Brexit’s Impact on UK Trade. What is really happening?

While the UK formally left the EU and the European Common Market Area in January 2020, the Transition Period which was in place until 31st December 2020 allowed for the trade relationships between the UK and the EU to continue essentially unchanged. Now that Brexit has officially come into force, we can examine the impact it has had on bilateral trade between the UK and its trading partners. VesselsValue’s AIS and GIS derived trade flow data offers a unique perspective from which to assess trade impacts, tracking imports and exports in real time. This provides up to date views of trade patterns ahead of most official statistics.

The Context: Brexit and Covid19

The year 2020 was truly a year of challenge and change as the enormous interruptions to economies worldwide due to the Covid19 pandemic had a significant impact on trade patterns, globally as well as in the UK. With Brexit having occurred while the wider economy was still affected by the pandemic, any changes in trade volumes could be attributable to:

- The impact of higher tariffs / non tariff costs of doing trade after Brexit.

- The impact of the pandemic on wider economic activity and demand levels.

- Traders’ behaviour in attempting to alleviate some of Brexit’s anticipated effects.

Within this context of overlapping and interlinked influences, the detailed and real time data based on VesselsValue’s tracking of the global maritime fleet allows us to begin to disentangle the impacts of Brexit on trade over time and across different sectors.

Brexit: the impact on trade volumes

While aggregate trade statistics are an important indicator and commonly cited, any policy or regulatory change is likely to affect different economic sectors differently.

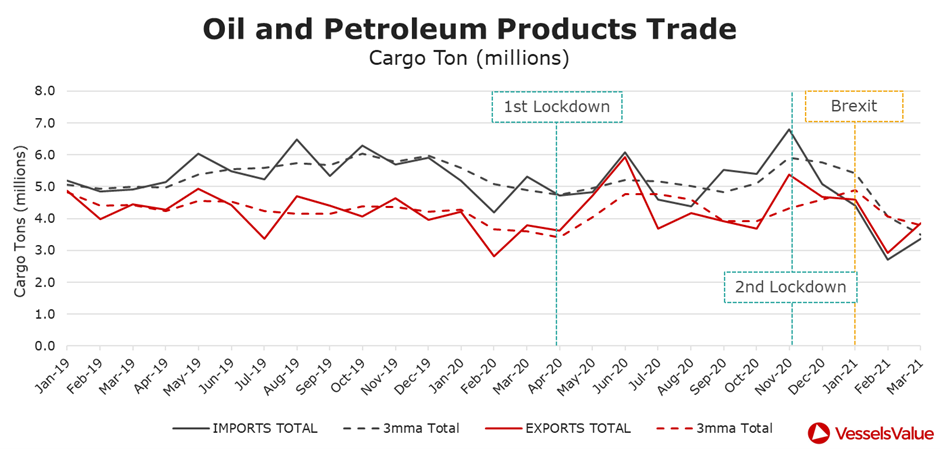

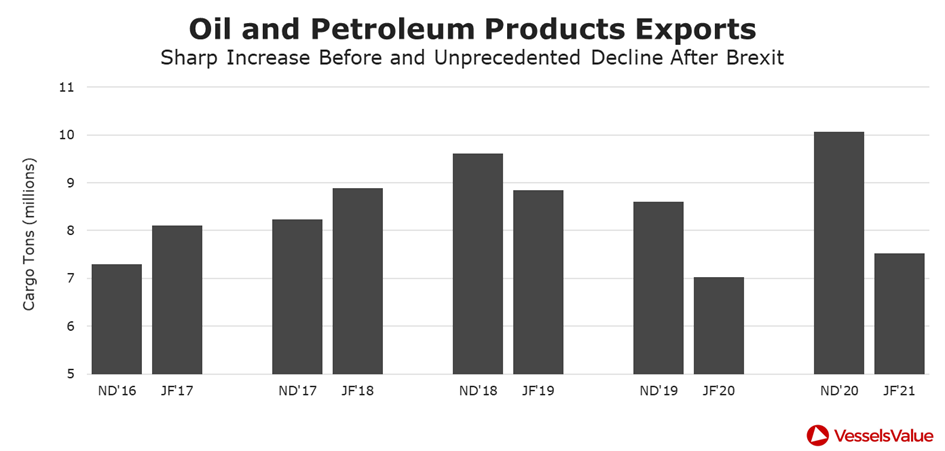

Oil and petroleum products: imports and exports fall to their lowest in recent history

