2024 Half Year Review: RoRo

This RoRo half year review is one of a series of reports providing a summary analysis of the first half of 2024 in the tanker, bulker, container, offshore, and LNG / LPG sectors. In each, we explore three areas: the newbuild market, second-hand sale and purchase activities, and demolition trends. Combining Veson’s extensive datasets with many decades of combined experience among our analysts, these insightful reports provide clarity on the key factors influencing each market and the potential implications for stakeholders in the months ahead.

RoRo Summary

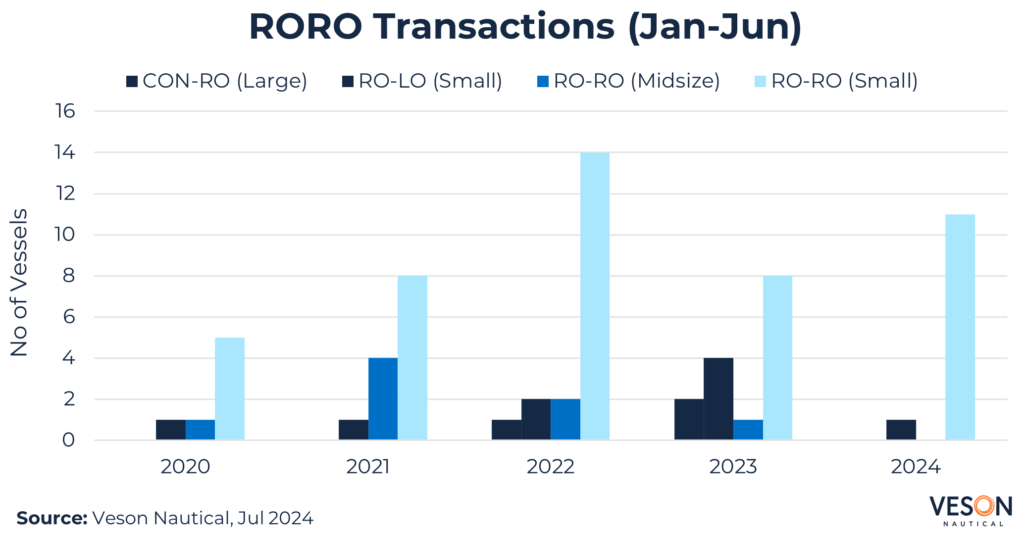

Leading shortsea owner-operator, DFDS, provided a flat outlook during their Q1 presentation, pointing to a mixed picture for freight from weaker demand in the Baltic and the Channel. The same could be said for Sale and Purchase (S&P) activity based on a scarcity of sales and fixtures, down c.20% and c.68% respectively versus 1H 2023.

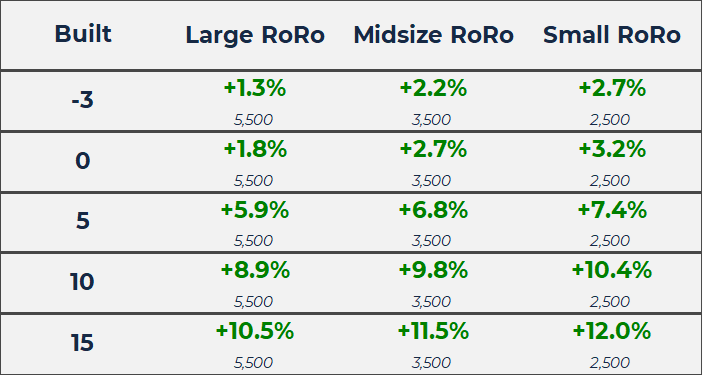

However, demand for second-hand Roll-On Roll-Offs (ROROs) remained firm, supported by a low orderbook of c.5.5%, particularly in the small segment after an impressive price was paid for a mid-aged 1,800 Lane Meter (LM) vessel, lifting values for similar.

By the end of June, fifteen-year-old values for 3,500 LM and 2,500 LM ROROs finished the second quarter at EUR 39 mil and EUR 32.2 mil, up c.12% from January.

