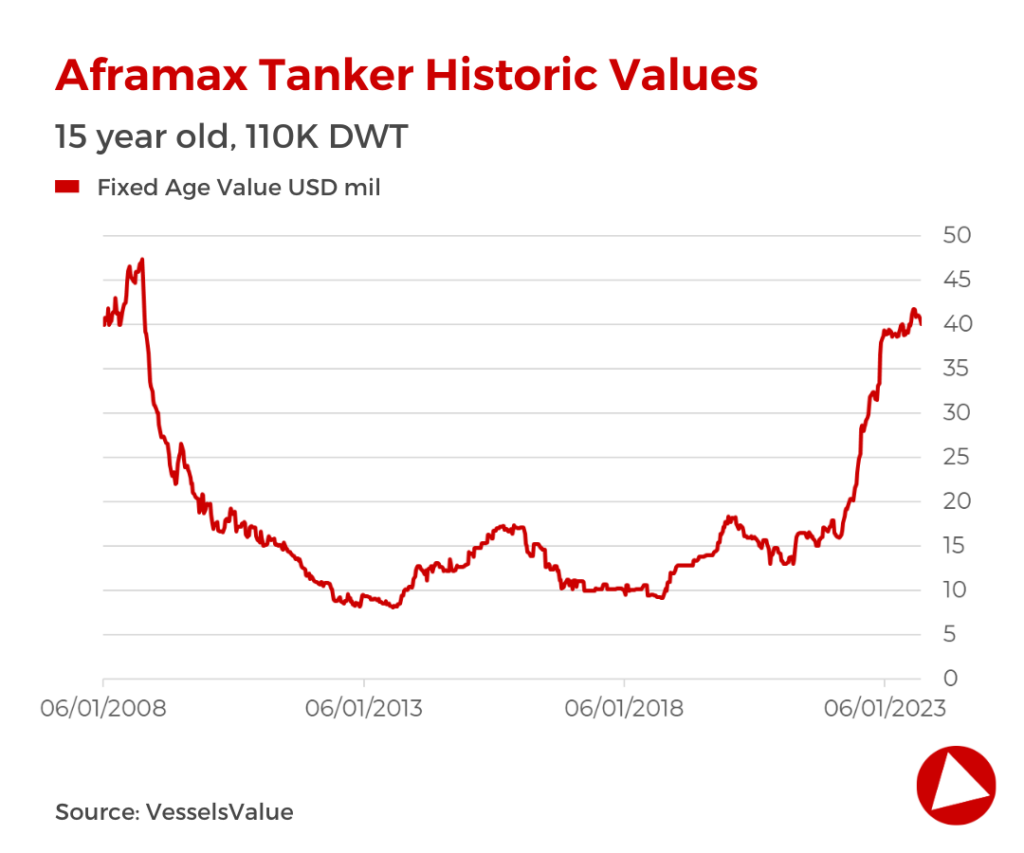

Aframax values hover near historical highs

15YO Aframaxes valued at USD 40.04 mil in September 2023

In recent weeks there has been a slight correction in values based on the latest benchmark sales. However, year on year values for this sector are up across all age categories, for example 15YO vessels of 110,000 DWT are up by c.20.95% from USD 31.88 mil to USD 38.46 mil as values hover close to the record highs of September 2008.

Notable sales include the Aframaxes Anavatos 2 and Fulmar (115,00 DWT, Jan 2009, Hanjin HI) sold to Unknown Middle Eastern buyers for USD 79 mil en bloc, VV Value USD 86.17 mil. This time last year, the same vessels were valued at USD 70.52 mil.

Greek owners been behind a high proportion of the sales, offloading 37 vessels so far this year or c. 35.6%. The United Arab Emirates are currently in second place with c. 15%, Canada and China rank joint third with c. 8.4%.

Many sales continue to be to Unknown buyers, accounting for c. 38.3% since the start of 2023. Sales to unknown buyers has been a trend that we have encountered over the past year. Since the sanctions on Russian commodities came in to force a new breed of Tanker market player has emerged keen to take advantage of potentially elevated earnings.

Overall sentiment for this sector remains positive and Aframax newbuildings have increased by c. 191.7% YoY with 70 new contracts reported in this sector so far this year. The fact that there have been no demolition sales reported this year highlights the continued strong demand for this sector, and as values remain high, there are plenty of prospects for secondhand sales of older vessels at an age where such vessels would previously have been scrap candidates at current earnings levels.

Although the spot market has seen some volatility, the time charter market remains firm and one year time charter rates for Aframaxes are currently up by c. 44.9% year on year to around USD 41,770 USD/Day as Aframax earnings continue to outperforming the larger Suezmax sector.

Want to know more about how our

data can help you assess the market?