A positive outlook for UAE ports post-Covid

Container activity in UAE ports is booming. Tankers are showing signs of recovery.

This article will use our Trade data to assess how trade routes in and out of the UAE have grown over time, as well as assess the impact Covid-19 has had on specific ports across the Container and Tanker sectors.

The UAE is home to some key international ports. With a strong focus on economic development, the country is reliant on these hubs to help drive growth and form vital trade connections with other countries. The UAE has a number of well-connected Container and Tanker ports, which serve the country with imports and facilitate exports, as well as transhipment within the Middle East Gulf region.

UAE Container Growth

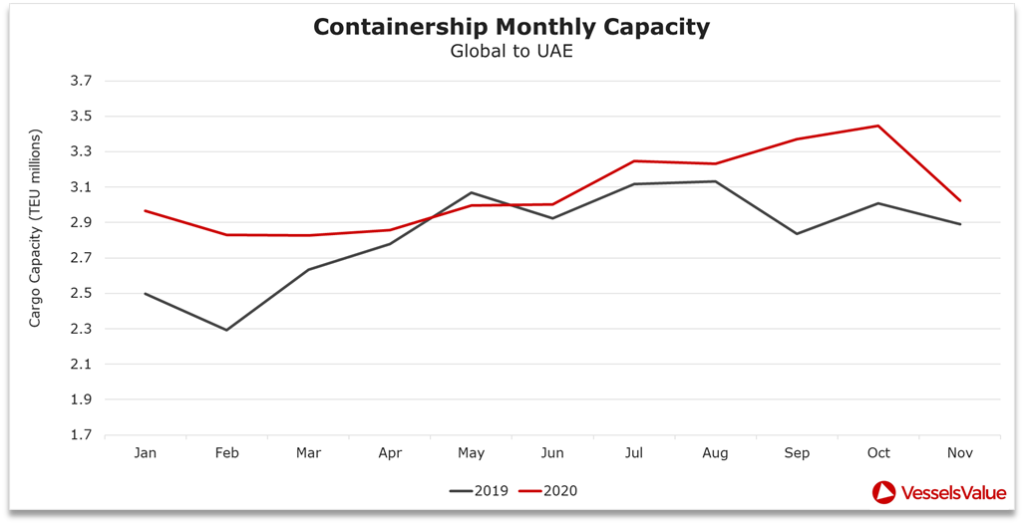

As consumerisation and disposable income grows in the UAE, so do Container imports. Despite the global Covid-19 pandemic, Container trade into the UAE has stayed above 2019 levels. The below chart shows a YoY view of total monthly cargo capacity for Handy Container up to ULCV size vessels, heading into the UAE from anywhere else in the world.

Both years experienced a decline in Containership capacity around January and February in the New Year but picked up again into the summer months. Growth in capacity this year was less pronounced between February and May than last, likely the result of Covid-19 disruptions and lessening demand. However, Containership capacity has stayed strong overall, reaching a high of 3,445,071 TEU in October, an impressive 15% increase on the same period last year. Some short-term volatility was seen in November as monthly capacity fell, but this overall growth suggests that consumer demand has stayed consistent in the UAE, despite the strains of the Covid-19 pandemic.

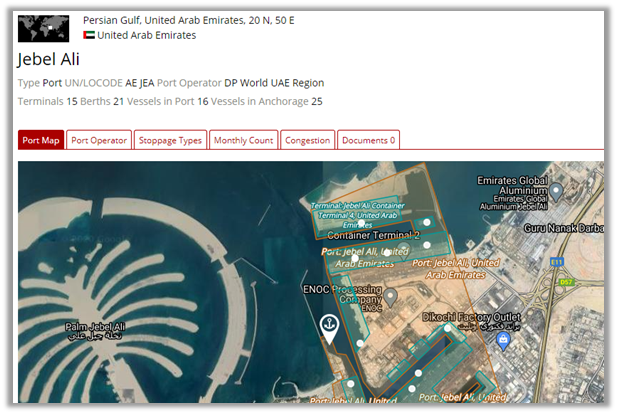

Jebel Ali

Using our Port Analytics data, we will now take a closer look at Jebel Ali, one of the main transhipment ports in the UAE.