VV Mini Matrix – Change ($m/LM)

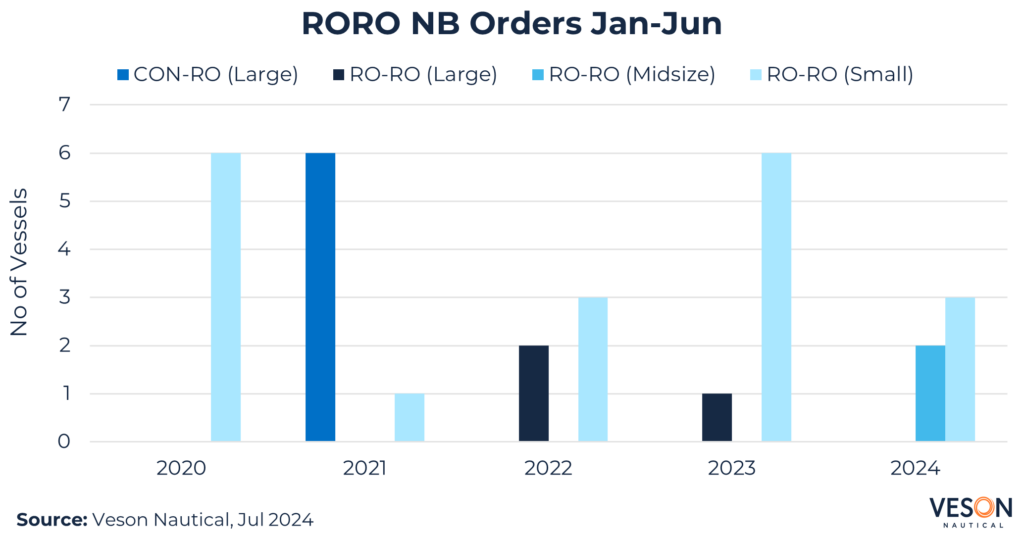

Newbuildings

Newbuild orders were isolated to five deals in total, compared to seven vessels in 1H 2023. In February, Smyril Line paid USD 78 mil per vessel for a pair of midsize 3,300 LM units at Yantai Raffles for delivery in 2026. Whilst in June, Toyofuji Shipping and Fukuju Senpaku confirmed 1 x 1,794 LM unit each at Mitsubishi HI for delivery in 2027, price undisclosed.

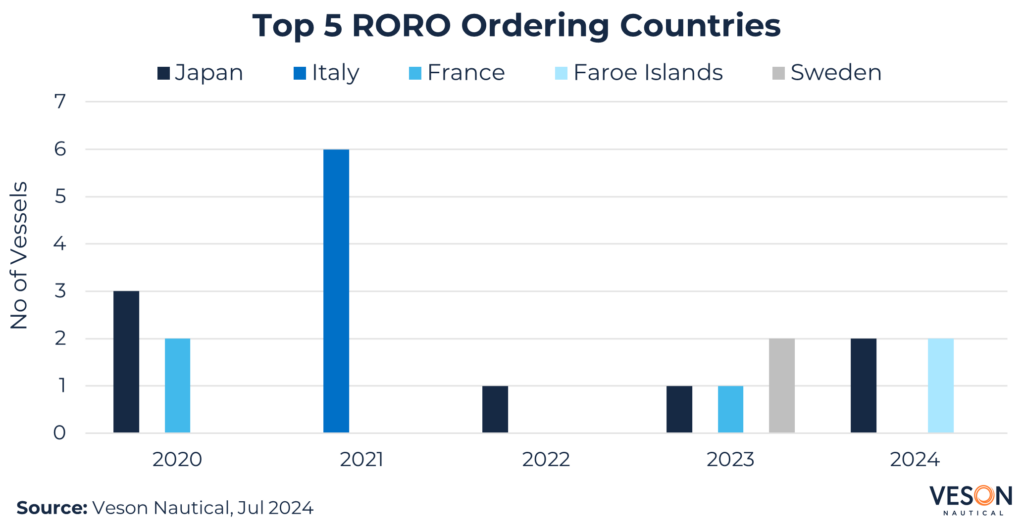

Looking at top ordering countries over the last five first half years, Japan ranks first (7 vessels), followed by Italy (6 vessels) and France (3 vessels). However, Faroe Islands shared top spot with Japan in 1H 2024 after a Smyril Lines double order.

