Cruise Ships

We have just broken into the passenger ship market with the launch of automated valuations, data and satellite intelligence for Cruise ships.

This comes at a time when Cruise ships are very much under the microscope due to the global outbreak of COVID-19.

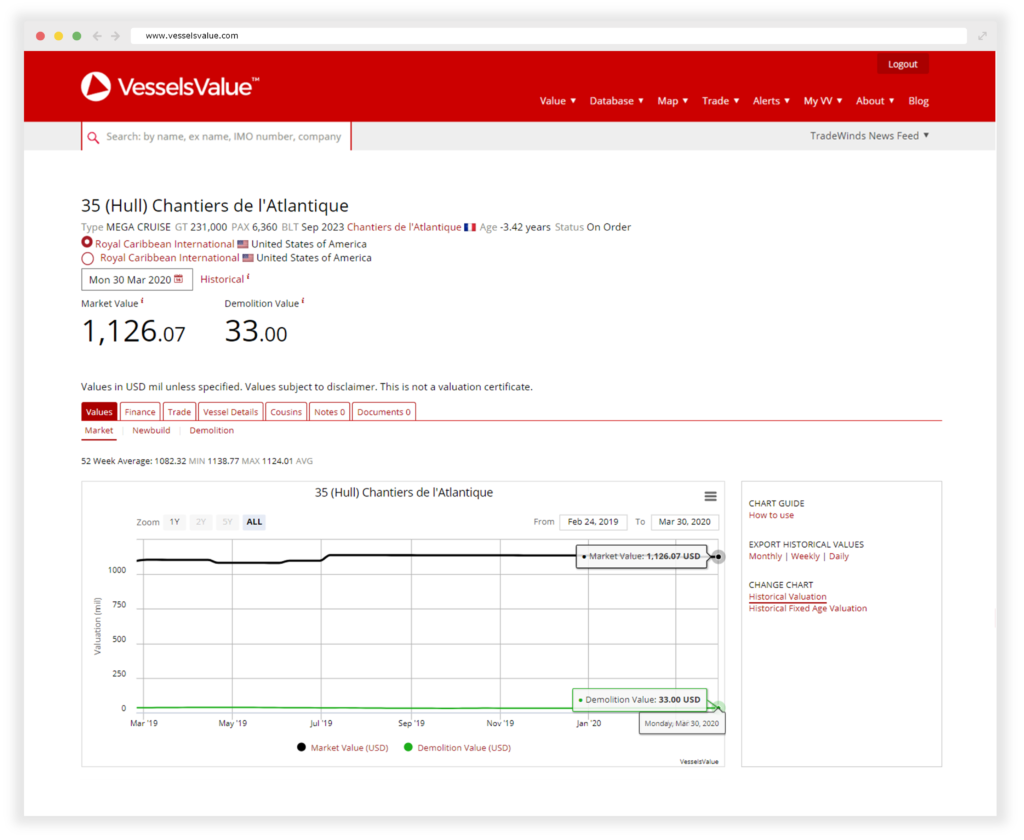

The global Cruise fleet consists of 483 vessels with an aggregate value of over USD 167 billion (data valid 31st March 2020). Individual assets can be worth in excess of USD 1 billion each, which is a first for us making Cruise ships one of the most expensive maritime assets in the world today.

VesselsValue has spent the past 12 months collating and verifying their commercial and fleet databases and have now gone live with daily updated automated market valuations, as well as demolition and fixed aged values dating back to 2010 for the below asset types, in an effort to provide industry participants with a wider and more in depth view into the Cruise Ship sector.

- Mega Cruise

- Large Cruise

- Standard

- Luxury

- Small Cruise

- Standard

- Luxury

- Expedition

- Expedition Luxury

The development of Discounted Cash Flow valuations is already underway and will be live in the near future.