For Oil and petroleum products, while trade rebounded sharply after the initial lockdowns, activity settled at a broadly reduced level for the summer months. Towards the end of the year, November registered the largest volume of imports going back to at least 2015 at 6.79mt. This burst of activity was short lived, however, and was followed by a sharp drop to a February low of 2.7mt (the lowest since 2015 by some margin). While we saw a slight recovery in March, imports remain extremely weak. Exports from the UK, while somewhat less volatile than imports, followed the same pattern.

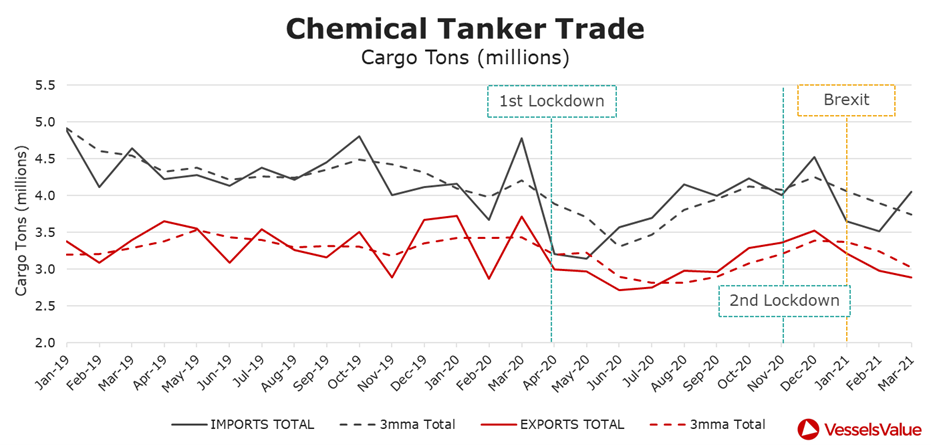

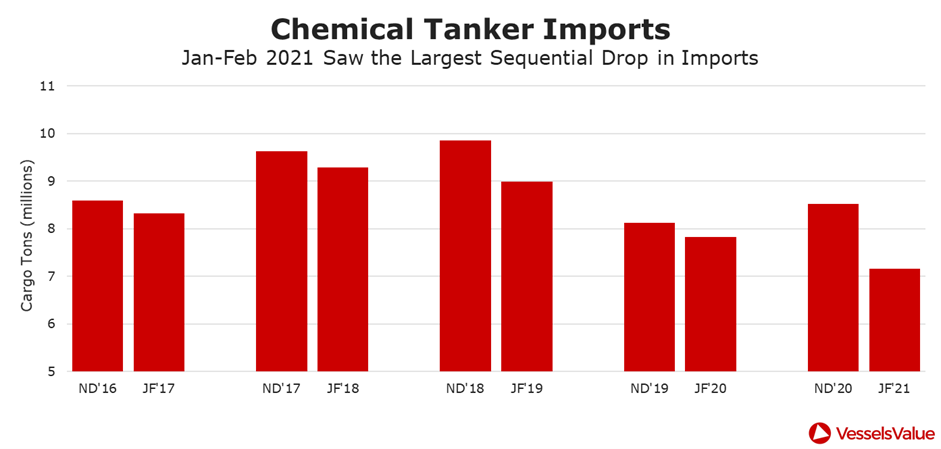

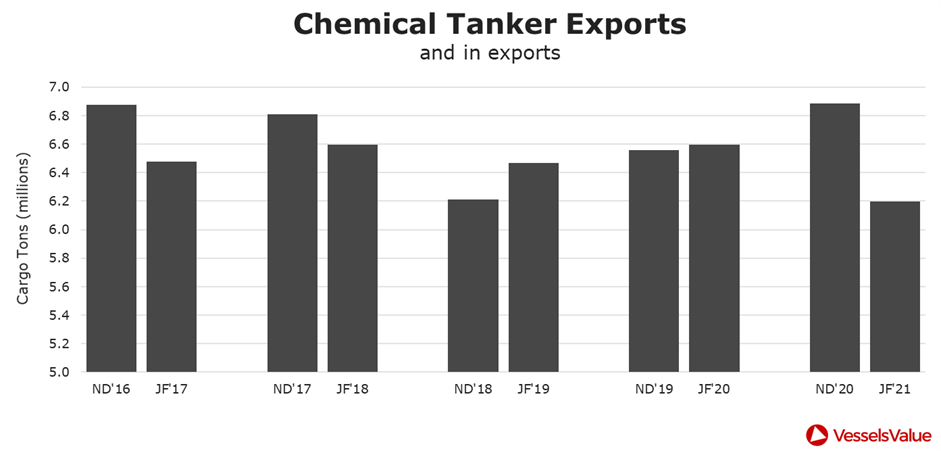

Chemical products: sharp decline post Brexit