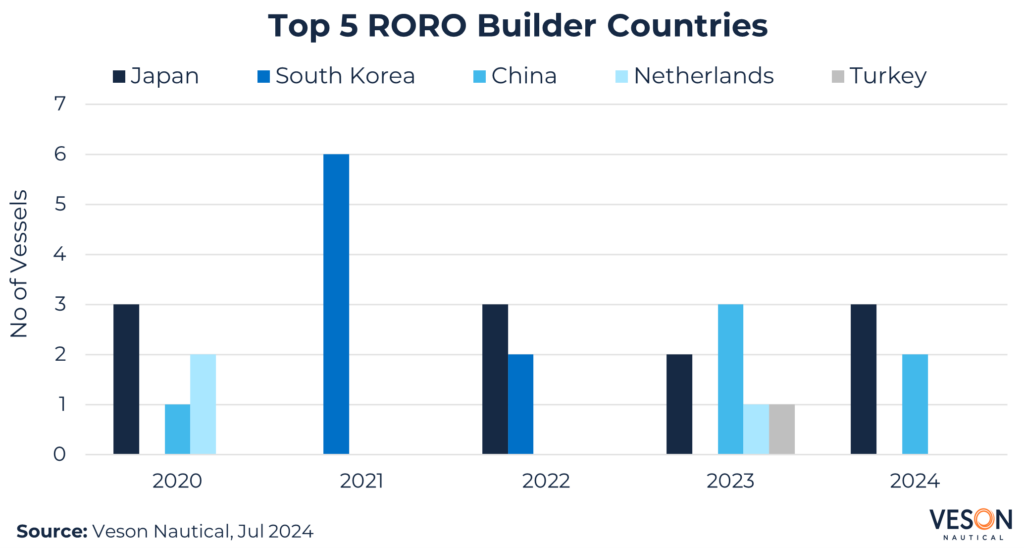

Japan and South Korea remain the top two builder countries for ROROs, followed by China in third, moving up the rankings. Shipowners’ preference for Chinese builds is growing, but it is not dominant like neighbouring ROPAX Ferry and Vehicle Carrier (LCTC, PCTC) sectors.

Grimaldi selected Jinling Shipyard, Jiangsu, for their pair of large 7,800 LMs ordered in 2022, whereas Cobelfret chose Hyundai Mipo for their slightly larger 8,000 LMs ordered in the same year showing split support by top owners. These super-sized ROROs are expected to be delivered in Q1 2025.

Sale and Purchase

S&P activity was down c.20% year-over-year, recording 12 sales in 1H 2024. Headline deals included:

- Pietro Manunta (3,225 LM, Jul 1991, Daewoo) sold to Salem Al Makrani Cargo for EUR 12 mil (DD due) in January, VV value EUR 13.6 mil day before sale.

- Seatruck Panoroma (1,830 LM, Nov 2008, Ast de Huelva) sold to TMC for EUR 21 mil in February, VV value EUR 16.4 mil day before sale.

- Finnkarft and Finnhawk (1,853 LM, Dec 2000 / Jan 2001, Jinling Shipyard Jiangsu) sold to Fred Olsen SA for EUR 28 mil en bloc in March, VV combined value EUR 30.68 mil day before sale.

