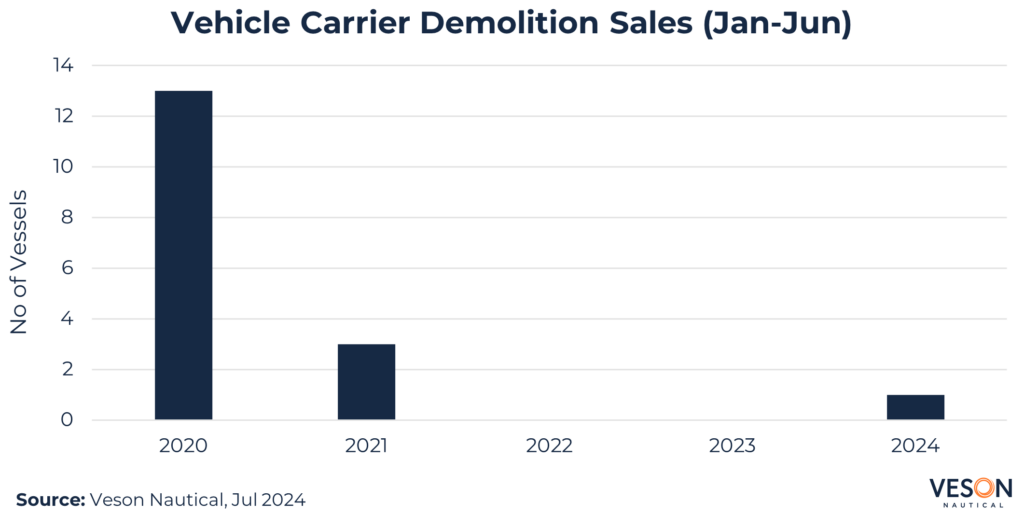

Demolition

Demolition remained non-existent based on a supply starved market. The only sale involved distribution vessel Fugako Maru (960 CEU, Feb 1997, Mitsubishi HI). Demo price 516 USD/LDT, LDT 7,795, which equates to a VV Demo price of USD 4.02 mil. Delivery location Bangladesh.

Conclusion

Vehicle carriers remained hot property in 1H 2024 because demand continued to outpace supply following strong light vehicle export growth from Asia, forecasting +6.6% for 2024, supported by a prolonged Red Sea crisis increasing sailing distances around the COGH that ensured supply kept low with no obvious end in sight.

Mid-age PCTC values gained an impressive c.9% through to June, however a lack of supporting transactions and cooling rates suggest asset price softening going forward. Further support arrives from a swollen c.41% orderbook to live fleet ratio, and hiked Electric Vehicle (EV) tariffs set by the EU for China.

Stay up to date of the market by reading our full 2024 half-year review across the following sectors: