Consolidation is King – Tidewater and Swire Pacific Offshore

Tongues are wagging in the Offshore sector this week, as one of the longest running rumours in the market has finally come true. Tidewater Marine (USA) has acquired Swire Pacific Offshore (Singapore) for USD 190 mil, the company’s biggest powerplay since its acquisition of GulfMark Offshore back in 2018.

But why SPO, and why now? This article will seek to answer these questions and provide commentary on why this long time coming deal makes sense for both parties.

A Force to be Reckoned With

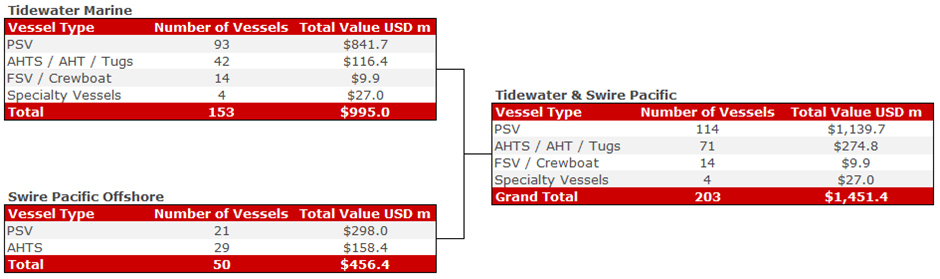

The acquisition of SPO takes Tidewater to 203 vessels with a combined VV value of USD 1.45 billion.

All data correct as of 11/03/2022.

Lock and Key Regional Fleet Integration

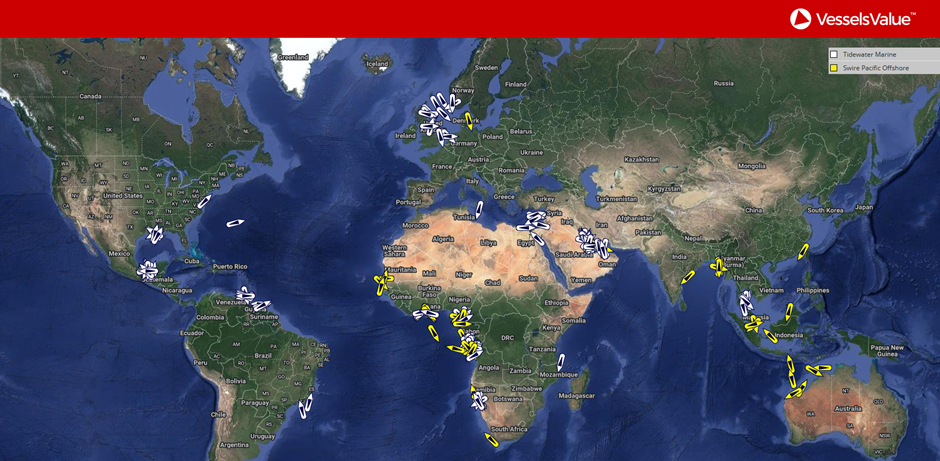

Tidewater’s main areas of operation are the North Sea, US Gulf of Mexico, West Africa, Egypt, and the Middle East. SPO have a strong presence in West Africa, Southeast Asia, and Australia. In summary, Tidewater became a fully global player with a robust fleet in the main areas of operation.

Modern Versatile Fleet up for Grabs

The average age of the Swire fleet (PSV and AHTS) is around 10 years old. Swire went against the status quo over the last few years and continued to take delivery of their large Japanese built PSVs. This was not an ideal situation considering the Offshore market conditions. However, as a result their fleet average age was driven down.

By acquiring SPO, Tidewater also unlocked access to 18 high quality large PSVs (4,000 DWT +) with an average age of 6.7 years old, and 10 very large AHTS (16,000 BHP +) vessels with average age of 8.4 years. Both this size and specification of vessel have experienced a firming in value during late 2021 and early 2022, and a significant reduction in sale and purchase candidates. Thus, the SPO acquisition allows Tidewater to add assets quickly and concisely to their fleet, and not become victim to increased owners asking prices and/or increased buying competition.

Out with the Old, In with the New

Since around 2018, Tidewater have been aggressively selling their non core tonnage to modernise their fleet. Based on VesselsValue transactional data, Tidewater have sold around 60 vessels (mix of PSVs, AHT/AHTS, FSV) for further trading and around 70 vessels for demolition. This has allowed them to accumulate an estimated USD 140 million war chest (estimated c. USD 100 million for all secondhand sales from 2018 and estimated around USD 40 million for all demolition sales from 2018). The acquisition of SPO fills the void created by reducing their overall fleet number, and having cash coming in over the last few years is always helps.

When the Going Gets Tough, The Tough Buy Their Competitors

It is no secret SPO haven’t had the easiest of downturns and the company has been suffering for many years, with mounting operating losses and burning through cash (at a substantially higher rate than most big Offshore players in the market). Growing write offs, the closing down of the Swire Subsea division, and the most surprising, declaring very expensive options of PSVs in the middle of the downturn. However, for a buyer like Tidewater, this presents its own set of opportunities to grab a bargain (or at least a more sensible asking price). The saying ‘one man’s misery is another man’s fortune’ springs to mind, and a knock on effect of this is stopping your competitors buying SPO or their assets. Controlling the market is critical to remain the top player!

Jumping Back into the Large Anchor Handling Market

Tidewater has a small exposure to the large AHTS market, with five vessels between 13,000 BHP and 16,000 BHP, the majority of which are working in West Africa. The purchase of SPO will give them access to Swire’s well respected D class very large anchor handlers, modern, young, and high bollard pull. Again, the large AHTS market has recently witnessed a sharp tightening, and there are limited sale and purchase candidates. On the chartering side, large AHTS rates are firming, and they are in high demand from both the Renewables and Oil and Gas sector.

Conclusion

With chatter in the Offshore market of a recovery in our midst, this transaction primes Tidewater to take full advantage of any changing market conditions and really set themselves apart from their competitors. It will be interesting to see how other large OSV owners react to this news and what strategies they put in place to compete with the new Tidewater / SPO fleet in the long term.

VesselsValue data as of March 2022.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?