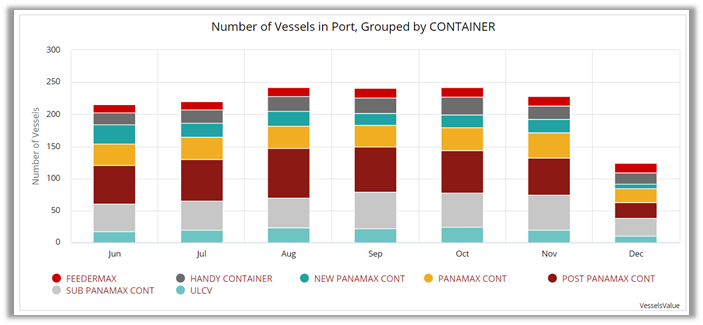

With 3517 journeys in total ending in the port over the last year, it received nearly triple the number of journeys compared to the UAE’s second top port, Khalifa. The most popular Container types to enter Jebel Ali are Sub-Panamax and Post Panamax containers, completing journeys from countries in the East such as Singapore and Malaysia, but also inter-regional journeys between Oman and Saudi Arabia.

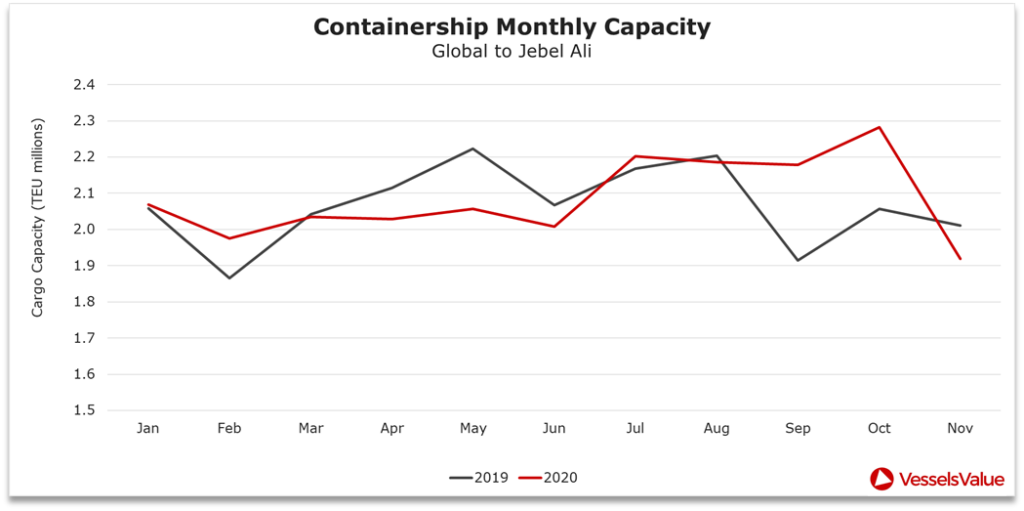

The below chart shows a YoY comparison of total monthly Containership capacity into Jebel Ali.

As shown on the chart, total capacity in January started slightly above last year but fell into February. It then stayed at just below 2,000,000 TEU until recovering promisingly into July this year, before exceeding levels seen this time last year by 11% in October. Overall, capacity has been consistently recovering since June this year, despite a decline seen more recently in November. This data suggests that the UAE’s top Container port was impacted by Covid-19 at the beginning of the year, as many ports globally experienced reduced imports alongside record numbers of inactive containerships during this time. However, as demand recovered and port operations began to return to normal, Q3 saw a significant increase in total capacity on the route.

UAE Tanker Growth

Despite the UAE diversifying into different markets to aid development, a large percentage of the countries GDP is still derived from oil production. This year to date, the UAE has exported nearly 197,000,000 MT of oil globally on large dirty Tankers. However, this is down 7% in total compared to the same period last year, suggestive of the impact of Covid-19 on global oil demand. A significant proportion of UAE oil is exported from Fujairah port, located in the Gulf of Oman, followed by Zirku Island in the Persian Gulf.