Chemical products show a similar pattern to Oil and petroleum products, with substantial weakness in both imports and exports after the first lockdowns in early 2020. Following a ramp up in activity towards the end of the year, “real Brexit” brought renewed declines in trade in early 2021. Unlike the Oil sector, the UK’s Chemical product exports continued to decline into March.

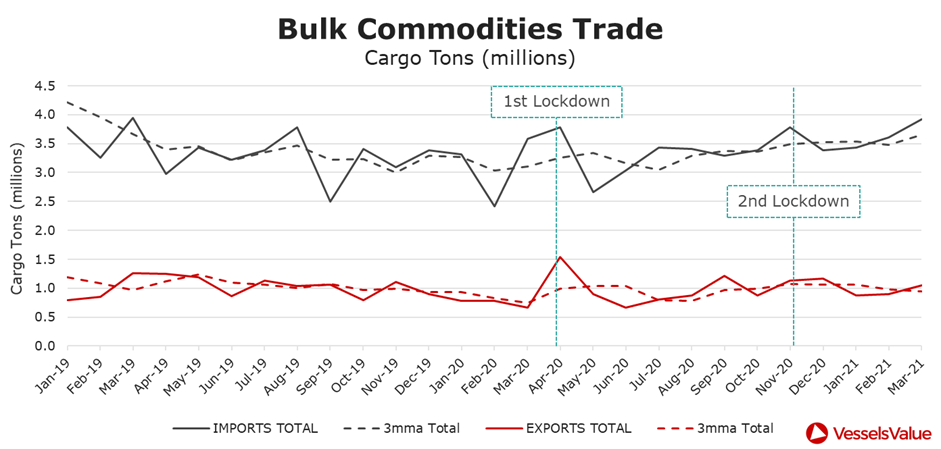

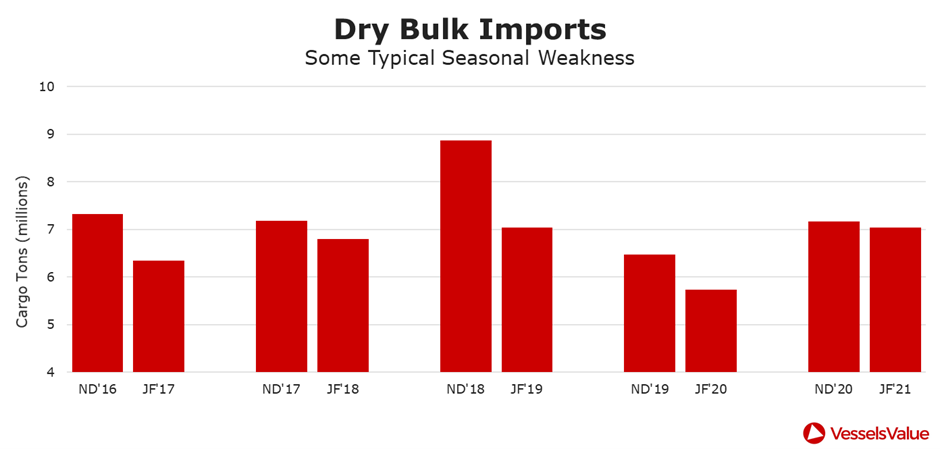

Dry Bulk Commodities trade: “steady as she goes”

Dry Bulk Commodities are seeing volatile trade, but very different patterns of impact to Oil or Chemicals. Activity has been far more resilient, with imports in particular picking up strength into 2021.