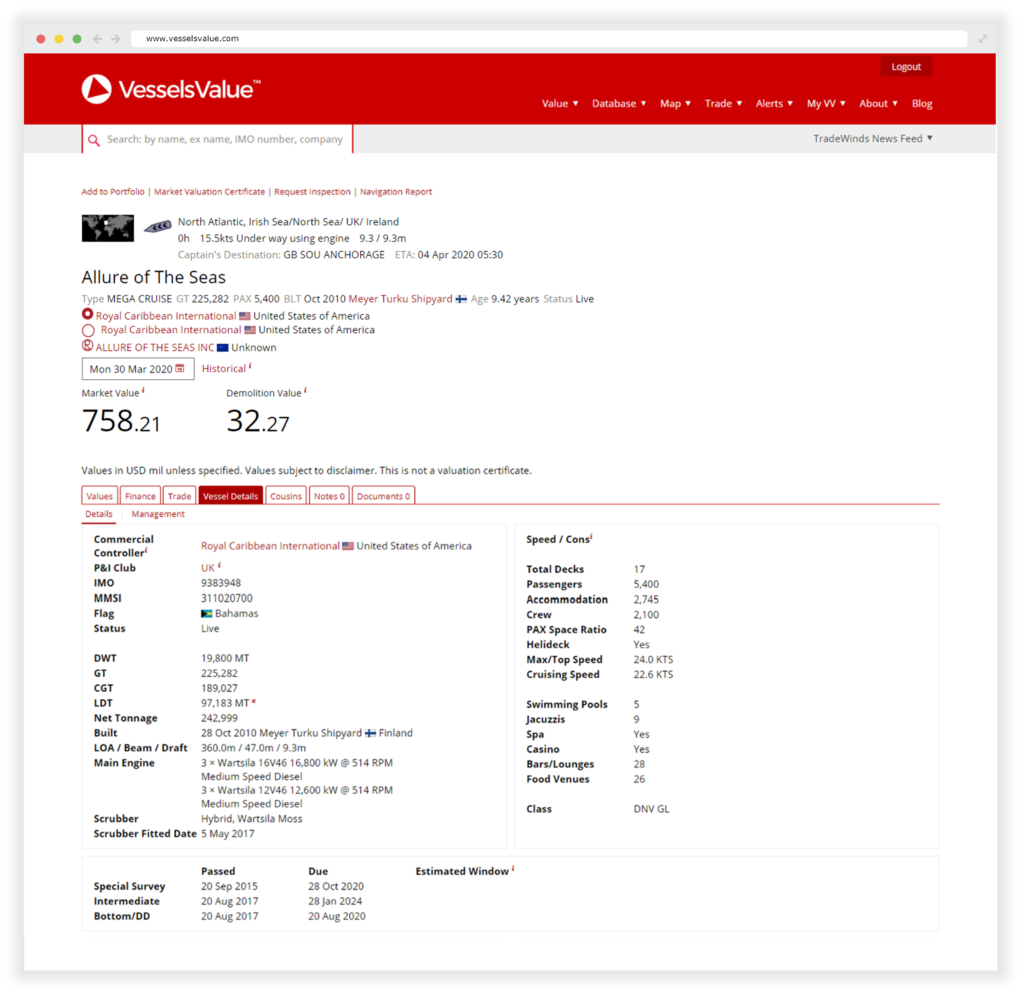

Unique Features

From a valuation point of view, Cruise ships are highly complex assets and VV has taken into consideration a number of Cruise specific features to be factored into their algorithms. These include passenger to space ratio, total number of decks and accommodation, and number of swimming pools, casinos and restaurants among others.