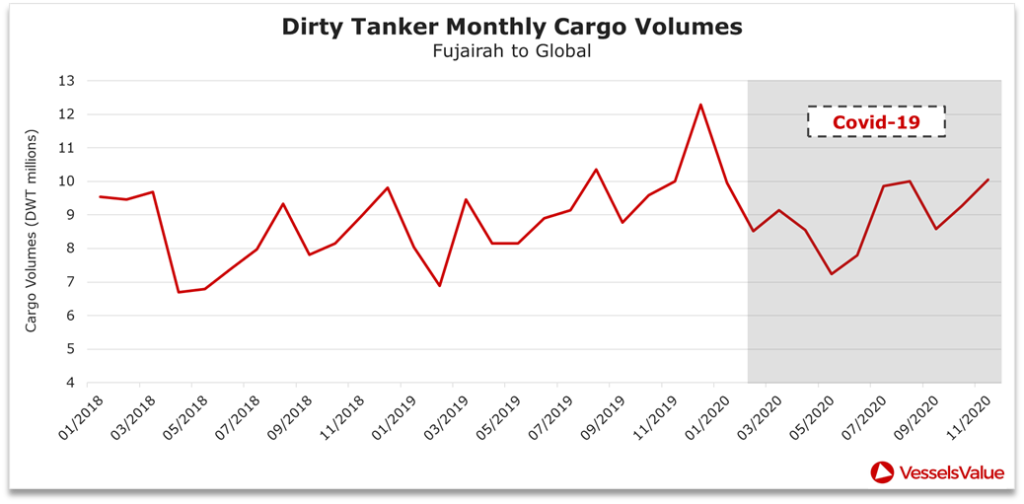

Fast emerging as an oil storage and shipping hub, Fujairah is no longer just a popular bunkering port. As uncertainties around transiting the Strait of Hormuz unfolded last summer due to the tanker attacks, Fujairah was increasingly used to store and ship crude towards the end of last year due to its strategic location. This chart shows monthly estimated cargo miles leaving Fujairah in Tankers (VLCC to Aframax), since the start of 2018.

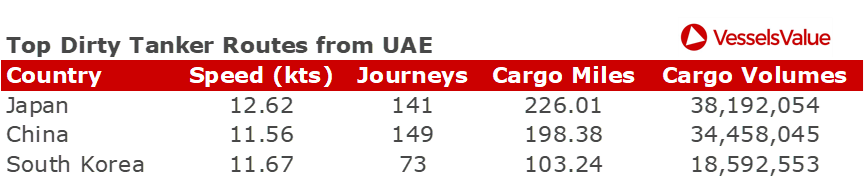

A clear increase in cargo volumes leaving Fujairah can be seen since April 2019, as volumes begin to follow an upwards trajectory until peaking in December 2019 at 12,291,482 MT, 25% higher than in December 2018. However, into 2020, volumes plummeted by 31% to 8,518,318 MT. This shows the impact that Covid-19 had on oil demand in February, as refiners were slowing down and trading partners in the East entered lockdowns. The below table shows the top 3 receiving countries of dirty Tankers from the UAE, by cargo miles, over the last year.

Exports declined even further into May this year, before improving temporarily in June, July and August. The future of exports from Fujairah depends heavily on how the world recovers from Covid-19 and how quickly demand returns to normal. Also, many ports and countries are still working their way through surplus oil stored from the oil glut experienced in late March this year, pushing many vessels into floating storage. If a vaccine is proven successful, global oil demand could increase rapidly as people return to normal activities, and Fujairah is likely to continue with growth in Tanker exports as experienced in 2019.

Summary

Overall, Container trade within the UAE has not faltered as significantly as other countries and has experienced good overall growth, especially when compared to figures last year. This suggests that the investment the UAE has made in recent years to improving port infrastructure has proven beneficial, especially amid the pandemic where human workforces were compromised, and technology proved vital.

Conversely, oil exports overall from the country have suffered, with levels this year to date not quite reaching highs seen in 2019. However, a Covid-19 vaccine is a good sign for UAE Tanker exports, and it is expected that recovering demand in 2021 could bring Tanker exports back close to where they were last year.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?