Car Carrier Bidding Wars Spark All Time Rates Boom

Bidding wars for Car Carriers are driving rates up to record highs never before seen in the sector. Eastern Pacific’s Lake Wanaka (4,902 CEU, May 2008, Xiamen Shipbuilding Ind) was fixed for 1 year at 50,000 USD/Day to Volkswagen in March. A premium of 10,000 USD/Day compared to the larger, younger Lake Geneva (6,178 CEU, Jan 2015, Imabari) fixed for 6 months to Glovis just 12 weeks prior. It won’t be long until we see fixtures at 75,000 USD/Day for Post Panamax units. Logically, we should expect higher based on the fundamentals.

It’s not just tonnage suppliers who are benefitting. Operators have started to earn quarterly profits finally worth bragging about after 6 years of pain, securing higher margins from spot business. Car rates of 200 USD/CBM (cubic meter) were being quoted by a leading European Operator this month because “vessels are overflowing with cargo.” Up from 100 USD/CBM last quarter. This is bullish. OEMs should take note and revisit freight contracts with Operators sooner rather than later to avoid disappointment. Space on ships has just got a lot more expensive.

Recent developments should not be surprising because underlying demand for cars has been strong since Q3 2020, after the first major wave of Covid-19 passed through Europe. Global light vehicle production slipped to just c.76.5 million units in 2021 weighed down by a chronic microchip shortage, compared to c.81 million of sales units reducing inventory by c.4.5 million. Less autos were made versus sold, depleting inventory which compounded month on month as production failed to keep up with sales demand.

Improved semiconductor material supply, and wider spread immunity from Covid-19 have enabled trade to flourish more freely this year. Auto analysts have just signalled a reduction in global production for 2022, cutting forecasts by c.2 million units based on soaring energy and raw material cost rises tied to the Ukraine and Russia crisis. Although a minor market for the sector, Russia supplies 40% of the world’s mined palladium used in catalytic convertors. Thus plays a critical role in material supply for auto production, presenting the next major potential headwind for the auto industry if the crisis drags on.

Commodity price inflation has gone crazy in the last 30 days. The price of nickel surged c.250% over 2 days in early March, used regularly in vehicle chassis. Oil continues to trend higher, driving bunker prices for IFO380 up c.21% this quarter. That being said, we are still looking at c.84 million for both sales and production 2022, equating to production growth of c.7.5 million compared to 2021.

Deepsea ships are speeding up this quarter, supporting firming cargo demand. Using VVs aggregated live vessel data to monitor average speeds for deepsea assets from 4000 CEU upwards, we can see that PCTCs are trading at their fastest pace in 9 years during March. Speeds are averaging 15.91 knots this month, up from 15.61 knots in February, versus 15.59 in January. OEMs want cars delivered quicker and are prepared to pay more for it, representing a significant power shift in favour of Operators.

You only have to get an online quote on your car to obtain a true sense of underlying demand in the market. Secondhand car prices have soared at unprecedented rates over the last 2 years due to chip shortages, by as much as c.46% including some top 10 models. Tesla have just raised prices again for its entire EV fleet charging up to 10% more. The cheapest Model 3 Rear Wheel Drive now starts at USD 46,990. Inventories in the US are desperately low. Prices for used vehicles have skyrocketed. Put simply, there are not enough cars to go around.

Shipowners follow production forecasts closely as it has proved to be an excellent metric to predict future demand on PCTCs. In recent years, c.18% of annual production has been shipped on Vehicle Carriers. Latest forecasts for 2022 suggest an extra c.1.3 million cars will be exported on deepsea services. Again, this is bullish.

Additionally, China is on the cusp of an export revolution on the back of surging EV demand, which is set to shake up the industry. Supported by an armada of Post Panamax newbuilds close to being inked for delivery in the second half of this decade. EVs comprise c.29% of all light vehicle sales in the Netherlands. France just topped c.20%. Norway is at c.65%, increasing to c.85% if we include hybrids. The US is at c.12% overall and climbing. The trend is clearly going north.

China is in pole position to throttle the market by leveraging on their c.80% share of global battery production, and c.30% share of all light vehicles sold globally. Over 80% of EVs sold in China are made locally by OEMs including SAIC-GM-Wuling, BYD, Great Wall, GAC, SAIC, Changan, Xpeng, Geely, NIO, and Chery. A vast list unparalleled elsewhere, primed to feed both developed and developing markets for years to come.

Tesla were smart setting up in China. They are expanding at their Gigafactory in Shanghai targeting 2 million EV sales this year, from 0.96 million in 2021. Comfortably out in front versus second placed Volkswagen at 480,000. Followed by SAIC-GM-Wuling in third based on 424,000 EVs sold.

We are yet to see Chinese brands penetrate Western markets, but it is only a matter of time based on the numbers. Chinese brands account for 17 of the top 20 bestselling EVs worldwide in January. The remaining 3 (Tesla Model 3, Tesla Model Y, Volkswagen ID.4) are also made in China (Source: EV-Volumes.com). Looking further, leading auto analyst JATO estimates c.25% of European EV sales could originate from China by 2030. Subject to safety regulation developments in Europe, China’s overall strategy on M&A and prioritized markets. Implying a monumental shift in trade volumes this decade as buyers switch on to China.

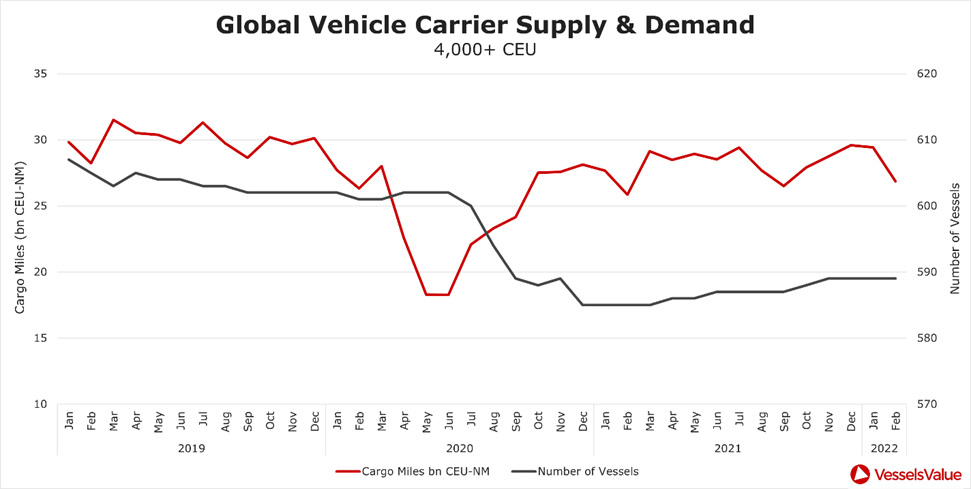

Focussing on global fleet supply, 5 consecutive years of low orders from 2016, combined with over exuberant scrapping activity by shipowners during the same period, laid solid foundations for short supply conditions embedded today. Last year bucked the trend as 53 vessel orders were confirmed, up 124% versus the historical average. Over 90% were 7000 CEU LNG Dual Fuel confirming a new standard. A healthy number, but it was left too late. Shipyards have now closed shop, fully booked until 2025.

Low net fleet growth will be further consolidated next year when the IMO’s regulations on EEXI and CII come into play. VV uses IMO ratified formula to provide EEXI estimates on every ship in the sector, giving clients an ability to check their ships and their competitors. This is of particular interest to owners when looking at tonnage they don’t own for both S&P and chartering purposes, and for banks when benchmarking their portfolios against other banks. VV estimates c.63% of the Vehicle Carrier fleet is EEXI noncompliant, presenting significant challenges for existing ships.

Shipowners are more nervous about CII ratings, and how this will impact their asset values and future borrowing power. Essentially, Operators could be forced to slow steam at peak demand periods, losing revenue to greener competitors. A genuine game changer which almost guarantees short supply for the next 2 to 3 years, pending no further global demand shocks.

Recent high sales prices achieved on the Hoegh Maputo (4900 CEU, Jul 2011, Xiamen Shipbuilding Ind) and Hoegh Singapore (4900 CEU, Nov 2011, Xiamen Shipbuilding Ind) raised eyebrows last month. Almost USD 80 million was spent by buyers Neptune Lines to secure a pair of 10 year old midsizes that have risen in value by c.61% since June 2021. Painful but necessary, and we expect this deal will prove good value in the long run.

As per VVs Fixed Age analysis which looks at the historic market value of an asset type with age depreciation removed, values are at 10 year highs. The sellers secured an excellent price, but so did the buyers relative to the alternative cost payable in the charter market going forward. Rates and asset values are likely to firm higher this year and next, as demand growth kicks in. This pair will hold value, retaining resale value into the next decade.

Is it too early to talk about six figure charters? Probably, but it’s no longer an impossibility based on embedded short supply supported by IMO regulations, and strong auto demand forecasts translating into increased shipments on PCTCs into the midterm. Revved up by the world’s insatiable appetite for EVs where China holds all the aces. Rates are rocketing but they have further to go. We are still early in this demand cycle.

VesselsValue Data as of March 2022.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?