Diesel Vacuum in Crisis – Struck Europe Sucks In MRs

Demand for Clean Tankers has shifted up another gear, as the Ukraine crisis intensifies.

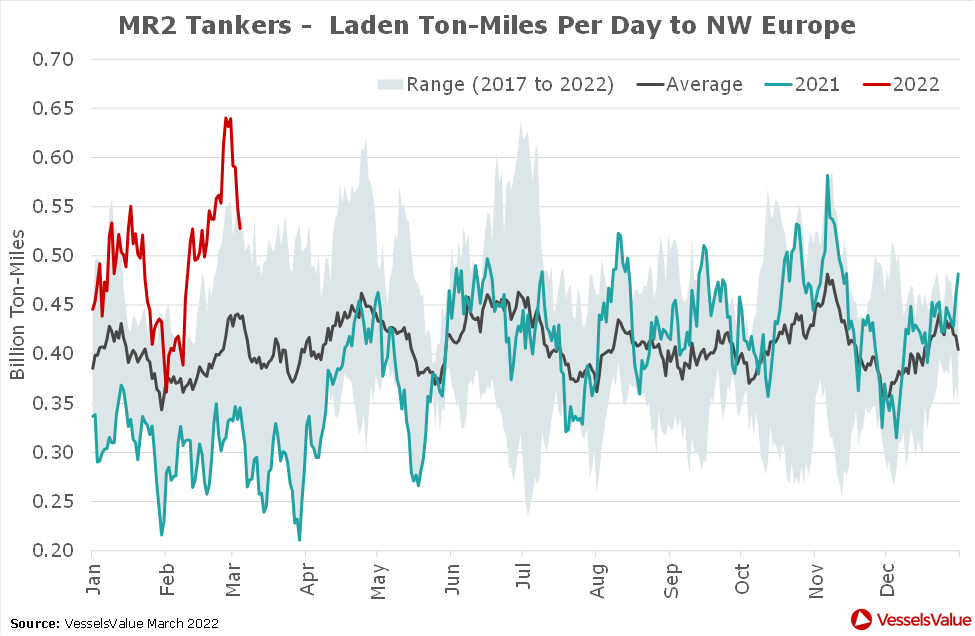

As Russian troops amassed at the border with Eastern Ukraine last month and hostilities commenced on February 24th, the MR Atlantic Basket (an average of freight rates on key routes in the Atlantic Basin) climbed steadily from a January 25th low of $5,032 per day to a current year-to-date high of $18,649 per day. Ship-tracking data from satellite and land-based sources confirms this is due to a step up in demand. Laden ton-miles for MR2 Tankers, the most populous type of ship for the carriage of refined oil products, accelerated from 4% (year-to-date, year-on-year growth) in mid-February to 7% at present.

The surge in freight rates was driven by imports into Northwest Europe. As shown in Figure 1 below, laden ton-miles into the region were already on a rising trend as the economy and oil prices recovered from depressed levels a year ago. However, as the crisis escalated, demand spiked to levels far above the upper end of its historical range.

The causes are twofold. Firstly, Russia, via ports in the Baltic and Black Seas, is a major supplier of diesel and middle distillates to European oil markets. Although not yet officially sanctioned, oil companies and traders have been almost completely unwilling to buy Russian cargoes due to heightened political, legal, and reputational risks, as well as practical difficulties such as obtaining letter-of-credit financing from Western banks. This, by itself, would leave a massive deficit of diesel in Europe. Secondly, despite wholesale prices for diesel and middle distillates climbing even more steeply than those for crude oil in Europe, the spiralling cost of natural gas, by which refineries are powered, has meant that European refiners are unable to take advantage of widening margins and have instead cut runs. This has compounded the first effect to leave European oil markets short of many products and particularly short of diesel.

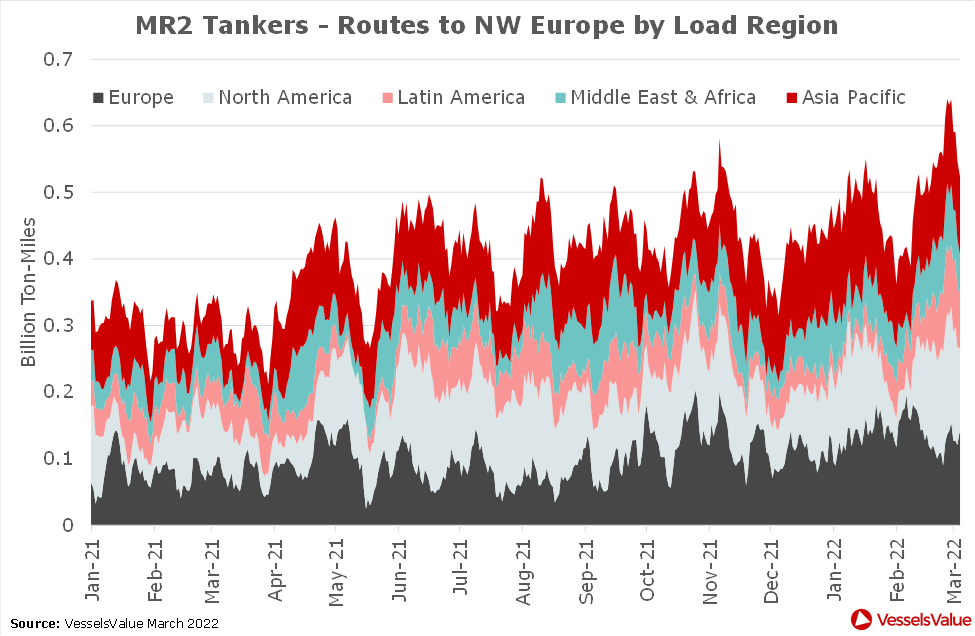

As shown in Figure 2, ton-mile demand has accelerated on routes into Northwest Europe from all major load regions. Particularly eye-catching is a 67% rise in ton-miles from North America (year-to-date, year-on-year) and a 76% rise from Asia Pacific. The former is driven mainly by shipments from refiners on the US East Coast, while the latter is driven by those from regional refining and storage hub, Singapore.

The effect on freight rates in the Atlantic is further exacerbated by a drop in shipping capacity. Due to the long term “dieselisation” of Europe’s vehicle fleet, relative to the US, the former tends to be short diesel but long gasoline, while the latter is the opposite. While markets are functioning normally, this creates a countertrade, but as refiners minimise throughputs in Europe, the data shows laden ton-miles on the reverse leg from Europe to the US East Coast have slowed. The laden/ballast ratio in the Atlantic has fallen and the Product Tanker fleet has, in effect, become less productive.

While the conflict persists, it is hard to imagine a near-term scenario in which any of these trends reverse: European oil buyers resume purchases of Russian diesel, natural gas prices normalise, or European refiners start running at full capacity. Hence, it seems likely that demand for shipping refined oil products will persist at these elevated levels and shipping capacity will be constrained by a lower laden/ballast ratio. The MR Atlantic Basket should at least hold its recent gains, if not push even higher.

Data as of March 2022.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?