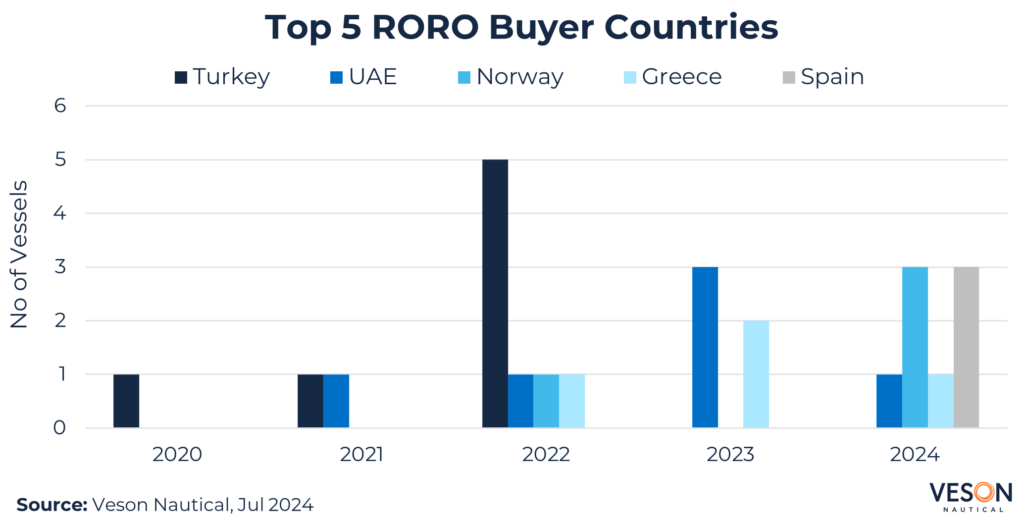

Spain and Norway were the top buying countries for ROROs in 1H 2024 based on three vessels each, supported by Balearia, Fred Olsen SA, and Sea-Cargo. Focusing on the top five buyer countries over five first half years, Turkey ranked top (7 vessels), followed by UAE (6 vessels), and Norway (4 vessels). Top Turkish buyers include Erkport, Ulusoy, Cenk, and Samsun Shipping.

Demolition

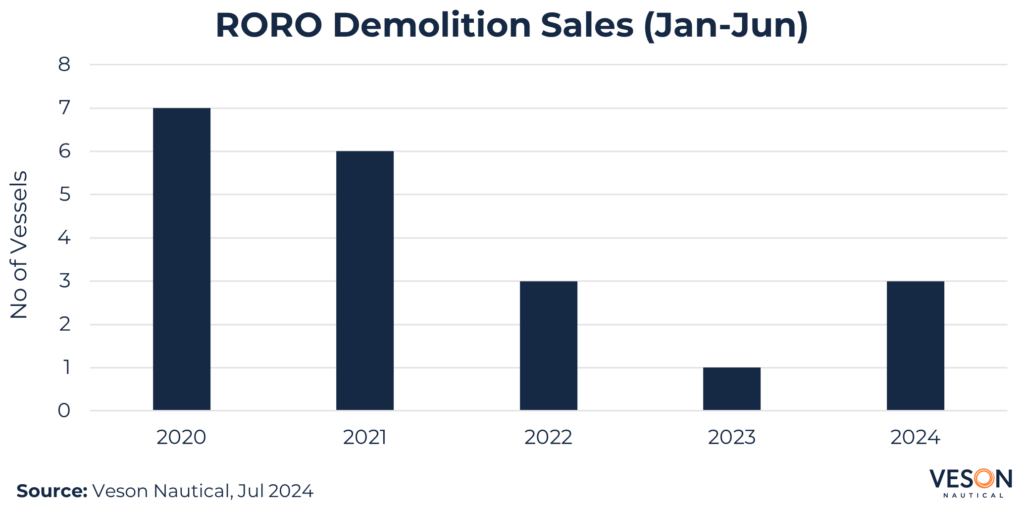

Demolition activity was restricted to three vessels. The headline deal involved Duta 1 (1,250 LM, Nov 1991, Naikai Setoda). Demo price 500 USD/LDT, LDT 5,931, which equates to a VV Demo price of USD 2.96 mil. Delivery location Bangladesh.

Conclusion

Overall, a quiet first half year for ROROs based on a flat freight market and reduced S&P activity. Buyer interest was concentrated on small 1,800 LM units attracting high sale prices, resulting in appreciating values for similar by c.12% by the end of June.

Looking forward, shipowners and investors can take comfort from a low orderbook of just c. 5.5%, and a tightly supplied container market through to 2025 that typically results in increased demand for RORO capacity.

Stay up to date of the market by reading our full 2024 half-year review across the following sectors: