Bulker values increase by nearly 50% in one year

Dry bulk values increase as Capesize earnings reach the highest seasonal levels since 2010

Values increase

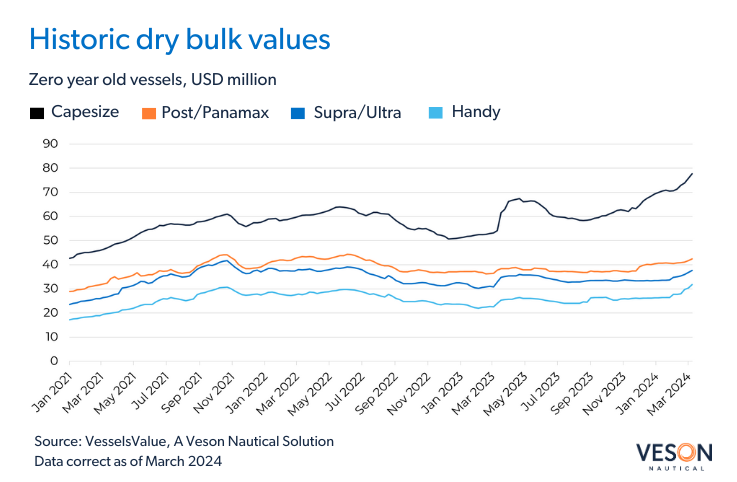

Values for Bulkers have been going from strength to strength this year, up across all ages and size categories, notably in the Capesize and Supramax sectors. In the Capesize sector, values for 20 YO vessels of 180,000 DWT have shot up by c.39.6 % from USD 13.86 mil to USD 19.35 mil, the highest levels since 2010. On the other end of the scale, newly delivered 0 YO Supramaxes of 60,000 DWT have firmed by c.12.6% since the start of the year from USD 33.44 mil to USD 37.64 mil.

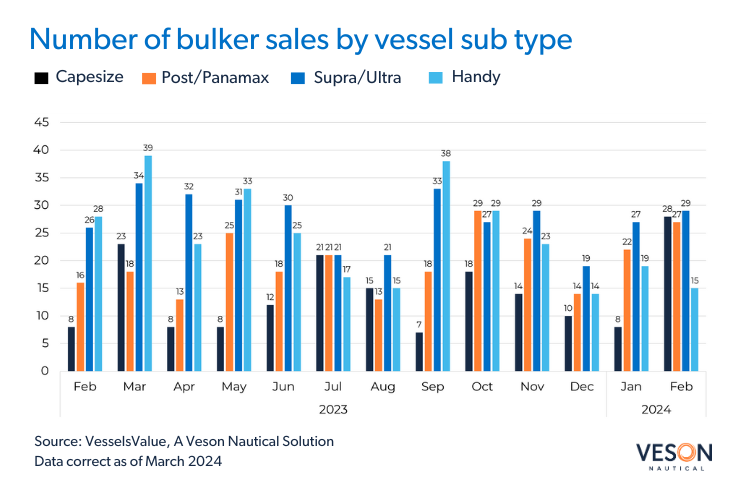

Year-on-year Capesize values have seen impressive gains and 0 YO vessels of 180,000 DWT have increased by c.43.3% from USD 53.25 mil to USD 76.22 mil. To date, the volume of Capesize sales has more than doubled from the same period last year, with 42 sales reported since 1 January 2024 compared to 20 sales for the same period in 2023.

The Bulker sale and purchase market has been very active showing a c.35% year-on-year increase. In February 2024 there were 33 Capesize sales concluded compared to just nine in February 2023, an increase of c.267% year-on-year. For the Supramax sector, this figure increased by c.20%. Greek buyers were the most active in the Capesize sector accounting for c.33% of purchases; they also ranked first in the Supramax market alongside Chinese buyers with a share of c.28%.

The recent surge in values can be attributed to robust earnings, especially notable during this time of year. Traditionally, Q1 is considered a quiet period for Bulkers due to seasonality and the Lunar New Year celebrations in the Far East, which typically lead to a temporary pause in market movement. However, this year is an exception with current Capesize earnings reaching the highest seasonal levels since 2010. At the time of writing, spot rates for Bulkers are around 35,750 USD/day, which is more than double the levels seen at this time last year when rates were around 15,000 USD/day. This spike can be credited to Chinese trade surpassing expectations, indicating a positive shift in global trade patterns in the first few months of the year.

Additional tonne mile demand has also provided support to Bulkers earnings as security concerns in the Red Sea have led to disruptions in the Suez Canal, prompting many owners to contemplate longer journeys around the capes as a means of avoiding these troubled areas.

Notable sales

Notable recent sales that have continued to push values higher include: the Capesize (Newcastlemax) Shin Koryu (208,000 DWT, Oct 2009, Universal) to Winning Shipping for USD 32.75 mil, VV Value USD 30.46 mil; the Supramax BC Bulk Monaco (63,700 DWT, Jun 2023, Shin Kasado Dock) sold to CTM Deher for USD 40.5 mil, VV Value USD 39.69 mil; and the Supramax BC Andromeda (61,500 DWT, Jan 2011, Oshima) sold to unknown Turkish buyers for USD 21.0 mil (DD Passed), VV Value USD 19.80 mil.