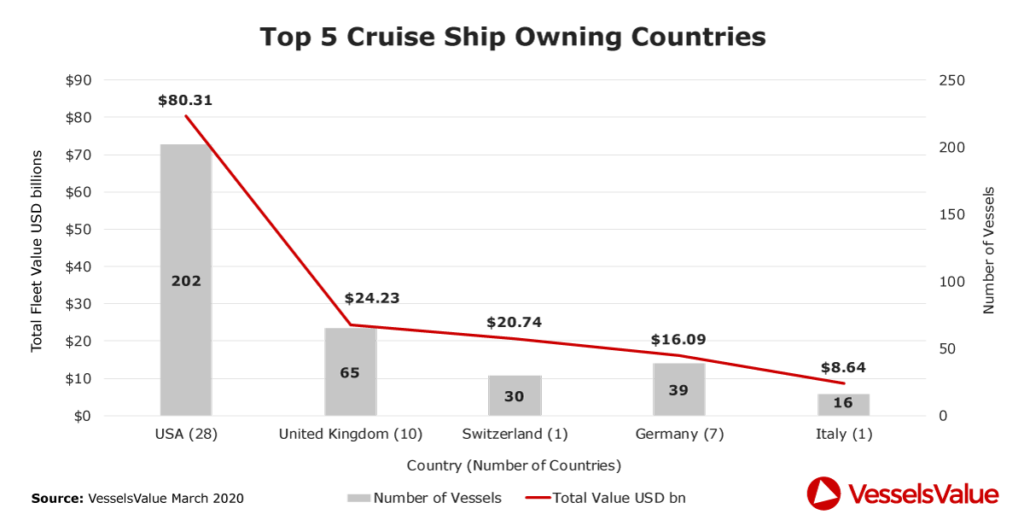

Owners

The USA accounts for 43% of total fleet size and holds a 48% market share in terms of value.

Values

The newbuild Hull 35 (231,000 GT, Sep 2023, Chantiers de l’Atlantique) is VesselsValue’s highest valued Maritime asset at USD 1.13 billion. She was ordered in February last year for a reported EUR 1.10 billion by Royal Caribbean International. The value had increased from when she was ordered until just before COVID-19, which has caused the value to decline.

The Industry up to 2020

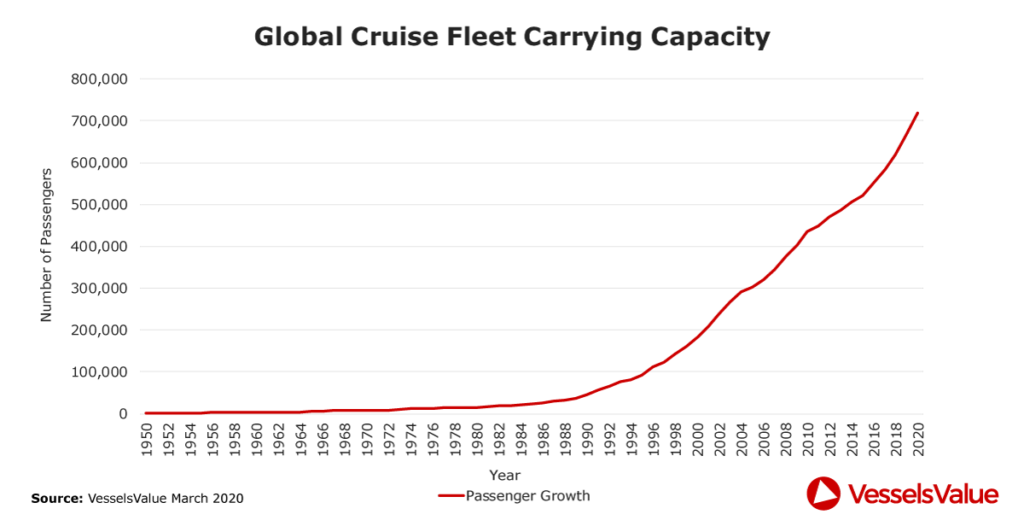

Cruise ships carried over 30 million people on voyages in 2019 making them one of the most highly commoditised assets on the water. The below graph shows the total number of passengers that can be cruising the water at any one time. The popularity of Cruises has risen exponentially, a trend that the fleet size has mirrored. As a result, the Cruise market (and tourism market) was widely perceived to be in a boom phase heading into 2020.

