A Winter Write Up on the VLCC and LNG Markets

Introduction

In today’s carbonised economy, where millions of barrels of oil are consumed daily, the transportation of fuel is a crucial cog in the world’s energy consumption. With such large quantities required globally, the oceans are the most cost effective route for moving this cargo to areas that do not have rich natural reserves of fossil fuels. If countries can’t extract and refine these fuels locally, cargo vessels do the work in ensuring a stable and secure oil and gas supply.

Very Large Crude Carriers (VLCCs) are the largest vessels within the Tanker fleet and are typically primed for the transportation of crude oil from areas of extraction to specialised facilities for refining. Ranging in sizes between 200,000 – 600,000 DWT, these vessels are among the largest found on the world’s oceans. As of November 2021, there are 915 VLCCs in operation.

LNG (liquefied natural gas) carriers have a similar role in the transportation of hydrocarbons, however since their product is naturally gaseous, pressurised tanks and extremely low temperatures are required to keep the cargo in a liquid state for efficient trading. VesselsValue splits LNG carriers by size with “Large LNG” (100,000 to 200,000 CBM (cubic meters) in size) being the most popular on today’s oceans, totalling 536 live vessels out of the 644 LNG carriers.

These two types of vessels are crucial in current, but also future, hydrocarbon trade. How have these vessel types fared in response to the Covid-19 pandemic, and with a global push for greener alternatives, what does their future look like?

VLCCs

Background

Since April 2020, the VLCC earnings market has remained at low levels due to a high supply of vessels and a steady demand for oil. This has also been true of the wider Tanker market where earnings have remained relatively constant over the last 18 months. The TD3C-TCE (VLCC spot earnings) reached a low of -6,779 USD/Day in March 2021, as VLCC and other crude carrying sectors simply lacked the consumer demand for oil.

Government responses to Covid-19 forced people to remain at home, reducing the need for crude oil products like petrol, diesel, and jet fuel, not essential in a world under house arrest. An oil price war between Russia and Saudi Arabia resulted in oil supply heavily outweighing demand and a surge in requirement for floating storage. This forced VLCC earnings up to an eyewatering 264,000 USD/Day in March 2020. These rates then plummeted after an OPEC production cut was agreed, and consumer demand reached its Covid-19 induced record low. The earnings have struggled to make their anticipated recovery since.

Values

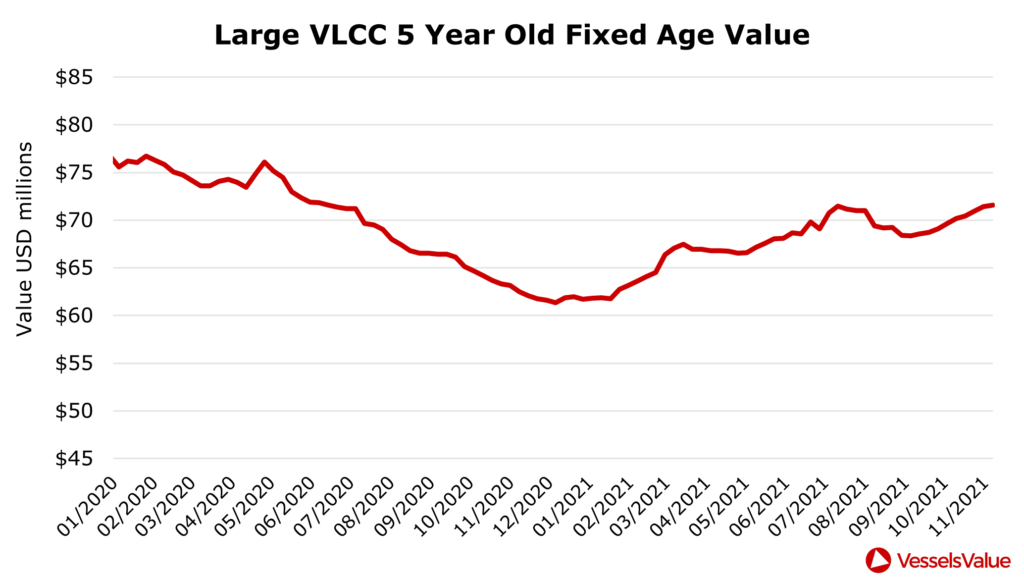

This is best demonstrated by looking at VLCC values. A five year old generic VLCC saw its value drop from USD 75.39 mil in 2019 to USD 62.47 mil in 2020, a startling decrease in value of 17.1%. The constant threat of Covid-19 outbreaks, particularly following the emergence of the Delta variant, has kept many major economies in flux. Consumer habits pre pandemic, such as driving to work and flying for business regularly, have only made a limited return since.

