Cruise Ships: Fleet Development

The current Cruise orderbook sits at 104 vessels, worth an aggregated value of USD 60.3 billion, accounting for 34% of the overall global order book.

The flurry of ordering activity experienced between 2014 and 2018 was an attempt by Cruise companies to keep on top of the ever-growing demand for travel. A demand which currently sits at record lows due to restrictions brought about by COVID-19.

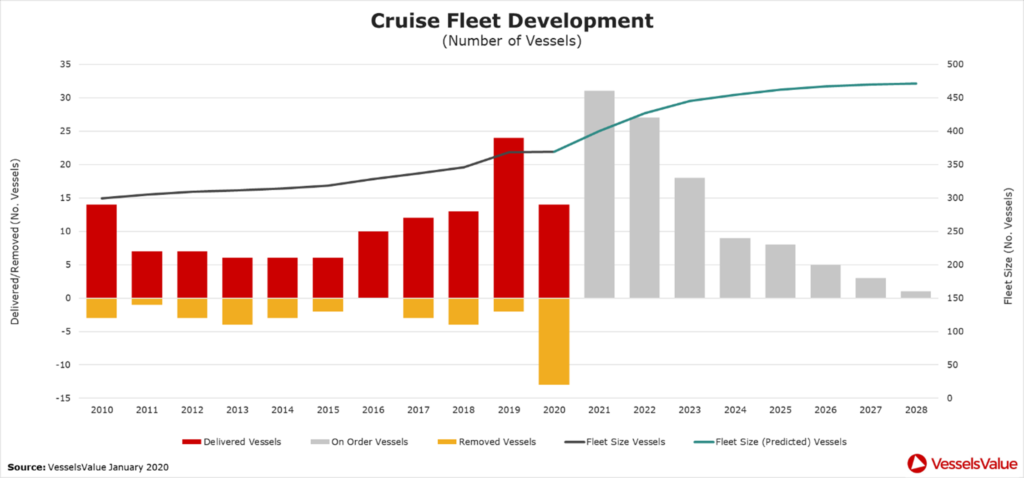

The below graph shows the number of Cruise ships delivered and removed from the water each year and the overall fleet size from 2010-2028. The ‘predicted’ fleet size is based on current orders, assuming there are no removals.

As Cruise companies and yards try to mitigate the market effects of COVID-19, ordering has slowed significantly and delays have been introduced. This has resulted in only 14 of the planned 22 Cruise ships being delivered this year.

To save on layup costs and to free up cash flow for incoming deliveries, the major operators chose to scrap their older less efficient vessels. In 2020, for the first time in many years, the balance between removals and deliveries was progressively more aligned.

Going forward, Cruise companies and shipbuilders must now be cautious not to oversupply the market without the increase in demand to match. By 2028 the fleet is projected to increase in size by 28% with the ability to carry over 925,000 passengers at any given time.

As it stands, 2021 is set to be a record-breaking year with an expected 31 vessels due to be delivered, worth a staggering USD 13.6 billion in total. A quick and confident return of demand is paramount for the industry to rebound, otherwise we should expect to see further delays and removals in an attempt to balance things out.

Hopefully the COVID-19 vaccine will be the catalyst that propels the Cruise industry back onto its previous positive trajectory. The stock market is already starting to reflect this with share prices for the major Cruise lines over double what they were back in April.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?