Brexit: the evidence for pre-Brexit stockpiling

While Brexit itself has clearly impacted trade, there could be impacts driven by the expectation of Brexit and what would happen after it took place. For example, if a UK importer expects an increase in either tariff or non tariff costs of trading, they may choose to build up inventories in the UK ahead of the Brexit date and increase their imports. Similarly, if a UK importer expects GBP to weaken after Brexit, they too will have an incentive to build up inventories ahead of Brexit. Similar considerations apply to overseas-based importers, who will have incentives to build up inventories of UK sourced products ahead of Brexit if they expect trade costs to increase or GBP appreciation.

Using detailed VesselsValue AIS and GIS derived trade flow data, we can examine whether the UK’s imports or exports reveal a certain amount of precautionary inventory building ahead of Brexit itself. To analyse this, we have considered the volume of trade in the two months following Brexit (Jan-Feb ’21) relative to the two months immediately before Brexit (Nov Dec ’20) and compared those volumes to recent history.

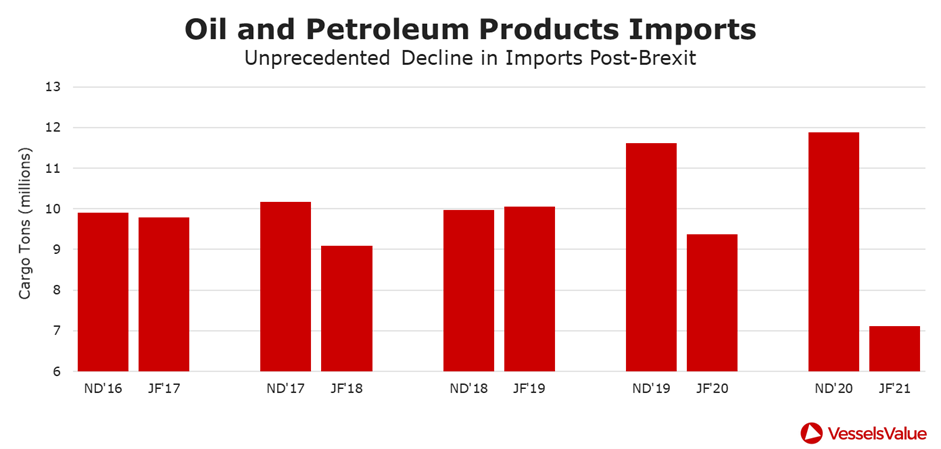

Oil and petroleum products: significant apparent build up of inventories

UK based importers of Oil and petroleum products appear to have engaged in a significant amount of precautionary inventory building just before Brexit. Considering the volume of imports in the 2 months preceding Brexit, we have seen the highest level of imports in recent history and 2% higher than in 2019 despite a smaller economy than in the previous year. This was immediately followed by a 40% drop in imports in the first 2 months following Brexit.

Considering the behaviour of importers of UK-origin Oil and petroleum products, we again see a substantial increase in purchasing immediately before Brexit (17% higher year on year), which is then followed by a 25% decline into January and February.

Chemical products

While not as drastic as Oil and petroleum products, we have strong evidence of precautionary purchasing in Chemical product markets as well both by UK importers and by overseas importers of UK products. For example, while UK imports were 5% higher in November December than in the previous year, they declined by 16% during January and February.

Similarly, UK exports of Chemical products showed a significant increase just before Brexit (+5% year on year), which was then followed by a very significant drop immediately after Brexit of 10%.