However, with the pandemic seemingly waning, VLCC values have risen. That same generic five year old VLCC has seen its value increase by 14% from USD 62.47 mil to USD 71.57 mil from this time last year, shown in Figure 1. High steel prices have forced the price of newbuild Tankers up, with the younger live fleet also increasing in value as a result.

S&P

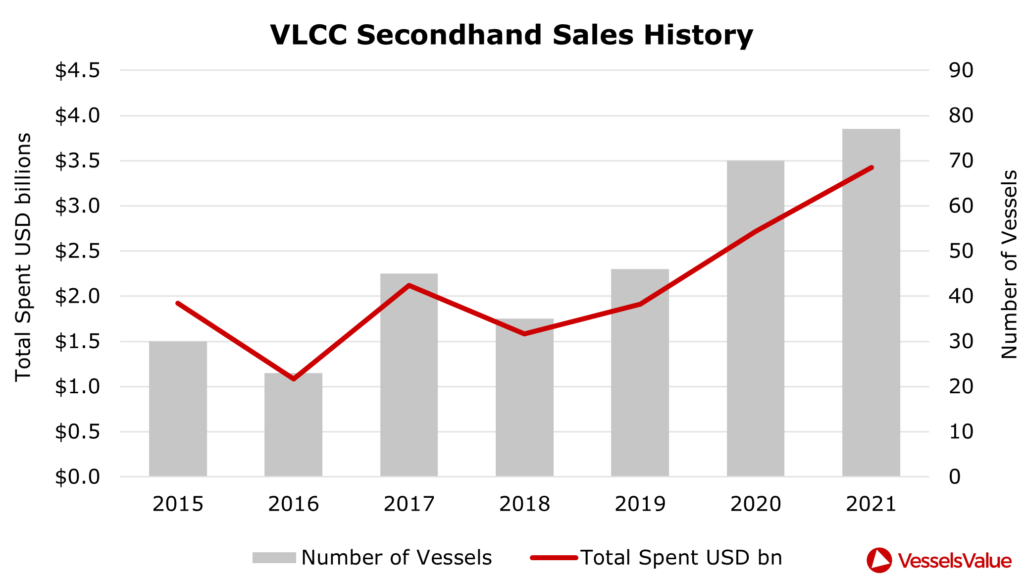

The S&P activity in the VLCC market has continued to increase year on year, despite the effects of low earnings. 77 VLCCs have already changed hands so far this year, shown in Figure 2, up from 70 in 2020, 46 in 2019 and 35 in 2018. Rather than being reflective of a strong market, the increasing activity has likely been driven by owners’ desire to position themselves with reliable vessels in the event of a market recovery, capitalising on lower prices for the majority of the last 18 months.

The high S&P activity has also contributed to the recent firming of VLCC values. Some notable sales from 2021 include the Nissos Antiparos and Nissos Santorini (319,000 DWT, Jul 2019, Hyundai Heavy Ind.) from Okeanis Eco Tankers to Frontline Ltd. for USD 90 mil each in June. More recently in October, we saw International Seaways part with six VLCCs on 10 year bareboat charters for a total of USD 375 mil.

Owners

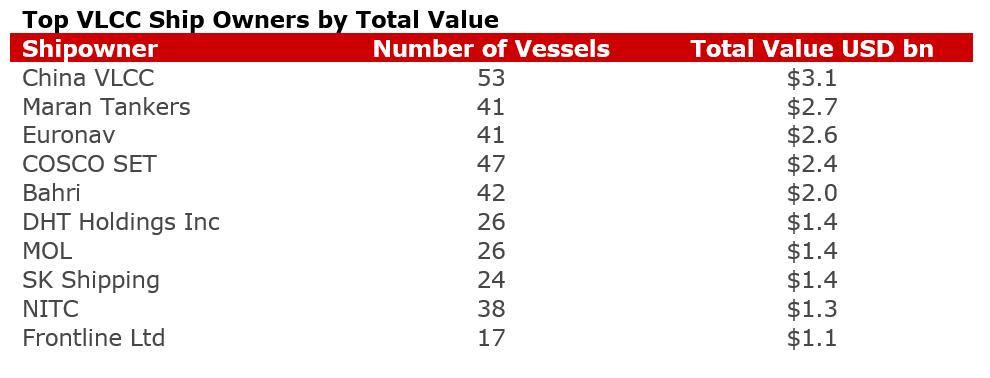

These promising signs bode well for the world’s top VLCC owners. Greek and Chinese owners have 458 of the world’s 915 live VLCCs with the top two owners being China VLCC and Maran Tankers, owning 53 and 41 vessels respectively. Combined, these two companies have a VLCC fleet worth USD 5.8 billion, as seen in Figure 3.