COVID-19

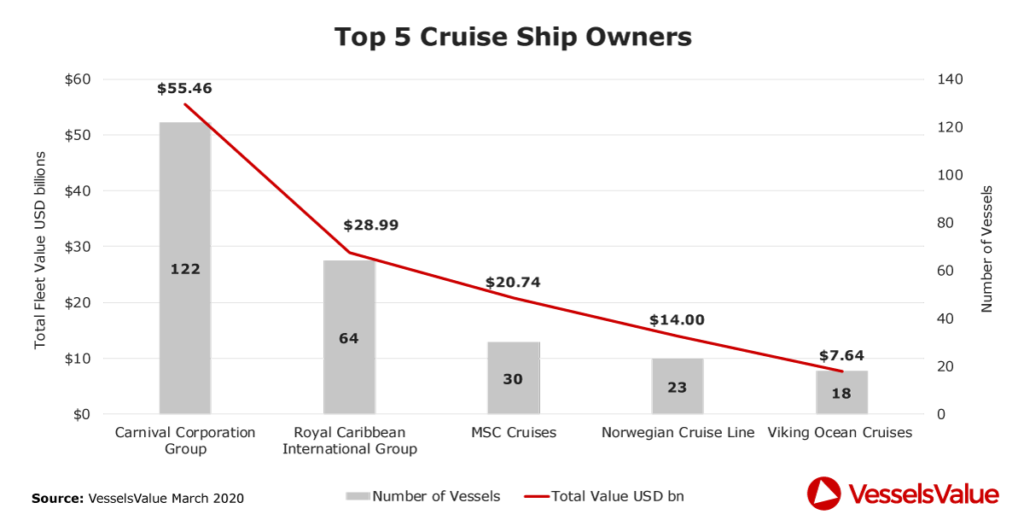

Things have taken a turn for the worse in 2020 with the global outbreak of COVID-19. Some of these billion dollar assets have become financial liabilities with several high priced vessels now laid up and not working. Carnival Corp, the world’s largest owner, has just had to secure a USD 3 billion loan to cope with the crisis.

The sale and purchase market has come to a halt, with the only real transactions concluded on a sale and leaseback basis. Perhaps the most well known of these is the Genting Dream 150,000 GT, built 2016 Germany, that was sold in Jan 2020 prior to the crisis to Chinese leasing company for USD 900 mill against a 12 year bareboat charter back to sellers. VV value today USD 777 mil.

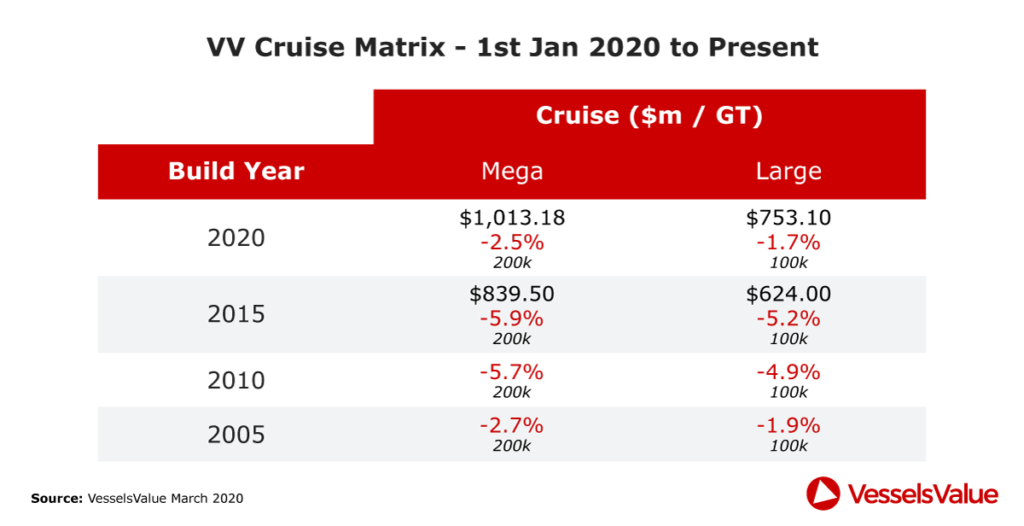

The total value of the entire fleet has fallen by USD 4 billion since 1st Jan this year.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.