Dry Bulk Commodities

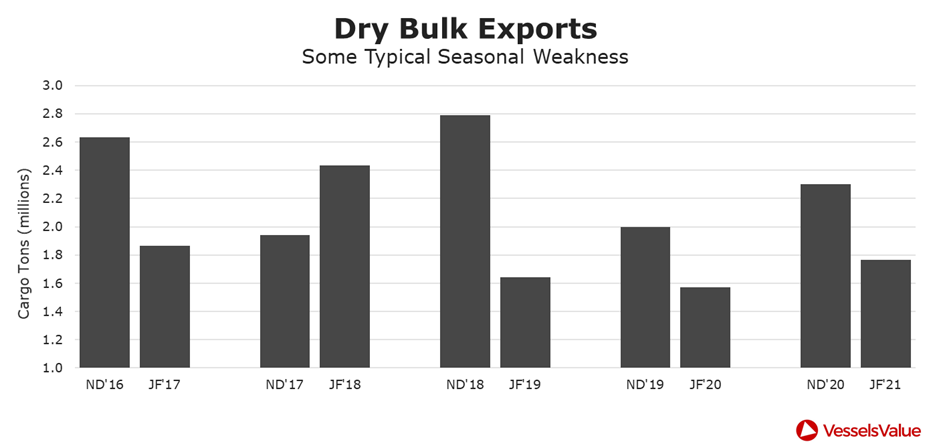

When considering whether UK based or overseas-based traders undertook any stockpiling of dry bulk commodities ahead of Brexit, in the expectation of increased costs or adverse currency moves following Brexit, the sector again shows a very different pattern to either the Oil or the Chemicals sectors. Specifically, there is no evidence of inventory building in dry bulk commodities, either by UK based importers or by overseas importers of UKorigin products.

Brexit: the impact on trade partnerships

In addition to the volume of trade over time and across sectors, VesselsValue detailed shipping data allows us to examine how Brexit is impacting the UK’s trading relationships.

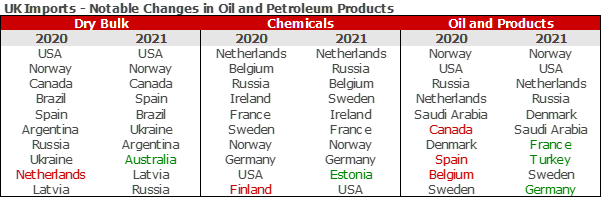

Considering the top 10 trading partners for UK importers in each sector, there has been very little change in where the UK sources imports from between 2020 and the first 3 months of 2021. In Dry Bulk commodities, The Netherlands has been replaced by Australia. While the UK’s relative share in the global Dry Bulk trade is small, shifts like this, if prolonged and widened further, could prove supportive for Dry Bulk shipping markets.

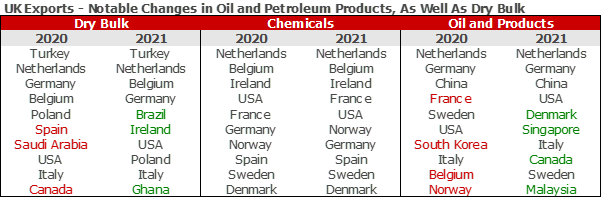

Regarding UK exports, there is no change in the top 10 trading partners for Chemicals, but there have been notable changes in both Dry Bulk and Oil and petroleum products. While the changes in Dry Bulk are relatively less impactful due to the UK’s relatively small scale in this market, in Oil and petroleum products the UK has replaced three short sea destinations (France, Belgium, Norway) with three much more distant trading partners (Singapore, Canada, Malaysia). This analysis is based on three months of data since the effective Brexit took place. However, if that shift in who the UK trades with is sustained or expanded further going forward, it could have more significant implications for demand and supply in the Tanker shipping markets.

Summary

VesselsValue’s rich and real time trade data allows us to analyse in detail, and ahead of the release of official statistics, the UK’s emerging trade patterns as we move into the “post Brexit” phase. There is clear evidence for significant declines in Oil, petroleum product and Chemical product trades immediately after Brexit. Apart from a general slowdown of economic activity associated with the effects of Covid19 and increased costs of doing business post Brexit, there is strong evidence to suggest that at least part of the decline in trade sector wide in early 2021 has been driven by precautionary building up of inventories in the final months of 2020. This suggests that much of the decline in trade we have witnessed may reverse as those inventories begin to draw down.

We will continue to monitor the trade situation and report on any further developments.

Trade Data from VesselsValue as of May 2021.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?