Demolition and Newbuild Orders

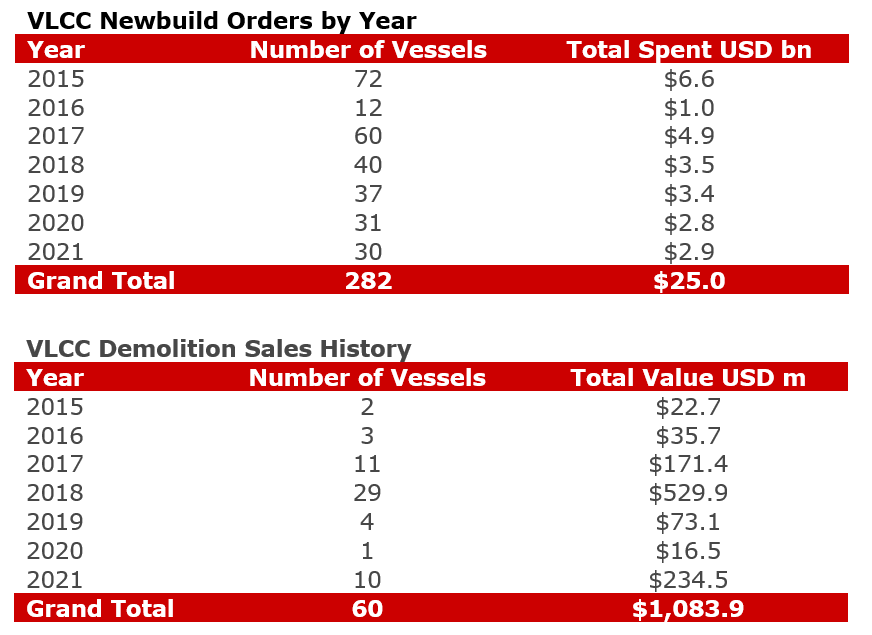

But for the majority of the last year, lacklustre Tanker earnings and record high steel prices have made older tonnage more attractive for scrapping. The number of VLCCs scrapped in 2019 and 2020 combined was five. There have been 10 demolition sales in 2021 so far, representing a vast increase in the removal of VLCCs from the fleet. Local infrastructure projects have sent sub continent demand for scrap metal through the roof. Consequently, the price has risen to over 600 USD/LDT and has remained at these record levels for several months.

Despite newbuild orders slowing in the past few years, 2021 has seen a total of 30 orders, with Greece’s Central Mare and Maran Tankers responsible for four each. Figure 4 shows the difference between scrapping and ordering activity. There are 75 VLCCs on order currently, representing 22.7 million DWT in oil carrying capacity. The future fleet development looks positive with additions far outweighing the current scrapping rates. The average age of the live fleet is just 9.7 years old, signalling a healthy VLCC sector.

Outlook

A growing number of VLCCs, despite a poor performance for the entire Tanker sector this past 18 months, is reflective of a wider issue. Even with many government commitments to decarbonisation, oil still seems to have a future at least in the short to medium term. The US alone consumes around 20 million barrels per day, and while this demand is present, the growing fleet of crude carriers will continue to trade.

LNG

Background

LNG is a crucial fuel globally and hence its transportation method is vital. Although pipelines are used in some instances, specialised LNG carrying vessels have become the norm for LNG trade. The heaviest routes of 2021 being Australian, USA, and Middle Eastern exports to Asia. Australia to China alone has resulted so far in 234.791 bn CBM-NM.

LNG carriers follow a seasonal sentiment pattern, with the highest earnings coinciding with the northern hemisphere’s winter. As the cold sets in, LNG is used as a primary source for heating in many homes. The Covid-19 pandemic has not had a hugely detrimental effect on LNG carrying vessels as the gas required to heat buildings was in firm demand as the 2020/21 winter was particularly cold.

Earnings

The BLNG1 (LNG spot market) reached a high of 230,000 USD/Day in January 2021 as Europe depleted its gas supplies and began importing. However, as of November, the same spot market is at a three year high of 424,000 USD/Day. This represents a staggering 84% increase and is still rising.

