An Overview of the Ferry Market

Freight Demand Main Catalyst for Fleet Growth Since 2012

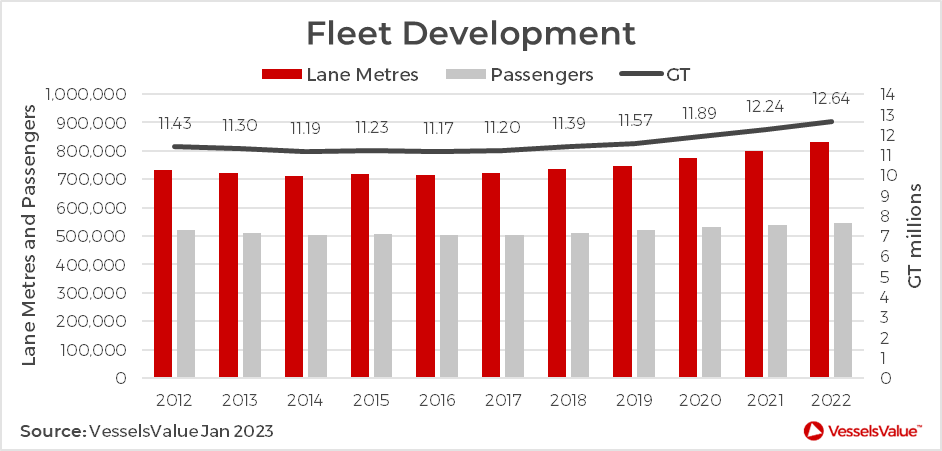

Looking at fleet development from Midsizes upwards, steady year-on-year (YoY) net growth has been evident since 2016, up +1.47 mil GT (+13.2%) inclusive of 2022. The main catalyst behind this growth has been stronger demand for freight capacity, adding 116,285 Lane Meters (+16.2%). By contrast, passenger capacity firmed at a slower pace of +8.6%, at just over half the rate.

Ageing Fleet Under Pressure

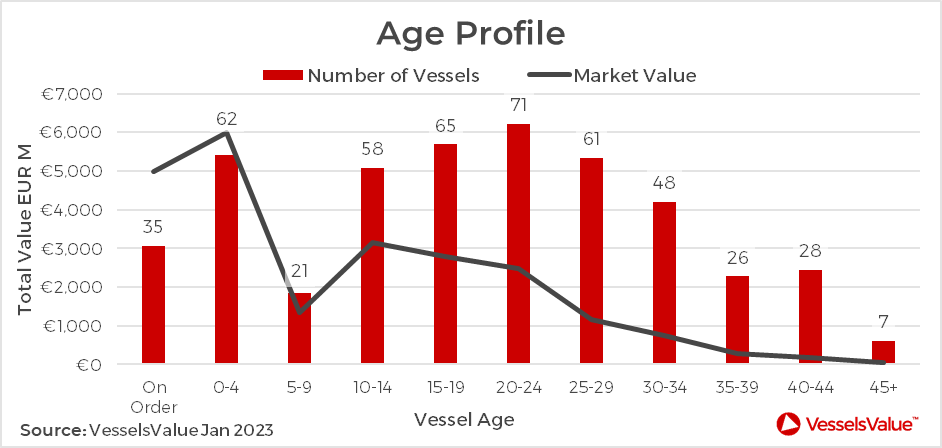

Almost a quarter of the fleet above >12,999 GT is 30 years of age or older comprising 109 vessels. This is high, and these would be prime candidates for demolition in most deepsea sectors. However, this is not the case for shortsea Ferries, especially for assets trading in main market Europe. Cruise type Ferries, for example, are known to operate into their forties and beyond on Baltic and Mediterranean corridors. Achieving respectable prices on the S&P market as seen by the sale of 42YO Rosella (16,879 GT, 1530 PAX, 720 LM, 422 Cabins, April 1980, Meyer Turku Shipyard) transacting at EUR 11.25 mil last month, VV valued this ship at EUR 11.29 mil the day before sale.

This mature group of Ferries have a combined value of EUR 1.26 bil as of January 2nd. However, their worth is likely to come under increased pressure later this decade once the International Maritime Organisation’s (IMO) new green regulations on CII (Carbon Intensity Indicator) are fully policed. Ultimately, this will force ships to steam slower, and ship owners to nominate inefficient, vintage units earlier to the breakers.

Furthermore, if the EU continues to push forward with a levy based approach to CO2 emissions, this spells trouble for smaller, less capitalised European shipowners. VesselsValue estimates c.23% of the fleet is exposed based on an average demolition age of 42. We could be approaching peak values for 30-35 year old tonnage, based on a de facto age restriction from CII.

Top 10 Ship Owning Nations by Market Value

Italy is the top owning nation by Market Value (>12,999 GT), holding a staggering USD 4.04 bil (16.8%) worth of fleet including live, on order and subsidiaries. China takes second place based on USD 2.64 bil (11%), followed closely by Japan in third at USD 2.56 bil (10.6%). Eight of the top ten ship owning nations by Market Value are European.