Values

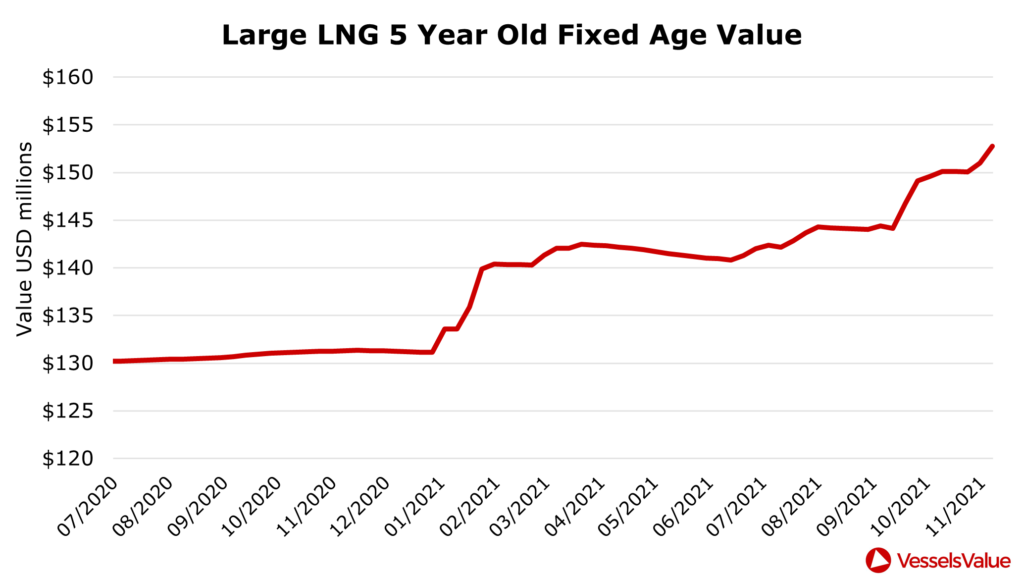

As with VLCCs, increases in earnings led to increases in values for these vessels. Figure 5 shows that in 2020 a generic five year old Large LNG vessel was worth USD 131.31 mil, but in 2021 this has grown to USD 152.74 mil, a 16.3% rise.

These record earnings and values come amid an ongoing global energy crisis. A perfect storm of unreliable renewable energy sources, diminishing supply of LNG from the globe’s largest producers, and freezing conditions that left European reserves diminished, has resulted in the price of LNG soaring. Germany’s reluctance to approve the Nord Stream 2 pipeline from Russia, only further encouraged the price rise in Europe.

Owners

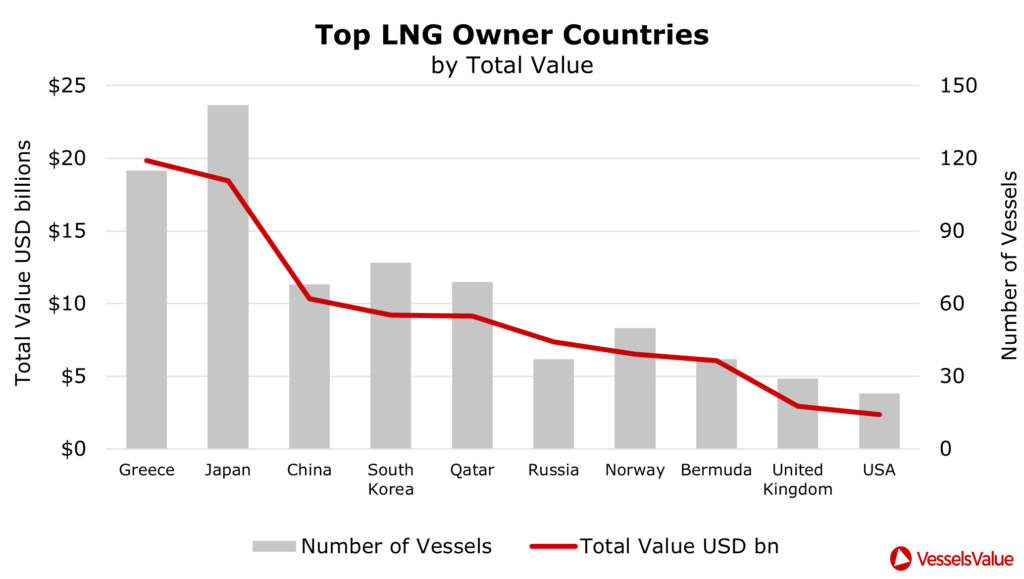

This comes as welcome news to some of the largest owners of these vessels as earnings have never been better, and fleet values have rocketed. Figure 6 shows that Greece and Japan lead the way in terms of number of vessels and asset value. There are 142 Japanese owned LNG vessels on the water, with a value of USD 18.4 billion. Greece, meanwhile, has 115 vessels but takes the largest share of value with a fleet worth USD 19.8 billion.

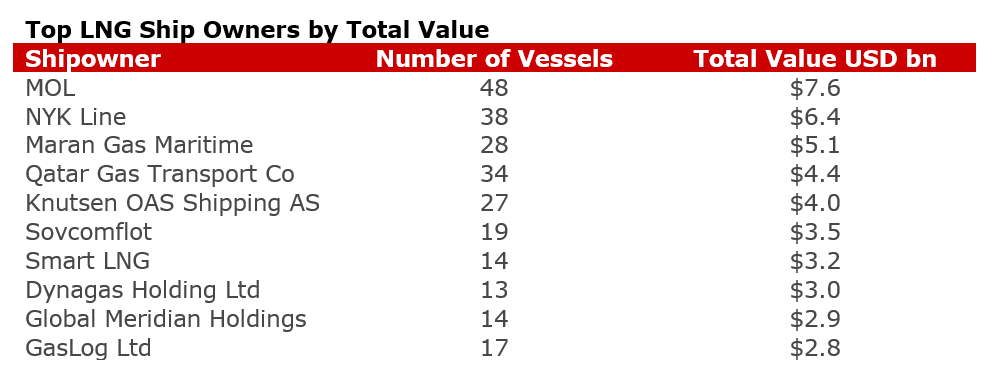

The top LNG vessel owners are the Japanese MOL and NYK Line, with 48 and 38 vessels respectively. Combined, their LNG fleets are worth USD 14 billion, as shown in Figure 7.

Demolition and Newbuild orders

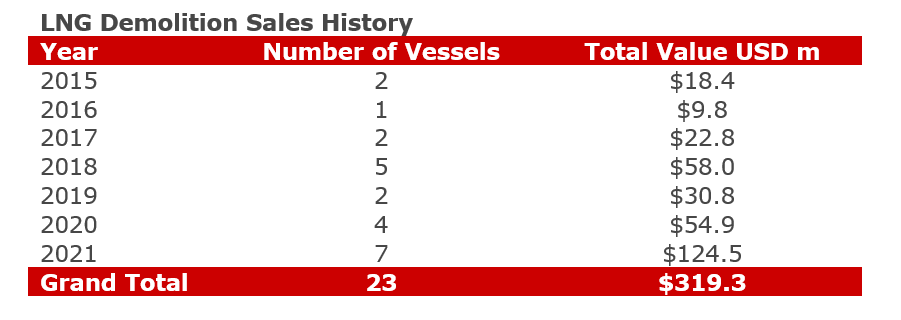

As for fleet development, the outlook is positive for LNG carriers. The orderbook has expanded hugely in the last five years, from eight newbuild orders in 2016 to 73 so far in 2021. This, when combined with single digit LNG demolition sales year on year (see Figure 8), bodes well for an increasing fleet size with a total of 172 vessels due for delivery in the next four years. This is likely to become more important soon, as for many, LNG is the key in the movement towards net zero.

Outlook

LNG has a far lower carbon impact on the environment when compared to traditional fossil fuels such as oil and coal. Consequently, it is seen by many as a solution to reducing carbon emissions, whilst waiting for greener energy sources to mature and become viable at a scale like that of hydrocarbons. LNG fuelled vessels have become increasingly common.

Future

With the IMO’s aim to reduce carbon emissions by 40% by 2030 and 70% by 2050 compared with 2008 levels, LNG provides a practical short medium term solution. The fuel has a strong supply infrastructure, reduces both the release of carbon dioxide and NOx gases, and prevents vessels from needing to lower speeds to cut their carbon footprints in line with IMO regulations.

The IMO’s EEXI (Energy Efficiency Existing Index) and EEDI (Energy Efficiency Design Index) for current and newbuild vessels respectively are relatively new measures designed to regulate vessel emissions and impacts on the environment. With conformity to be required, it seems the shipping industry is finally taking seriously the impact it has on the climate.

Conclusion

To fully replace oil and coal, key drivers of CO2 emissions, a global switch to green energy sources will be required. In the short term, this seems unrealistic and helps explain the forecasted fleet growth of VLCCs. With Tanker rates expected to return with consumer demand, the values of these vessels will likely follow. Hence, we can expect that oil carriers like VLCCs do have a future in the distribution of product globally, with oil still crucial to our current energy consumption.

Environmental concerns are a key component in the increasing size of the LNG fleet. These vessels seem to have a promising future, as natural gas is a far cleaner method of generating energy. With a healthy infrastructure underpinning it, LNG provides a robust shorter term method of reducing our carbon output in anticipation of green energy sources becoming more reliable and readily available in the future.

Data as of December 2021.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?