Top 10 Companies by Market Value

Grimaldi Group has the most valuable Ferry fleet by Market Value when ranking top companies (>12,999 GT), owning an impressive USD 1.49 bil (6.2%) of fleet including live, on order, and subsidiaries. Tallink Group take second place based on USD 1.31 bil (5.4%). Followed by Stena Group in third at USD 1.27 bil (5.3%). Notable companies outside of Europe include China’s ICBC Financial Leasing, and Bank of Communications Financial Leasing (BoComm) ranked sixth and seventh globally.

Focussing on European companies outside of the top ten, Brittany Ferries stand out owning USD 346.81 mil (EUR 328.67 mil) of fleet excluding Condor Voyager (6,581 GT, 843 PAX, 380 LM, Nov 2000, Incat), based on seven Ferries averaging EUR 46.95 mil per vessel. VV offers daily values in EUR and GBP currency, in addition to USD for this sector.

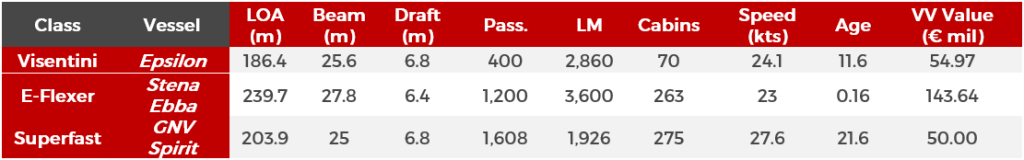

Visentini, E-Flexer and Superfast Class

Ferries are known for their uniqueness, typically built for specific routes and markets. However, standardisation exists within the sector determining a sweet spot for LOA, beam, draft, passengers, freight, cabins, speed and deck configuration, resulting in higher sales interest in the S&P market.

Visentini builds remain highly desirable RoPax Ferries, as seen by the sale price of 11.6 year old Epsilon (26,375 GT, 400 PAX, 2,860 LM, 70 Cabins, April 2011, Cantieri Navale Visentini), sold to EuroAfrica for EUR 50 mil on May 24th 2022. VV values Epsilon at EUR 54.97 mil as of January 2nd.

Stena’s E-Flexer’s from Jinling Shipyard Weihai, designed by Stena RoRo and Deltamarin, are a notable size upgrade to the Visentini’s. Each vessel has been adapted for the specific needs of their customers, including Stena Line, DFDS, Brittany Ferries and Marine Atlantic. Stena Ebba and Stena Estelle are the largest in class, offering an impressive 3,600 Lane Meters and 1,200 Passengers that can run on either methanol or LNG, as an alternative to diesel. VV values Stena Ebba at EUR 143.64 mil as of January 2nd.

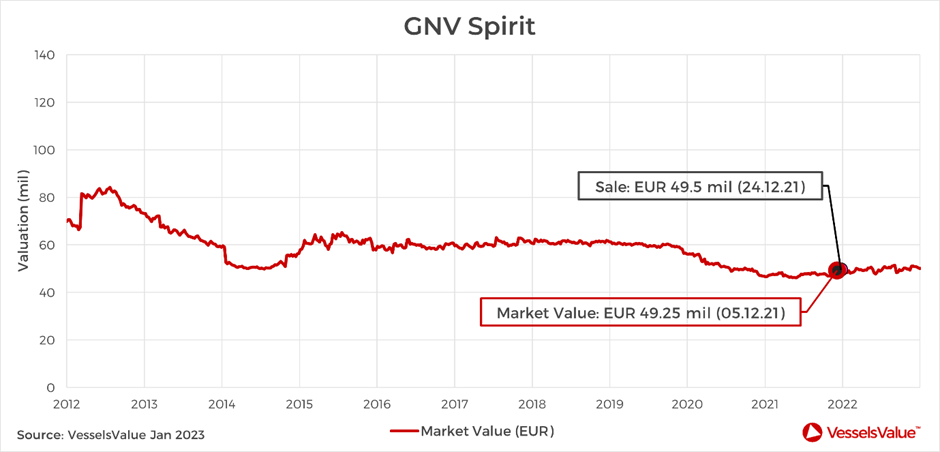

Finally, the Superfast class remain excellent passenger Ferries offering increased speed without compromising on freight. Twenty year old assets still attract firm buyer interest, as demonstrated by the sale price for Cap Finistere (32,728 GT, 1,608 PAX, 1,926 LM, 275 Cabins, Apr 2001, HDW) sold by Brittany Ferries to MSC / GNV for EUR 49.5 mil in December 2021. VV values GNV Spirit, previously Cap Finistere, at EUR 50.00 mil as of January 2nd.

Most Valuable Live Ferry Today

Full Speed Ahead

Ferries aged 30 years and older, comprising c.23% of the fleet (>12,999 GT), face major headwinds later this decade. This is based on tightening green regulations from the IMO, and growing pressure from the EU to implement a carbon tax for Shipping. Additionally, a major global recession is lurking potentially more destructive than the last. This will likely weigh on earnings and values in the midterm, particularly for passenger focussed Ferries.

Asset prices for RoPax Ferries and Cruiseferries (>12,999 GT) have held up relatively well until now. Going forward, values are going to come under increased pressure and more scrutiny as we enter a new green era for Shipping, shining a perpetual spotlight on energy efficiency. New investors are also entering the market familiar with daily valuation models, bringing new ideas and expectations with them.

VesselsValue data as of January 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?